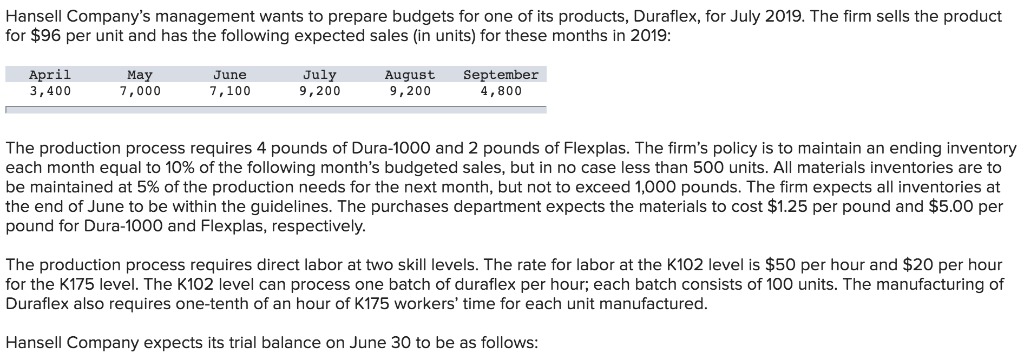

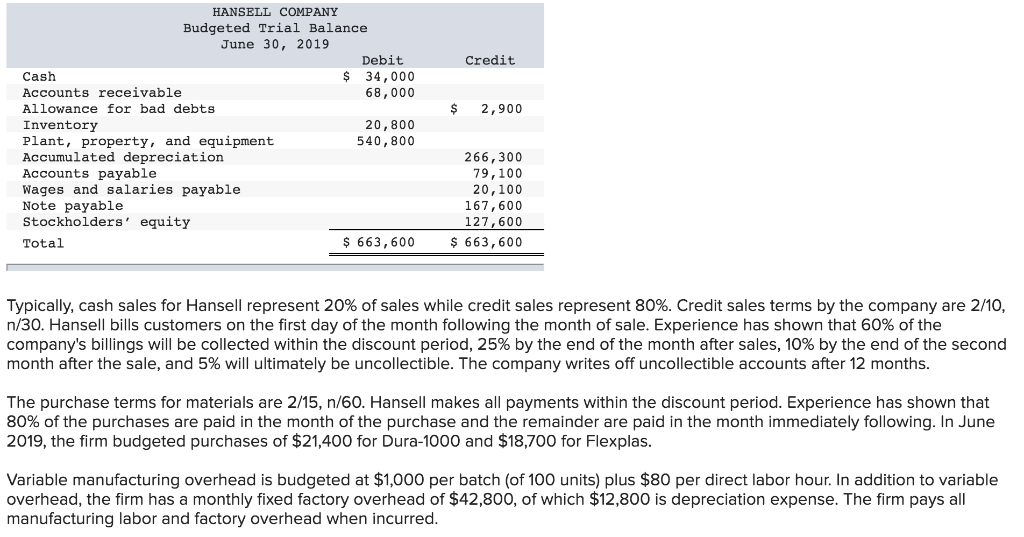

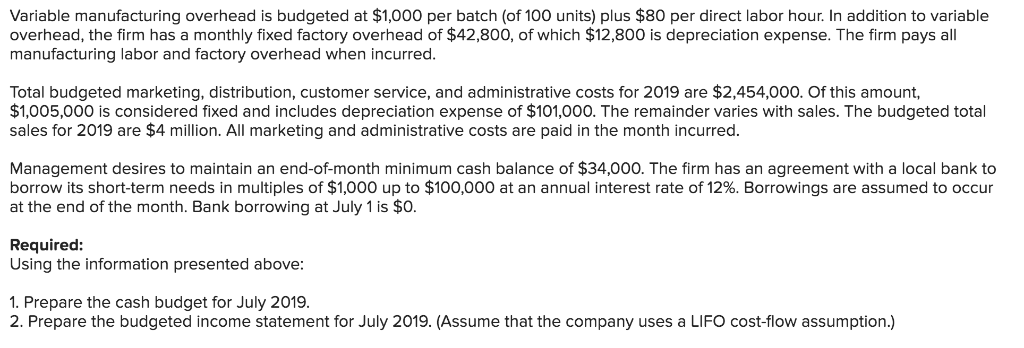

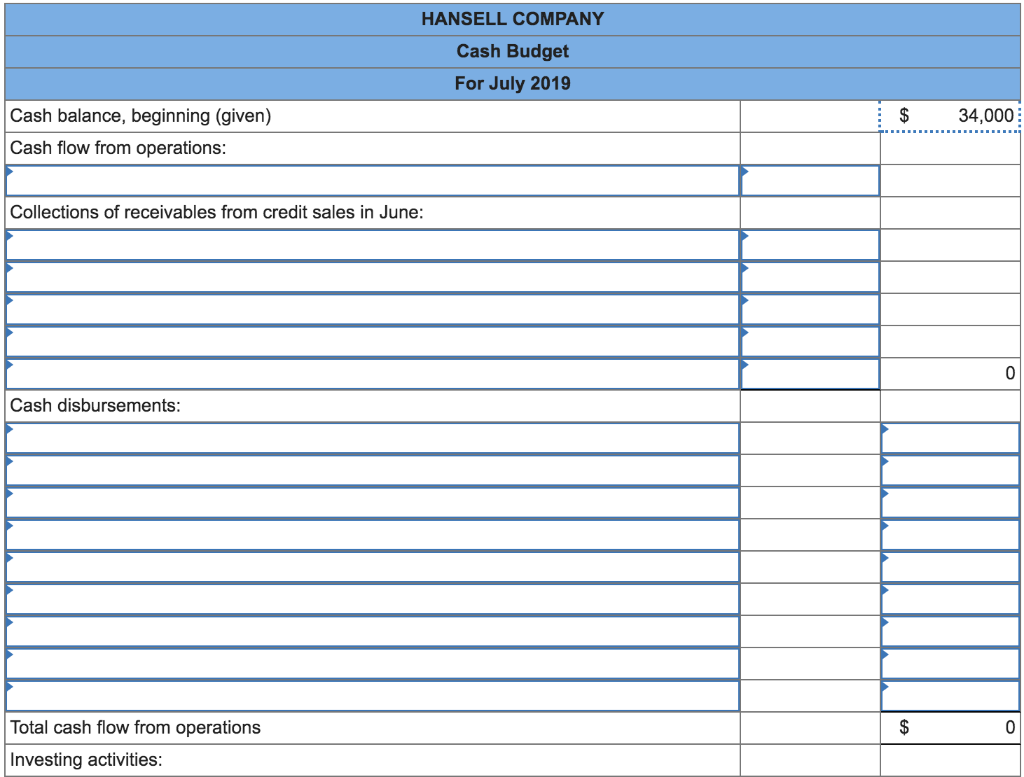

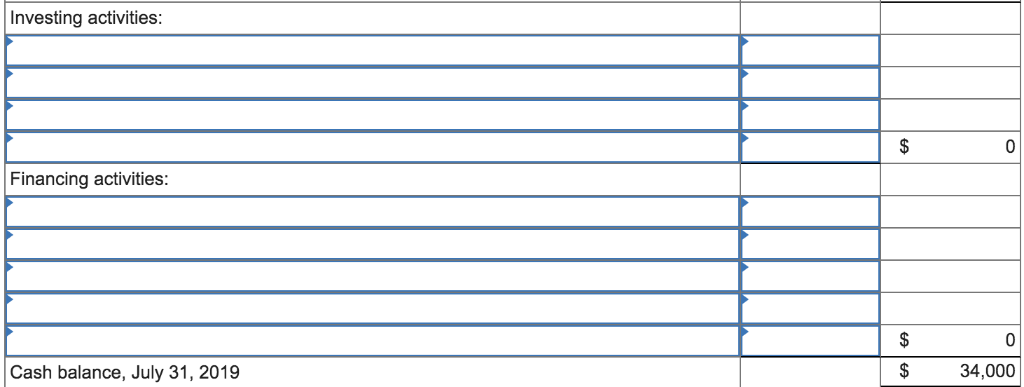

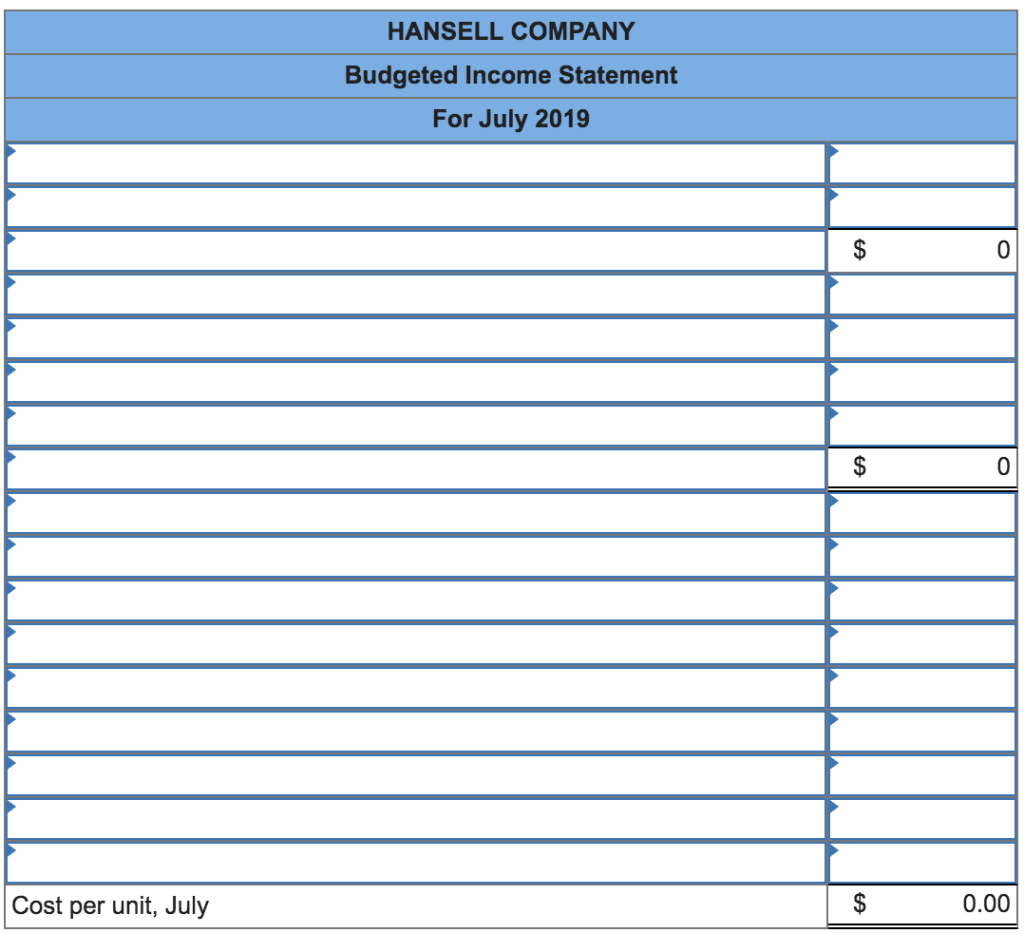

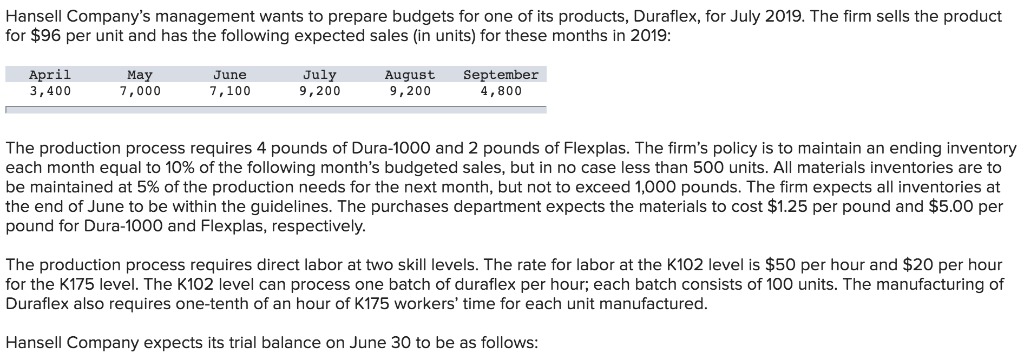

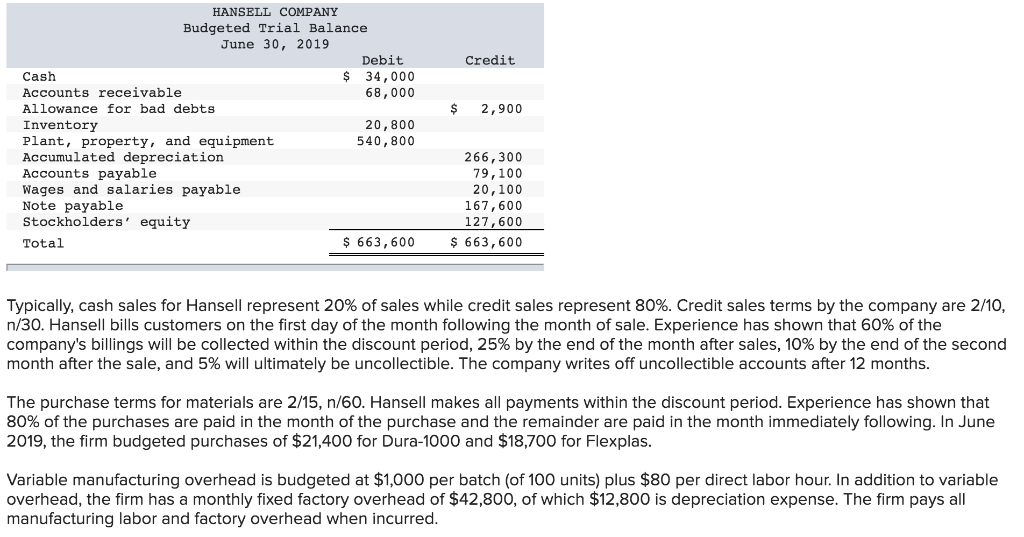

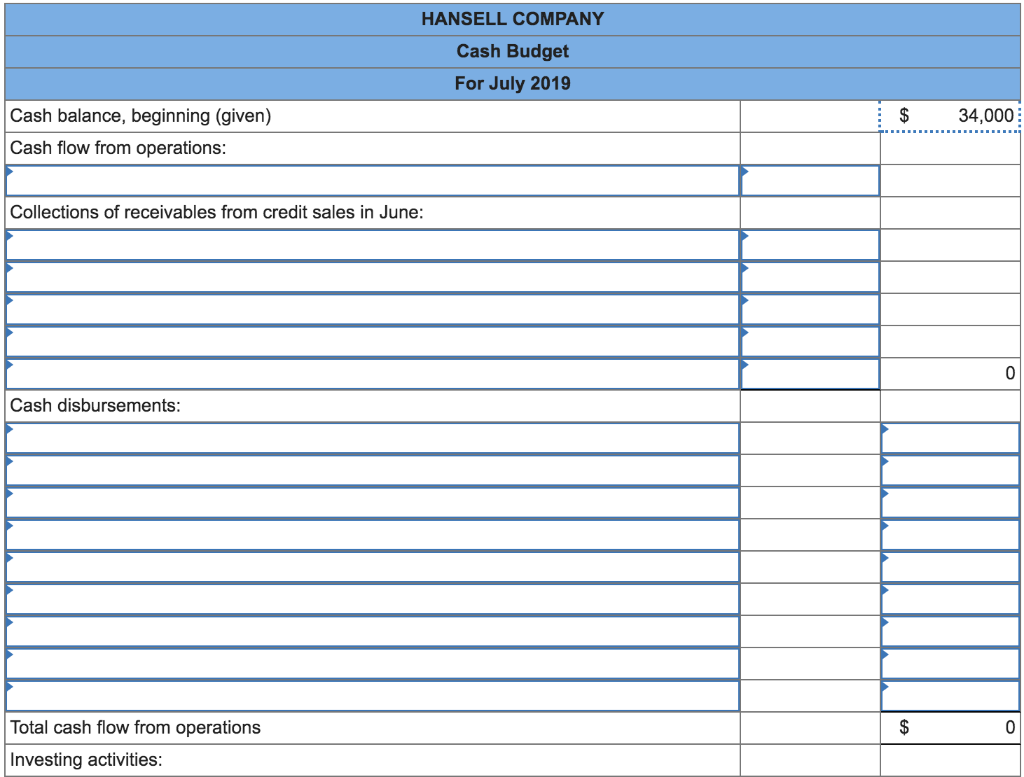

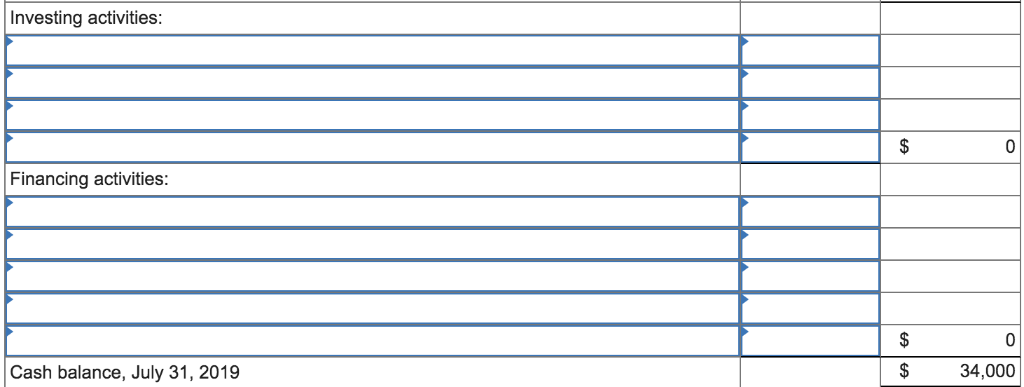

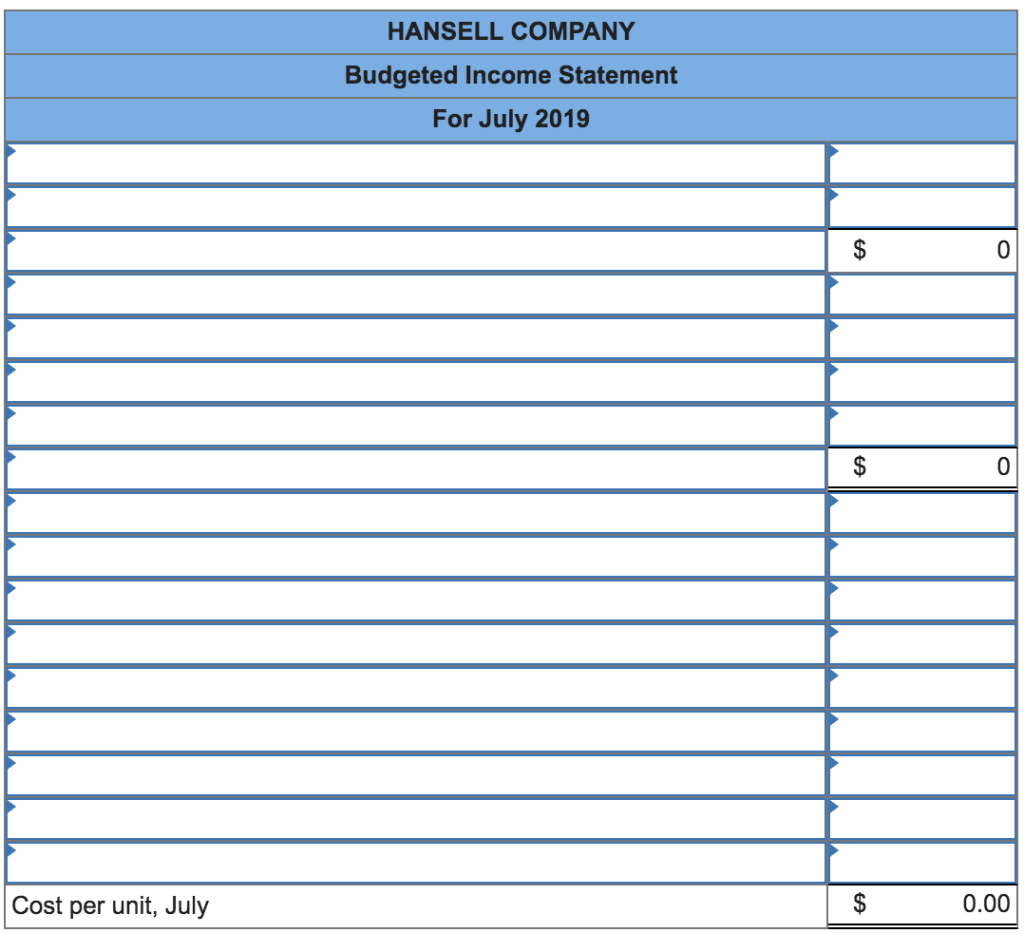

HANSELL COMPANY Budgeted Trial Balance June 30, 2019 Debit 68,000 20,800 Credit $ 34,000 Cash Accounts receivable Allowance for bad debts Inventory Plant, property, and equipment Accumulated depreciation Accounts payable Wages and salaries payable Note payable Stockholders' equity Total $ 2,900 540,800 266,300 79,100 20,100 167,600 127,600 663,600 $ 663,600 Typically, cash sales for Hansell represent 20% of sales while credit sales represent 80%. Credit sales terms by the company are 2/10, n/30. Hansel bills customers on the first day of the month following the month of sale. Experience has shown that 60% of the company's billings will be collected within the discount period, 25% by the end of the month after sales, 10% by the end of the second month after the sale, and 5% will ultimately be uncollectible. The company writes off uncollectible accounts after 12 months The purchase terms for materials are 2/15, n/60. Hansell makes all payments within the discount period. Experience has shown that 80% of the purchases are paid in the month of the purchase and the remainder are paid in the month immediately following. In June 2019, the firm budgeted purchases of $21,400 for Dura-1000 and $18,700 for Flexplas. Variable manufacturing overhead is budgeted at $1,000 per batch (of 100 units) plus $80 per direct labor hour. In addition to variable overhead, the firm has a monthly fixed factory overhead of $42,800, of which $12,800 is depreciation expense. The firm pays al manufacturing labor and factory overhead when incurred HANSELL COMPANY Cash Budget For July 2019 34,000 Cash balance, beginning (given) Cash flow from operations: Collections of receivables from credit sales in June: 0 Cash disbursements Total cash flow from operations Investing activities: HANSELL COMPANY Budgeted Trial Balance June 30, 2019 Debit 68,000 20,800 Credit $ 34,000 Cash Accounts receivable Allowance for bad debts Inventory Plant, property, and equipment Accumulated depreciation Accounts payable Wages and salaries payable Note payable Stockholders' equity Total $ 2,900 540,800 266,300 79,100 20,100 167,600 127,600 663,600 $ 663,600 Typically, cash sales for Hansell represent 20% of sales while credit sales represent 80%. Credit sales terms by the company are 2/10, n/30. Hansel bills customers on the first day of the month following the month of sale. Experience has shown that 60% of the company's billings will be collected within the discount period, 25% by the end of the month after sales, 10% by the end of the second month after the sale, and 5% will ultimately be uncollectible. The company writes off uncollectible accounts after 12 months The purchase terms for materials are 2/15, n/60. Hansell makes all payments within the discount period. Experience has shown that 80% of the purchases are paid in the month of the purchase and the remainder are paid in the month immediately following. In June 2019, the firm budgeted purchases of $21,400 for Dura-1000 and $18,700 for Flexplas. Variable manufacturing overhead is budgeted at $1,000 per batch (of 100 units) plus $80 per direct labor hour. In addition to variable overhead, the firm has a monthly fixed factory overhead of $42,800, of which $12,800 is depreciation expense. The firm pays al manufacturing labor and factory overhead when incurred HANSELL COMPANY Cash Budget For July 2019 34,000 Cash balance, beginning (given) Cash flow from operations: Collections of receivables from credit sales in June: 0 Cash disbursements Total cash flow from operations Investing activities