Answered step by step

Verified Expert Solution

Question

1 Approved Answer

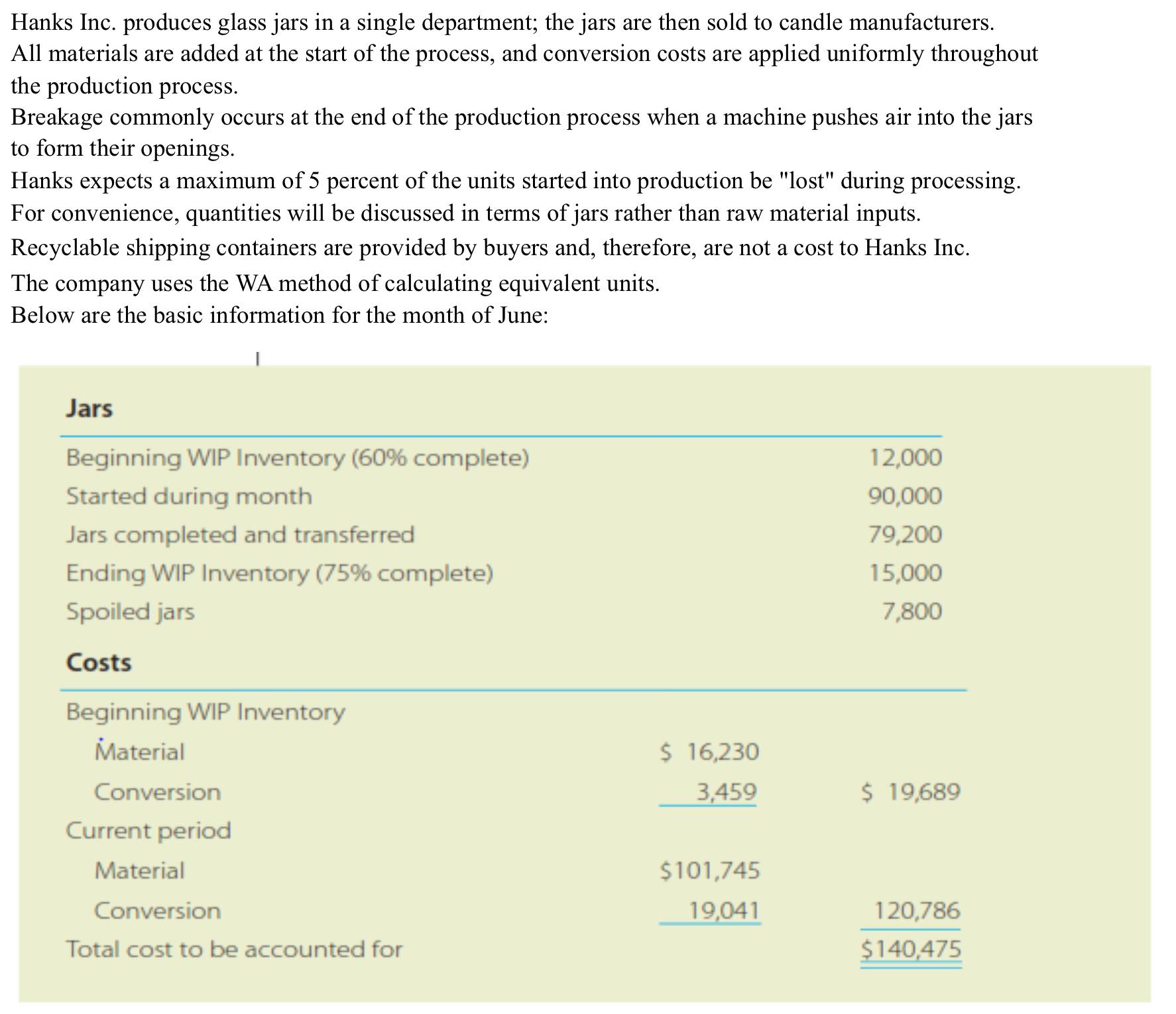

Hanks Inc. produces glass jars in a single department; the jars are then sold to candle manufacturers. All materials are added at the start

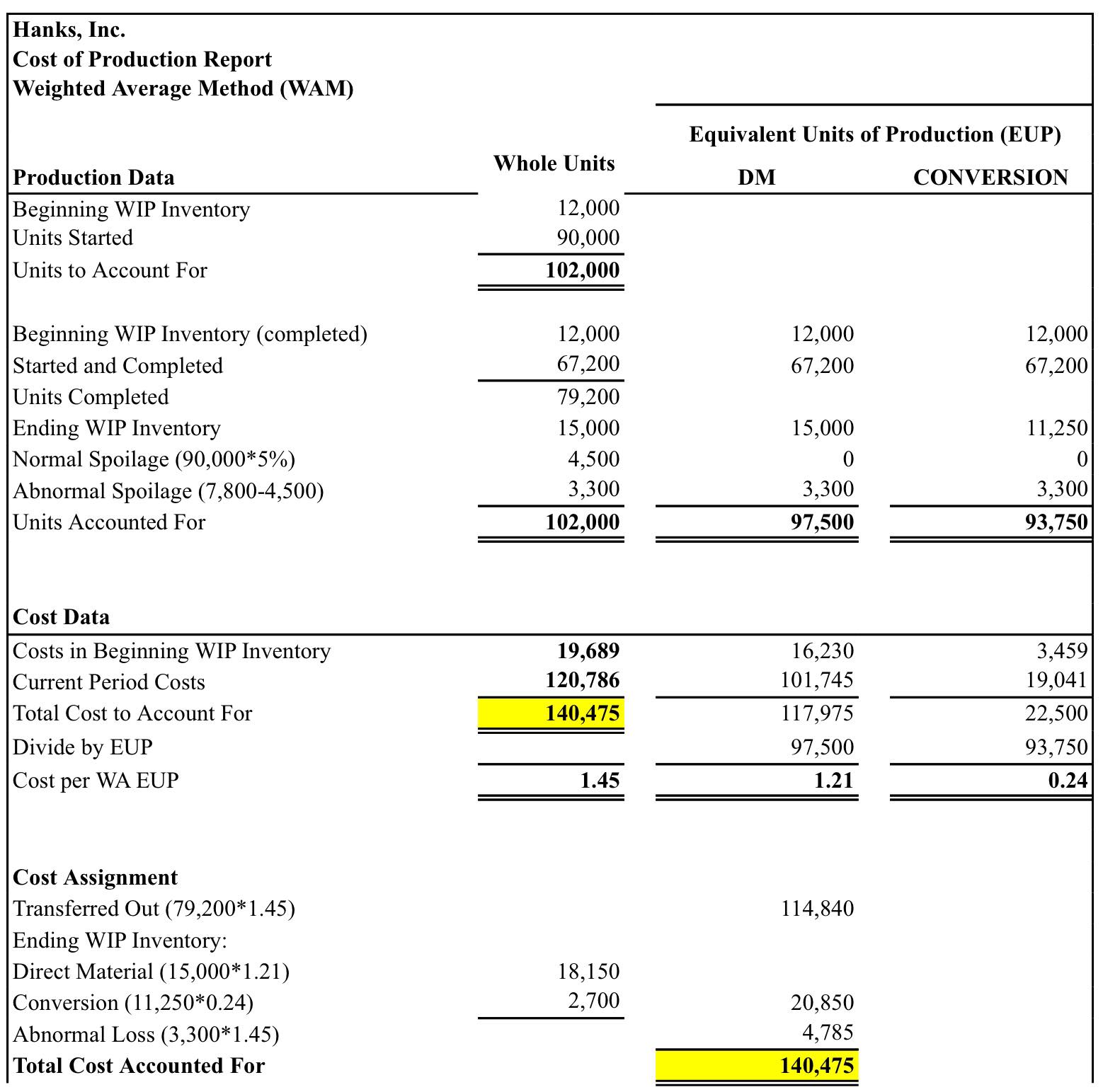

Hanks Inc. produces glass jars in a single department; the jars are then sold to candle manufacturers. All materials are added at the start of the process, and conversion costs are applied uniformly throughout the production process. Breakage commonly occurs at the end of the production process when a machine pushes air into the jars to form their openings. Hanks expects a maximum of 5 percent of the units started into production be "lost" during processing. For convenience, quantities will be discussed in terms of jars rather than raw material inputs. Recyclable shipping containers are provided by buyers and, therefore, are not a cost to Hanks Inc. The company uses the WA method of calculating equivalent units. Below are the basic information for the month of June: Jars Beginning WIP Inventory (60% complete) Started during month Jars completed and transferred Ending WIP Inventory (75% complete) Spoiled jars Costs Beginning WIP Inventory Material Conversion Current period Material Conversion Total cost to be accounted for 12,000 90,000 79,200 15,000 7,800 $ 16,230 3,459 $ 19,689 $101,745 19,041 120,786 $140,475 Hanks, Inc. Cost of Production Report Weighted Average Method (WAM) Equivalent Units of Production (EUP) Whole Units Production Data DM CONVERSION Beginning WIP Inventory Units Started Units to Account For 12,000 90,000 102,000 Beginning WIP Inventory (completed) 12,000 12,000 12,000 Started and Completed 67,200 67,200 67,200 Units Completed 79,200 Ending WIP Inventory 15,000 15,000 11,250 Normal Spoilage (90,000*5%) 4,500 0 Abnormal Spoilage (7,800-4,500) 3,300 3,300 3,300 Units Accounted For 102,000 97,500 93,750 Cost Data Costs in Beginning WIP Inventory 19,689 16,230 3,459 Current Period Costs 120,786 101,745 19,041 Total Cost to Account For 140,475 117,975 22,500 Divide by EUP 97,500 93,750 Cost per WA EUP 1.45 1.21 0.24 Cost Assignment Transferred Out (79,200*1.45) 114,840 Ending WIP Inventory: Direct Material (15,000*1.21) 18,150 Conversion (11,250*0.24) 2,700 20,850 Abnormal Loss (3,300*1.45) 4,785 Total Cost Accounted For 140,475

Step by Step Solution

There are 3 Steps involved in it

Step: 1

12000 jars 60 complete 90000 jars 100 complete 102000 equivalent units of production Production Data ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started