Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hank Manufacturing makes cleaning solvent sold in large container with a plastic liner. Their monthly sales forecast consists of: January 40,000 units, February 38,500 units,

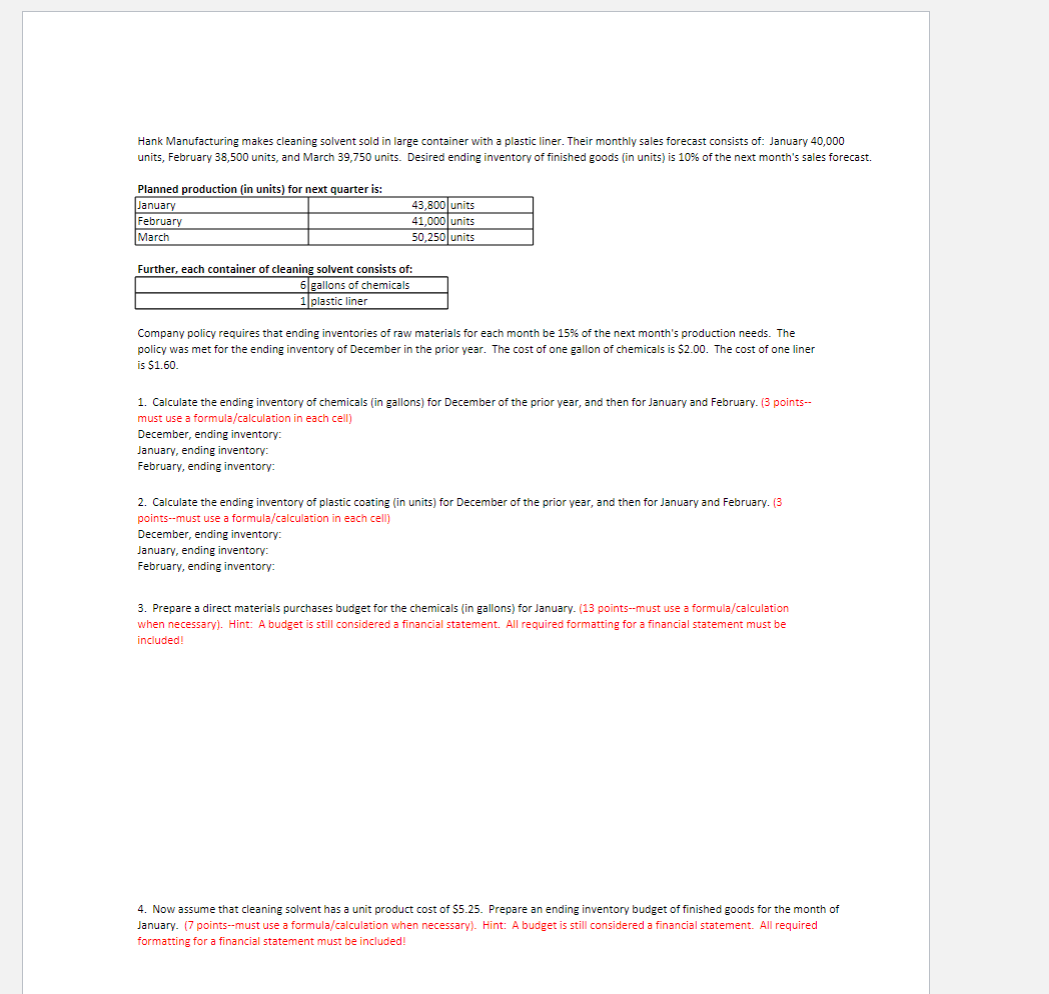

Hank Manufacturing makes cleaning solvent sold in large container with a plastic liner. Their monthly sales forecast consists of: January 40,000 units, February 38,500 units, and March 39,750 units. Desired ending inventory of finished goods (in units) is 10% of the next month's sales forecast. Planned nrodurtion (in unitsl for next auarter is: Company policy requires that ending inventories of raw materials for each month be 15% of the next month's production needs. The policy was met for the ending inventory of December in the prior year. The cost of one gallon of chemicals is $2.00. The cost of one liner is $1.60. 1. Calculate the ending inventory of chemicals (in gallons) for December of the prior year, and then for January and February. (3 points-must use a formula/calculation in each cell) December, ending inventory: January, ending inventory: February, ending inventory: 2. Calculate the ending inventory of plastic coating (in units) for December of the prior year, and then for January and February. (3 points--must use a formula/calculation in each cell] December, ending inventory: January, ending inventory: February, ending inventory: 3. Prepare a direct materials purchases budget for the chemicals (in gallons) for January. (13 points--must use a formula/calculation when necessary). Hint: A budget is still considered a financial statement. All required formatting for a financial statement must be included! 4. Now assume that cleaning solvent has a unit product cost of \$5.25. Prepare an ending inventory budget of finished goods for the month of January. (7 points--must use a formula/calculation when necessary). Hint: A budget is still considered a financial statement. All required formatting for a financial statement must be included

Hank Manufacturing makes cleaning solvent sold in large container with a plastic liner. Their monthly sales forecast consists of: January 40,000 units, February 38,500 units, and March 39,750 units. Desired ending inventory of finished goods (in units) is 10% of the next month's sales forecast. Planned nrodurtion (in unitsl for next auarter is: Company policy requires that ending inventories of raw materials for each month be 15% of the next month's production needs. The policy was met for the ending inventory of December in the prior year. The cost of one gallon of chemicals is $2.00. The cost of one liner is $1.60. 1. Calculate the ending inventory of chemicals (in gallons) for December of the prior year, and then for January and February. (3 points-must use a formula/calculation in each cell) December, ending inventory: January, ending inventory: February, ending inventory: 2. Calculate the ending inventory of plastic coating (in units) for December of the prior year, and then for January and February. (3 points--must use a formula/calculation in each cell] December, ending inventory: January, ending inventory: February, ending inventory: 3. Prepare a direct materials purchases budget for the chemicals (in gallons) for January. (13 points--must use a formula/calculation when necessary). Hint: A budget is still considered a financial statement. All required formatting for a financial statement must be included! 4. Now assume that cleaning solvent has a unit product cost of \$5.25. Prepare an ending inventory budget of finished goods for the month of January. (7 points--must use a formula/calculation when necessary). Hint: A budget is still considered a financial statement. All required formatting for a financial statement must be included Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started