Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Halloween Costumes Unlimited is considering a new 3-year store expansion project that requires an initial fixed asset investment of $2.6 million. The fixed asset falls

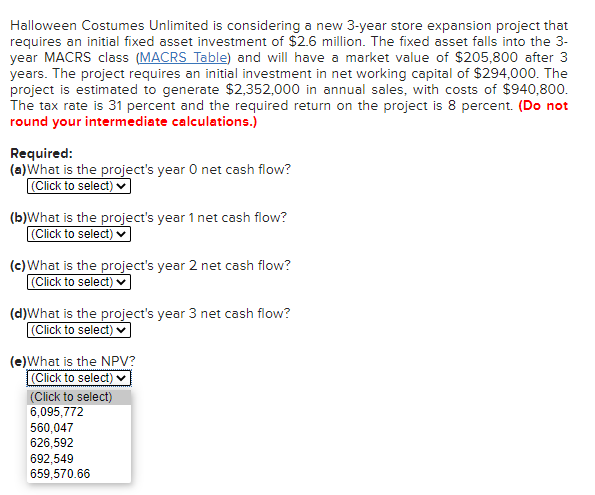

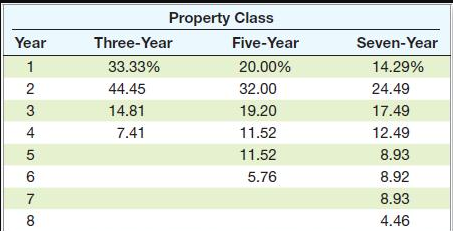

Halloween Costumes Unlimited is considering a new 3-year store expansion project that requires an initial fixed asset investment of $2.6 million. The fixed asset falls into the 3- year MACRS class (MACRS Table) and will have a market value of $205,800 after 3 years. The project requires an initial investment in net working capital of $294,000. The project is estimated to generate $2,352,000 in annual sales, with costs of $940,800. The tax rate is 31 percent and the required return on the project is 8 percent. (Do not round your intermediate calculations.) Required: (a)What is the project's year 0 net cash flow? (Click to select) (b)What is the project's year 1 net cash flow? (Click to select) (c) What is the project's year 2 net cash flow? (Click to select) (d)What is the project's year 3 net cash flow? (Click to select) (e) What is the NPV? (Click to select) (Click to select) 6,095,772 560,047 626,592 692,549 659,570.66 Year 1 2 3 Property Class Three-Year Five-Year 33.33% 20.00% 44.45 32.00 14.81 19.20 7.41 11.52 11.52 5.76 4 Seven-Year 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started