Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hand written solution is required, do NOT use excel functions to solve. The Nobel Prize is administered by The Nobel Foundation, a private institution that

Hand written solution is required, do NOT use excel functions to solve.

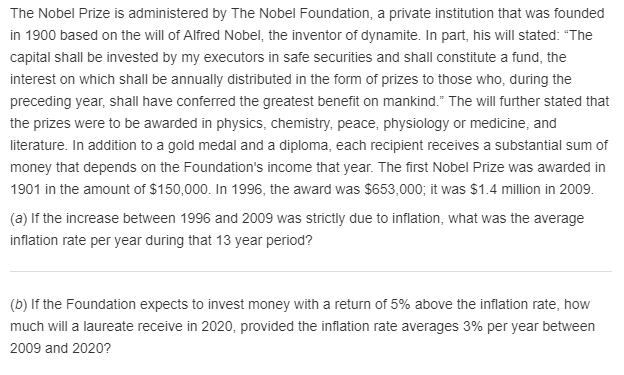

The Nobel Prize is administered by The Nobel Foundation, a private institution that was founded in 1900 based on the will of Alfred Nobel, the inventor of dynamite. In part, his will stated: "The capital shall be invested by my executors in safe securities and shall constitute a fund, the interest on which shall be annually distributed in the form of prizes to those who, during the preceding year, shall have conferred the greatest benefit on mankind." The will further stated that the prizes were to be awarded in physics, chemistry, peace, physiology or medicine, and literature. In addition to a gold medal and a diploma, each recipient receives a substantial sum of money that depends on the Foundation's income that year. The first Nobel Prize was awarded in 1901 in the amount of $150,000. In 1996, the award was $653,000; it was $1.4 million in 2009 (a) If the increase between 1996 and 2009 was strictly due to inflation, what was the average inflation rate per year during that 13 year period? (b) If the Foundation expects to invest money with a return of 5% above the inflation rate, how much will a laureate receive in 2020, provided the inflation rate averages 3% per year between 2009 and 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started