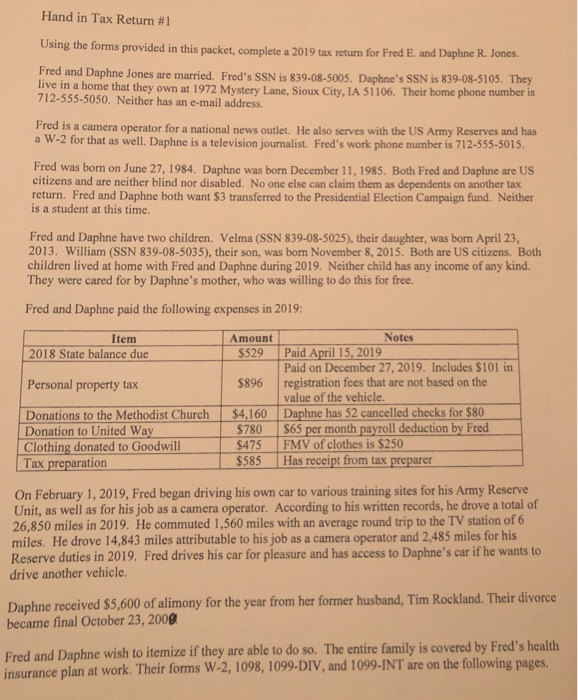

Hand in Tax Return #1 Using the forms provided in this packet, complete a 2019 tax return for Fred E. and Daphne R Jones Fred and Daphne Jones are married. Fred's SSN is 839-08-5005. Daphne's SSN is 839-08-5105. They live in a home that they own at 1972 Mystery Lane. Sioux City, IA 51106. Their home phone number is 712-555-5050. Neither has an e-mail address Fred is a camera operator for a national news outlet. He also serves with the US Army Reserves and has a W-2 for that as well. Daphne is a television journalist. Fred's work phone number is 712-555-5015. Fred was born on June 27, 1984. Daphne was born December 11. 1985. Both Fred and Daphne are US citizens and are neither blind nor disabled. No one else can claim them as dependents on another tax return. Fred and Daphne both want $3 transferred to the Presidential Election Campaign fund. Neither is a student at this time. Fred and Daphne have two children. Velma (SSN 839-08-5025), their daughter, was bom April 23, 2013. William (SSN 839-08-5035), their son, was born November 8, 2015. Both are US citizens. Both children lived at home with Fred and Daphne during 2019. Neither child has any income of any kind. They were cared for by Daphne's mother, who was willing to do this for free. Fred and Daphne paid the following expenses in 2019: Item 2018 State balance due Amount $529 Personal property tax $896 Notes Paid April 15, 2019 Paid on December 27, 2019. Includes $101 in registration fees that are not based on the value of the vehicle. Daphne has 52 cancelled checks for $80 $65 per month payroll deduction by Fred FMV of clothes is $250 Has receipt from tax preparer Donations to the Methodist Church Donation to United Way Clothing donated to Goodwill Tax preparation $4,160 $780 $475 $585 On February 1, 2019, Fred began driving his own car to various training sites for his Army Reserve Unit, as well as for his job as a camera operator. According to his written records, he drove a total of 26,850 miles in 2019. He commuted 1,560 miles with an average round trip to the TV station of 6 miles. He drove 14,843 miles attributable to his job as a camera operator and 2,485 miles for his Reserve duties in 2019. Fred drives his car for pleasure and has access to Daphne's car if he wants to drive another vehicle. Daphne received $5,600 of alimony for the year from her former husband, Tim Rockland. Their divorce became final October 23, 2009 Fred and Daphne wish to itemize if they are able to do so. The entire family is covered by Fred's health insurance plan at work. Their forms W-2, 1098, 1099-DIV, and 1099-INT are on the following pages. Hand in Tax Return #1 Using the forms provided in this packet, complete a 2019 tax return for Fred E. and Daphne R Jones Fred and Daphne Jones are married. Fred's SSN is 839-08-5005. Daphne's SSN is 839-08-5105. They live in a home that they own at 1972 Mystery Lane. Sioux City, IA 51106. Their home phone number is 712-555-5050. Neither has an e-mail address Fred is a camera operator for a national news outlet. He also serves with the US Army Reserves and has a W-2 for that as well. Daphne is a television journalist. Fred's work phone number is 712-555-5015. Fred was born on June 27, 1984. Daphne was born December 11. 1985. Both Fred and Daphne are US citizens and are neither blind nor disabled. No one else can claim them as dependents on another tax return. Fred and Daphne both want $3 transferred to the Presidential Election Campaign fund. Neither is a student at this time. Fred and Daphne have two children. Velma (SSN 839-08-5025), their daughter, was bom April 23, 2013. William (SSN 839-08-5035), their son, was born November 8, 2015. Both are US citizens. Both children lived at home with Fred and Daphne during 2019. Neither child has any income of any kind. They were cared for by Daphne's mother, who was willing to do this for free. Fred and Daphne paid the following expenses in 2019: Item 2018 State balance due Amount $529 Personal property tax $896 Notes Paid April 15, 2019 Paid on December 27, 2019. Includes $101 in registration fees that are not based on the value of the vehicle. Daphne has 52 cancelled checks for $80 $65 per month payroll deduction by Fred FMV of clothes is $250 Has receipt from tax preparer Donations to the Methodist Church Donation to United Way Clothing donated to Goodwill Tax preparation $4,160 $780 $475 $585 On February 1, 2019, Fred began driving his own car to various training sites for his Army Reserve Unit, as well as for his job as a camera operator. According to his written records, he drove a total of 26,850 miles in 2019. He commuted 1,560 miles with an average round trip to the TV station of 6 miles. He drove 14,843 miles attributable to his job as a camera operator and 2,485 miles for his Reserve duties in 2019. Fred drives his car for pleasure and has access to Daphne's car if he wants to drive another vehicle. Daphne received $5,600 of alimony for the year from her former husband, Tim Rockland. Their divorce became final October 23, 2009 Fred and Daphne wish to itemize if they are able to do so. The entire family is covered by Fred's health insurance plan at work. Their forms W-2, 1098, 1099-DIV, and 1099-INT are on the following pages