Answered step by step

Verified Expert Solution

Question

1 Approved Answer

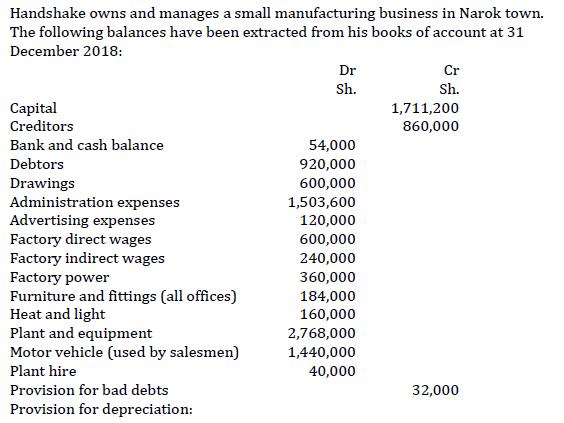

Handshake owns and manages a small manufacturing business in Narok town. The following balances have been extracted from his books of account at 31

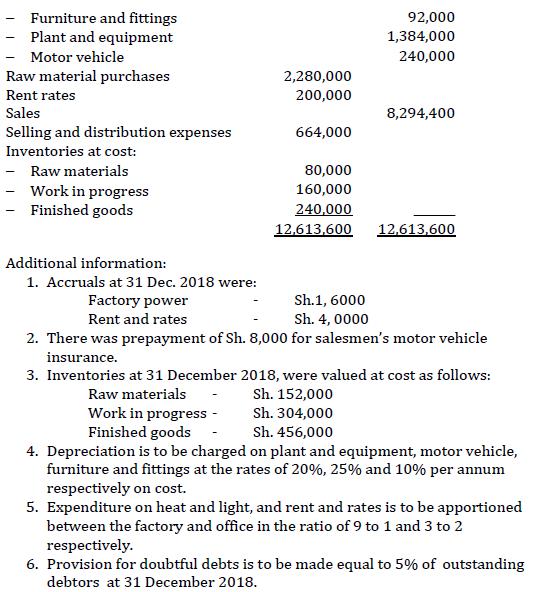

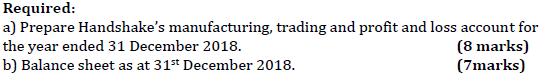

Handshake owns and manages a small manufacturing business in Narok town. The following balances have been extracted from his books of account at 31 December 2018: Dr Cr Sh. Sh. Capital 1,711,200 Creditors 860,000 Bank and cash balance 54,000 Debtors 920,000 Drawings 600,000 Administration expenses 1,503,600 Advertising expenses 120,000 Factory direct wages 600,000 Factory indirect wages 240,000 Factory power 360,000 Furniture and fittings (all offices) 184,000 Heat and light 160,000 Plant and equipment 2,768,000 Motor vehicle (used by salesmen) 1,440,000 Plant hire 40,000 Provision for bad debts 32,000 Provision for depreciation: Furniture and fittings Plant and equipment 92,000 1,384,000 Motor vehicle 240,000 Raw material purchases 2,280,000 Rent rates 200,000 Sales 8,294,400 Selling and distribution expenses 664,000 Inventories at cost: - Raw materials 80,000 - Work in progress 160,000 - Finished goods 240,000 12,613,600 12,613,600 Additional information: 1. Accruals at 31 Dec. 2018 were: Factory power Rent and rates Sh.1, 6000 Sh. 4, 0000 2. There was prepayment of Sh. 8,000 for salesmen's motor vehicle insurance. 3. Inventories at 31 December 2018, were valued at cost as follows: Raw materials Sh. 152,000 Work in progress - Sh. 304,000 Sh. 456,000 Finished goods- 4. Depreciation is to be charged on plant and equipment, motor vehicle, furniture and fittings at the rates of 20%, 25% and 10% per annum respectively on cost. 5. Expenditure on heat and light, and rent and rates is to be apportioned between the factory and office in the ratio of 9 to 1 and 3 to 2 respectively. 6. Provision for doubtful debts is to be made equal to 5% of outstanding debtors at 31 December 2018. Required: a) Prepare Handshake's manufacturing, trading and profit and loss account for the year ended 31 December 2018. b) Balance sheet as at 31st December 2018. (8 marks) (7marks)

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Lets start by preparing the manufacturing trading and profit and loss account for Handshakes business for the year ended 31 December 2018 After that w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started