Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hand-in Date The hand-in date for the Coursework Assignment is on or before 23.55, 19 April, 2022. The coursework report must be submitted via Turnitin

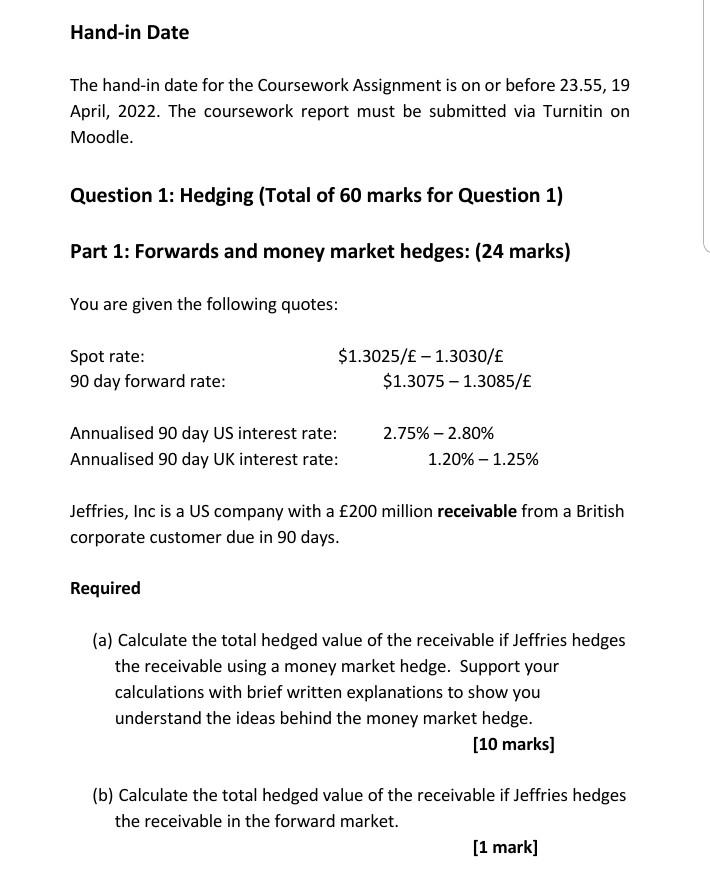

Hand-in Date The hand-in date for the Coursework Assignment is on or before 23.55, 19 April, 2022. The coursework report must be submitted via Turnitin on Moodle. Question 1: Hedging (Total of 60 marks for Question 1) Part 1: Forwards and money market hedges: (24 marks) You are given the following quotes: Spot rate: 90 day forward rate: $1.3025/- 1.3030/ $1.3075 - 1.3085/ Annualised 90 day US interest rate: Annualised 90 day UK interest rate: 2.75% - 2.80% 1.20%-1.25% Jeffries, Inc is a US company with a 200 million receivable from a British corporate customer due in 90 days. Required (a) Calculate the total hedged value of the receivable if Jeffries hedges the receivable using a money market hedge. Support your calculations with brief written explanations to show you understand the ideas behind the money market hedge. (10 marks] (b) Calculate the total hedged value of the receivable if Jeffries hedges the receivable in the forward market. [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started