Answered step by step

Verified Expert Solution

Question

1 Approved Answer

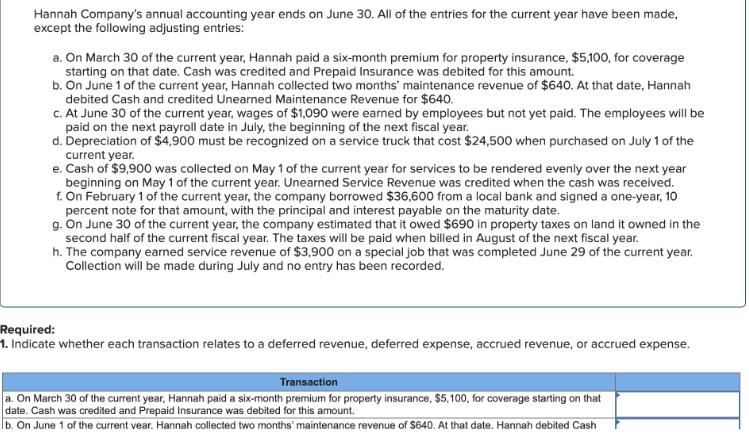

Hannah Company's annual accounting year ends on June 30. All of the entries for the current year have been made, except the following adjusting

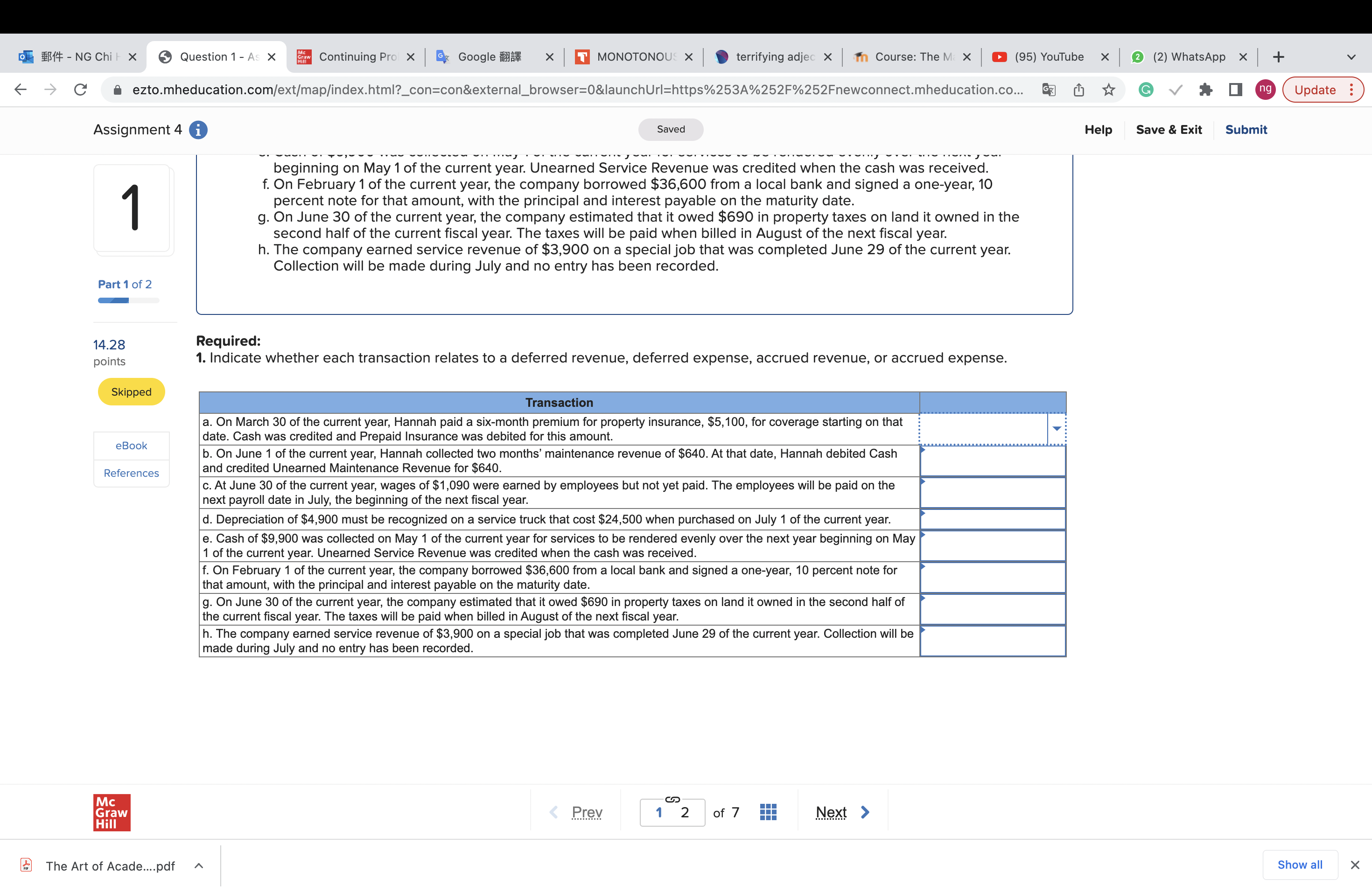

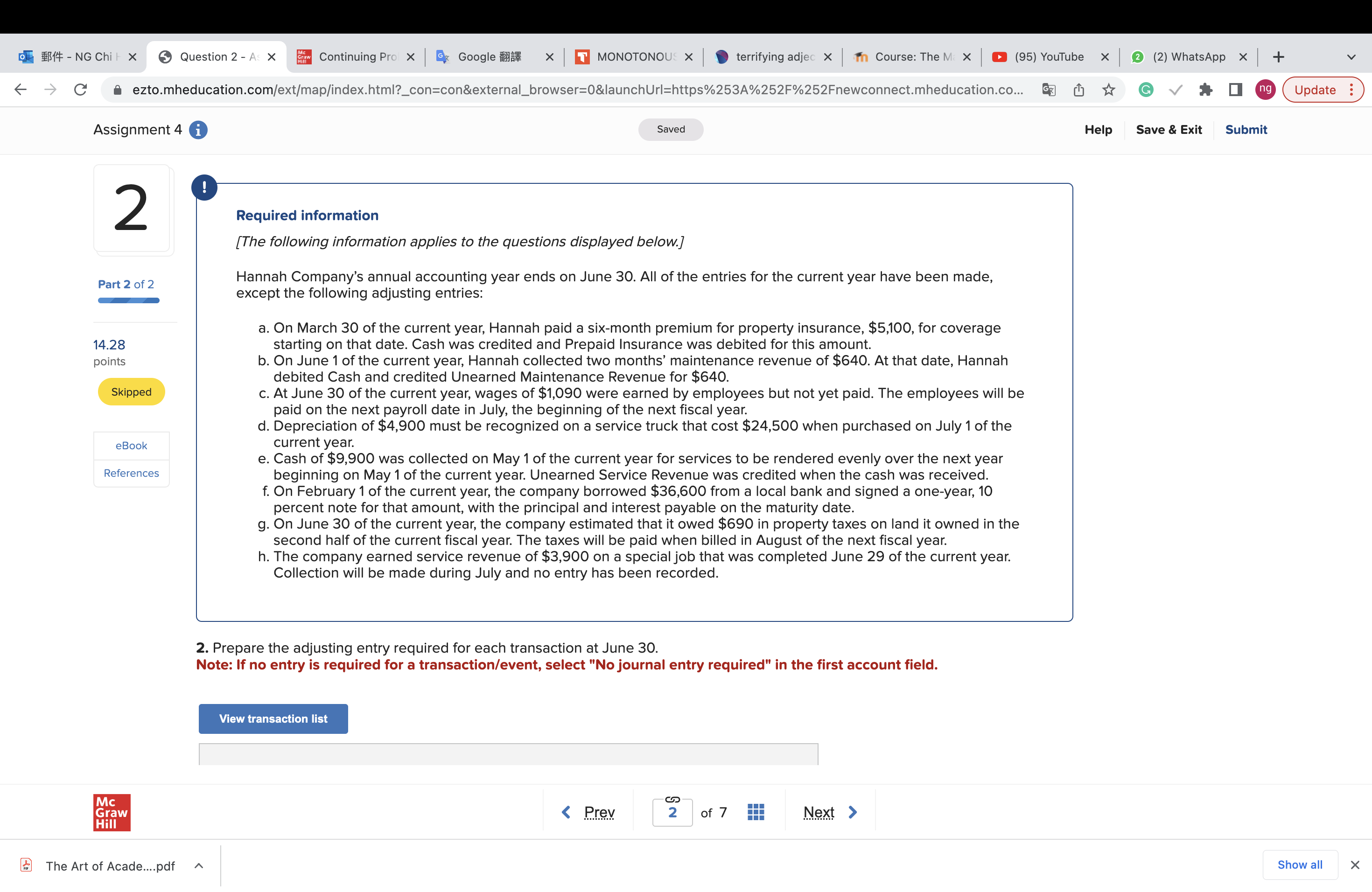

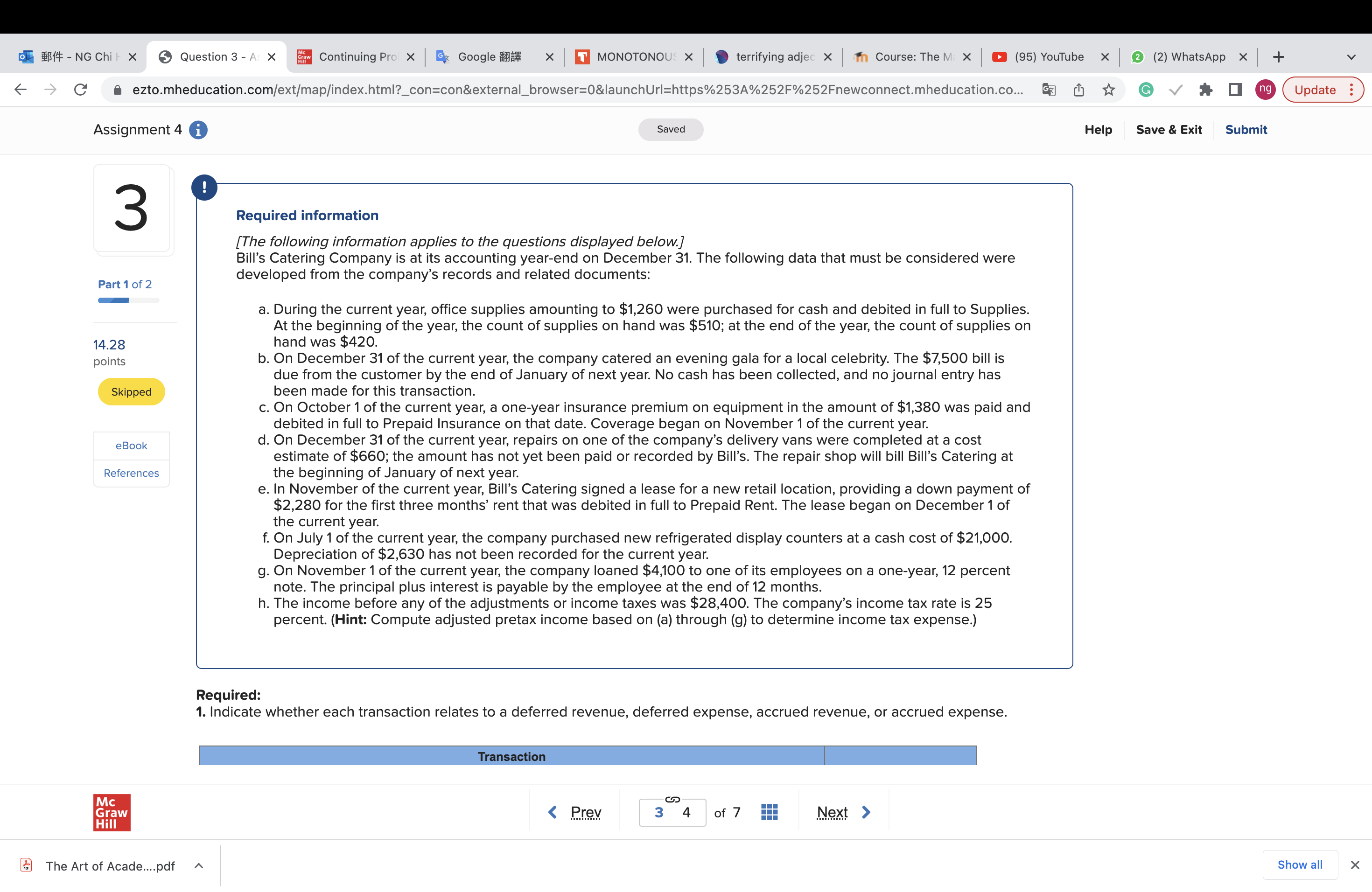

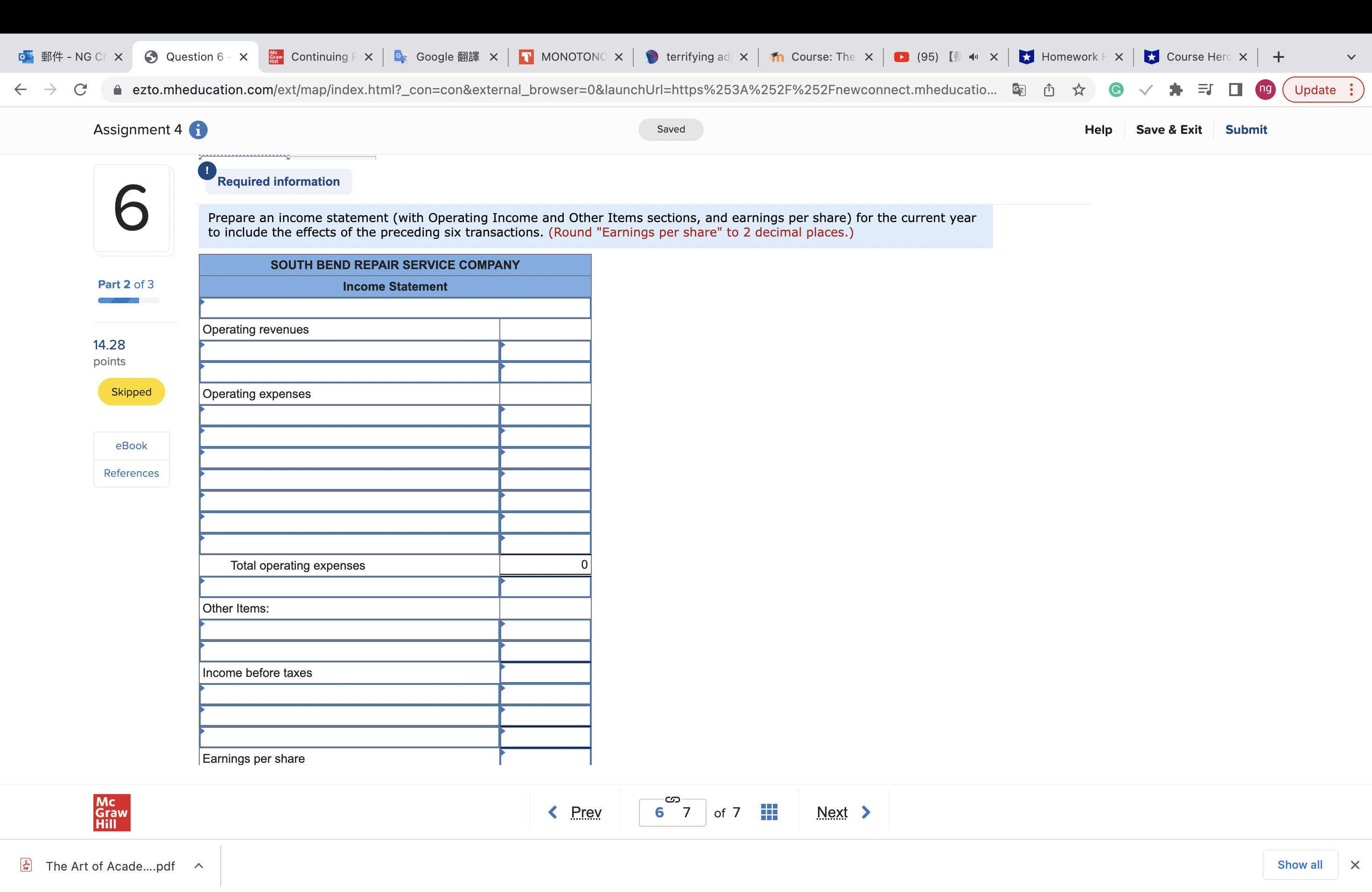

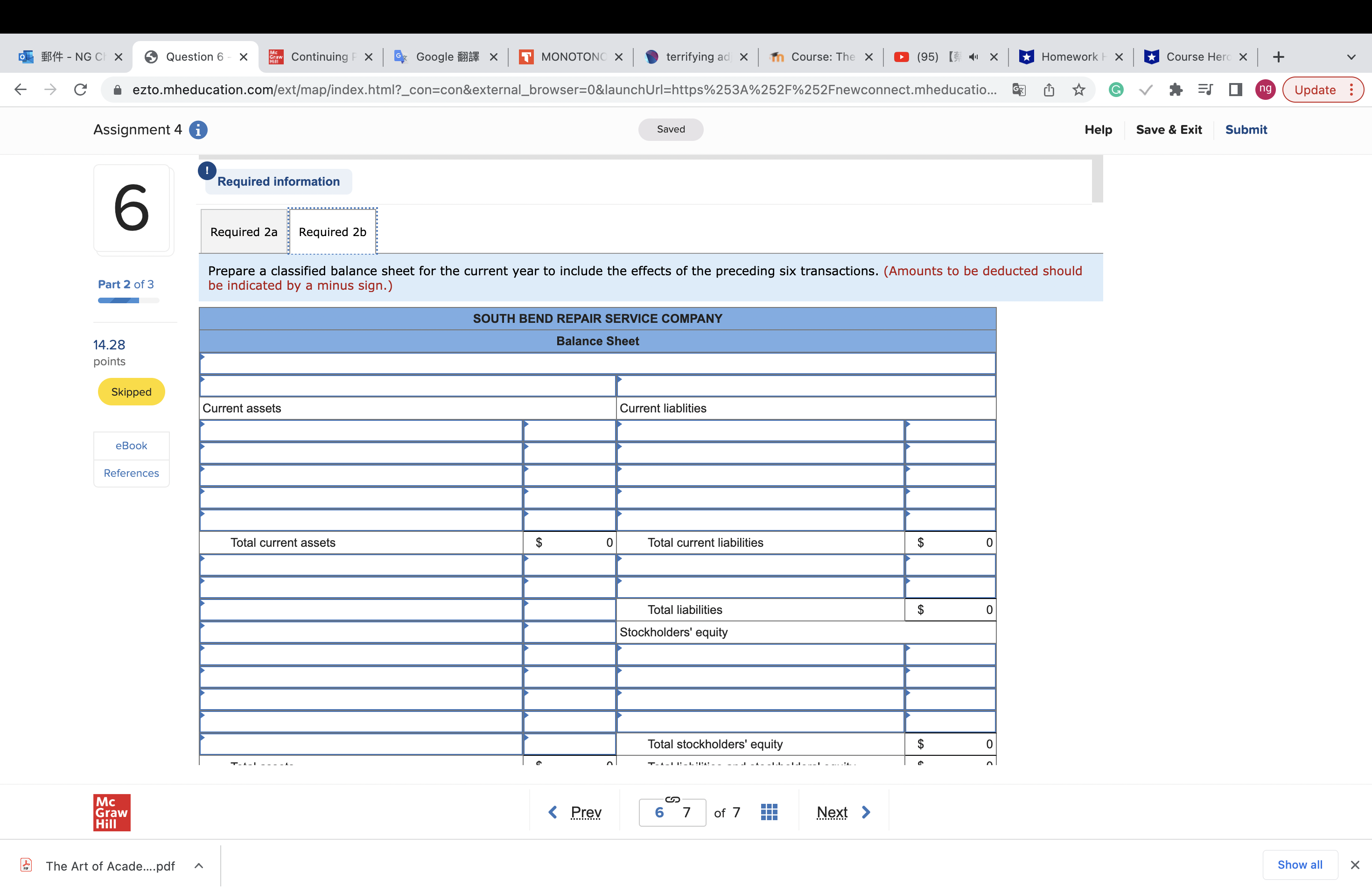

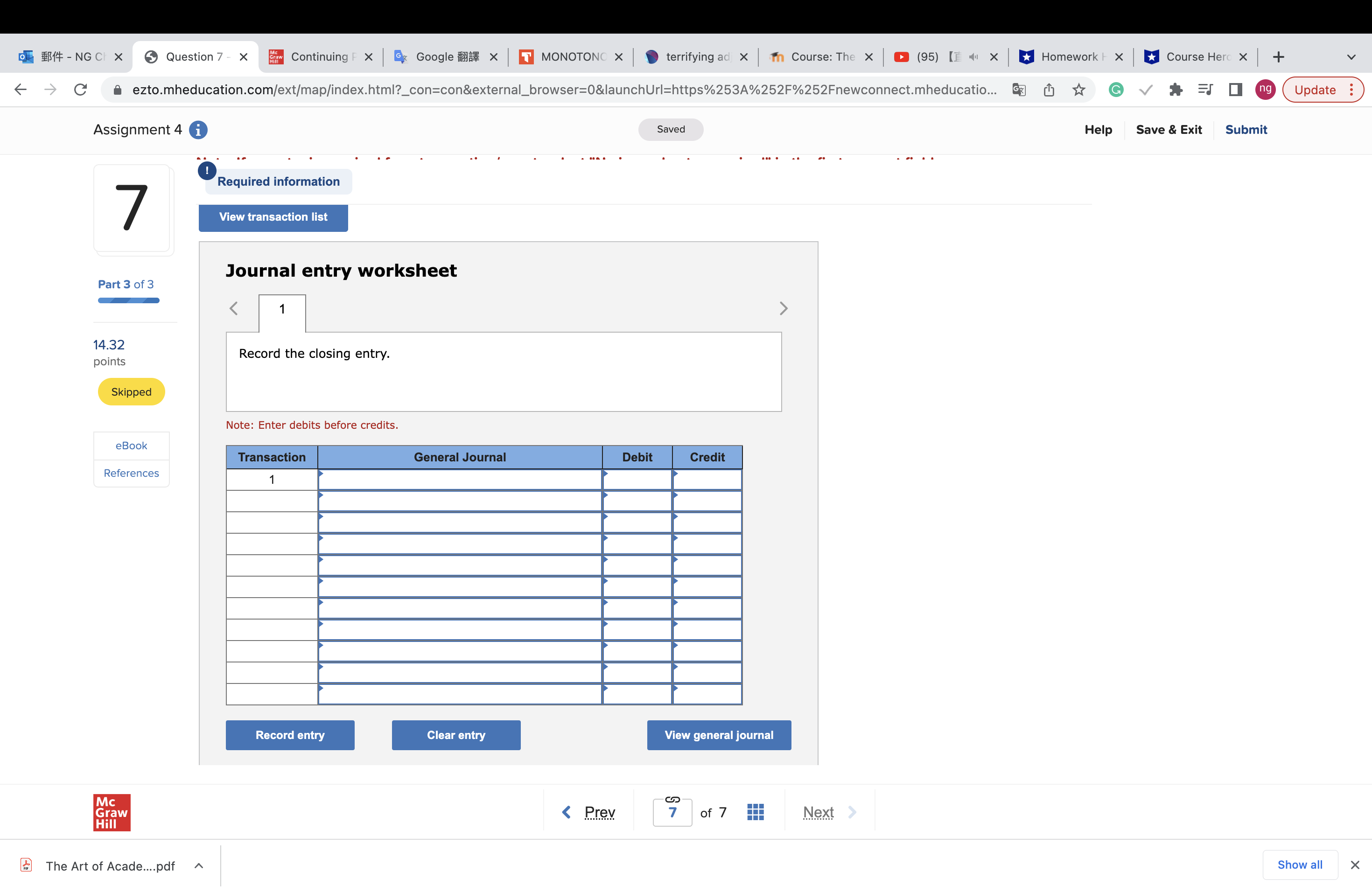

Hannah Company's annual accounting year ends on June 30. All of the entries for the current year have been made, except the following adjusting entries: a. On March 30 of the current year, Hannah paid a six-month premium for property insurance, $5,100, for coverage starting on that date. Cash was credited and Prepaid Insurance was debited for this amount. b. On June 1 of the current year, Hannah collected two months' maintenance revenue of $640. At that date, Hannah debited Cash and credited Unearned Maintenance Revenue for $640. c. At June 30 of the current year, wages of $1,090 were earned by employees but not yet paid. The employees will be paid on the next payroll date in July, the beginning of the next fiscal year. d. Depreciation of $4,900 must be recognized on a service truck that cost $24,500 when purchased on July 1 of the current year. e. Cash of $9,900 was collected on May 1 of the current year for services to be rendered evenly over the next year beginning on May 1 of the current year. Unearned Service Revenue was credited when the cash was received. f. On February 1 of the current year, the company borrowed $36,600 from a local bank and signed a one-year, 10 percent note for that amount, with the principal and interest payable on the maturity date. g. On June 30 of the current year, the company estimated that it owed $690 in property taxes on land it owned in the second half of the current fiscal year. The taxes will be paid when billed in August of the next fiscal year. h. The company earned service revenue of $3,900 on a special job that was completed June 29 of the current year. Collection will be made during July and no entry has been recorded. Required: 1. Indicate whether each transaction relates to a deferred revenue, deferred expense, accrued revenue, or accrued expense. Transaction a. On March 30 of the current year, Hannah paid a six-month premium for property insurance, $5,100, for coverage starting on that date. Cash was credited and Prepaid Insurance was debited for this amount. b. On June 1 of the current year. Hannah collected two months' maintenance revenue of $640. At that date. Hannah debited Cash (95) YouTube 2 (2) WhatsApp + ng Update: - NG Chi X Mc Question 1 As X Graw Continuing Pro X Google MONOTONOUS X C terrifying adjec Course: The Max | ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fnewconnect.mheducation.co... Assignment 4 i Saved beginning on May 1 of the current year. Unearned Service Revenue was credited when the cash was received. 1 f. On February 1 of the current year, the company borrowed $36,600 from a local bank and signed a one-year, 10 percent note for that amount, with the principal and interest payable on the maturity date. g. On June 30 of the current year, the company estimated that it owed $690 in property taxes on land it owned in the second half of the current fiscal year. The taxes will be paid when billed in August of the next fiscal year. Part 1 of 2 h. The company earned service revenue of $3,900 on a special job that was completed June 29 of the current year. Collection will be made during July and no entry has been recorded. 14.28 points Skipped Required: 1. Indicate whether each transaction relates to a deferred revenue, deferred expense, accrued revenue, or accrued expense. Transaction eBook References a. On March 30 of the current year, Hannah paid a six-month premium for property insurance, $5,100, for coverage starting on that date. Cash was credited and Prepaid Insurance was debited for this amount. b. On June 1 of the current year, Hannah collected two months' maintenance revenue of $640. At that date, Hannah debited Cash and credited Unearned Maintenance Revenue for $640. c. At June 30 of the current year, wages of $1,090 were earned by employees but not yet paid. The employees will be paid on the next payroll date in July, the beginning of the next fiscal year. d. Depreciation of $4,900 must be recognized on a service truck that cost $24,500 when purchased on July 1 of the current year. e. Cash of $9,900 was collected on May 1 of the current year for services to be rendered evenly over the next year beginning on May 1 of the current year. Unearned Service Revenue was credited when the cash was received. f. On February 1 of the current year, the company borrowed $36,600 from a local bank and signed a one-year, 10 percent note for that amount, with the principal and interest payable on the maturity date. g. On June 30 of the current year, the company estimated that it owed $690 in property taxes on land it owned in the second half of the current fiscal year. The taxes will be paid when billed in August of the next fiscal year. h. The company earned service revenue of $3,900 on a special job that was completed June 29 of the current year. Collection will be made during July and no entry has been recorded. Mc Graw Hill PDF The Art of Acade....pdf S < Prev 1 2 of 7 Next > Help Save & Exit Submit Show all - NG Chi X Question 2 As X Mc Graw Continuing Pro Google C MONOTONOUS X terrifying adjec 1 Course: The Max | (95) YouTube 2 (2) WhatsApp + ng Update: ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.co... Assignment 4 i Saved ! 2 Required information Part 2 of 2 14.28 points Skipped eBook References [The following information applies to the questions displayed below.] Hannah Company's annual accounting year ends on June 30. All of the entries for the current year have been made, except the following adjusting entries: a. On March 30 of the current year, Hannah paid a six-month premium for property insurance, $5,100, for coverage starting on that date. Cash was credited and Prepaid Insurance was debited for this amount. b. On June 1 of the current year, Hannah collected two months' maintenance revenue of $640. At that date, Hannah debited Cash and credited Unearned Maintenance Revenue for $640. c. At June 30 of the current year, wages of $1,090 were earned by employees but not yet paid. The employees will be paid on the next payroll date in July, the beginning of the next fiscal year. d. Depreciation of $4,900 must be recognized on a service truck that cost $24,500 when purchased on July 1 of the current year. e. Cash of $9,900 was collected on May 1 of the current year for services to be rendered evenly over the next year beginning on May 1 of the current year. Unearned Service Revenue was credited when the cash was received. f. On February 1 of the current year, the company borrowed $36,600 from a local bank and signed a one-year, 10 percent note for that amount, with the principal and interest payable on the maturity date. g. On June 30 of the current year, the company estimated that it owed $690 in property taxes on land it owned in the second half of the current fiscal year. The taxes will be paid when billed in August of the next fiscal year. h. The company earned service revenue of $3,900 on a special job that was completed June 29 of the current year. Collection will be made during July and no entry has been recorded. Mc Graw Hill 2. Prepare the adjusting entry required for each transaction at June 30. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. PDF The Art of Acade....pdf View transaction list < Prev GN of 7 Next > Help Save & Exit Submit Show all - NG Chi X Question 3 As X Mc Graw Continuing Pro Google C MONOTONOUS X terrifying adjec 1 Course: The Max | (95) YouTube 2 (2) WhatsApp + ng Update: ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.co... Assignment 4 i Saved 3 ! Required information Part 1 of 2 14.28 points Skipped eBook References Mc Graw Hill [The following information applies to the questions displayed below.] Bill's Catering Company is at its accounting year-end on December 31. The following data that must be considered were developed from the company's records and related documents: a. During the current year, office supplies amounting to $1,260 were purchased for cash and debited in full to Supplies. At the beginning of the year, the count of supplies on hand was $510; at the end of the year, the count of supplies on hand was $420. b. On December 31 of the current year, the company catered an evening gala for a local celebrity. The $7,500 bill is due from the customer by the end of January of next year. No cash has been collected, and no journal entry has been made for this transaction. c. On October 1 of the current year, a one-year insurance premium on equipment in the amount of $1,380 was paid and debited in full to Prepaid Insurance on that date. Coverage began on November 1 of the current year. d. On December 31 of the current year, repairs on one of the company's delivery vans were completed at a cost estimate of $660; the amount has not yet been paid or recorded by Bill's. The repair shop will bill Bill's Catering at the beginning of January of next year. e. In November of the current year, Bill's Catering signed a lease for a new retail location, providing a down payment of $2,280 for the first three months' rent that was debited in full to Prepaid Rent. The lease began on December 1 of the current year. f. On July 1 of the current year, the company purchased new refrigerated display counters at a cash cost of $21,000. Depreciation of $2,630 has not been recorded for the current year. g. On November 1 of the current year, the company loaned $4,100 to one of its employees on a one-year, 12 percent note. The principal plus interest is payable by the employee at the end of 12 months. h. The income before any of the adjustments or income taxes was $28,400. The company's income tax rate is 25 percent. (Hint: Compute adjusted pretax income based on (a) through (g) to determine income tax expense.) Required: 1. Indicate whether each transaction relates to a deferred revenue, deferred expense, accrued revenue, or accrued expense. PDF The Art of Acade....pdf Transaction S < Prev 3 4 of 7 Next > Help Save & Exit Submit Show all - NG Chi X Question 4 As X Mc Graw Continuing Pro X Google MONOTONOUS X terrifying adjec 1 Course: The M: X | (95) YouTube 2 (2) WhatsApp + C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fnewconnect.mheducation.co... Assignment 4 i Saved ng Update: Help Save & Exit Submit ! 4 Required information Part 2 of 2 14.28 points Skipped eBook References Mc Graw Hill [The following information applies to the questions displayed below.] Bill's Catering Company is at its accounting year-end on December 31. The following data that must be considered were developed from the company's records and related documents: a. During the current year, office supplies amounting to $1,260 were purchased for cash and debited in full to Supplies. At the beginning of the year, the count of supplies on hand was $510; at the end of the year, the count of supplies on hand was $420. b. On December 31 of the current year, the company catered an evening gala for a local celebrity. The $7,500 bill is due from the customer by the end of January of next year. No cash has been collected, and no journal entry has been made for this transaction. c. On October 1 of the current year, a one-year insurance premium on equipment in the amount of $1,380 was paid and debited in full to Prepaid Insurance on that date. Coverage began on November 1 of the current year. d. On December 31 of the current year, repairs on one of the company's delivery vans were completed at a cost estimate of $660; the amount has not yet been paid or recorded by Bill's. The repair shop will bill Bill's Catering at the beginning of January of next year. e. In November of the current year, Bill's Catering signed a lease for a new retail location, providing a down payment of $2,280 for the first three months' rent that was debited in full to Prepaid Rent. The lease began on December 1 of the current year. f. On July 1 of the current year, the company purchased new refrigerated display counters at a cash cost of $21,000. Depreciation of $2,630 has not been recorded for the current year. g. On November 1 of the current year, the company loaned $4,100 to one of its employees on a one-year, 12 percent note. The principal plus interest is payable by the employee at the end of 12 months. h. The income before any of the adjustments or income taxes was $28,400. The company's income tax rate is 25 percent. (Hint: Compute adjusted pretax income based on (a) through (g) to determine income tax expense.) 2. Prepare the adjusting entry required for each transaction at December 31 of the current year. Note: Round the income tax computation to the nearest dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. PDF The Art of Acade....pdf G < Prev of 7 Next > Show all - NG Chi X Mc Question 5 As X Graw Continuing Pro X Google MONOTONOUS X terrifying adjec 1 Course: The M: X | (95) YouTube 2 (2) WhatsApp + C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fnewconnect.mheducation.co... Assignment 4 i Saved ng Update: Help Save & Exit Submit 5 Part 1 of 3 Cash Accounts receivable Supplies Prepaid insurance Equipment Accumulated depreciation Other assets Accounts payable SOUTH BEND REPAIR SERVICE COMPANY Unadjusted Trial Balance For the Year Ended December 31 Debit 21,500 8,900 Credit 3,200 2,800 28,900 13,900 7,000 4,400 14.28 Wages payable points Income taxes payable Skipped Note payable (two years; 12% interest due each December 31) Common stock (4,000 shares outstanding all year) Additional paid-in capital eBook References Mc Graw Hill Retained earnings Service revenue Wages expense Remaining expenses (not detailed; excludes income tax) Income tax expense Totals Data not yet recorded at December 31 of the current year include: a. Depreciation expense for the current year, $4,900. b. Insurance expired during the current year, $1,400. 7,000 490 17,600 8,110 57,500 27,100 9,600 109,000 109,000 c. Wages earned by employees but not yet paid on December 31 of the current year, $4,000. d. The supplies count at the end of the current year reflected $2,200 in remaining supplies on hand to be used in the next year. e. Seven months of interest expense (on the note payable borrowed on June 1 of the current year) was incurred in the current year. f. Income tax expense was $3,314. Required: 1. Prepare the adjusting entry needed at December 31. Note: If no entry is required for a transaction/event. select "No journal entry required" in the first account field. PDF The Art of Acade....pdf < Prev 5 S 16 7 of 7 Next > Show all - NG Chi X Mc Question 7 - As X Graw Continuing Pro X Google MONOTONOUS X terrifying adjec 1 Course: The M: X | (95) YouTube 2 (2) WhatsApp + C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fnewconnect.mheducation.co... Assignment 4 i Saved ng Update: Help Save & Exit Submit 7 Part 3 of 3 14.32 Cash Accounts receivable Supplies Prepaid insurance Equipment Accumulated depreciation Other assets Accounts payable SOUTH BEND REPAIR SERVICE COMPANY Unadjusted Trial Balance For the Year Ended December 31 Debit 21,500 8,900 Credit 3,200 2,800 28,900 13,900 7,000 4,400 points Wages payable Income taxes payable Skipped Note payable (two years; 12% interest due each December 31) Common stock (4,000 shares outstanding all year) 7,000 490 Additional paid-in capital 17,600 Retained earnings 8,110 eBook Service revenue 57,500 Wages expense References Remaining expenses (not detailed; excludes income tax) Income tax expense 27,100 9,600 Totals 109,000 109,000 Data not yet recorded at December 31 of the current year include: a. Depreciation expense for the current year, $4,900. b. Insurance expired during the current year, $1,400. Mc Graw Hill c. Wages earned by employees but not yet paid on December 31 of the current year, $4,000. d. The supplies count at the end of the current year reflected $2,200 in remaining supplies on hand to be used in the next year. e. Seven months of interest expense (on the note payable borrowed on June 1 of the current year) was incurred in the current year. f. Income tax expense was $3,314. 3. Record the closing entry. Note: If no entry is required for a transaction/event. select "No iournal entry required" in the first account field. PDF The Art of Acade....pdf G < Prev 7 of 7 Next Show all - NG Chi X Mc Question 3 As X Graw Continuing Pro X Google MONOTONOUS X C terrifying adjec Course: The Max | ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fnewconnect.mheducatio... (95) Ask a Question | + ng Update: Assignment 4 i Saved Help Save & Exit Submit percent. (Hint: Compute adjusted pretax income based on (a) through (g) to determine income tax expense.) 3 Required: 1. Indicate whether each transaction relates to a deferred revenue, deferred expense, accrued revenue, or accrued expense. Part 1 of 2 Transaction 14.28 points Skipped eBook References a. During the current year, office supplies amounting to $1,260 were purchased for cash and debited in full to Supplies. At the beginning of the year, the count of supplies on hand was $510; at the end of the year, the count of supplies on hand was $420. b. On December 31 of the current year, the company catered an evening gala for a local celebrity. The $7,500 bill is due from the customer by the end of January of next year. No cash has been collected, and no journal entry has been made for this transaction. c. On October 1 of the current year, a one-year insurance premium on equipment in the amount of $1,380 was paid and debited in full to Prepaid Insurance on that date. Coverage began on November 1 of the current year. d. On December 31 of the current year, repairs on one of the company's delivery vans were completed at a cost estimate of $660; the amount has not yet been paid or recorded by Bill's. The repair shop will bill Bill's Catering at the beginning of January of next year. e. In November of the current year, Bill's Catering signed a lease for a new retail location, providing a down payment of $2,280 for the first three months' rent that was debited in full to Prepaid Rent. The lease began on December 1 of the current year. f. On July 1 of the current year, the company purchased new refrigerated display counters at a cash cost of $21,000. Depreciation of $2,630 has not been recorded for the current year. g. On November 1 of the current year, the company loaned $4,100 to one of its employees on a one-year, 12 percent note. The principal plus interest is payable by the employee at the end of 12 months. h. The income before any of the adjustments or income taxes was $28,400. The company's income tax rate is 25 percent. (Hint: Compute adjusted pretax income based on (a) through (g) to determine income tax expense.) Mc Graw Hill PDF The Art of Acade....pdf < Prev 3 S 4 of 7 Next > Show all -NGC Question 6 Mc Graw Continuing G Google MONOTONO terrifying ad x Course: The X (95) [ Homework + X Course Hero x + C S= ng Update: ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducatio... Assignment 4 i Saved ! Required information 6 Part 2 of 3 14.28 points Prepare an income statement (with Operating Income and Other Items sections, and earnings per share) for the current year to include the effects of the preceding six transactions. (Round "Earnings per share" to 2 decimal places.) SOUTH BEND REPAIR SERVICE COMPANY Operating revenues Skipped Operating expenses eBook References Mc Graw Hill PDF The Art of Acade....pdf Income Statement Total operating expenses 0 Other Items: Income before taxes Earnings per share < Prev S 10 6 7 of 7 Next > Help Save & Exit Submit Show all -NGC Question 6 Mc Graw Continuing G Google MONOTONO terrifying ad x Course: The X (95) [ Homework + X Course Hero x + C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducatio... Assignment 4 i Saved S= ng Update: Help Save & Exit Submit ! Required information 6 Required 2a Required 2b Part 2 of 3 14.28 points Prepare a classified balance sheet for the current year to include the effects of the preceding six transactions. (Amounts to be deducted should be indicated by a minus sign.) Skipped Current assets eBook References Mc Graw Hill PDF The Art of Acade....pdf SOUTH BEND REPAIR SERVICE COMPANY Balance Sheet Current liablities Total current assets $ 0 Total current liabilities Total liabilities Stockholders' equity + n < Prev Total stockholders' equity S 6 7 of 7 Next > EA FA 0 0 0 n Show all -NGC Question 7 X Mc Graw Continuing X G Google MONOTONO terrifying ad x In Course: The | (95) Homework + X Course Hero + C S= ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducatio... Assignment 4 i Saved ! 7 Required information View transaction list Part 3 of 3 Journal entry worksheet 1 14.32 points Skipped eBook References Mc Graw Hill PDF The Art of Acade....pdf Record the closing entry. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit Clear entry Record entry View general journal G < Prev 7 of 7 Next > Help ng Update: Save & Exit Submit Show all

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started