Answered step by step

Verified Expert Solution

Question

1 Approved Answer

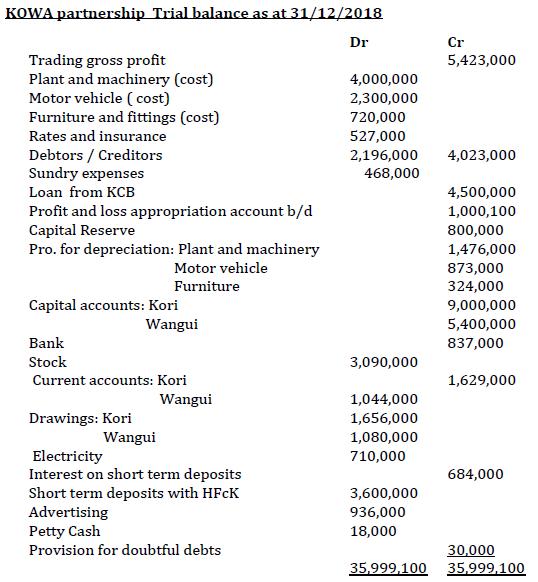

The following trial balance was extracted from the books of accounts of KOWA partnership operated by Kori and Wangui partners for the period ended 31/12/2018

The following trial balance was extracted from the books of accounts of KOWA partnership operated by Kori and Wangui partners for the period ended 31/12/2018 after preparing a trading account.

KOWA partnership Trial balance as at 31/12/2018 Trading gross profit Dr 4,000,000 Cr 5,423,000 Plant and machinery (cost) Motor vehicle (cost) 2,300,000 Furniture and fittings (cost) 720,000 Rates and insurance 527,000 Debtors / Creditors Sundry expenses Loan from KCB 2,196,000 4,023,000 468,000 4,500,000 Capital Reserve Profit and loss appropriation account b/d Pro. for depreciation: Plant and machinery Motor vehicle Furniture Wangui Capital accounts: Kori 1,000,100 800,000 1,476,000 873,000 324,000 9,000,000 5,400,000 Bank 837,000 Stock 3,090,000 Current accounts: Kori 1,629,000 Wangui 1,044,000 Drawings: Kori 1,656,000 Wangui 1,080,000 Electricity 710,000 Interest on short term deposits Short term deposits with HFCK Advertising 684,000 3,600,000 936,000 Petty Cash Provision for doubtful debts 18,000 30,000 35,999,100 35,999,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

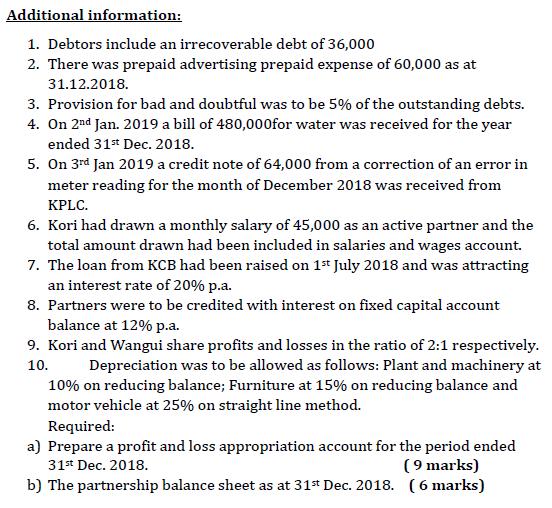

To prepare the Profit and Loss Appropriation Account and the Partnership Balance Sheet for KOWA partnership as at 31st December 2018 we need to address several points based on the given trial balance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started