Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Halifax Partners, a leveraged buyout firm, is considering an investment in a national retail bookseller. The target is attractive to Halifax because of its

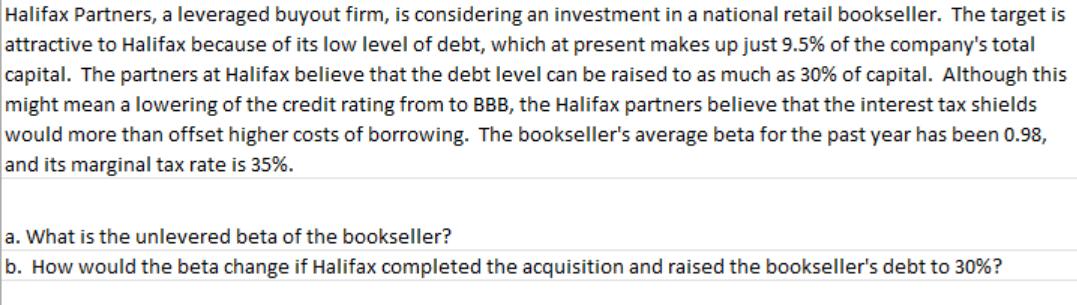

Halifax Partners, a leveraged buyout firm, is considering an investment in a national retail bookseller. The target is attractive to Halifax because of its low level of debt, which at present makes up just 9.5% of the company's total capital. The partners at Halifax believe that the debt level can be raised to as much as 30% of capital. Although this might mean a lowering of the credit rating from to BBB, the Halifax partners believe that the interest tax shields would more than offset higher costs of borrowing. The bookseller's average beta for the past year has been 0.98, and its marginal tax rate is 35%. a. What is the unlevered beta of the bookseller? b. How would the beta change if Halifax completed the acquisition and raised the bookseller's debt to 30%?

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the unlevered beta of the bookseller well use the Hamada equation which relates the lev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started