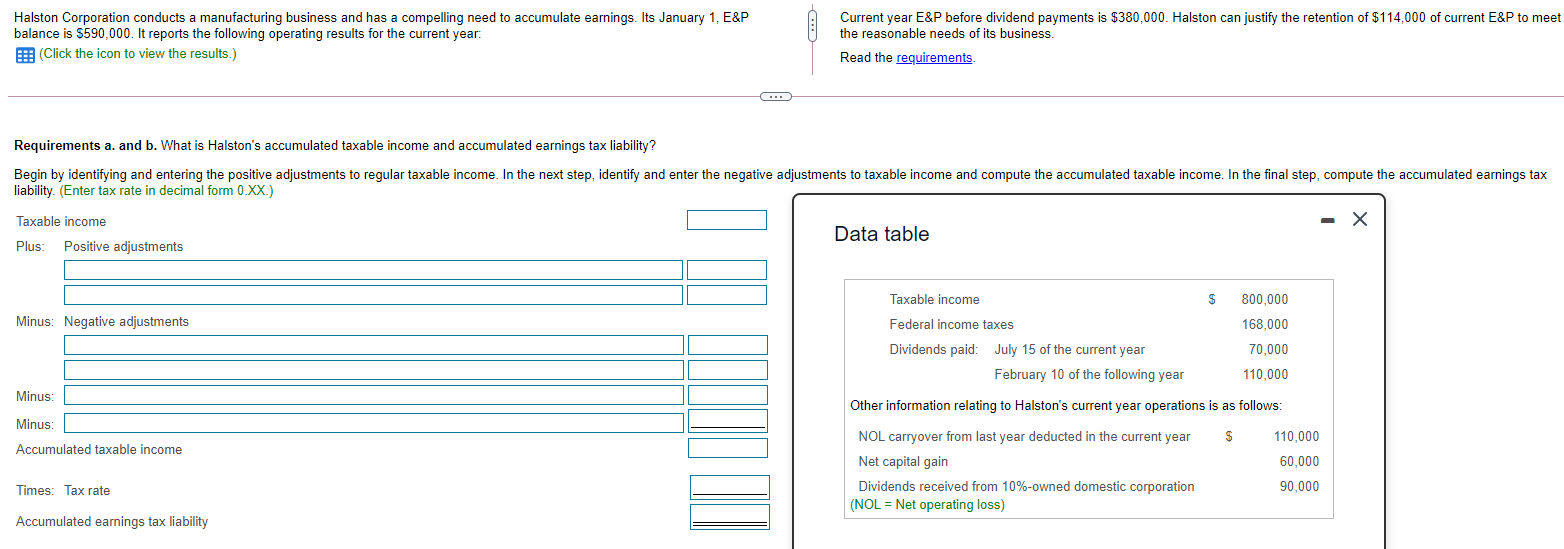

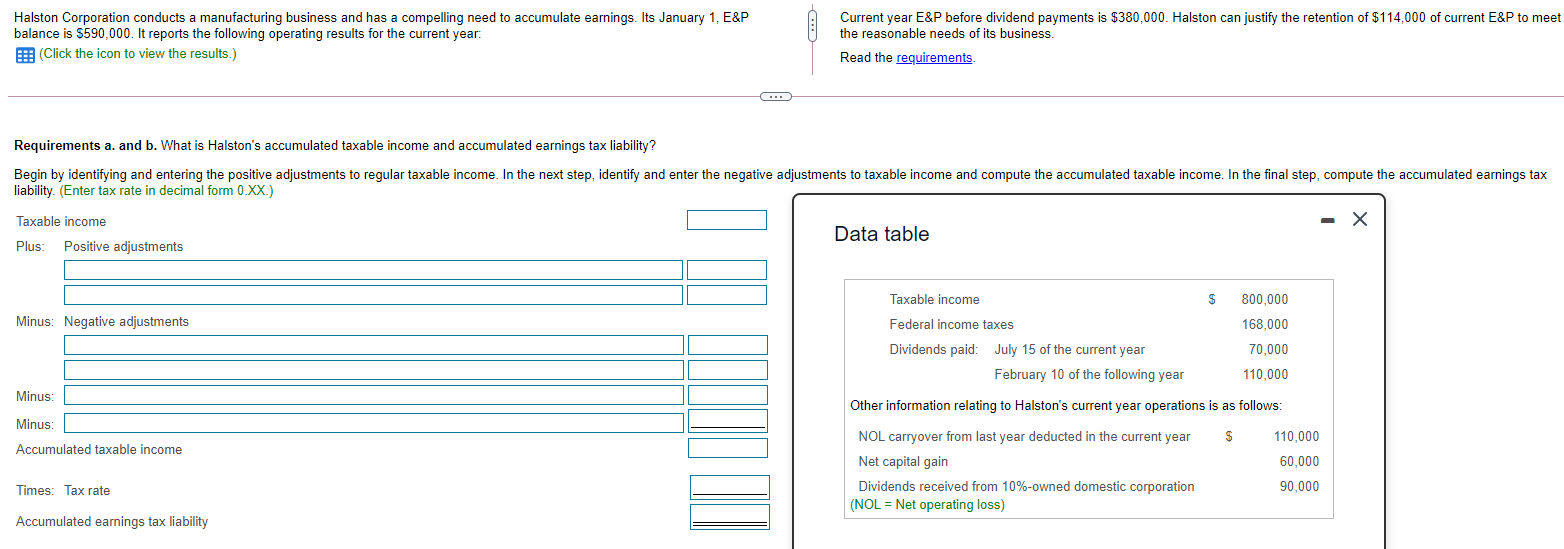

Halston Corporation conducts a manufacturing business and has a compelling need to accumulate earnings. Its January 1, E&P balance is $590,000. It reports the following operating results for the current year: E: (Click the icon to view the results.) Current year E&P before dividend payments is $380,000. Halston can justify the retention of $114,000 of current E&P to meet the reasonable needs of its business. Read the requirements Requirements a. and b. What is Halston's accumulated taxable income and accumulated earnings tax liability? Begin by identifying and entering the positive adjustments to regular taxable income. In the next step, identify and enter the negative adjustments to taxable income and compute the accumulated taxable income. In the final step, compute the accumulated earnings tax liability. (Enter tax rate in decimal form 0.XX.) - Taxable income Plus: Positive adjustments Data table Taxable income $ 800,000 Minus: Negative adjustments Federal income taxes 168,000 70,000 Dividends paid: July 15 of the current year February 10 of the following year 110,000 Minus: Other information relating to Halston's current year operations is as follows: Minus: $ Accumulated taxable income 110,000 60,000 NOL carryover from last year deducted in the current year Net capital gain Dividends received from 10%-owned domestic corporation (NOL = Net operating loss) Times: Tax rate 90,000 Accumulated earnings tax liability Halston Corporation conducts a manufacturing business and has a compelling need to accumulate earnings. Its January 1, E&P balance is $590,000. It reports the following operating results for the current year: E: (Click the icon to view the results.) Current year E&P before dividend payments is $380,000. Halston can justify the retention of $114,000 of current E&P to meet the reasonable needs of its business. Read the requirements Requirements a. and b. What is Halston's accumulated taxable income and accumulated earnings tax liability? Begin by identifying and entering the positive adjustments to regular taxable income. In the next step, identify and enter the negative adjustments to taxable income and compute the accumulated taxable income. In the final step, compute the accumulated earnings tax liability. (Enter tax rate in decimal form 0.XX.) - Taxable income Plus: Positive adjustments Data table Taxable income $ 800,000 Minus: Negative adjustments Federal income taxes 168,000 70,000 Dividends paid: July 15 of the current year February 10 of the following year 110,000 Minus: Other information relating to Halston's current year operations is as follows: Minus: $ Accumulated taxable income 110,000 60,000 NOL carryover from last year deducted in the current year Net capital gain Dividends received from 10%-owned domestic corporation (NOL = Net operating loss) Times: Tax rate 90,000 Accumulated earnings tax liability