Question

Hagen-Dazs wants to capitalize on the latest diet fad. They are considering a new product line of zero-carb ice creams to sell in grocery stores.

Hagen-Dazs wants to capitalize on the latest diet fad. They are considering a new product line of zero-carb ice creams to sell in grocery stores. This new product line will only exist for 3 years, as Hagen-Dazs predicts that the fad will fade after 3 years. They will need to use both existing equipment and invest in new equipment worth $210,000 to create the new product. The new equipment will be depreciated $50,000 each year over the 3-year life of the project. They will be able to sell this equipment for $30,000 at the end of three years; it will otherwise be worthless to them. The existing equipment is currently fully-depreciated, and currently has no other use at the company. Hagen-Dazs could sell this equipment for $10,000 today but it will be worthless after 3 years. With the new product the company projects increases in revenue of $260,000 each year for 3 years and additional costs of $170,000 each year. Net working capital will need to increase by $50,000 today if the project is taken, and return to its pre-project level at the end of year 3. The tax rate is 34%. Their cost of capital is 11%.

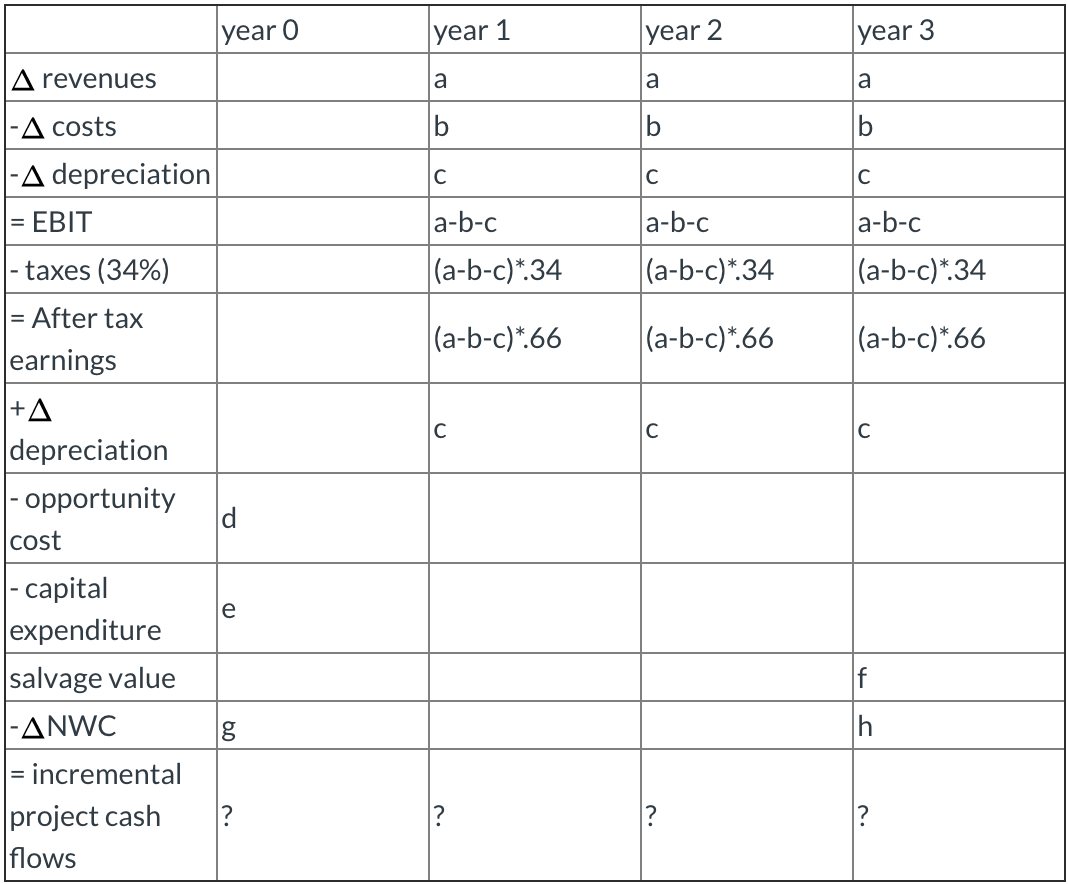

The table below is intended to find the incremental cash flows for this project. The table is only partially filled out. The missing elements are referred to with letters. The questions below ask you about each missing element.

all numbers listed in thousands.

all numbers listed in thousands.

What should the change in revenues ("a") be in this table?

What should the change in costs ("b") be in this table?

What should the change in depreciation ("c") be in this table?

What is the opportunity cost in year 0 ("d") associated with the old equipment?

What is the capital expenditure in year 0 ("e")?

What is the salvage value for the equipment in year 3 ("f")?

What is the change in the net working capital in year 0 ("g")?

What is the change in the net working capital in year 1 ("h")?

What is the change in the net working capital in year 3 ("i")?

year 1 year 2 year 3 year o A revenues -A costs -A depreciation = EBIT a-b-c a-b-c (a-b-c)*.34 a-b-c (a-b-c)*.34 (a-b-c)*34 (a-b-c)*.66 (a-b-c)*.66 (a-b-c)*.66 - taxes (34%) = After tax earnings +A depreciation - opportunity cost - capital expenditure salvage value -ANWC = incremental project cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started