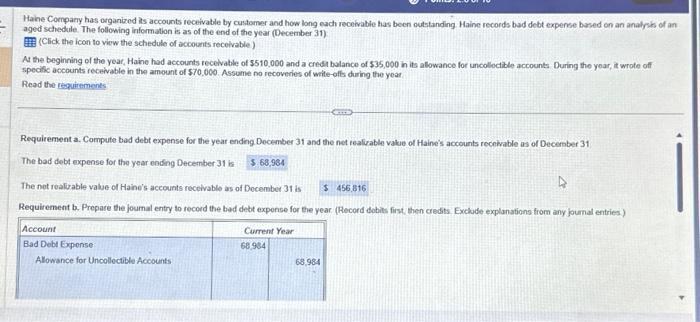

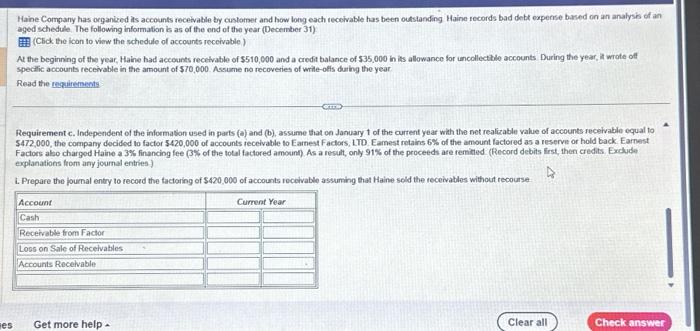

Hahe Cornpary has organized its accounts receivatile by customer and how long each recolvatie has been outstanding Haine records bad debt expense based on an analpik of ar aged schedule. The following information is as of the end of the year (December 31 ) (Click the icon to viow the schedule of accounts recelvable) A the beginning of the year, Haine had accounts recelvatle of $510,000 and a credi bolance of $35,000 in its alowance for uncolloctible accounts During the yoar, it wrote off specilic accounts receivable in the amount of $70,000. Assume no recoveries of wite-ofts during the yeat. Read the requirements Requirement a. Compute bad debt expense for the year ending Docember 31 and the net realivable vakie of Haine's accounts receivable as of Decenber 31 The bad debt expense for the year ending December 31 is The net realuable value of Haine's accounts recelvable as of December 31 is Requirement b. Prepare the joumal entry to record the bad debt expense for the year. (Rlecord dobits first, then credits Exclade explanations from any joumal entries.) Haine Company has organized its accounts receivable by cuslomet and how long each receivable has been outstanding Haine records bad debt experse bared on an analysis of an aged schedule. The following information is as of the ond of the year (December 31) (Click the icon to virw the schedule of accounts receivable) At the beginning of the year, Haine had accounts recetvable of $510,000 and a credit balance of $35,000in its allowance for uncollectillo accounts During the year, it wrote oft specilic accounts receivable in the amount of $70,000. Assume no recoveries of wrile-ofls during the year Read the regirements Requirement c. Independent of the information used in parts (a) and (b), assume that on January 1 of the current year with the net realizable value of accounts receivablo equal to $472,000, the company docided to factor $420,000 of accounts recelvatile to Earnest Faclors, ITD. Eamest retains 6% of the amount factored as a reserve or hold back. Earnest Factors abo charged Haine a 3\% financing fee (3\% of the total factored amouin). As a result, only 91% of the proceeds are remitled. (Record debits first, then credits. Exclude explanations from any joumal entries ) t. Prepare the journal entry to recoed the factoring of $20,000 of accounts recelvable assuming that Haine sold the receivatlos without recourse Haine Company has organired its accounts receivable by customer and how long each receivable has been outstanding Haine records bad detef expenne based on an analyik of an aged schedule The folloning information is as of tho end of the year (Deceenter 31) (Click the icon to view the schedule of accounts receivatle) At the beginning of the year, Haine had accounts roceivatile of $510,000 and a credit balance of $35,000 in its allowance for uncollectible accounts. During the year, it wrote of specilic accounts receivablo in the amount of $70,000. Assume no recoveries of write-offs duting the yeat. Requirements Whe the nealizatile value of accounts receivable equal to of the amount faclored as a reserve or hold back. Eamest are remitted (Record debits first, then credits Exclude ivables without recourse