Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hakara Company has been using direct labor costs as the basis for assigning overhead to its many products. Under this allocation system, product A

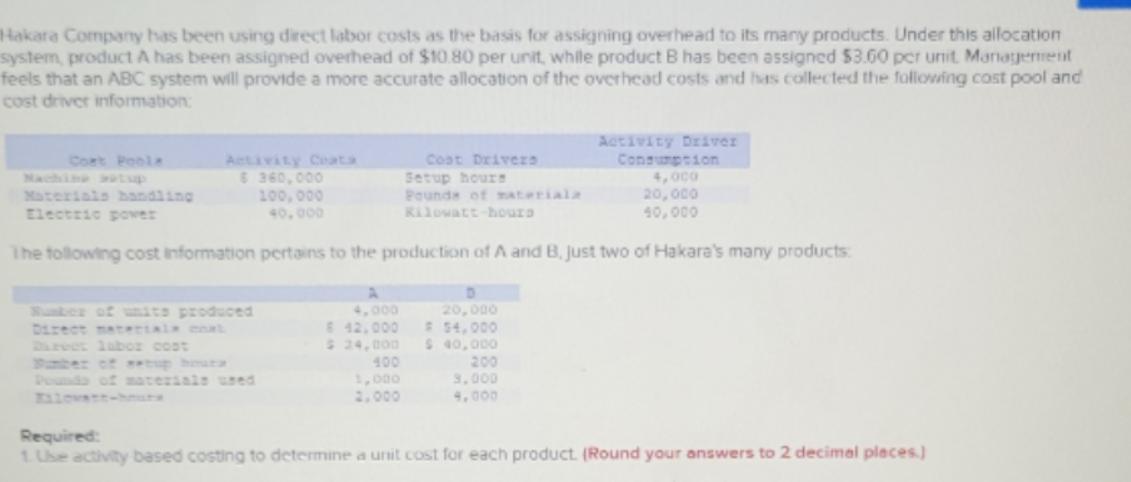

Hakara Company has been using direct labor costs as the basis for assigning overhead to its many products. Under this allocation system, product A has been assigned overhead of $10.80 per unit, while product B has been assigned $3.60 per unit Management feels that an ABC system will provide a more accurate allocation of the overhead costs and has collected the following cost pool and cost driver information: Coat Driveza Setup hours Pounds of materiala Kilowatt-hours The following cost information pertains to the production of A and B, just two of Hakara's many products: Electric power 6.360,000 100,000 Sumber of units produced 20,000 42,000 # $4,000 $ 24,000 $ 40,000 400 1,000 Activity Driver Consumption 20,000 40,000 200 9.000 Required: 1. Use activity based costing to determine a unit cost for each product. (Round your answers to 2 decimal places.)

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Machine Setup Material Handling Electric Power Direct Materials Dire...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started