Question

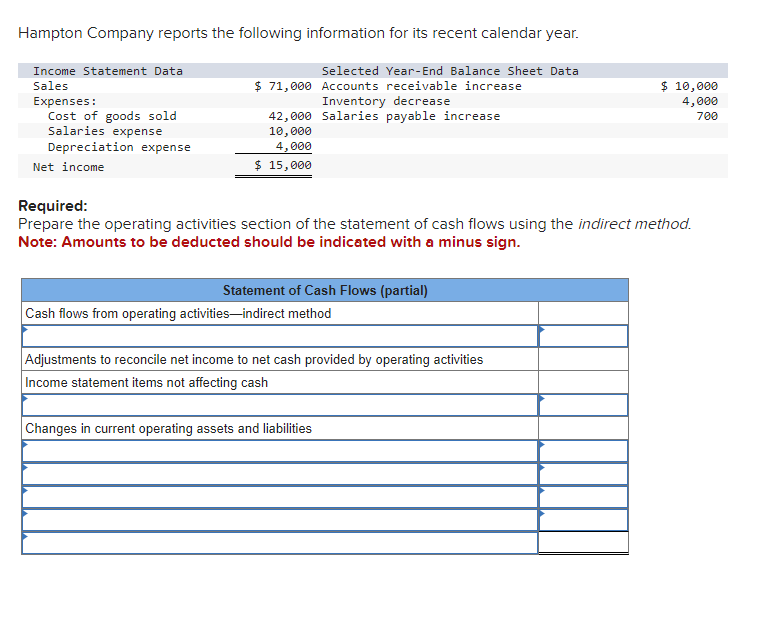

Hampton Company reports the following information for its recent calendar year. Income Statement Data Sales Expenses: Cost of goods sold Salaries expense Depreciation expense

Hampton Company reports the following information for its recent calendar year. Income Statement Data Sales Expenses: Cost of goods sold Salaries expense Depreciation expense Net income Required: Selected Year-End Balance Sheet Data Inventory decrease $ 10,000 4,000 $ 71,000 Accounts receivable increase 42,000 Salaries payable increase 10,000 4,000 $ 15,000 Prepare the operating activities section of the statement of cash flows using the indirect method. Note: Amounts to be deducted should be indicated with a minus sign. 700 Statement of Cash Flows (partial) Cash flows from operating activities-indirect method Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental accounting principle

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

21st edition

1259119831, 9781259311703, 978-1259119835, 1259311708, 978-0078025587

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App