Question

Hande Bhd sells and distributes medical supplies to hospitals and pharmacies. The company closes its accounts on 31 December each year and uses an effective

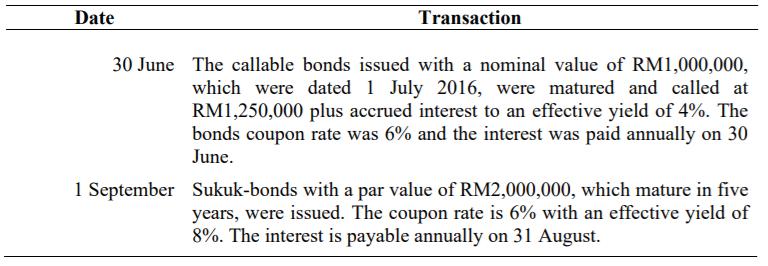

Hande Bhd sells and distributes medical supplies to hospitals and pharmacies. The company closes its accounts on 31 December each year and uses an effective interest method to amortise bond premium or discount. The following are the selected transactions on the books of Hande Bhd for the financial year 2019.

REQUIRED:

(Round all numbers to the nearest RM)

(a) Determine the price of the (i) callable bonds and (ii) sukuk-bonds on the issuance date. Prepare the bond amortisation schedule for the callable bonds.

(b) Prepare all the related journal entries for Hande Bhd for the financial year 2019.

(c) Hande Bhd believes that financial liabilities such as bonds should not be measured at fair value but at amortised cost. Briefly explain whether the fair value option for financial liabilities is relevant for Hande Bhd.

Date Transaction 30 June The callable bonds issued with a nominal value of RM1,000,000, which were dated 1 July 2016, were matured and called at RM1,250,000 plus accrued interest to an effective yield of 4%. The bonds coupon rate was 6% and the interest was paid annually on 30 June. 1 September Sukuk-bonds with a par value of RM2,000,000, which mature in five years, were issued. The coupon rate is 6% with an effective yield of 8%. The interest is payable annually on 31 August.

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution sol c Accounting for a financial liability at amortised cost means that the liabil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started