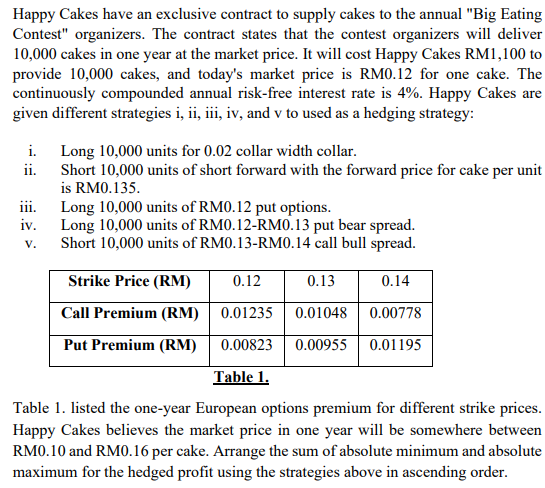

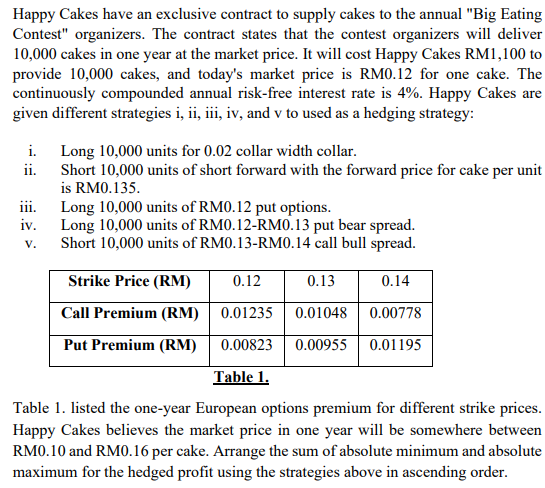

Happy Cakes have an exclusive contract to supply cakes to the annual "Big Eating Contest" organizers. The contract states that the contest organizers will deliver 10,000 cakes in one year at the market price. It will cost Happy Cakes RM1,100 to provide 10,000 cakes, and today's market price is RM0.12 for one cake. The continuously compounded annual risk-free interest rate is 4%. Happy Cakes are given different strategies i, ii, iii, iv, and v to used as a hedging strategy: i. Long 10,000 units for 0.02 collar width collar. ii. Short 10,000 units of short forward with the forward price for cake per unit is RM0.135. iii. Long 10,000 units of RM0.12 put options. iv. Long 10,000 units of RM0.12-RM0.13 put bear spread. Short 10,000 units of RM0.13-RM0.14 call bull spread. V. Strike Price (RM) 0.12 0.13 0.14 Call Premium (RM) 0.01235 0.01048 0.00778 Put Premium (RM) 0.00823 0.00955 0.01195 Table 1. Table 1. listed the one-year European options premium for different strike prices. Happy Cakes believes the market price in one year will be somewhere between RM0.10 and RM0.16 per cake. Arrange the sum of absolute minimum and absolute maximum for the hedged profit using the strategies above in ascending order. Happy Cakes have an exclusive contract to supply cakes to the annual "Big Eating Contest" organizers. The contract states that the contest organizers will deliver 10,000 cakes in one year at the market price. It will cost Happy Cakes RM1,100 to provide 10,000 cakes, and today's market price is RM0.12 for one cake. The continuously compounded annual risk-free interest rate is 4%. Happy Cakes are given different strategies i, ii, iii, iv, and v to used as a hedging strategy: i. Long 10,000 units for 0.02 collar width collar. ii. Short 10,000 units of short forward with the forward price for cake per unit is RM0.135. iii. Long 10,000 units of RM0.12 put options. iv. Long 10,000 units of RM0.12-RM0.13 put bear spread. Short 10,000 units of RM0.13-RM0.14 call bull spread. V. Strike Price (RM) 0.12 0.13 0.14 Call Premium (RM) 0.01235 0.01048 0.00778 Put Premium (RM) 0.00823 0.00955 0.01195 Table 1. Table 1. listed the one-year European options premium for different strike prices. Happy Cakes believes the market price in one year will be somewhere between RM0.10 and RM0.16 per cake. Arrange the sum of absolute minimum and absolute maximum for the hedged profit using the strategies above in ascending order