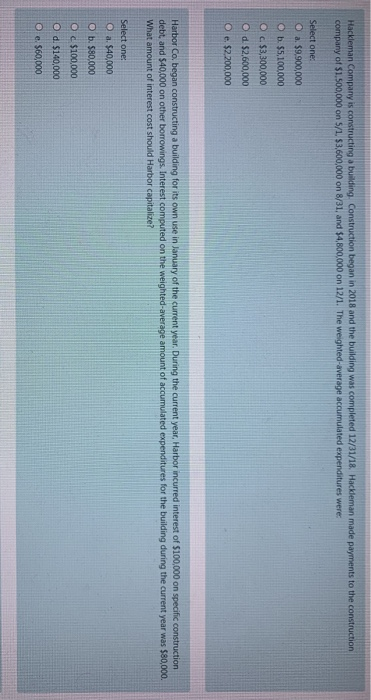

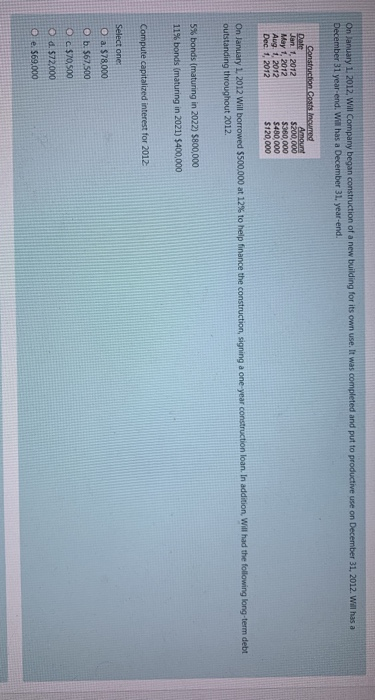

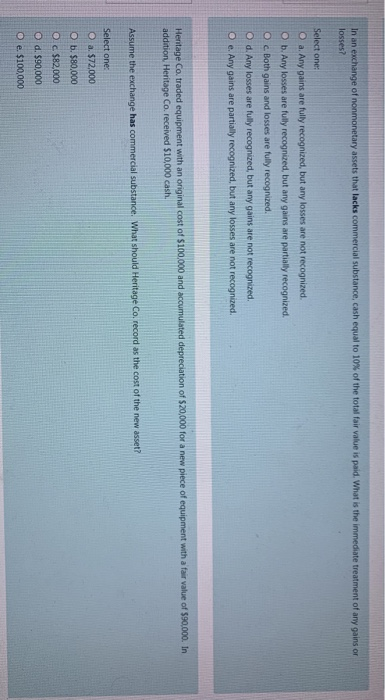

Hackleman Company is constructing a building Construction began in 2018 and the building was completed 12/31/18. Hackleman made payments to the construction company of $1,500,000 on 5/1. $3,600,000 on 8/31, and $4,500,000 on 12/1. The weighted average accumulated expenditures were Select one O a. $9.900,000 @b. 55.100.000 O c. $3,300,000 O d. $2,600,000 O e. $2.200,000 Harbor Co, began constructing a building for its own use in January of the current year. During the current year, Harbor incurred interest of $100,000 on specific construction debt, and $40,000 on other borrowings. Interest computed on the weighted average amount of accumulated expenditures for the building during the current year was $80,000. What amount of interest cost should Harbor capitalize? Select one: 0 a $40,000 O b. 580,000 O c$100,000 O d. $140,000 e. $60,000 On January 1, 2012, Will Company began construction of a new building for its own use. It was completed and put to productive use on December 31, 2012. Will has a December 31 year-end. Will has a December 31. year-end. Construction Costs incurred Date Amount Jan 1, 2012 $200,000 May 1, 2012 $360,000 Aug 1, 2012 $480 000 Dec 1, 2012 $120,000 On January 1, 2012 Will borrowed $500.000 at 12% to help finance the construction, signing a one-year construction loan. In addition, Will had the following long-term debt outstanding throughout 2012 5% bonds (maturing in 2022) $800,000 11% bonds (maturing in 2021) $400,000 Compute capitalized interest for 2012 Select one: O a. 578.000 O b: $67,500 O c $70,500 d. $72,000 e. $69.000 In an exchange of nonmonetary assets that lacks commercial substance, cash equal to 10% of the total fair value is paid. What is the immediate treatment of any gains or losses? Select one: O a. Any gains are fully recognized, but any losses are not recognized O b. Any losses are fully recognized, but any gains are partially recognized. O c. Both gains and losses are fully recognized O d. Any losses are fully recognized, but any gains are not recognized O e. Any gains are partially recognized, but any losses are not recognized Hentage Co. traded equipment with an original cost of $100,000 and accumulated depreciation of $20,000 for a new piece of equipment with a fair value of $90,000. In addition Heritage Co. received $10,000 cash. Assume the exchange has commercial substance. What should Heritage Co. record as the cost of the new asset? Select one: O a. $72,000 O b. $80,000 O. c. $82,000 O d. $90,000 O e. $100,000