Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*handwriting QUESTION 1 (20 MARKS) a. You have won a total of RM75,000.00 from a contest participating in a reality television program. The prize money

*handwriting

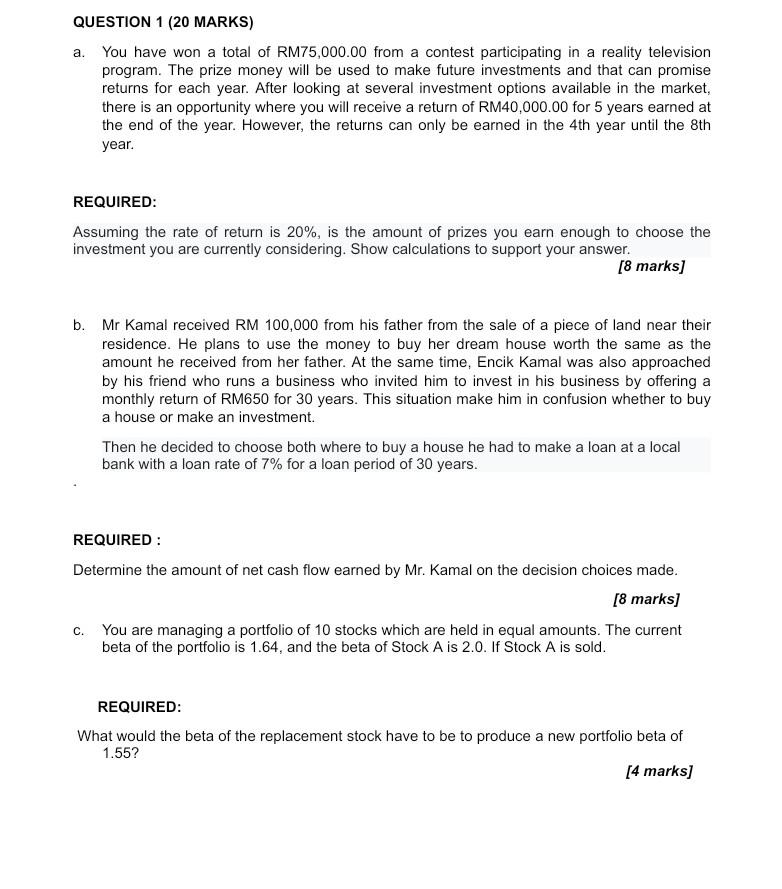

QUESTION 1 (20 MARKS) a. You have won a total of RM75,000.00 from a contest participating in a reality television program. The prize money will be used to make future investments and that can promise returns for each year. After looking at several investment options available in the market, there is an opportunity where you will receive a return of RM40,000.00 for 5 years earned at the end of the year. However, the returns can only be earned in the 4th year until the 8th year. REQUIRED: Assuming the rate of return is 20%, is the amount of prizes you earn enough to choose the investment you are currently considering. Show calculations to support your answer. [8 marks] b. Mr Kamal received RM 100,000 from his father from the sale of a piece of land near their residence. He plans to use the money to buy her dream house worth the same as the amount he received from her father. At the same time, Encik Kamal was also approached by his friend who runs a business who invited him to invest in his business by offering a monthly return of RM650 for 30 years. This situation make him in confusion whether to buy a house or make an investment. Then he decided to choose both where to buy a house he had to make a loan at a local bank with a loan rate of 7% for a loan period of 30 years. REQUIRED: Determine the amount of net cash flow earned by Mr. Kamal on the decision choices made. [8 marks] c. You are managing a portfolio of 10 stocks which are held in equal amounts. The current beta of the portfolio is 1.64, and the beta of Stock A is 2.0. If Stock A is sold. REQUIRED: What would the beta of the replacement stock have to be to produce a new portfolio beta of 1.55? [4 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started