Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Han Company wishes to forecast its cash flows for Year 2. In Year 2, sales are expected to increase by 50%. Management has made the

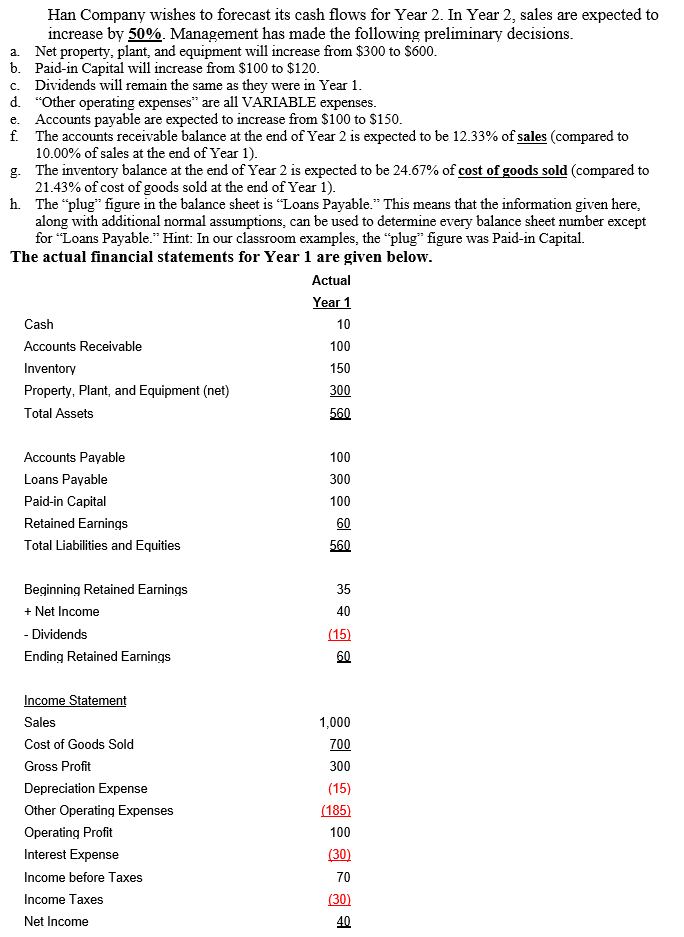

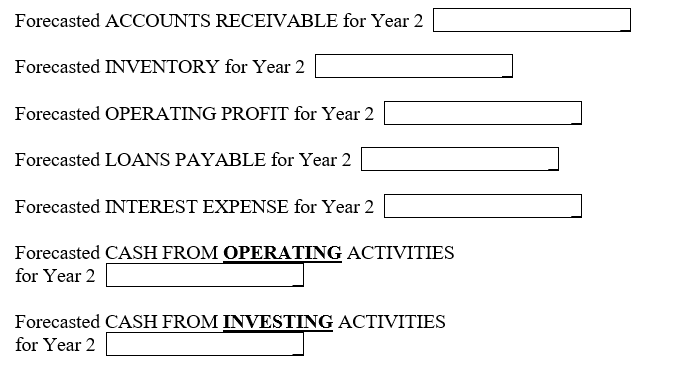

Han Company wishes to forecast its cash flows for Year 2. In Year 2, sales are expected to increase by 50%. Management has made the following preliminary decisions. a. Net property, plant, and equipment will increase from $300 to $600. b. Paid-in Capital will increase from $100 to $120. c. Dividends will remain the same as they were in Year 1. d. "Other operating expenses" are all VARIABLE expenses. e. Accounts payable are expected to increase from $100 to $150. f. The accounts receivable balance at the end of Year 2 is expected to be 12.33% of sales (compared to 10.00% of sales at the end of Year 1). g. The inventory balance at the end of Year 2 is expected to be 24.67% of cost of goods sold (compared to 21.43% of cost of goods sold at the end of Year 1 ). h. The "plug" figure in the balance sheet is "Loans Payable." This means that the information given here, along with additional normal assumptions, can be used to determine every balance sheet number except for "Loans Payable." Hint: In our classroom examples, the "plug" figure was Paid-in Capital. The actual financial statements for Year 1 are given below. Forecasted ACCOUNTS RECEIVABLE for Year 2 Forecasted INVENTORY for Year 2 Forecasted OPERATING PROFIT for Year 2 Forecasted LOANS PAYABLE for Year 2 Forecasted INTEREST EXPENSE for Year 2 Forecasted CASH FROM OPERATING ACTIVITIES for Year 2 Forecasted CASH FROM INVESTING ACTIVITIES for Year 2

Han Company wishes to forecast its cash flows for Year 2. In Year 2, sales are expected to increase by 50%. Management has made the following preliminary decisions. a. Net property, plant, and equipment will increase from $300 to $600. b. Paid-in Capital will increase from $100 to $120. c. Dividends will remain the same as they were in Year 1. d. "Other operating expenses" are all VARIABLE expenses. e. Accounts payable are expected to increase from $100 to $150. f. The accounts receivable balance at the end of Year 2 is expected to be 12.33% of sales (compared to 10.00% of sales at the end of Year 1). g. The inventory balance at the end of Year 2 is expected to be 24.67% of cost of goods sold (compared to 21.43% of cost of goods sold at the end of Year 1 ). h. The "plug" figure in the balance sheet is "Loans Payable." This means that the information given here, along with additional normal assumptions, can be used to determine every balance sheet number except for "Loans Payable." Hint: In our classroom examples, the "plug" figure was Paid-in Capital. The actual financial statements for Year 1 are given below. Forecasted ACCOUNTS RECEIVABLE for Year 2 Forecasted INVENTORY for Year 2 Forecasted OPERATING PROFIT for Year 2 Forecasted LOANS PAYABLE for Year 2 Forecasted INTEREST EXPENSE for Year 2 Forecasted CASH FROM OPERATING ACTIVITIES for Year 2 Forecasted CASH FROM INVESTING ACTIVITIES for Year 2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started