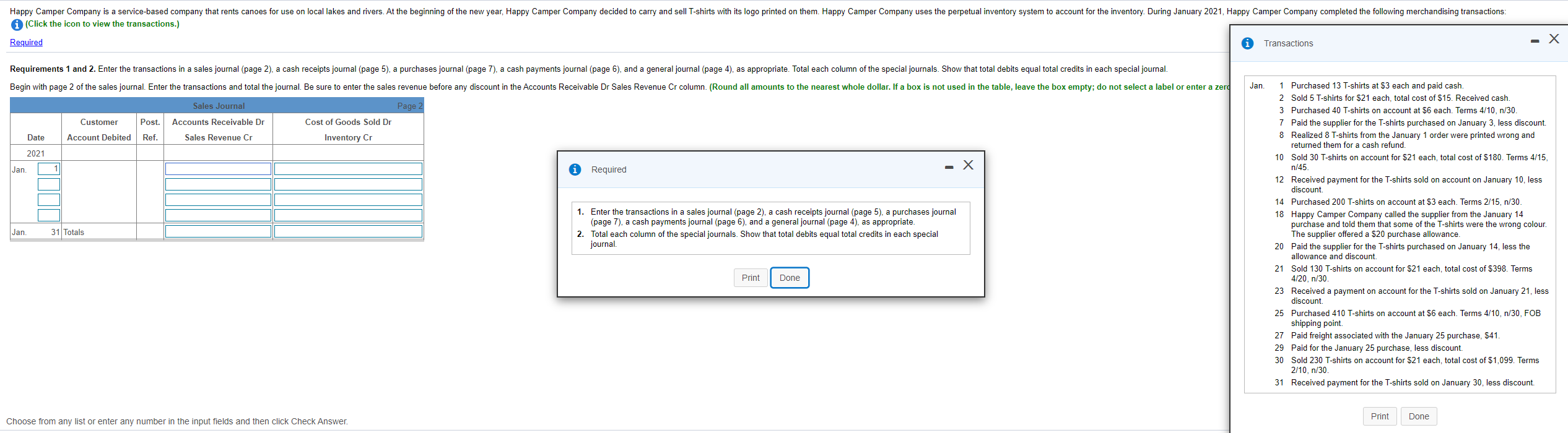

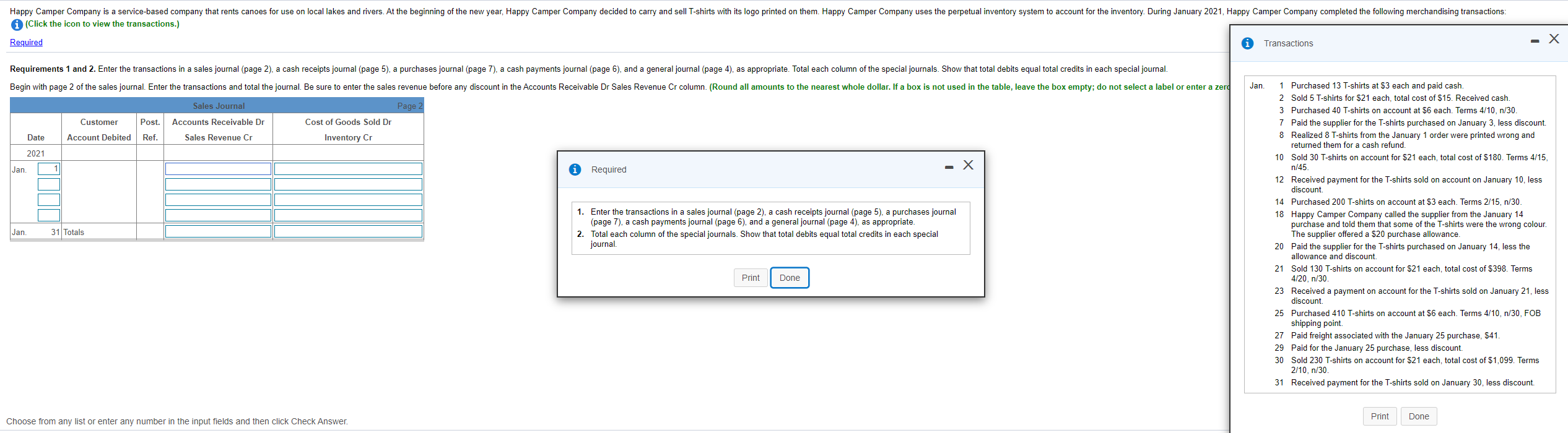

Happy Camper Company is a service-based company that rents canoes for use on local lakes and rivers. At the beginning of the new year, Happy Camper Company decided to carry and sell T-shirts with its logo printed on them. Happy Camper Company uses the perpetual inventory system to account for the inventory. During January 2021, Happy Camper Company completed the following merchandising transactions: (Click the icon to view the transactions.) Required Transactions Requirements 1 and 2. Enter the transactions in a sales journal (page 2), a cash receipts journal (page 5), a purchases journal (page 7), a cash payments journal (page 6), and a general journal (page 4), as appropriate. Total each column of the special journals. Show that total debits equal total credits in each special journal. Begin with page 2 of the sales journal. Enter the transactions and total the journal. Be sure to enter the sales revenue before any discount in the Accounts Receivable Dr Sales Revenue Cr column. (Round all amounts to the nearest whole dollar. If a box is not used in the table, leave the box empty; do not select a label or enter a zerd Jan. Sales Journal Page 2 Customer Post. Accounts Receivable Dr Cost of Goods Sold Dr Inventory Cr Date Account Debited Ref. Sales Revenue Cr 2021 Jan. Required Jan. 31 Totals 1. Enter the transactions in a sales journal (page 2), a cash receipts journal (page 5), a purchases journal (page 7), a cash payments journal (page 6), and a general journal (page 4), as appropriate. 2. Total each column of the special journals. Show that total debits equal total credits in each special journal 1 Purchased 13 T-shirts at $3 each and paid cash. 2 Sold 5 T-shirts for $21 each, total cost of $15. Received cash. 3 Purchased 40 T-shirts on account at $6 each. Terms 4/10, n/30. 7 Paid the supplier for the T-shirts purchased on January 3, less discount. 8 Realized 8 T-shirts from the January 1 order were printed wrong and returned them for a cash refund. 10 Sold 30 T-shirts on account for $21 each, total cost of $180. Terms 4/15, n/45 12 Received payment for the T-shirts sold on account on January 10, less discount 14 Purchased 200 T-shirts on account at $3 each. Terms 2/15, n/30 18 Happy Camper Company called the supplier from the January 14 purchase and told them that some of the T-shirts were the wrong colour. The supplier offered a $20 purchase allowance. 20 Paid the supplier for the T-shirts purchased on January 14, less the allowance and discount. 21 Sold 130 T-shirts on account for 521 each, total cost of $398. Terms 4/20, n/30 23 Received a payment on account for the T-shirts sold on January 21, less discount 25 Purchased 410 T-shirts on account at $6 each. Terms 4/10, n/30, FOB shipping point 27 Paid freight associated with the January 25 purchase, $41. 29 Paid for the January 25 purchase, less discount. 30 Sold 230 T-shirts on account for $21 each, total cost of $1,099. Terms 2/10, n/30. 31 Received payment for the T-shirts sold on January 30, less discount. Print Done Print Done Choose from any list or enter any number in the input fields and then click Check Answer. Happy Camper Company is a service-based company that rents canoes for use on local lakes and rivers. At the beginning of the new year, Happy Camper Company decided to carry and sell T-shirts with its logo printed on them. Happy Camper Company uses the perpetual inventory system to account for the inventory. During January 2021, Happy Camper Company completed the following merchandising transactions: (Click the icon to view the transactions.) Required Transactions Requirements 1 and 2. Enter the transactions in a sales journal (page 2), a cash receipts journal (page 5), a purchases journal (page 7), a cash payments journal (page 6), and a general journal (page 4), as appropriate. Total each column of the special journals. Show that total debits equal total credits in each special journal. Begin with page 2 of the sales journal. Enter the transactions and total the journal. Be sure to enter the sales revenue before any discount in the Accounts Receivable Dr Sales Revenue Cr column. (Round all amounts to the nearest whole dollar. If a box is not used in the table, leave the box empty; do not select a label or enter a zerd Jan. Sales Journal Page 2 Customer Post. Accounts Receivable Dr Cost of Goods Sold Dr Inventory Cr Date Account Debited Ref. Sales Revenue Cr 2021 Jan. Required Jan. 31 Totals 1. Enter the transactions in a sales journal (page 2), a cash receipts journal (page 5), a purchases journal (page 7), a cash payments journal (page 6), and a general journal (page 4), as appropriate. 2. Total each column of the special journals. Show that total debits equal total credits in each special journal 1 Purchased 13 T-shirts at $3 each and paid cash. 2 Sold 5 T-shirts for $21 each, total cost of $15. Received cash. 3 Purchased 40 T-shirts on account at $6 each. Terms 4/10, n/30. 7 Paid the supplier for the T-shirts purchased on January 3, less discount. 8 Realized 8 T-shirts from the January 1 order were printed wrong and returned them for a cash refund. 10 Sold 30 T-shirts on account for $21 each, total cost of $180. Terms 4/15, n/45 12 Received payment for the T-shirts sold on account on January 10, less discount 14 Purchased 200 T-shirts on account at $3 each. Terms 2/15, n/30 18 Happy Camper Company called the supplier from the January 14 purchase and told them that some of the T-shirts were the wrong colour. The supplier offered a $20 purchase allowance. 20 Paid the supplier for the T-shirts purchased on January 14, less the allowance and discount. 21 Sold 130 T-shirts on account for 521 each, total cost of $398. Terms 4/20, n/30 23 Received a payment on account for the T-shirts sold on January 21, less discount 25 Purchased 410 T-shirts on account at $6 each. Terms 4/10, n/30, FOB shipping point 27 Paid freight associated with the January 25 purchase, $41. 29 Paid for the January 25 purchase, less discount. 30 Sold 230 T-shirts on account for $21 each, total cost of $1,099. Terms 2/10, n/30. 31 Received payment for the T-shirts sold on January 30, less discount. Print Done Print Done Choose from any list or enter any number in the input fields and then click Check