Hand writing answer, help me please

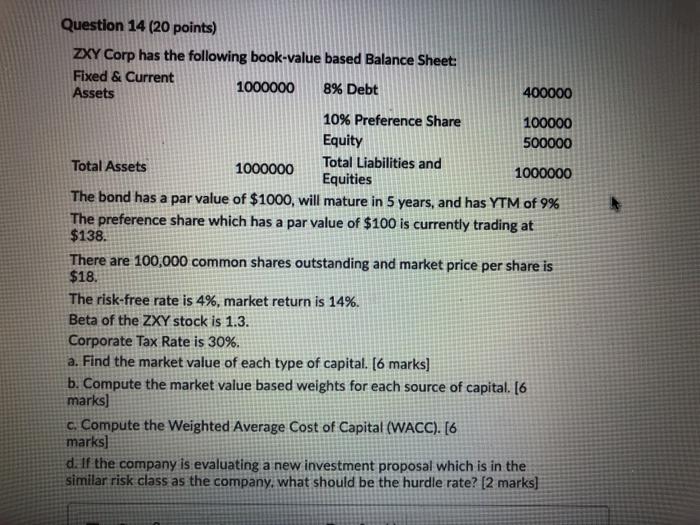

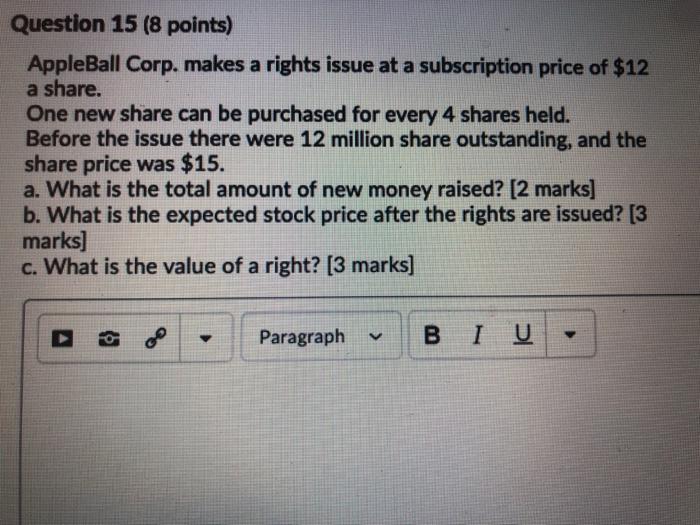

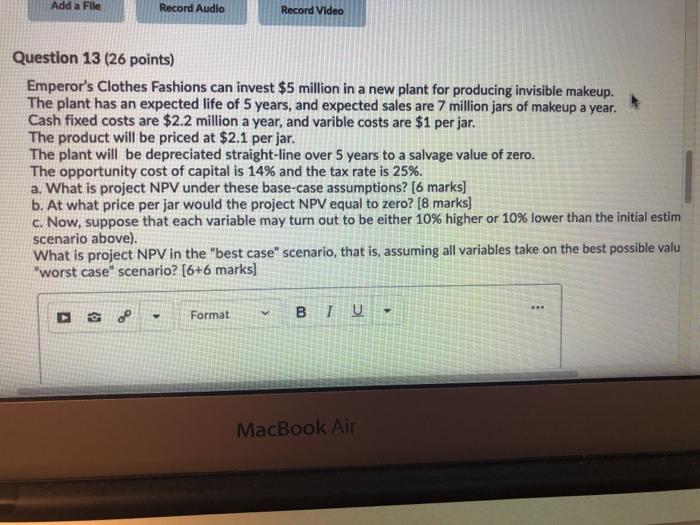

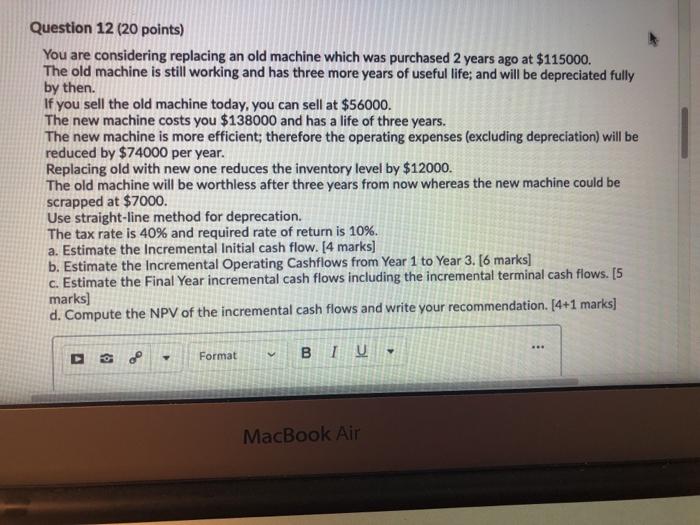

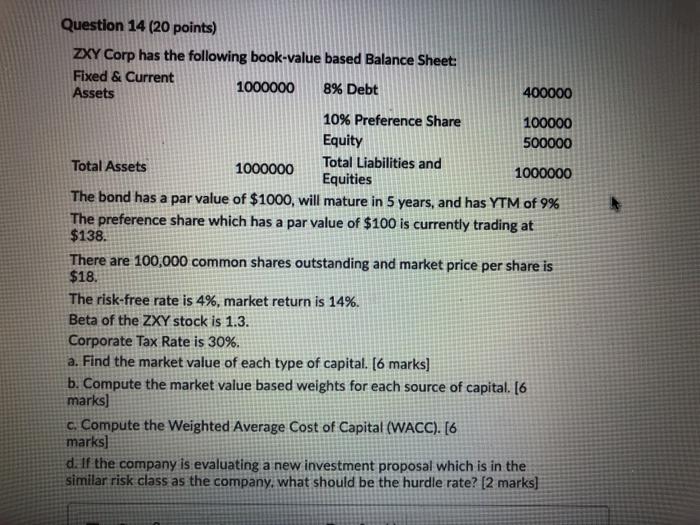

Question 14 (20 points) ZXY Corp has the following book-value based Balance Sheet: Fixed & Current Assets 1000000 8% Debt 400000 10% Preference Share 100000 Equity 500000 Total Assets 1000000 Total Liabilities and 1000000 Equities The bond has a par value of $1000, will mature in 5 years, and has YTM of 9% The preference share which has a par value of $100 is currently trading at $138. There are 100,000 common shares outstanding and market price per share is $18. The risk-free rate is 4%, market return is 14%. Beta of the ZXY stock is 1.3. Corporate Tax Rate is 30%. a. Find the market value of each type of capital. [6 marks] b. Compute the market value based weights for each source of capital. [6 marks) c. Compute the Weighted Average Cost of Capital (WACC). [6 marks) d. If the company is evaluating a new investment proposal which is in the similar risk class as the company, what should be the hurdle rate? [2 marks] Question 15 (8 points) AppleBall Corp. makes a rights issue at a subscription price of $12 a share. One new share can be purchased for every 4 shares held. Before the issue there were 12 million share outstanding, and the share price was $15. a. What is the total amount of new money raised? [2 marks] b. What is the expected stock price after the rights are issued? [3 marks] c. What is the value of a right? [3 marks) v Paragraph BI U Add a File Record Audio Record Video Question 13 (26 points) Emperor's Clothes Fashions can invest $5 million in a new plant for producing invisible makeup. The plant has an expected life of 5 years, and expected sales are 7 million jars of makeup a year. Cash fixed costs are $2.2 million a year, and varible costs are $1 per jar. The product will be priced at $2.1 per jar. The plant will be depreciated straight-line over 5 years to a salvage value of zero. The opportunity cost of capital is 14% and the tax rate is 25%. a. What is project NPV under these base-case assumptions? [6 marks] b. At what price per jar would the project NPV equal to zero? (8 marks) c. Now, suppose that each variable may turn out to be either 10% higher or 10% lower than the initial estim scenario above). What is project NPV in the "best case" scenario, that is, assuming all variables take on the best possible valu "worst case scenario? [6+6 marks] De- Format V BIU- MacBook Air Question 12 (20 points) You are considering replacing an old machine which was purchased 2 years ago at $115000. The old machine is still working and has three more years of useful life, and will be depreciated fully by then. If you sell the old machine today, you can sell at $56000. The new machine costs you $138000 and has a life of three years. The new machine is more efficient; therefore the operating expenses (excluding depreciation) will be reduced by $74000 per year. Replacing old with new one reduces the inventory level by $12000. The old machine will be worthless after three years from now whereas the new machine could be scrapped at $7000. Use straight-line method for deprecation. The tax rate is 40% and required rate of return is 10%. a. Estimate the Incremental Initial cash flow. [4 marks) b. Estimate the Incremental Operating Cashflows from Year 1 to Year 3. [6 marks] c. Estimate the Final Year incremental cash flows including the incremental terminal cash flows. [5 marks) d. Compute the NPV of the incremental cash flows and write your recommendation. [4+1 marks] Format V BIU- MacBook Air