Answered step by step

Verified Expert Solution

Question

1 Approved Answer

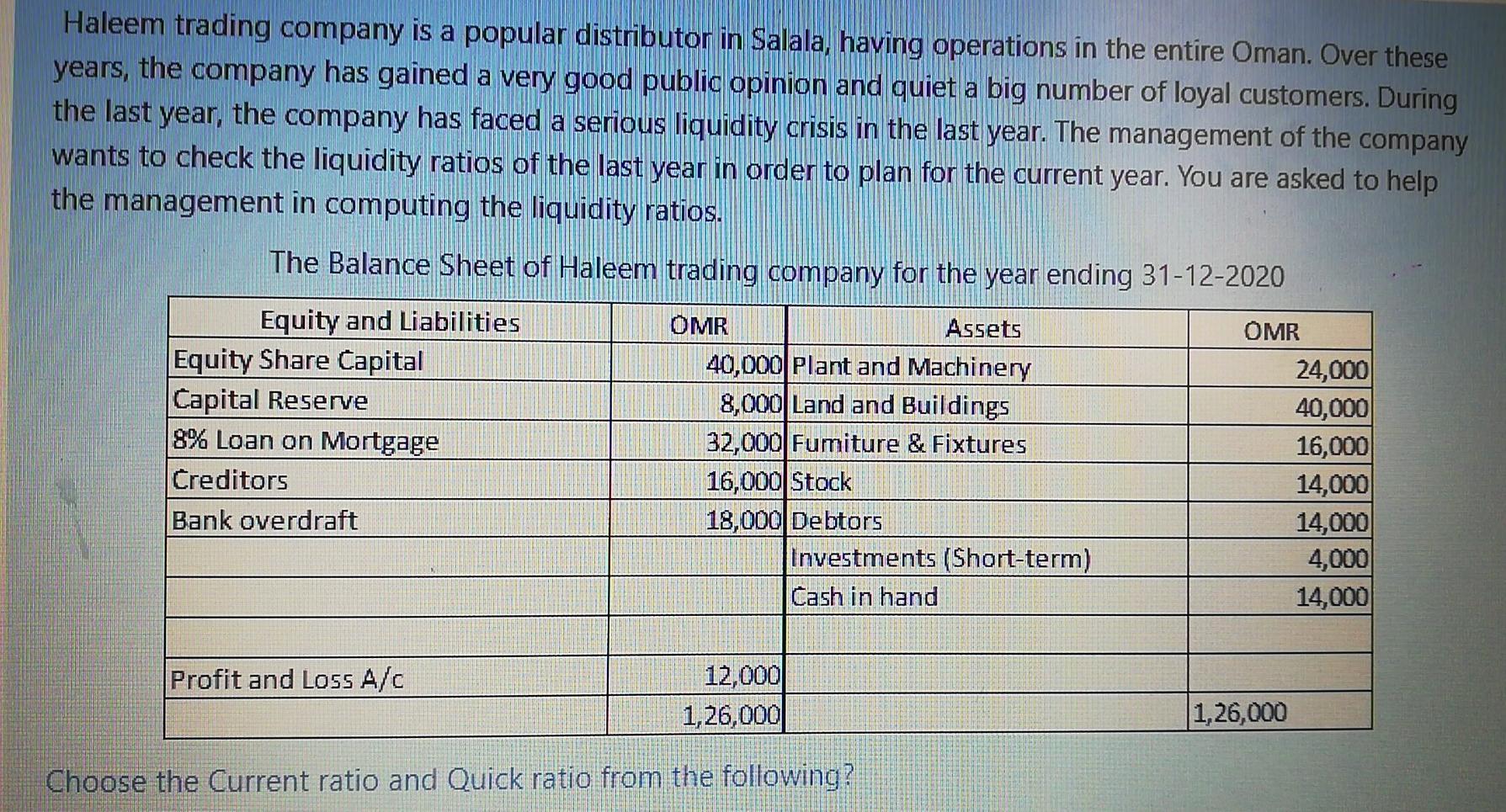

Haleem trading company is a popular distributor in Salala, having operations in the entire Oman. Over these years, the company has gained a very good

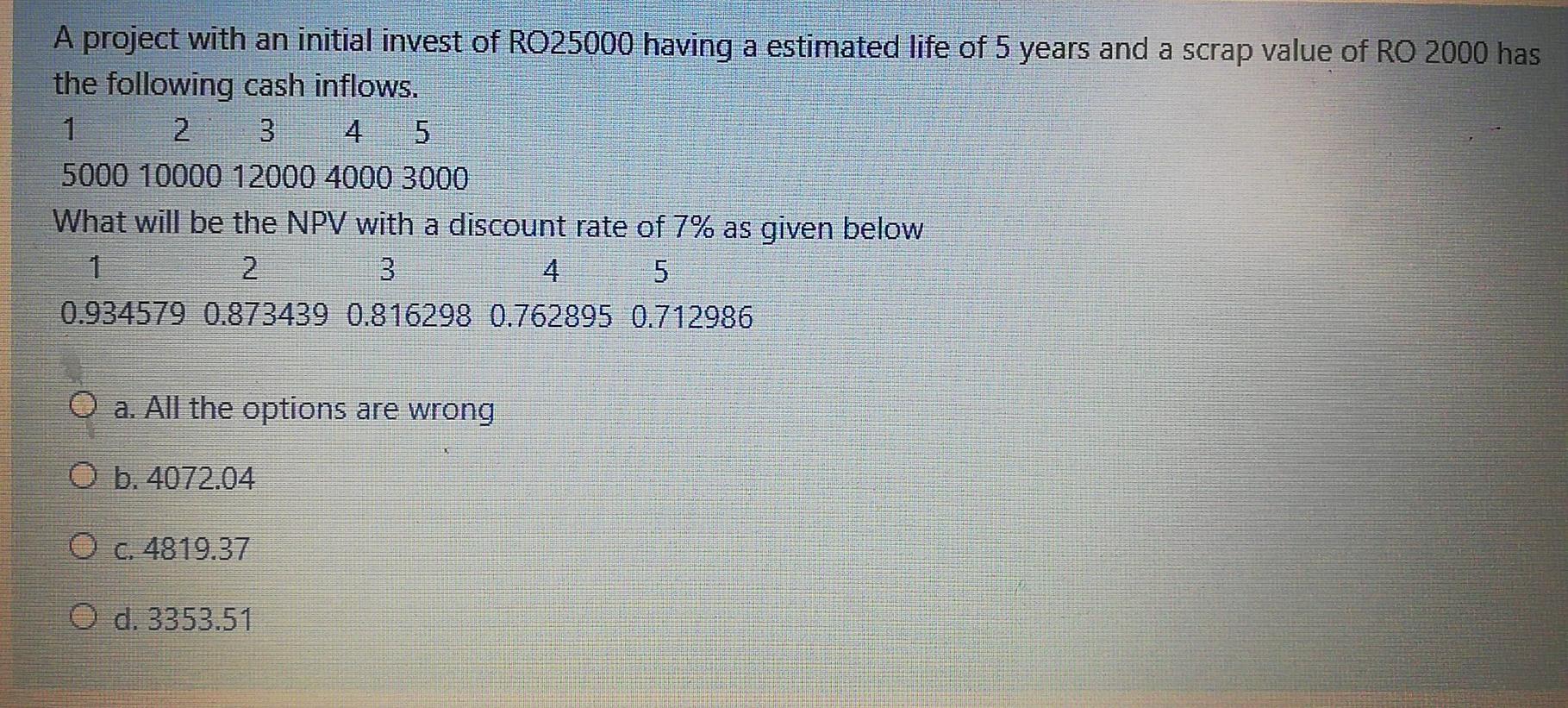

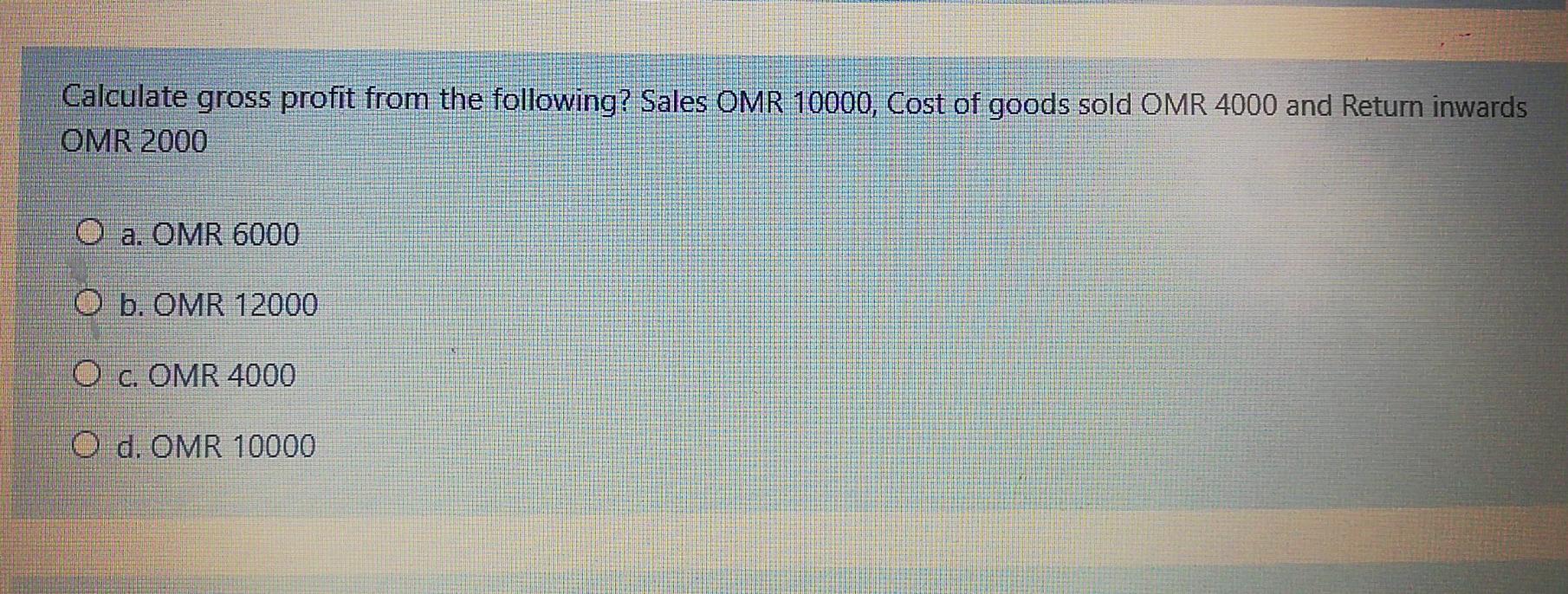

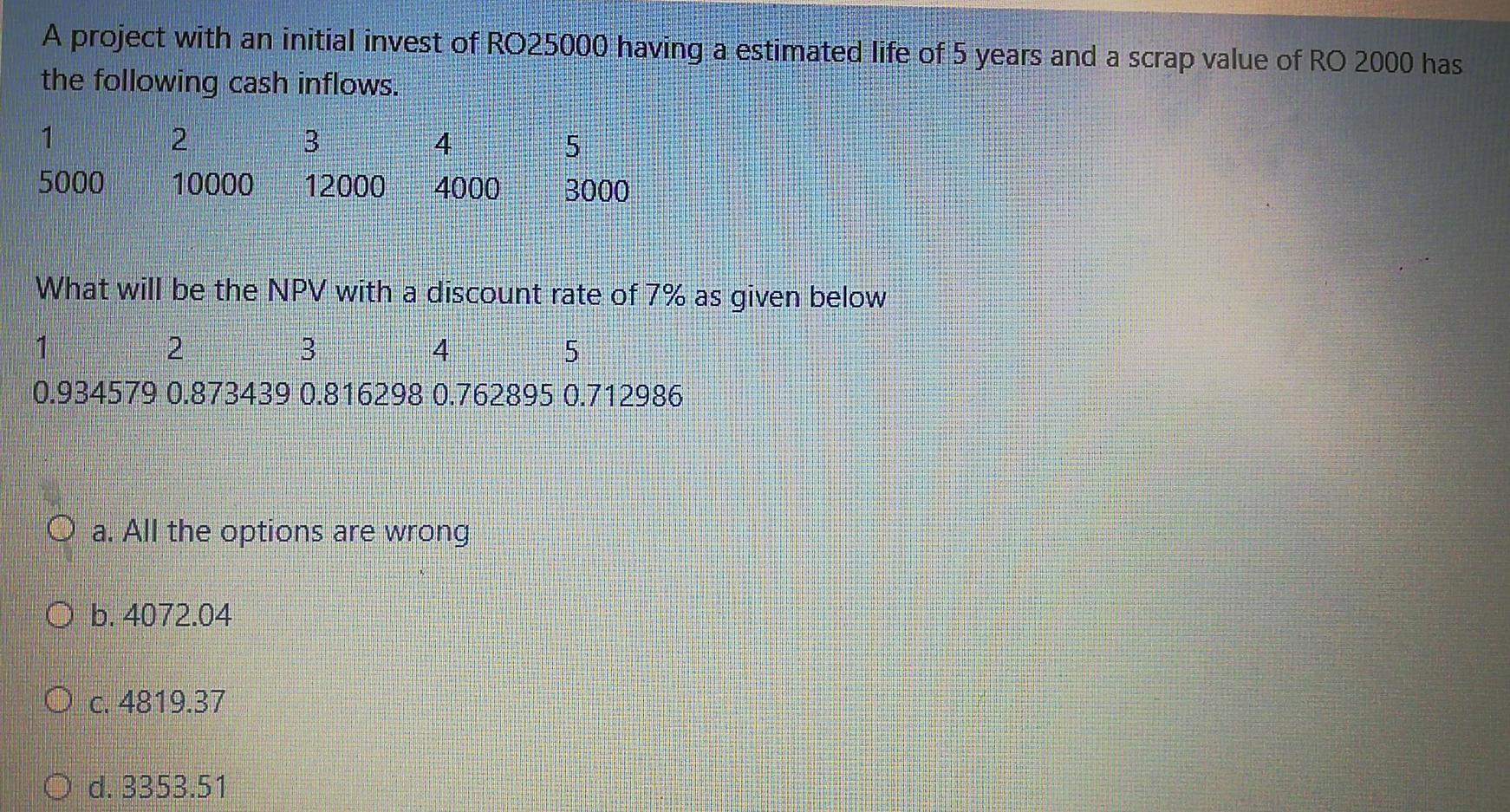

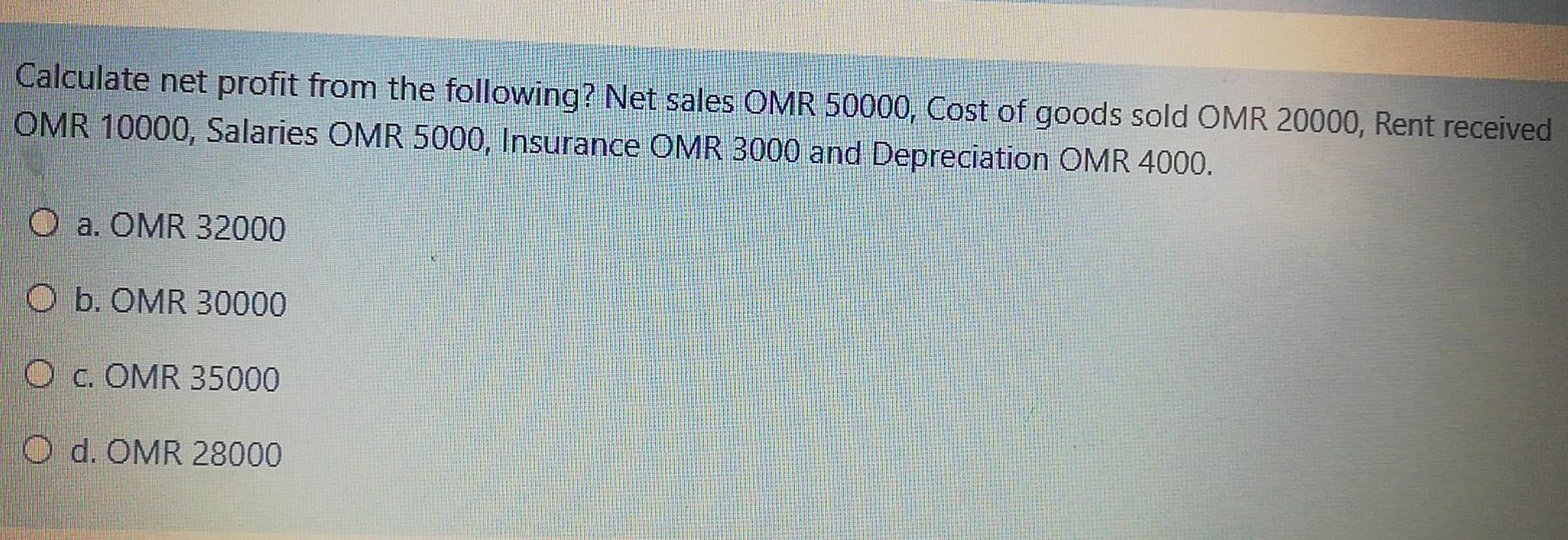

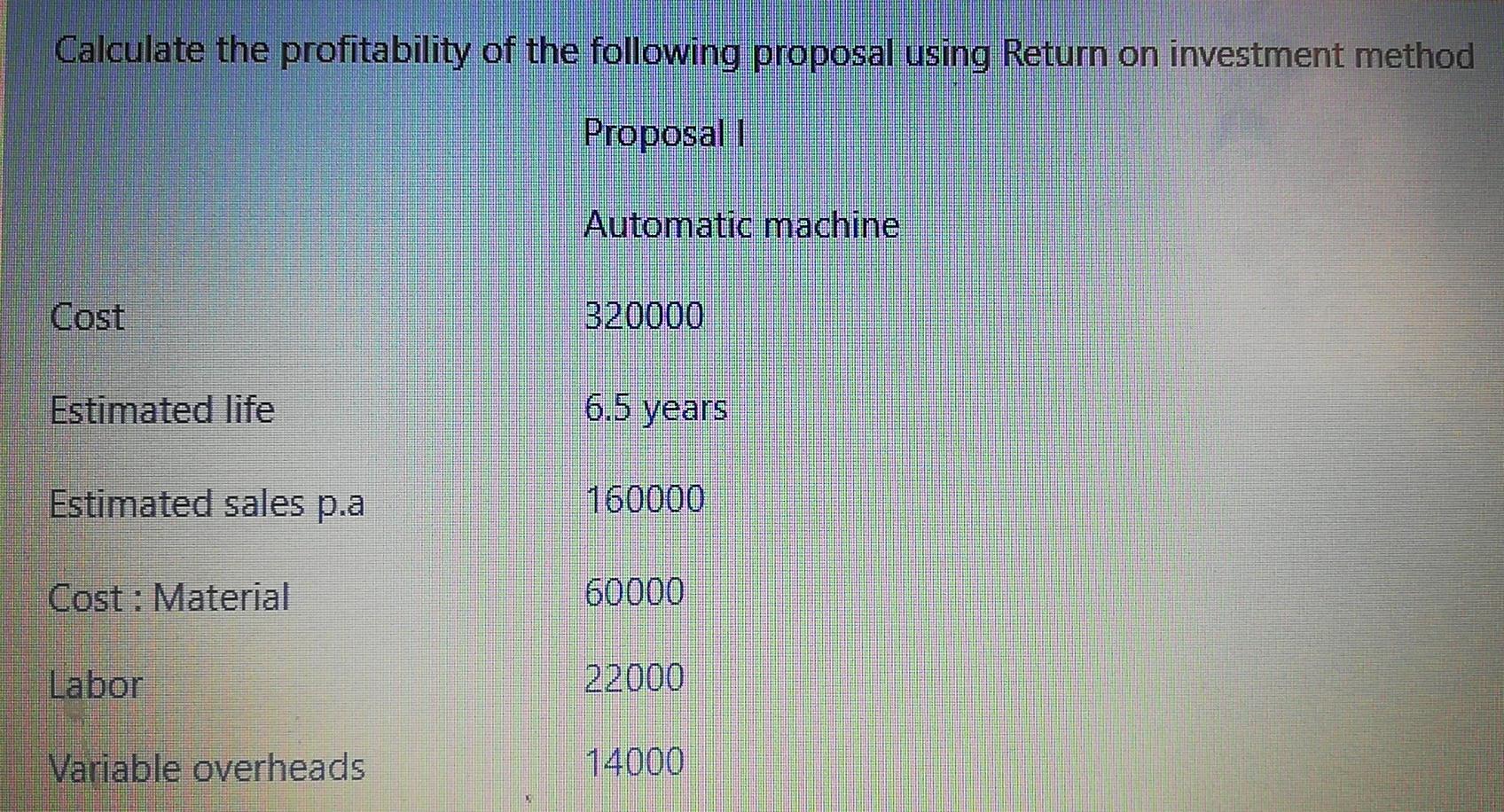

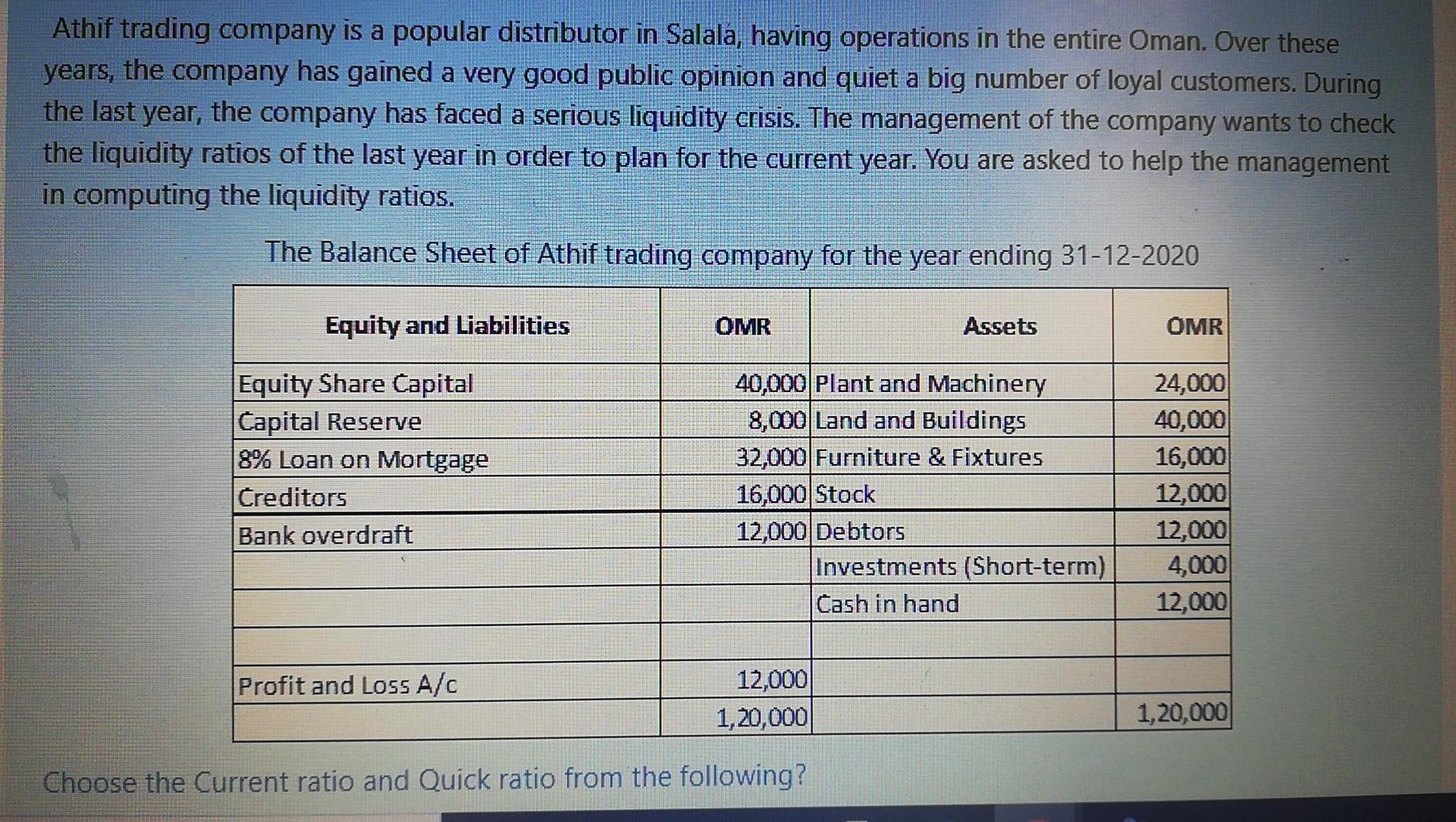

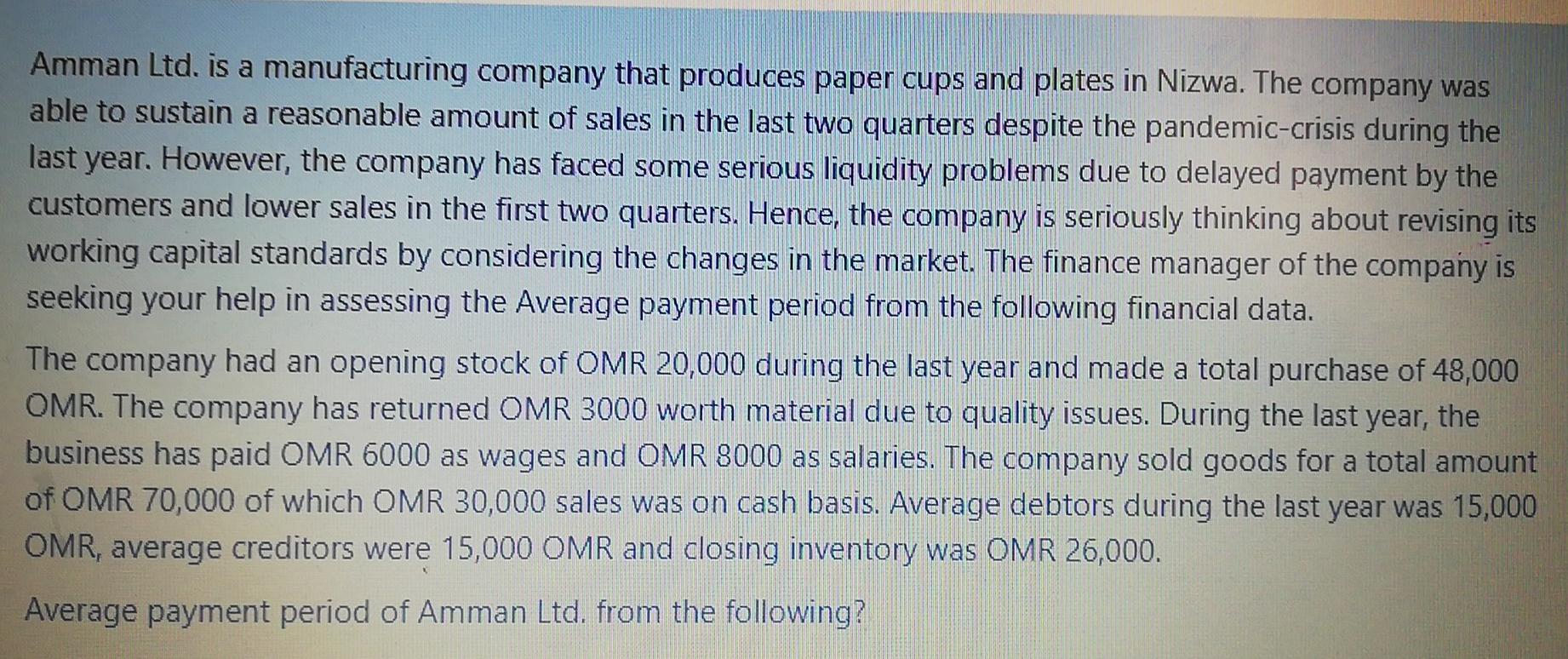

Haleem trading company is a popular distributor in Salala, having operations in the entire Oman. Over these years, the company has gained a very good public opinion and quiet a big number of loyal customers. During the last year, the company has faced a serious liquidity crisis in the last year. The management of the company wants to check the liquidity ratios of the last year in order to plan for the current year. You are asked to help the management in computing the liquidity ratios. The Balance Sheet of Haleem trading company for the year ending 31-12-2020 Equity and Liabilities OMR Assets OMR Equity Share Capital 40,000 plant and Machinery 24,000 Capital Reserve 8,000 Land and Buildings 40,000 8% Loan on Mortgage 32,000 Fumiture & Fixtures 16,000 Creditors 16,000 Stock 14,000 Bank overdraft 18,000 Debtors 14,000 Investments (Short-term) 4,000 Cash in hand 14,000 Profit and Loss A/C 12,000 1,26,000 1,26,000 Choose the Current ratio and Quick ratio from the following? A project with an initial invest of RO25000 having a estimated life of 5 years and a scrap value of RO 2000 has the following cash inflows. 1 2 3 5 5000 10000 12000 4000 3000 What will be the NPV with a discount rate of 7% as given below 1 4 5 0.934579 0.873439 0.816298 0.762895 0.712986 O a. All the options are wrong O b. 4072.04 O c. 4819.37 o d, 3353.51 Calculate gross profit from the following? Sales OMR 10000, Cost of goods sold OMR 4000 and Return inwards OMR 2000 O a OMR 6000 O b. OMR 12000 O c. OMR 4000 O d. OMR 10000 A project with an initial invest of RO25000 having a estimated life of 5 years and a scrap value of RO 2000 has the following cash inflows. 1 4 2 10000 5000 5 3000 12000 4000 What will be the NPV with a discount rate of 7% as given below 1 2 4 5 0.934579 0.873439 0.816298 0.762895 0.712986 O a. All the options are wrong O b. 4072.04 O c. 4819.37 O d. 3853.51 Calculate net profit from the following? Net sales OMR 50000, Cost of goods sold OMR 20000, Rent received OMR 10000, Salaries OMR 5000, Insurance OMR 3000 and Depreciation OMR 4000. O a. OMR 32000 O b. OMR 30000 O C. OMR 35000 O d. OMR 28000 Calculate the profitability of the following proposal using Return on investment method Proposali Automatic machine Cost 320000 Estimated life 6.5 years Estimated sales p.a 160000 Cost : Material 60000 Labor 22000 Variable overheads 14000 Athif trading company is a popular distributor in Salala, having operations in the entire Oman. Over these years, the company has gained a very good public opinion and quiet a big number of loyal customers. During the last year, the company has faced a serious liquidity crisis. The management of the company wants to check the liquidity ratios of the last year in order to plan for the current year. You are asked to help the management in computing the liquidity ratios. The Balance Sheet of Athif trading company for the year ending 31-12-2020 Equity and Liabilities OMR Assets OMR Equity Share Capital Capital Reserve 8% Loan on Mortgage Creditors Bank overdraft 40,000 plant and Machinery 8,000 Land and Buildings 32,000 Furniture & Fixtures 16,000 Stock 12,000 Debtors Investments (Short-term) Cash in hand 24,000 40,000 16,000 12,000 12,000 4,000 12,000 Profit and Loss A/C 12,000 1,20,000 1,20,000 Choose the Current ratio and Quick ratio from the following? Amman Ltd. is a manufacturing company that produces paper cups and plates in Nizwa. The company was able to sustain a reasonable amount of sales in the last two quarters despite the pandemic-crisis during the last year. However, the company has faced some serious liquidity problems due to delayed payment by the customers and lower sales in the first two quarters. Hence, the company is seriously thinking about revising its working capital standards by considering the changes in the market. The finance manager of the company is seeking your help in assessing the Average payment period from the following financial data. The company had an opening stock of OMR 20,000 during the last year and made a total purchase of 48,000 OMR. The company has returned OMR 3000 worth material due to quality issues. During the last year, the business has paid OMR 6000 as wages and OMR 8000 as salaries. The company sold goods for a total amount of OMR 70,000 of which OMR 30,000 sales was on cash basis. Average debtors during the last year was 15,000 OMR, average creditors were 15,000 OMR and closing inventory was OMR 26,000. Average payment period of Amman Ltd. from the following

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started