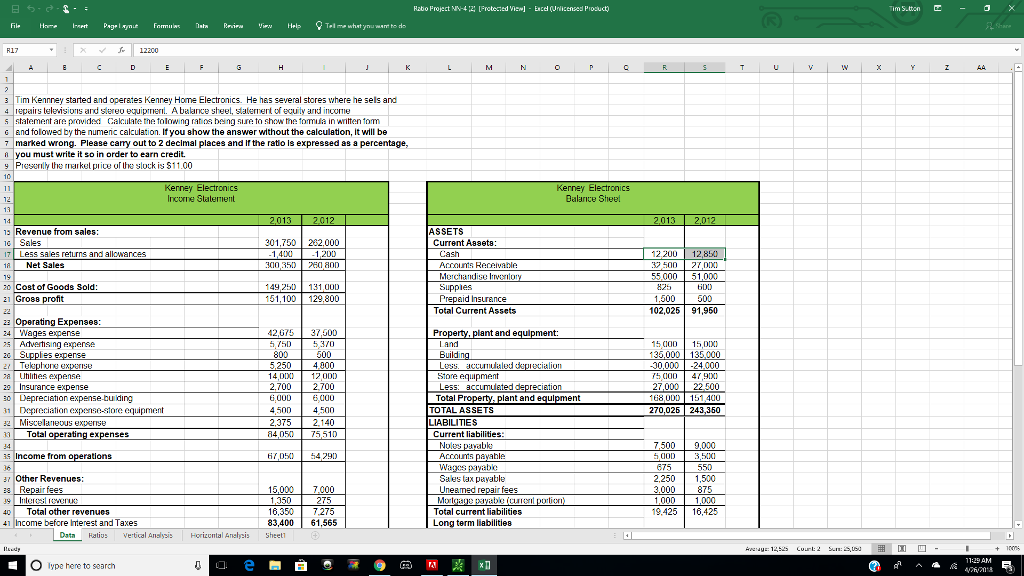

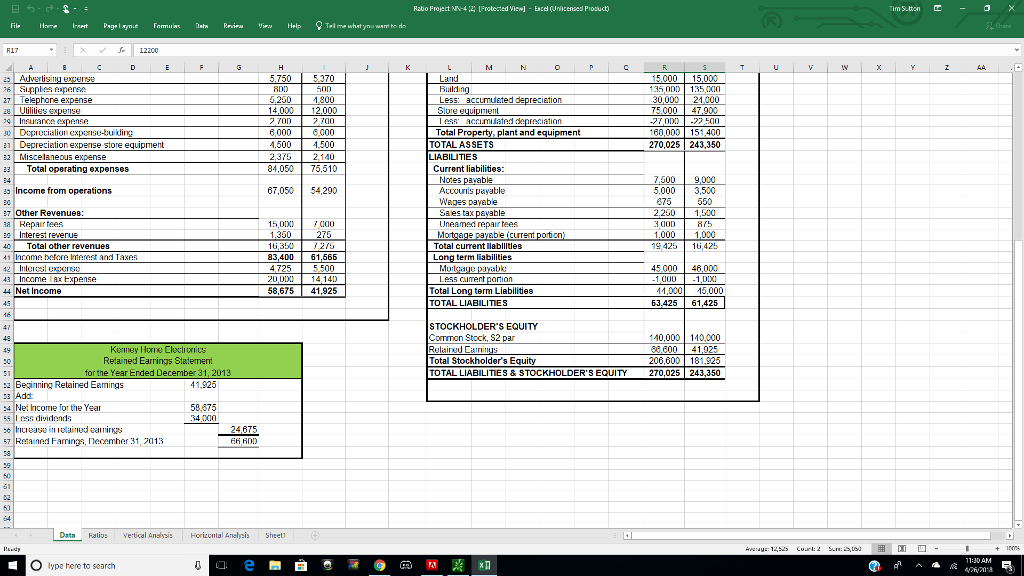

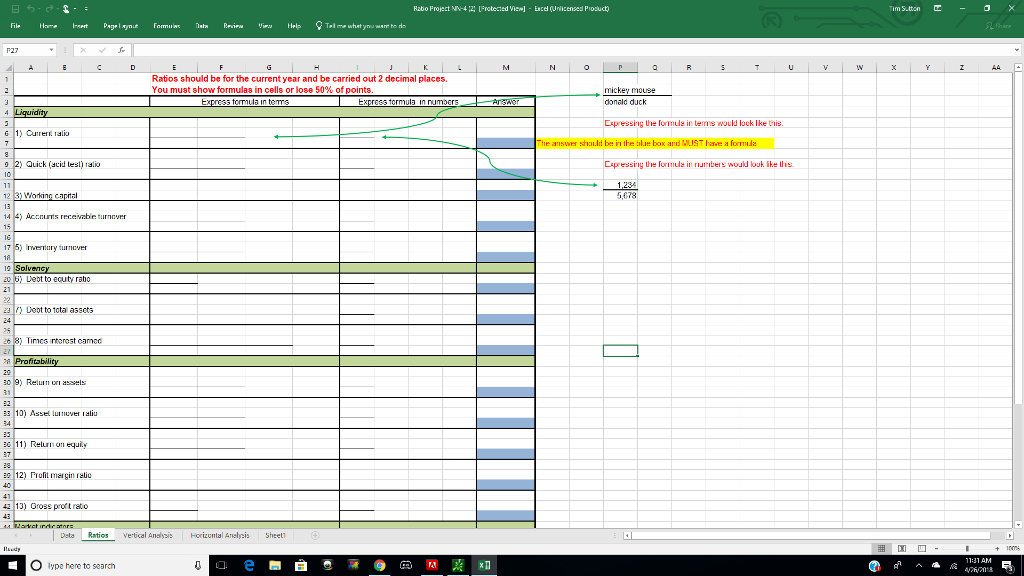

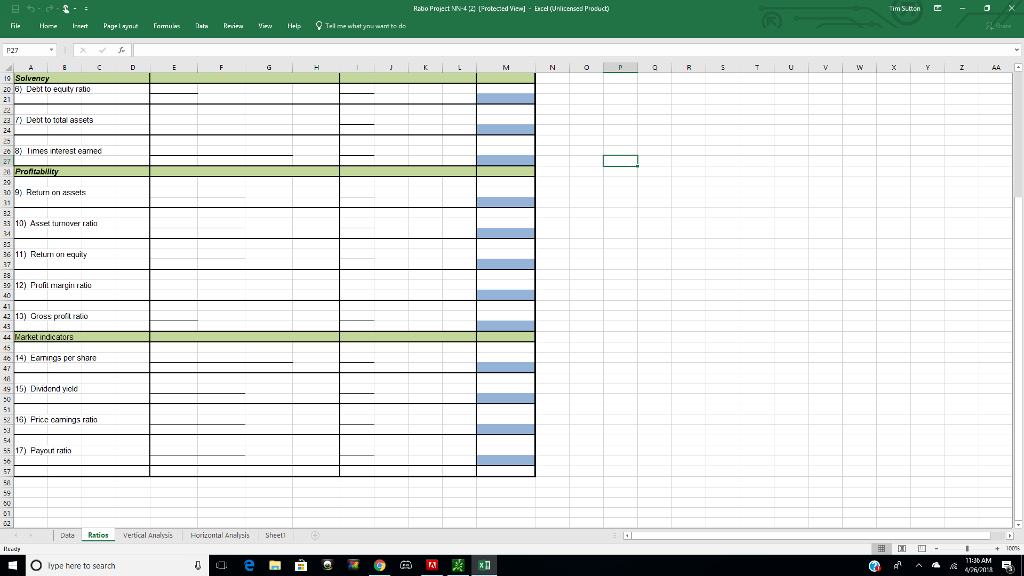

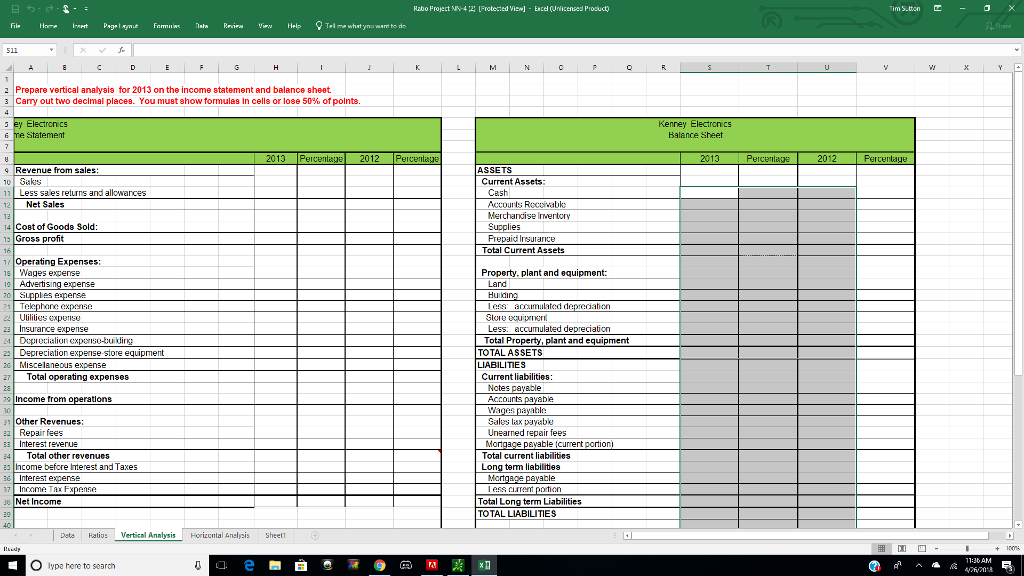

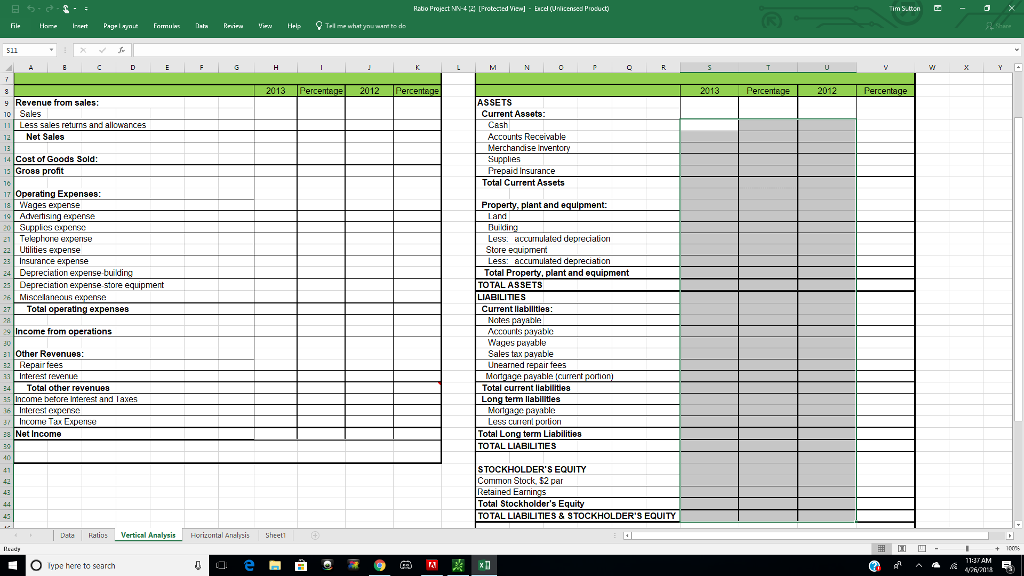

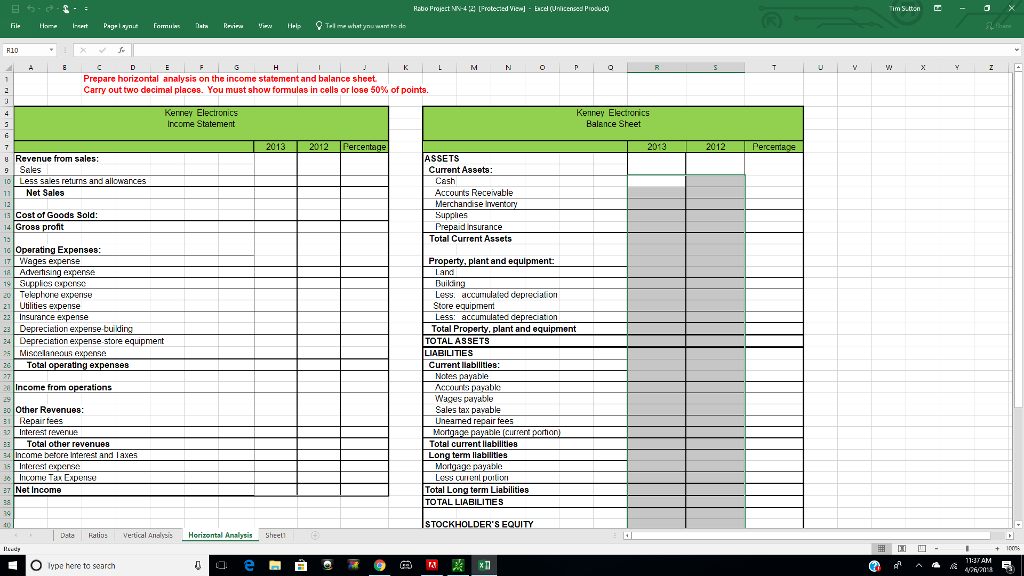

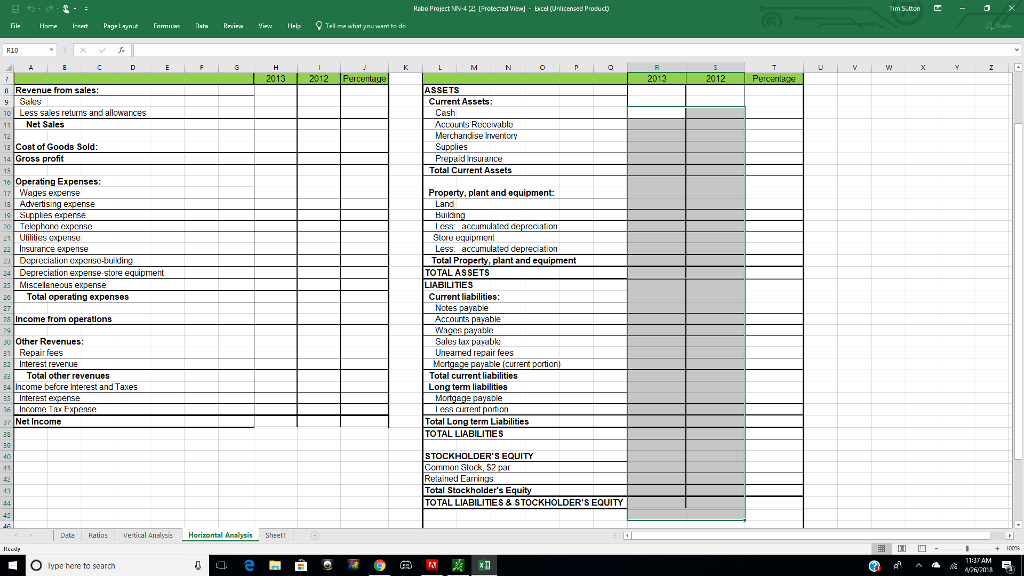

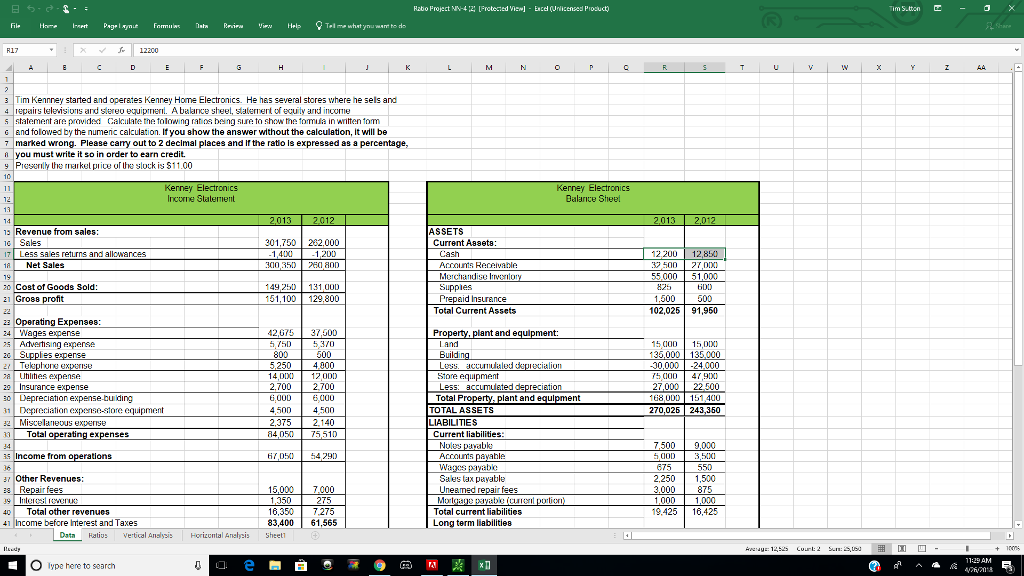

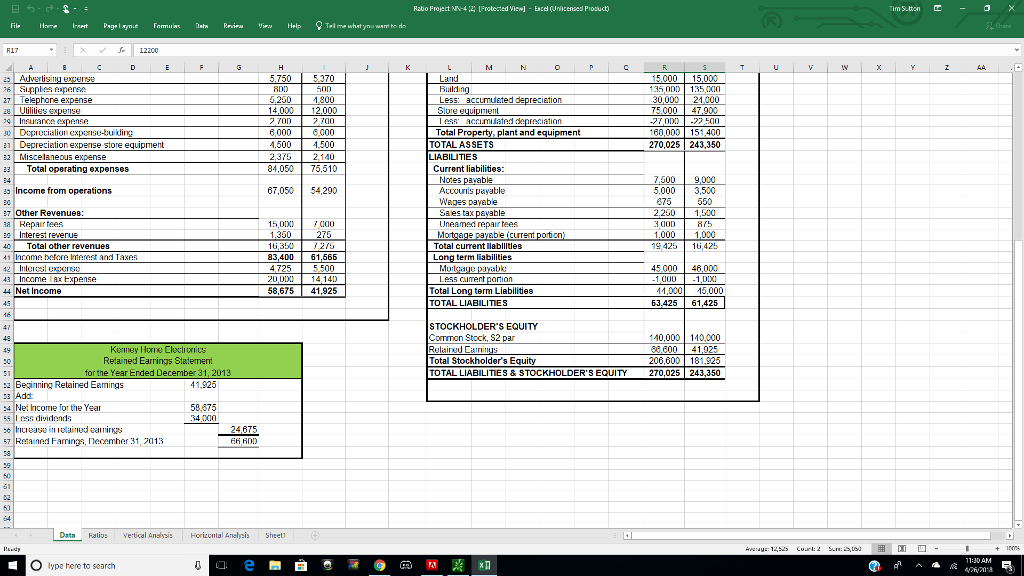

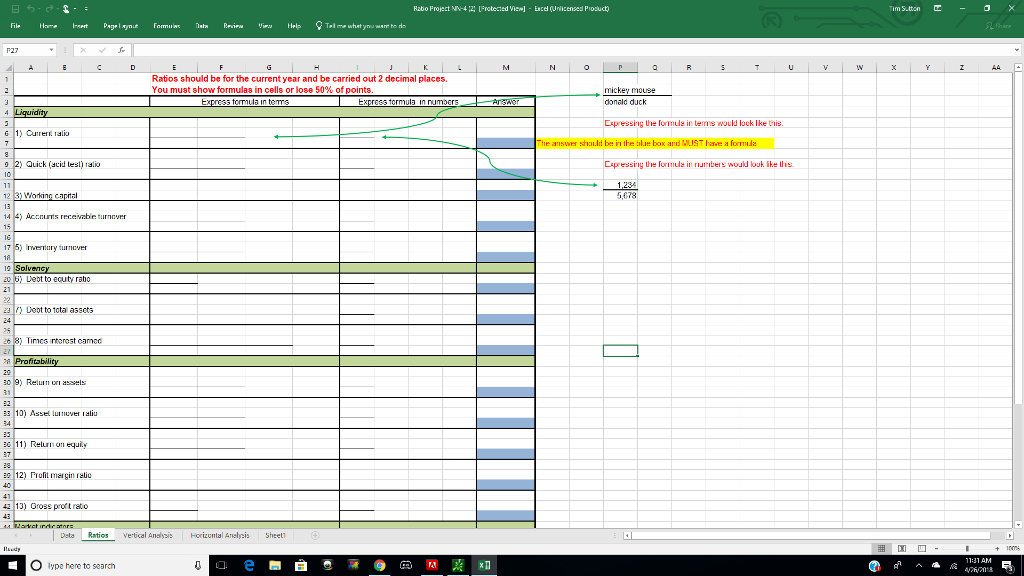

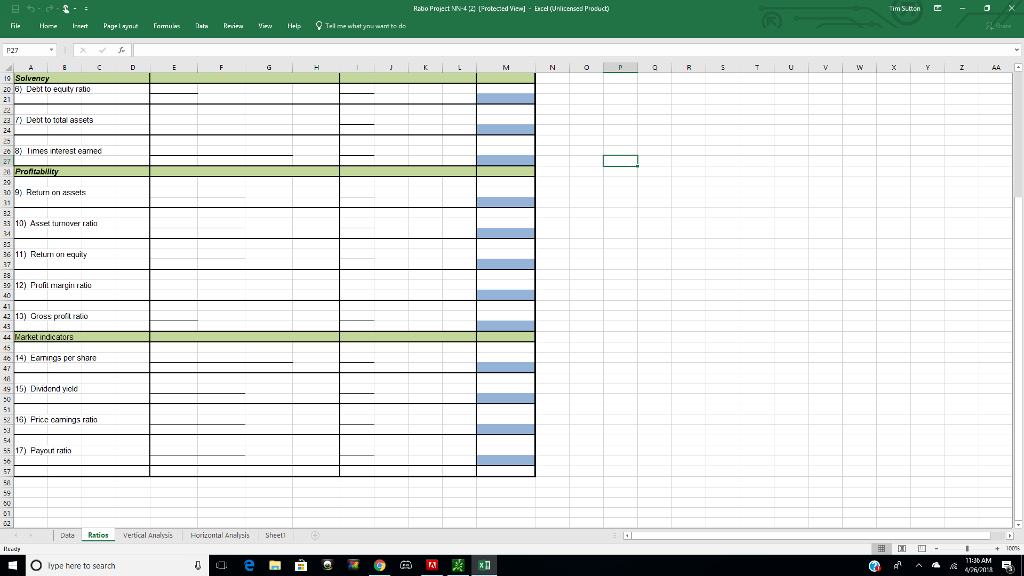

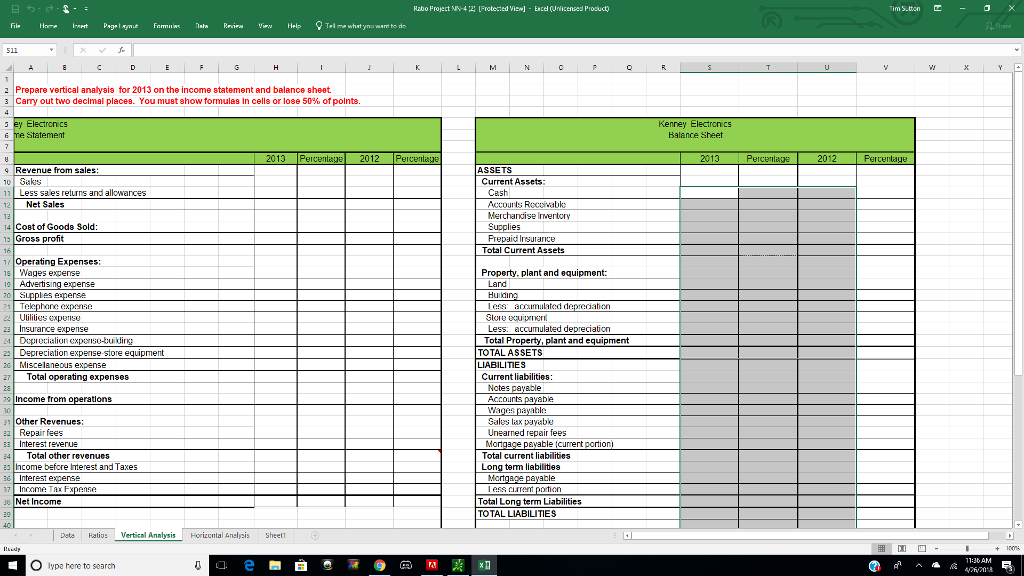

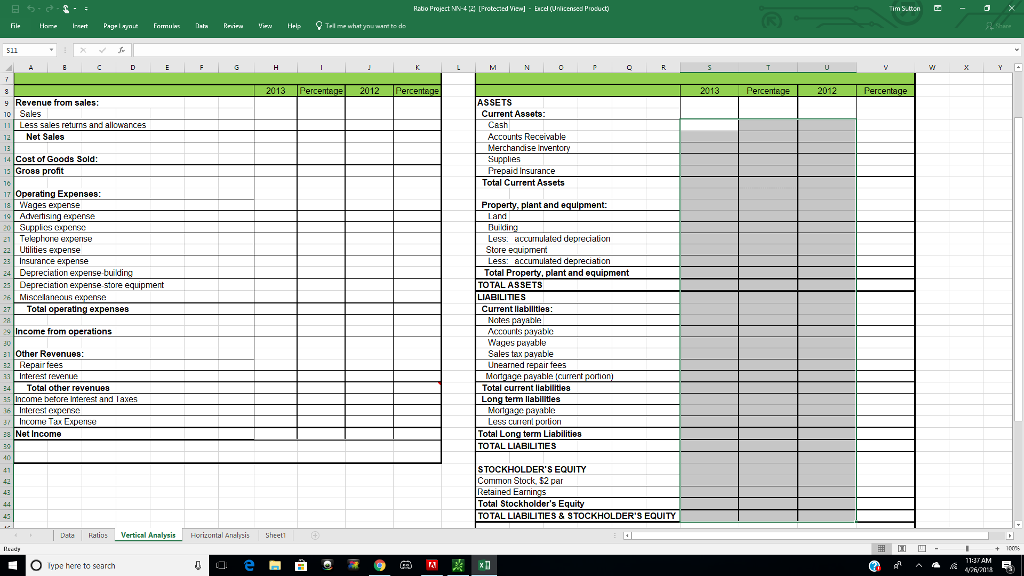

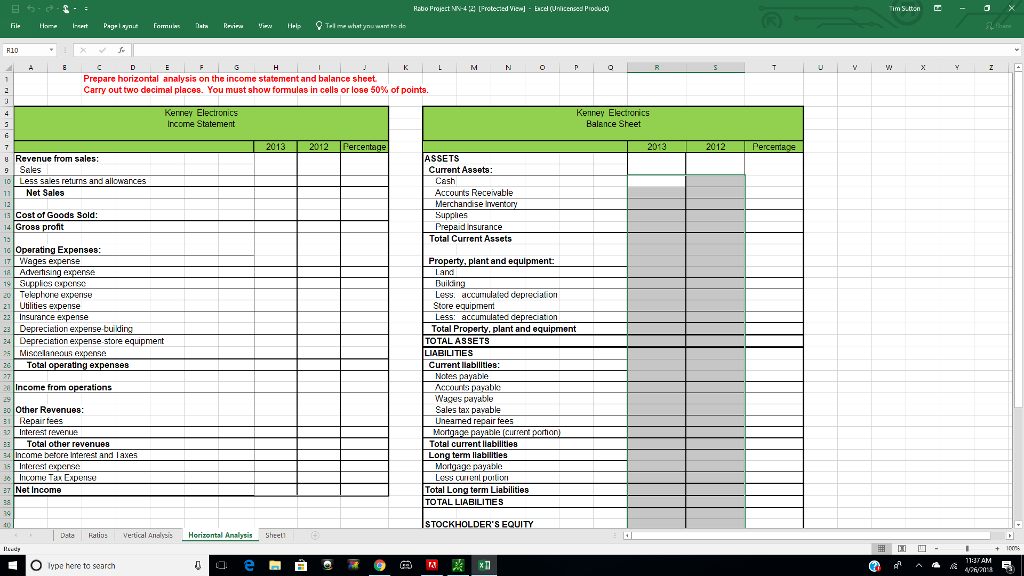

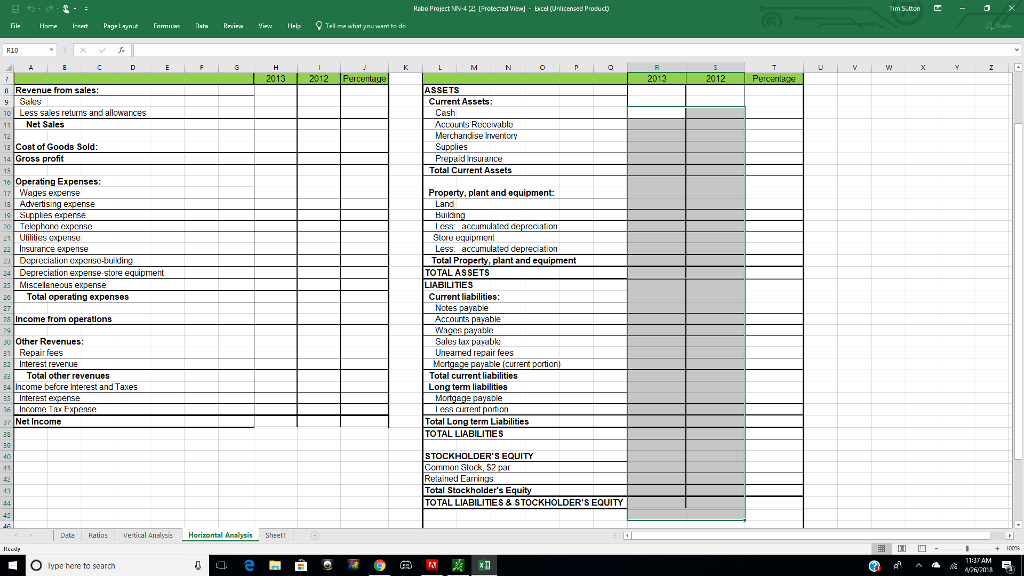

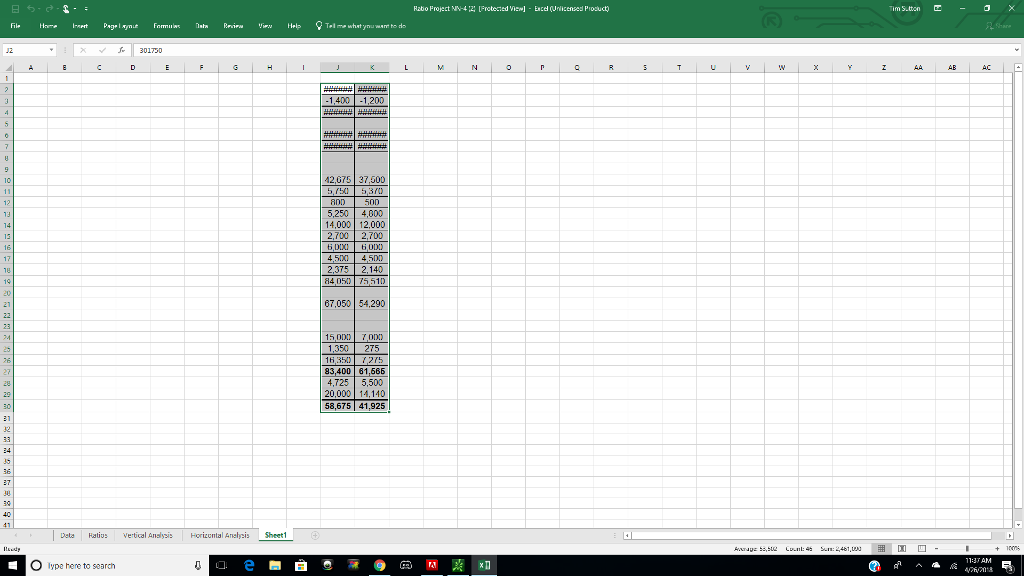

Habio Project NV-4 2 [Protected View] - Excel (Unlicensed Product) Tim Sutton E - X File Home Inert Parlame Formulat m o vies Viry Hels t el me what you to de J K L M N O P Q R S T U V W X Y Z AA 3 Tim Kennney started and operates Kenney Home Electronics. He has several stores where he sels and 4 repairs televisions and sercu equipmuril. A balance shoul, salernent of equity and income S statement are provided Calculate the folowing ratios being sure to show the fomula in written for G and folowed by the numeric calculation. If you show the answer without the calculation, it will be 7 marked wrong. Please carry out to 2 decimal places and if the ratio is expressed as a percentage, 8 you must write it so in order to earn credit. 9 Piesenilly the markel price of the stock is S11.00 Kerney Electronics Income Statement Kerney Electronics Balance Sheel 2013 2012 2013 2012 ASSETS Current Assets: 18 Revenue from sales: 10 Sales 17 Less sales returns and allowances 18 Net Sales 301.750 -1.400 300.350 282.000 1.200 260 80D Cash 20 Cost of Goods Sold: 21 Gross profit 149 250 151,100 131 COD 129.800 Accounts Receivable Merchandige verlory Suppies ????.id InsL??.?CE Total Current Assets | 12.200 37 500 55,000 825 1.500 102,025 12,850 | 27.000 51,000 GDO 500 91,950 42,675 5750 37,500 5.3/0 23 Operating Expenses: 24 Wages expense 25 Advertising experse 20 Supplies experse 27 Telephone expuse za Uhlihes expense 20 Insurance expense 30 Depreciation expense-building 31 Depreciation expense-store equipment 22 Miscelus expense 33 Total operating expenses 14 35 Income from operations 5.250 4.000 14 DIXI 12 000 2.700 L2.700 GOOD 6 000 4 500 4 500 2.375 2.140 84 050 75.510 15 000 135,000 30,000 75 Cap 27,000 168.000 270,026 15.000 135,000 -24.000 47.900 22,500 151.400 243.350 Property, plant and equipment: Land Building Less, accumulalod ukupnoclulion Store equipment Less: accumulated deprecietion Total Property, plant and equipment TOTAL ASSETS LIABILITIES Current liabilities: Nules Davabke Accounts payable Wagcs payable Sales tax pavable Uneamed repair fees Mortgage xuyuble ( c ul portion) Total current liabilities Long term liabilities 67,050 54 290 37 Other Revenues: 38 Repair fees 19 Interest loverus 40 Total other revenues 41 Income before Interest and Taxes Data Hatius Vertical Analysis 7,500 5 COD 675 2,250 3.000 1,000 19,425 9,000 3,50000 550 1,500 875 1,000 16,425 15,000 1.350 1R 350 83,400 Sheet1 7.000 275 7.275 61,565 Horizontal Anahsis AVENUE: 12,525 count:2 Sum 100 E O lype here to search | | | e a a = UU ILX + 2Aamuk 1149 AM 9 : A = x1 Habio Project NV-4 2 [Protected View] - Excel (Unlicensed Product) Tim Sutton E - X File Home Inert Parlame Formulat m o vies Viry Hels t el me what you to de J K L M N O P Q R S T U V W X Y Z AA 3 Tim Kennney started and operates Kenney Home Electronics. He has several stores where he sels and 4 repairs televisions and sercu equipmuril. A balance shoul, salernent of equity and income S statement are provided Calculate the folowing ratios being sure to show the fomula in written for G and folowed by the numeric calculation. If you show the answer without the calculation, it will be 7 marked wrong. Please carry out to 2 decimal places and if the ratio is expressed as a percentage, 8 you must write it so in order to earn credit. 9 Piesenilly the markel price of the stock is S11.00 Kerney Electronics Income Statement Kerney Electronics Balance Sheel 2013 2012 2013 2012 ASSETS Current Assets: 18 Revenue from sales: 10 Sales 17 Less sales returns and allowances 18 Net Sales 301.750 -1.400 300.350 282.000 1.200 260 80D Cash 20 Cost of Goods Sold: 21 Gross profit 149 250 151,100 131 COD 129.800 Accounts Receivable Merchandige verlory Suppies ????.id InsL??.?CE Total Current Assets | 12.200 37 500 55,000 825 1.500 102,025 12,850 | 27.000 51,000 GDO 500 91,950 42,675 5750 37,500 5.3/0 23 Operating Expenses: 24 Wages expense 25 Advertising experse 20 Supplies experse 27 Telephone expuse za Uhlihes expense 20 Insurance expense 30 Depreciation expense-building 31 Depreciation expense-store equipment 22 Miscelus expense 33 Total operating expenses 14 35 Income from operations 5.250 4.000 14 DIXI 12 000 2.700 L2.700 GOOD 6 000 4 500 4 500 2.375 2.140 84 050 75.510 15 000 135,000 30,000 75 Cap 27,000 168.000 270,026 15.000 135,000 -24.000 47.900 22,500 151.400 243.350 Property, plant and equipment: Land Building Less, accumulalod ukupnoclulion Store equipment Less: accumulated deprecietion Total Property, plant and equipment TOTAL ASSETS LIABILITIES Current liabilities: Nules Davabke Accounts payable Wagcs payable Sales tax pavable Uneamed repair fees Mortgage xuyuble ( c ul portion) Total current liabilities Long term liabilities 67,050 54 290 37 Other Revenues: 38 Repair fees 19 Interest loverus 40 Total other revenues 41 Income before Interest and Taxes Data Hatius Vertical Analysis 7,500 5 COD 675 2,250 3.000 1,000 19,425 9,000 3,50000 550 1,500 875 1,000 16,425 15,000 1.350 1R 350 83,400 Sheet1 7.000 275 7.275 61,565 Horizontal Anahsis AVENUE: 12,525 count:2 Sum 100 E O lype here to search | | | e a a = UU ILX + 2Aamuk 1149 AM 9 : A = x1