Answered step by step

Verified Expert Solution

Question

1 Approved Answer

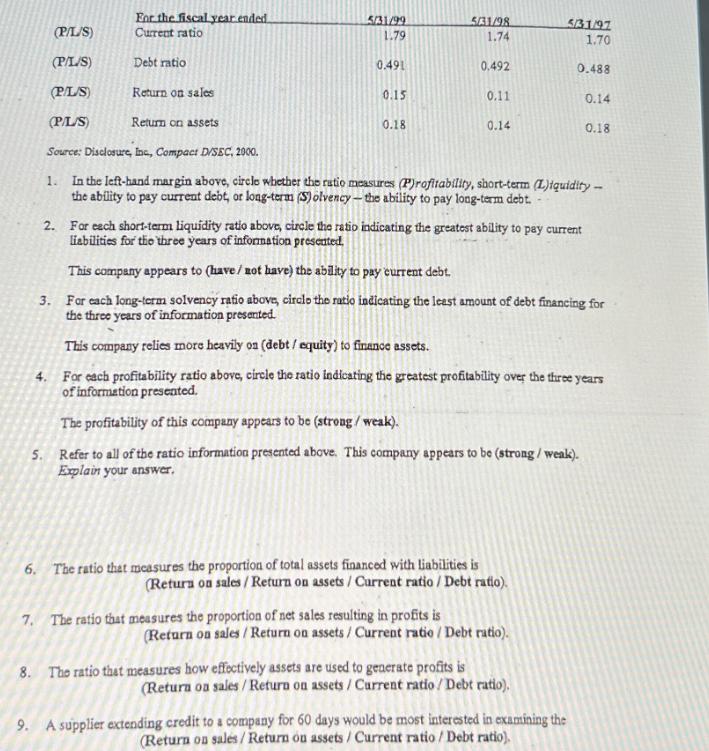

For the fiscal year ended 5/31/99 5/31/98 5/31/97 (P/L/S) Current ratio 1.79 1.74 1.70 (P/L/S) Debt ratio 0.491 0.492 0.488 (P/L/S) Return on sales

For the fiscal year ended 5/31/99 5/31/98 5/31/97 (P/L/S) Current ratio 1.79 1.74 1.70 (P/L/S) Debt ratio 0.491 0.492 0.488 (P/L/S) Return on sales 0.15 0.11 0.14 (P/L/S) Return on assets 0.18 0.14 0.18 Source: Disclosure, Inc, Compact D/SEC, 2000. 1. In the left-hand margin above, circle whether the ratio measures (P)rofitability, short-term (L)iquidity- the ability to pay current debt, or long-term (S)olvency-the ability to pay long-term debt. 2. For each short-term liquidity ratio above, circle the ratio indicating the greatest ability to pay current liabilities for the three years of information presented. This company appears to (have/ not have) the ability to pay current debt. 3. For each long-term solvency ratio above, circle the ratio indicating the least amount of debt financing for the three years of information presented. This company relies more heavily on (debt/equity) to finance assets. 4. For each profitability ratio above, circle the ratio indicating the greatest profitability over the three years of information presented. The profitability of this company appears to be (strong/weak). 5. Refer to all of the ratio information presented above. This company appears to be (strong/weak). Explain your answer. 6. The ratio that measures the proportion of total assets financed with liabilities is (Return on sales/Return on assets / Current ratio / Debt ratio). 7. The ratio that measures the proportion of net sales resulting in profits is (Return on sales/Return on assets/Current ratio/Debt ratio). 8. The ratio that measures how effectively assets are used to generate profits is (Return on sales/Return on assets / Current ratio/Debt ratio). 9. A supplier extending credit to a company for 60 days would be most interested in examining the (Return on sales/Return on assets / Current ratio/Debt ratio).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started