Answered step by step

Verified Expert Solution

Question

1 Approved Answer

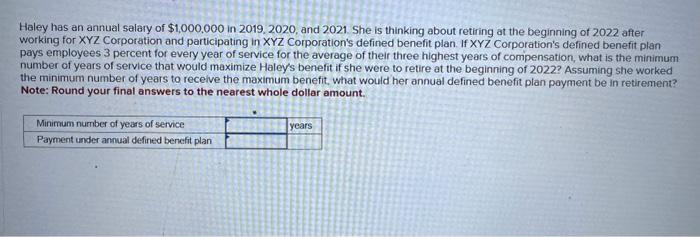

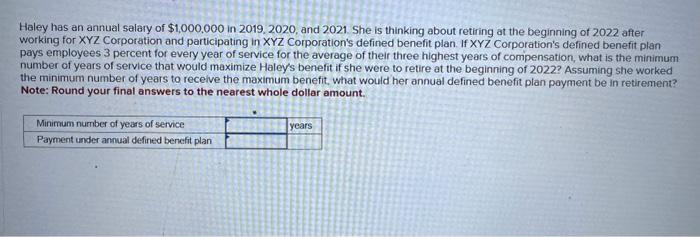

Haley has an annual salary of $1,000,000 in 2019, 2020, and 2021 Haley has an annual salary of $1,000,000 in 2019,2020, and 2021 . She

Haley has an annual salary of $1,000,000 in 2019, 2020, and 2021

Haley has an annual salary of $1,000,000 in 2019,2020, and 2021 . She is thinking about retiring at the beginning of 2022 after working for XYZ Corporation and participating in XYZ Corporation's defined benefit plan. If XYZ Corporation's defined benefit plan pays employees 3 percent for every year of service for the average of their three highest years of compensation, what is the minimum number of years of service that would maximize Haley's benefit if she were to retire at the beginning of 2022? Assuming she worked the minimum number of years to recelve the maximum benefit, what would her annual defined benefit plan payment be in retirement? Note: Round your final answers to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started