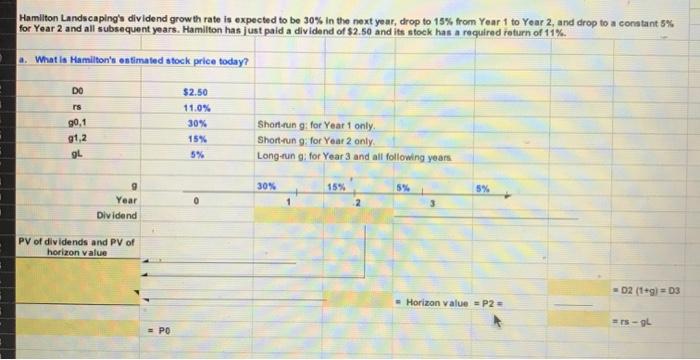

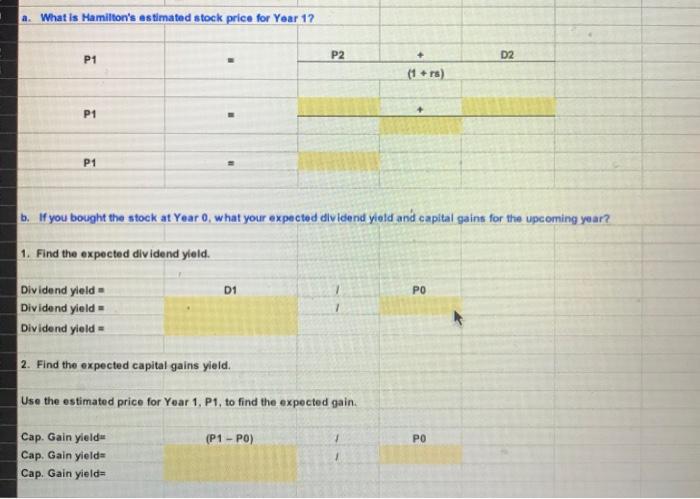

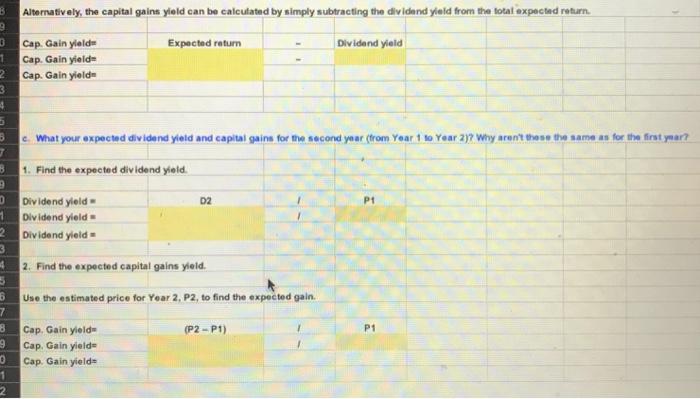

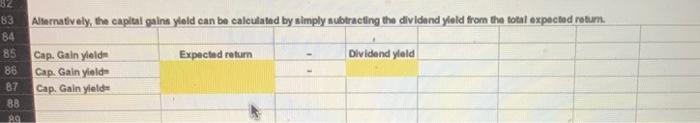

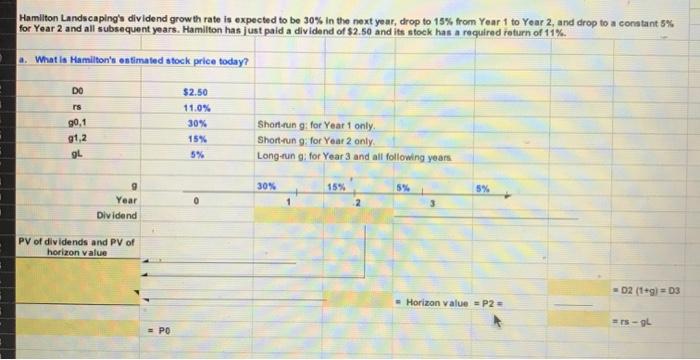

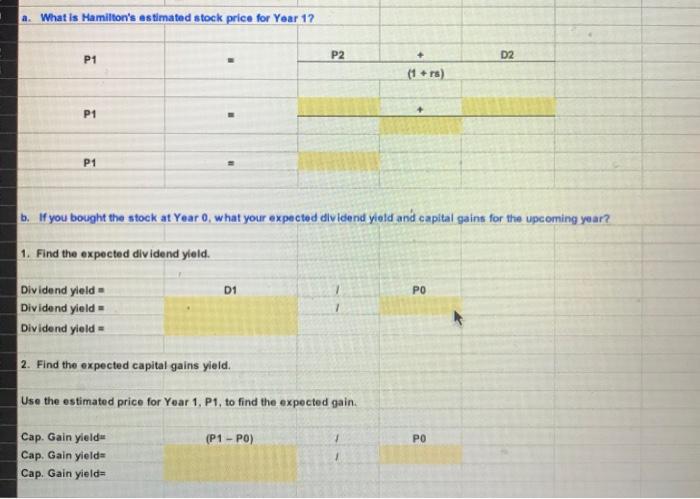

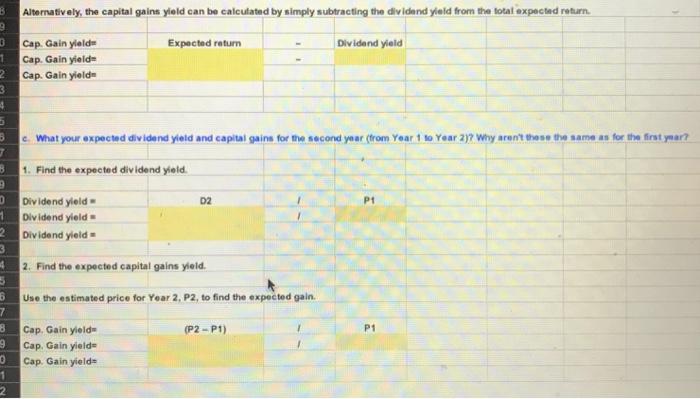

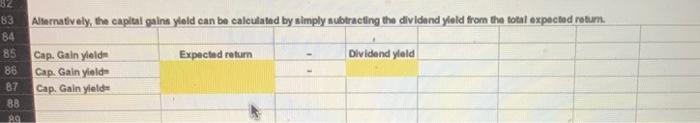

Hamilton Landscaping's dividend growth rate is expected to be 30% in the next year, crop to 15% from Your 1 to Year 2 and drop to a constant 5% for Year 2 and all subsequent years. Hamilton has just paid a dividend of $2.50 and its stock has a required return of 11% 2. What is Hamilton's entimated stock price today? DO rs 90,1 g1,2 OL $2.50 11.0% 30% 15% 5% Short.un g: for Year 1 only Short-run gfor Your 2 only Long-rungfor Year 3 and all following years. 30% 15% 5% 5% 9 Year Dividend 1 3 PV of dividends and PV of horizon value 02 (1g=D3 Horizon value = P2 = =13-L = PO a. What is Hamilton's estimated stock price for Year 1? P1 P2 + D2 (1+rs) P1 P1 b. If you bought the stock at Year 0, what your expected dividend yield and capital gains for the upcoming year? 1. Find the expected dividend yield. PO Dividend yield Dividend yield - Dividend yield 2. Find the expected capital gains yield. Use the estimated price for Year 1, P1, to find the expected gain. (P1-PO) 1 PO Cap. Gain yield Cap. Gain yields Cap. Gain yield- B Alternatively, the capital gains yield can be calculated by simply subtracting the dividend yield from the total expected return 9 3 Cap. Gain yields Expected return Dividend yield 1 Cap. Gain yields 2 Cap. Gain yield- 3 4 5 5 c. What your expected dividend yield and capital gains for the second year (from Year 1 to Year 2)? Why aren't these the same as for the first ymar? 7 B 1. Find the expected dividend yield. 9 0 Dividend yield 1 Dividend yield 2 Dividend yield 3 4 2. Find the expected capital gains yield. D2 Use the estimated price for Year 2, P2, to find the expected gain. B 7 8 9 (P2-P1) P1 Cap. Gain yield Cap. Gain yielde Cap. Gain yielde 1 Alternatively, the capital gain yield can be calculated by simply subtracting the dividend yield from the total expected rotum. Expected return Dividend yield 62 83 B4 85 B6 87 8B RO Cap. Gain yielde Cap. Gain yield Cap. Gain yields Hamilton Landscaping's dividend growth rate is expected to be 30% in the next year, crop to 15% from Your 1 to Year 2 and drop to a constant 5% for Year 2 and all subsequent years. Hamilton has just paid a dividend of $2.50 and its stock has a required return of 11% 2. What is Hamilton's entimated stock price today? DO rs 90,1 g1,2 OL $2.50 11.0% 30% 15% 5% Short.un g: for Year 1 only Short-run gfor Your 2 only Long-rungfor Year 3 and all following years. 30% 15% 5% 5% 9 Year Dividend 1 3 PV of dividends and PV of horizon value 02 (1g=D3 Horizon value = P2 = =13-L = PO a. What is Hamilton's estimated stock price for Year 1? P1 P2 + D2 (1+rs) P1 P1 b. If you bought the stock at Year 0, what your expected dividend yield and capital gains for the upcoming year? 1. Find the expected dividend yield. PO Dividend yield Dividend yield - Dividend yield 2. Find the expected capital gains yield. Use the estimated price for Year 1, P1, to find the expected gain. (P1-PO) 1 PO Cap. Gain yield Cap. Gain yields Cap. Gain yield- B Alternatively, the capital gains yield can be calculated by simply subtracting the dividend yield from the total expected return 9 3 Cap. Gain yields Expected return Dividend yield 1 Cap. Gain yields 2 Cap. Gain yield- 3 4 5 5 c. What your expected dividend yield and capital gains for the second year (from Year 1 to Year 2)? Why aren't these the same as for the first ymar? 7 B 1. Find the expected dividend yield. 9 0 Dividend yield 1 Dividend yield 2 Dividend yield 3 4 2. Find the expected capital gains yield. D2 Use the estimated price for Year 2, P2, to find the expected gain. B 7 8 9 (P2-P1) P1 Cap. Gain yield Cap. Gain yielde Cap. Gain yielde 1 Alternatively, the capital gain yield can be calculated by simply subtracting the dividend yield from the total expected rotum. Expected return Dividend yield 62 83 B4 85 B6 87 8B RO Cap. Gain yielde Cap. Gain yield Cap. Gain yields