Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Han and Leia are college students. They each have $150 per month to spend. They both enjoy driving but also consume a number of

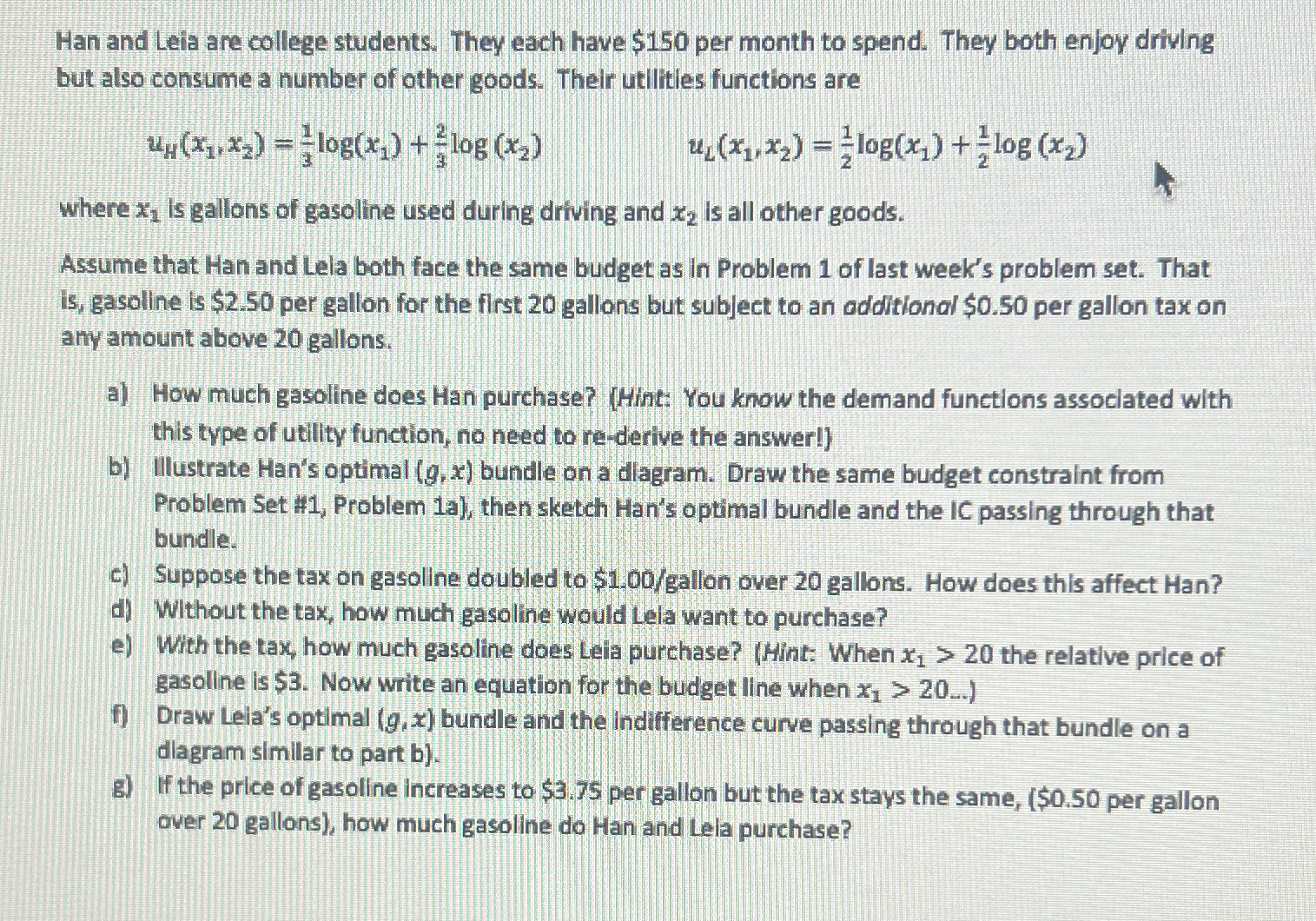

Han and Leia are college students. They each have $150 per month to spend. They both enjoy driving but also consume a number of other goods. Their utilities functions are (x1,x2) = log(x)+log (x2) u(x1,x2) = log(x)+log (x2) where x is gallons of gasoline used during driving and x is all other goods. Assume that Han and Lela both face the same budget as in Problem 1 of last week's problem set. That is, gasoline is $2.50 per gallon for the first 20 gallons but subject to an additional $0.50 per gallon tax on any amount above 20 gallons. a) How much gasoline does Han purchase? (Hint: You know the demand functions associated with this type of utility function, no need to re-derive the answer!] b) Illustrate Han's optimal (g, x) bundle on a diagram. Draw the same budget constraint from Problem Set #1, Problem 1a), then sketch Han's optimal bundle and the IC passing through that bundle. c) Suppose the tax on gasoline doubled to $1.00/gallon over 20 gallons. How does this affect Han? d) Without the tax, how much gasoline would Lela want to purchase? e) With the tax, how much gasoline does Leia purchase? (Hint: When x > 20 the relative price of gasoline is $3. Now write an equation for the budget line when x > 20...) f) Draw Lela's optimal (g,x) bundle and the indifference curve passing through that bundle on a diagram similar to part b). g) If the price of gasoline increases to $3.75 per gallon but the tax stays the same, ($0.50 per gallon over 20 gallons), how much gasoline do Han and Lela purchase?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started