Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hanover Tech is currently an all equity firm that has 800,000 shares of stock outstanding with a market price of $10.00 a share. The current

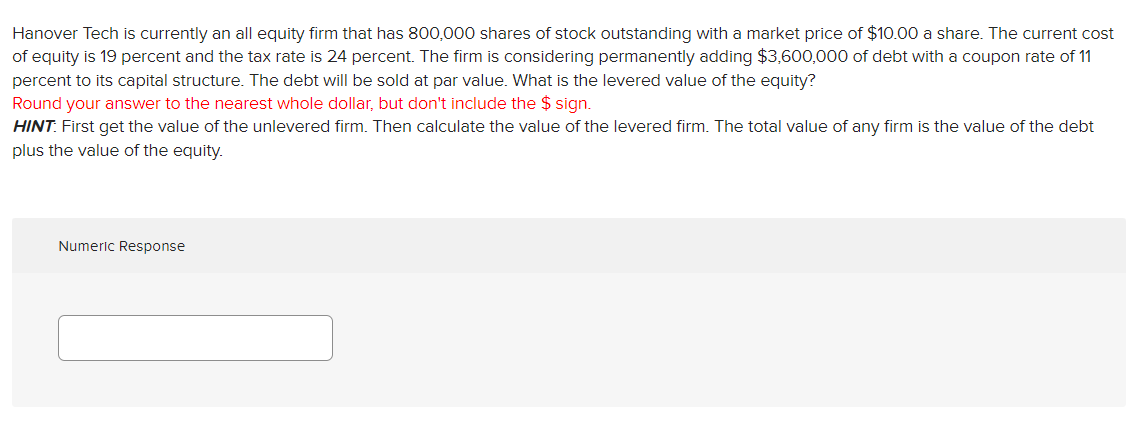

Hanover Tech is currently an all equity firm that has 800,000 shares of stock outstanding with a market price of $10.00 a share. The current cost of equity is 19 percent and the tax rate is 24 percent. The firm is considering permanently adding $3,600,000 of debt with a coupon rate of 11 percent to its capital structure. The debt will be sold at par value. What is the levered value of the equity? Round your answer to the nearest whole dollar, but don't include the $ sign. HINT: First get the value of the unlevered firm. Then calculate the value of the levered firm. The total value of any firm is the value of the debt plus the value of the equity. Numerlc Response

Hanover Tech is currently an all equity firm that has 800,000 shares of stock outstanding with a market price of $10.00 a share. The current cost of equity is 19 percent and the tax rate is 24 percent. The firm is considering permanently adding $3,600,000 of debt with a coupon rate of 11 percent to its capital structure. The debt will be sold at par value. What is the levered value of the equity? Round your answer to the nearest whole dollar, but don't include the $ sign. HINT: First get the value of the unlevered firm. Then calculate the value of the levered firm. The total value of any firm is the value of the debt plus the value of the equity. Numerlc Response Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started