Answered step by step

Verified Expert Solution

Question

1 Approved Answer

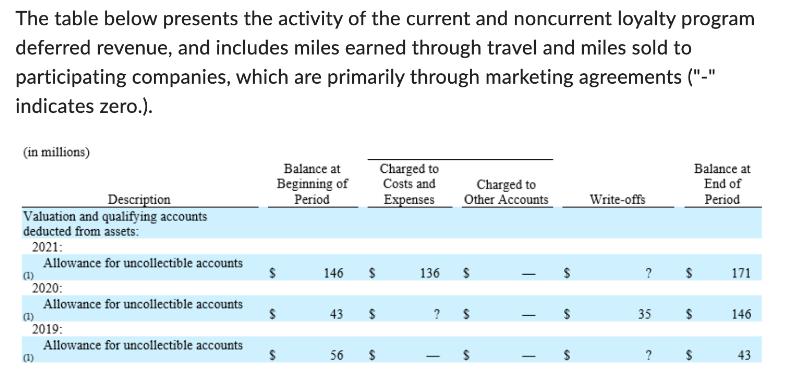

The table below presents the activity of the current and noncurrent loyalty program deferred revenue, and includes miles earned through travel and miles sold

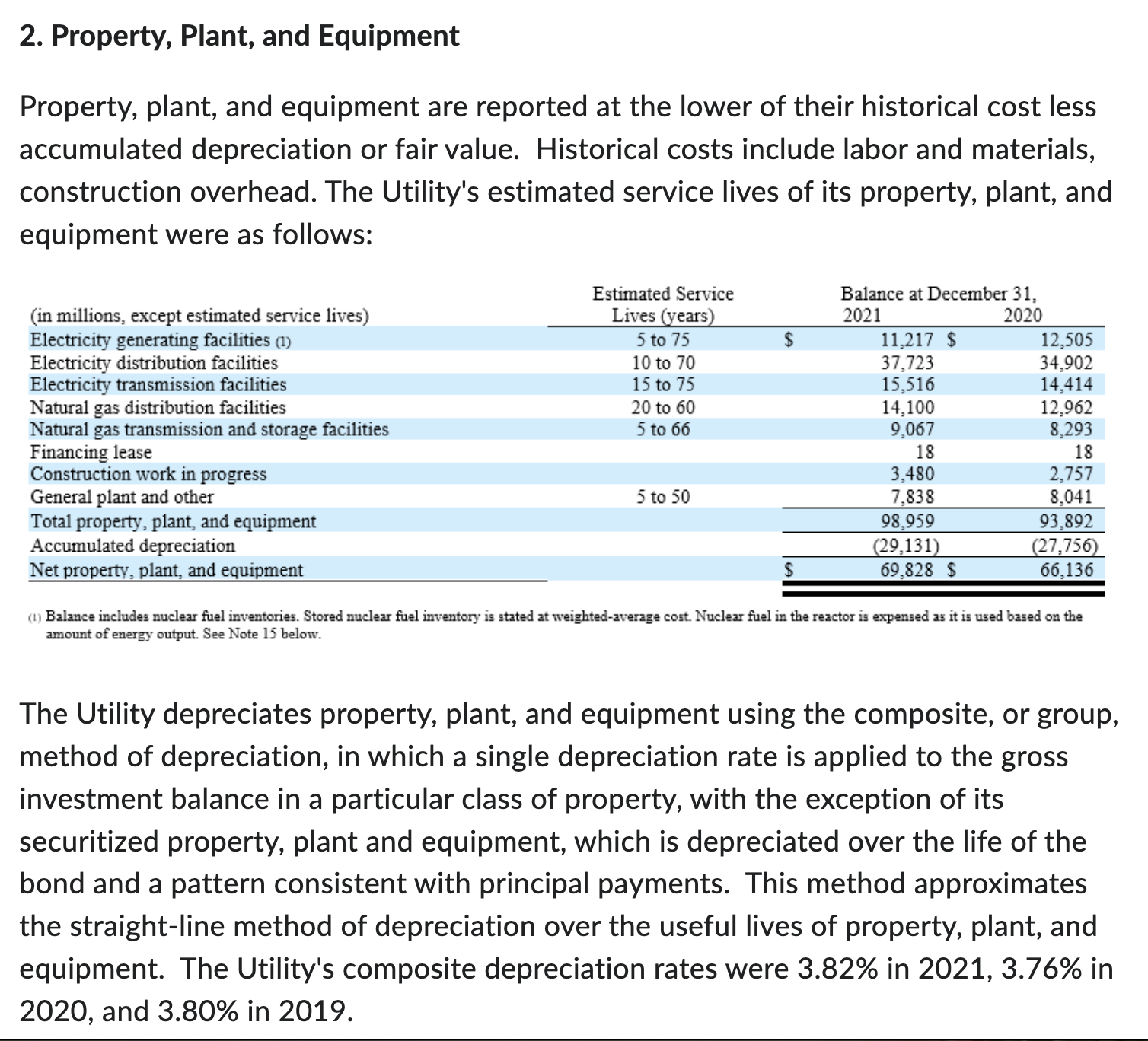

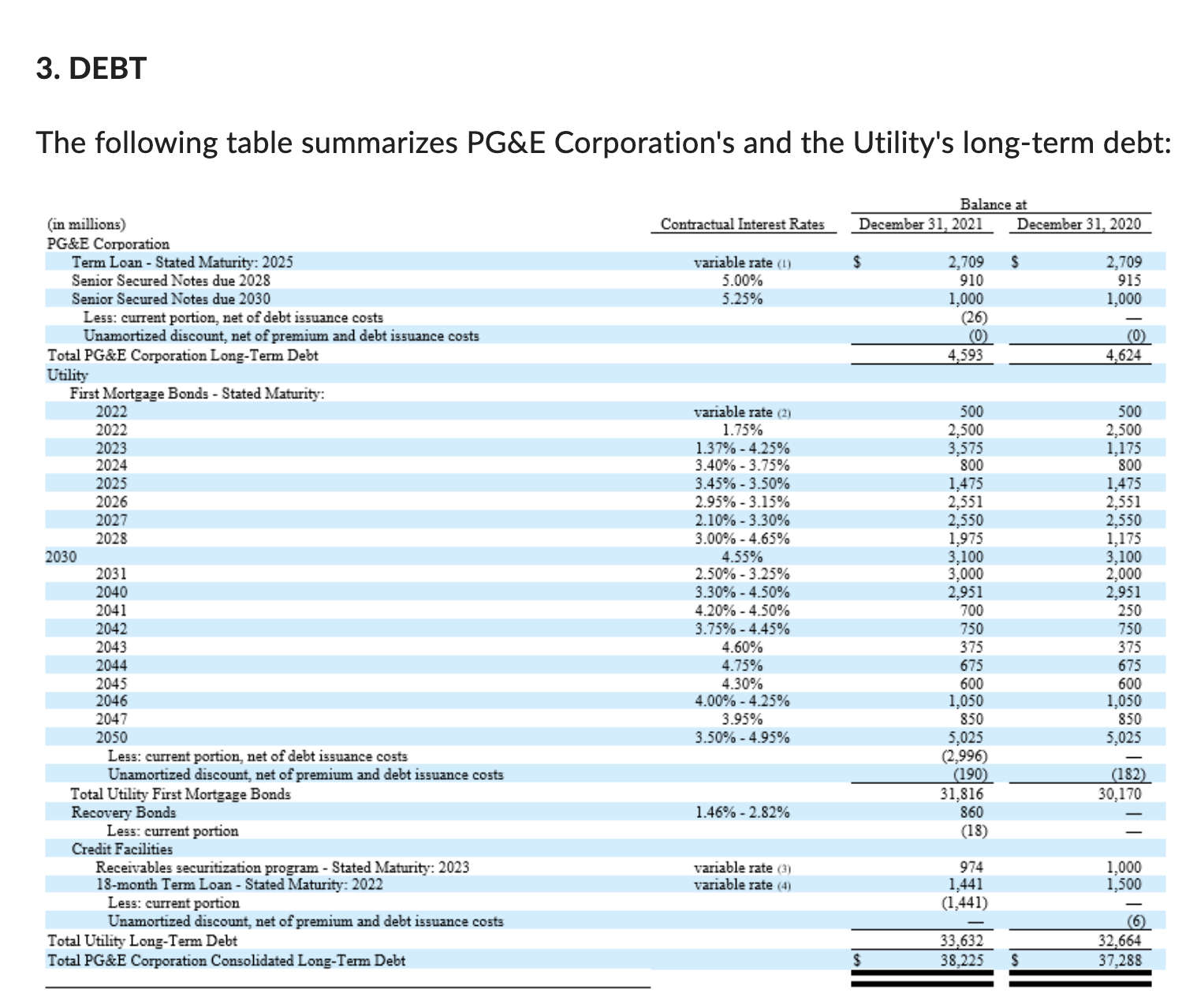

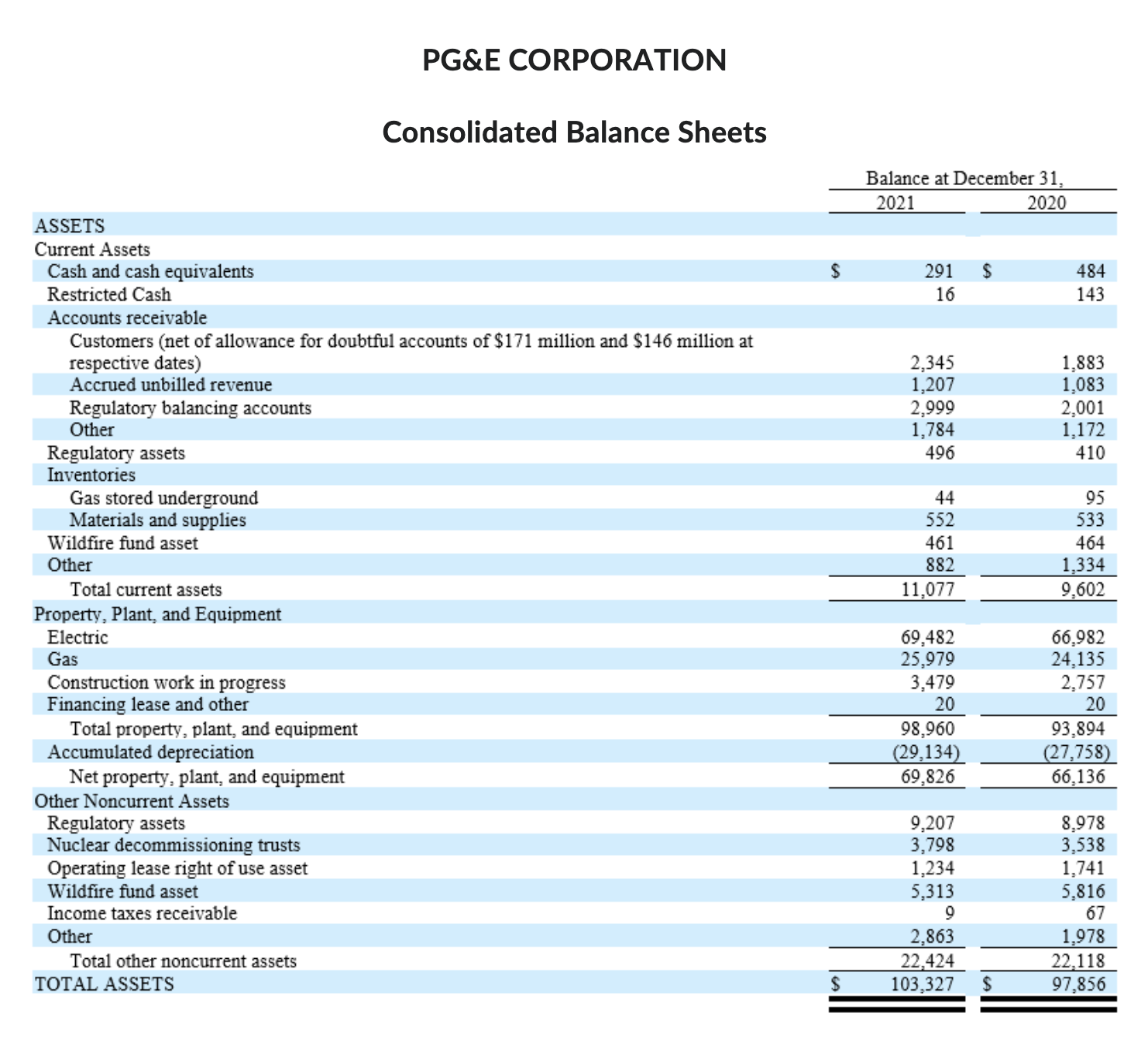

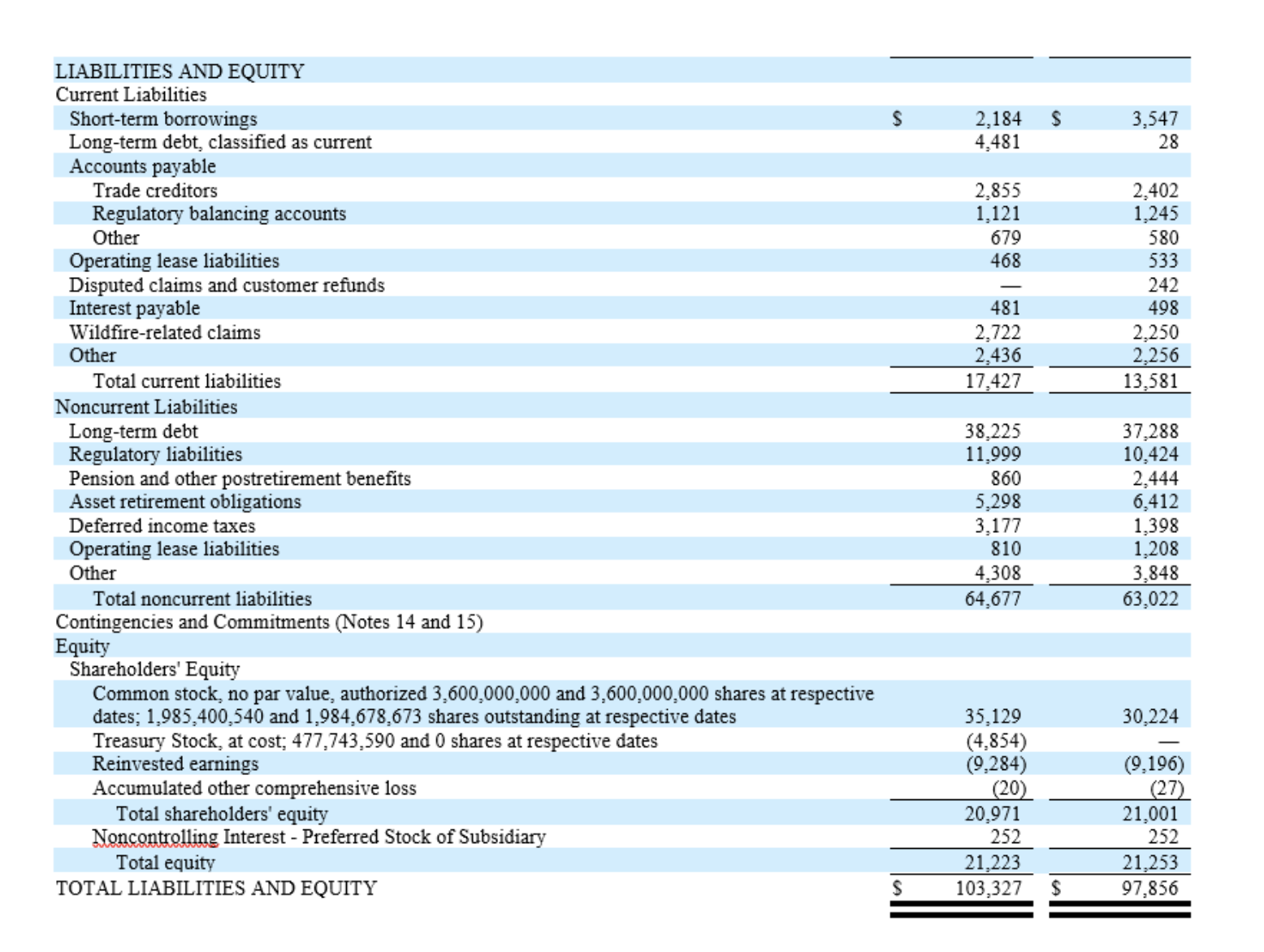

The table below presents the activity of the current and noncurrent loyalty program deferred revenue, and includes miles earned through travel and miles sold to participating companies, which are primarily through marketing agreements ("-" indicates zero.). (in millions) Description Valuation and qualifying accounts deducted from assets: 2021: Balance at Charged to Beginning of Period Costs and Expenses Charged to Other Accounts Write-offs Balance at End of Period ? $ Allowance for uncollectible accounts (1) 146 $ 136 2020: Allowance for uncollectible accounts (1) 43 2019: Allowance for uncollectible accounts (1) $ 56 $ - $ ? 171 35 ? 146 $ 43 2. Property, Plant, and Equipment Property, plant, and equipment are reported at the lower of their historical cost less accumulated depreciation or fair value. Historical costs include labor and materials, construction overhead. The Utility's estimated service lives of its property, plant, and equipment were as follows: (in millions, except estimated service lives) Electricity generating facilities (1) Electricity distribution facilities Estimated Service Lives (years) Balance at December 31, 2021 2020 5 to 75 S 11,217 $ 12,505 10 to 70 37,723 34,902 Electricity transmission facilities 15 to 75 15,516 14,414 Natural gas distribution facilities 20 to 60 14,100 12,962 Natural gas transmission and storage facilities 5 to 66 9,067 8,293 Financing lease 18 18 Construction work in progress 3,480 2,757 General plant and other 5 to 50 7,838 8,041 Total property, plant, and equipment 98,959 93,892 Accumulated depreciation (29,131) (27,756) Net property, plant, and equipment S 69,828 $ 66,136 (1) Balance includes nuclear fuel inventories. Stored nuclear fuel inventory is stated at weighted-average cost. Nuclear fuel in the reactor is expensed as it is used based on the amount of energy output. See Note 15 below. The Utility depreciates property, plant, and equipment using the composite, or group, method of depreciation, in which a single depreciation rate is applied to the gross investment balance in a particular class of property, with the exception of its securitized property, plant and equipment, which is depreciated over the life of the bond and a pattern consistent with principal payments. This method approximates the straight-line method of depreciation over the useful lives of property, plant, and equipment. The Utility's composite depreciation rates were 3.82% in 2021, 3.76% in 2020, and 3.80% in 2019. 3. DEBT The following table summarizes PG&E Corporation's and the Utility's long-term debt: (in millions) PG&E Corporation Term Loan - Stated Maturity: 2025 Senior Secured Notes due 2028 Senior Secured Notes due 2030 Less: current portion, net of debt issuance costs Unamortized discount, net of premium and debt issuance costs Total PG&E Corporation Long-Term Debt Utility Balance at Contractual Interest Rates December 31, 2021 December 31, 2020 variable rate (1) 5.00% 5.25% $ 2,709 S 2,709 910 915 1,000 1,000 (26) (0) (0) 4,593 4,624 First Mortgage Bonds - Stated Maturity: 2022 variable rate (2) 500 500 2022 1.75% 2,500 2,500 2023 1.37% -4.25% 3,575 1,175 2024 3.40%-3.75% 800 800 2025 3.45% -3.50% 1,475 1,475 2026 2.95% -3.15% 2,551 2,551 2027 2.10% -3.30% 2,550 2,550 2028 3.00% -4.65% 1,975 1,175 2030 4.55% 3,100 3,100 2031 2.50% -3.25% 3,000 2,000 2040 3.30% -4.50% 2,951 2,951 2041 4.20% -4.50% 700 250 2042 3.75%-4.45% 750 750 2043 4.60% 375 375 2044 4.75% 675 675 2045 4.30% 600 600 2046 4.00% -4.25% 1,050 1,050 2047 3.95% 850 850 2050 3.50% -4.95% 5,025 5,025 Less: current portion, net of debt issuance costs (2,996) Unamortized discount, net of premium and debt issuance costs (190) (182) Total Utility First Mortgage Bonds 31,816 30,170 Recovery Bonds Less: current portion Credit Facilities 1.46% -2.82% 860 (18) Receivables securitization program - Stated Maturity: 2023 18-month Term Loan - Stated Maturity: 2022 variable rate (3) variable rate (4) 974 1,000 1,441 1,500 Less: current portion Unamortized discount, net of premium and debt issuance costs Total Utility Long-Term Debt Total PG&E Corporation Consolidated Long-Term Debt (1,441) (6) 33,632 32,664 $ 38,225 $ 37,288 ASSETS Current Assets PG&E CORPORATION Consolidated Balance Sheets Balance at December 31, 2021 2020 Restricted Cash Cash and cash equivalents Accounts receivable Customers (net of allowance for doubtful accounts of $171 million and $146 million at respective dates) Accrued unbilled revenue Regulatory balancing accounts Other Regulatory assets Inventories Gas stored underground Materials and supplies Wildfire fund asset Other Total current assets Property, Plant, and Equipment S 291 $ 484 16 143 2,345 1,883 1,207 1,083 2,999 2,001 1,784 1,172 496 410 44 95 552 533 461 464 882 1,334 11,077 9,602 Electric 69,482 66,982 Gas 25,979 24,135 Construction work in progress 3,479 2,757 Financing lease and other 20 20 Total property, plant, and equipment 98,960 93,894 Accumulated depreciation (29,134) (27,758) Net property, plant, and equipment 69,826 66,136 Other Noncurrent Assets Regulatory assets Nuclear decommissioning trusts Operating lease right of use asset Wildfire fund asset Income taxes receivable Other Total other noncurrent assets TOTAL ASSETS 9,207 8,978 3,798 3,538 1,234 1,741 5,313 5,816 9 67 2,863 1,978 22,424 22,118 $ 103,327 $ 97,856 LIABILITIES AND EQUITY Current Liabilities Short-term borrowings Long-term debt, classified as current Accounts payable 2,184 S 3,547 4,481 28 Trade creditors 2,855 2,402 Regulatory balancing accounts 1,121 1,245 Other 679 580 Operating lease liabilities 468 533 Disputed claims and customer refunds 242 Interest payable 481 498 Wildfire-related claims 2,722 2,250 Other 2,436 2,256 Total current liabilities 17,427 13,581 Noncurrent Liabilities Long-term debt Regulatory liabilities Pension and other postretirement benefits Asset retirement obligations Deferred income taxes Operating lease liabilities Other 38,225 37,288 11,999 10,424 860 2,444 5,298 6,412 3,177 1,398 810 1,208 4,308 3,848 64,677 63,022 Total noncurrent liabilities Contingencies and Commitments (Notes 14 and 15) Equity Shareholders' Equity Common stock, no par value, authorized 3,600,000,000 and 3,600,000,000 shares at respective dates; 1,985,400,540 and 1,984,678,673 shares outstanding at respective dates 35,129 30,224 Treasury Stock, at cost; 477,743,590 and 0 shares at respective dates (4,854) Reinvested earnings (9,284) (9,196) Accumulated other comprehensive loss (20) (27) Total shareholders' equity Noncontrolling Interest - Preferred Stock of Subsidiary Total equity TOTAL LIABILITIES AND EQUITY 20,971 21,001 252 252 21,223 21,253 S 103,327 $ 97,856

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started