Answered step by step

Verified Expert Solution

Question

1 Approved Answer

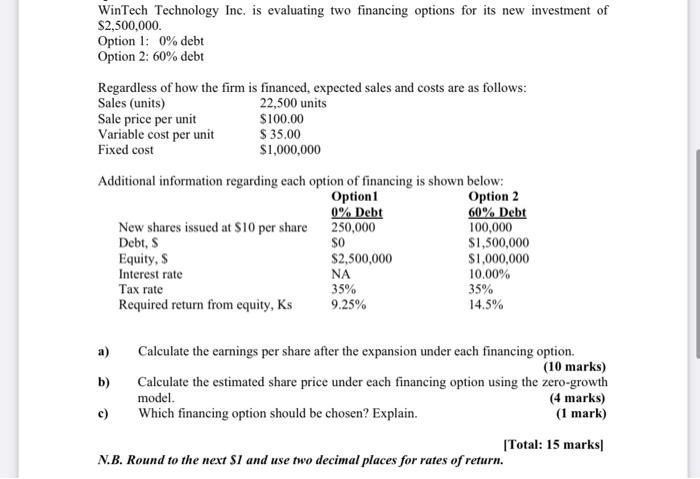

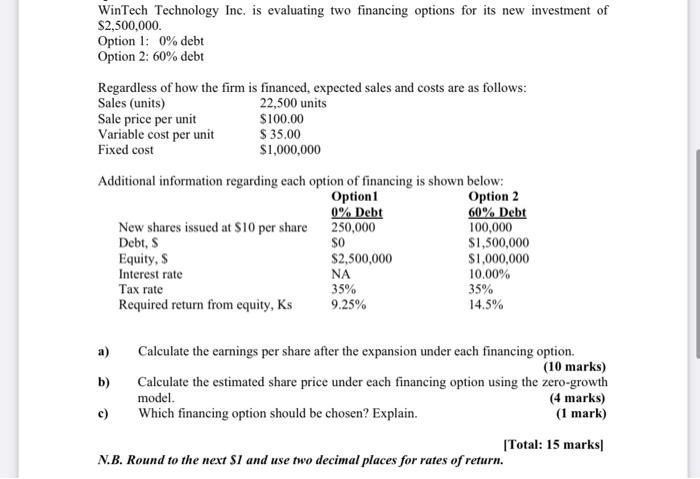

handwritten WinTech Technology Inc. is evaluating two financing options for its new investment of $2,500,000. Option 1: 0% debt Option 2: 60% debt Regardless of

handwritten

WinTech Technology Inc. is evaluating two financing options for its new investment of $2,500,000. Option 1: 0% debt Option 2: 60% debt Regardless of how the firm is financed, expected sales and costs are as follows: Sales (units) 22,500 units Sale price per unit $100.00 Variable cost per unit S 35.00 Fixed cost $1,000,000 Additional information regarding each option of financing is shown below: Option1 Option 2 0% Debt 60% Debt New shares issued at $10 per share 250,000 100,000 Debt, s SO $1,500,000 Equity, $2,500,000 $1,000,000 Interest rate NA 10.00% Tax rate 35% 35% Required return from equity, Ks 9.25% 14.5% a) b) Calculate the earnings per share after the expansion under each financing option. (10 marks) Calculate the estimated share price under each financing option using the zero-growth model. (4 marks) Which financing option should be chosen? Explain. (1 mark) c) [Total: 15 marks N.B. Round to the next $1 and use two decimal places for rates of return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started