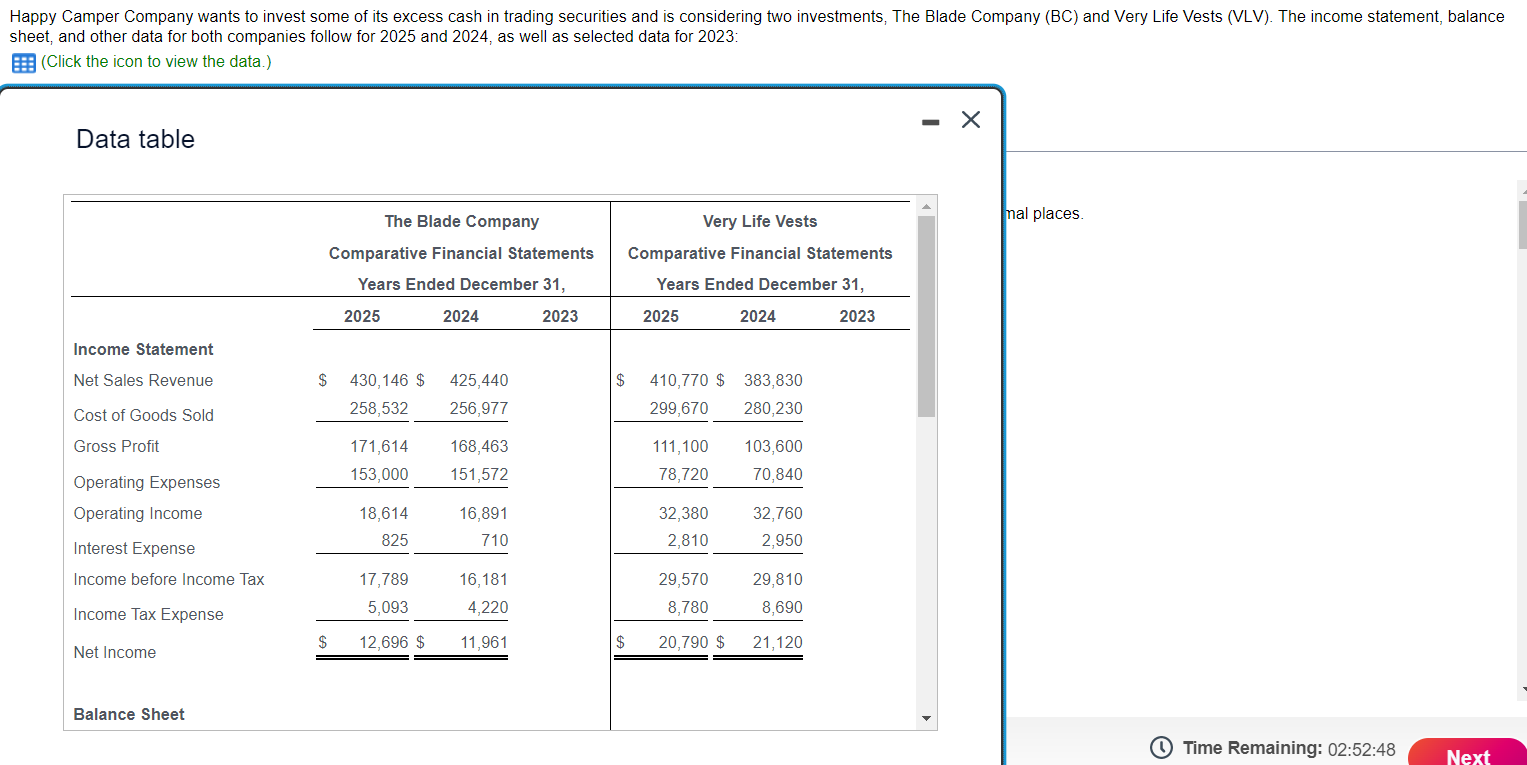

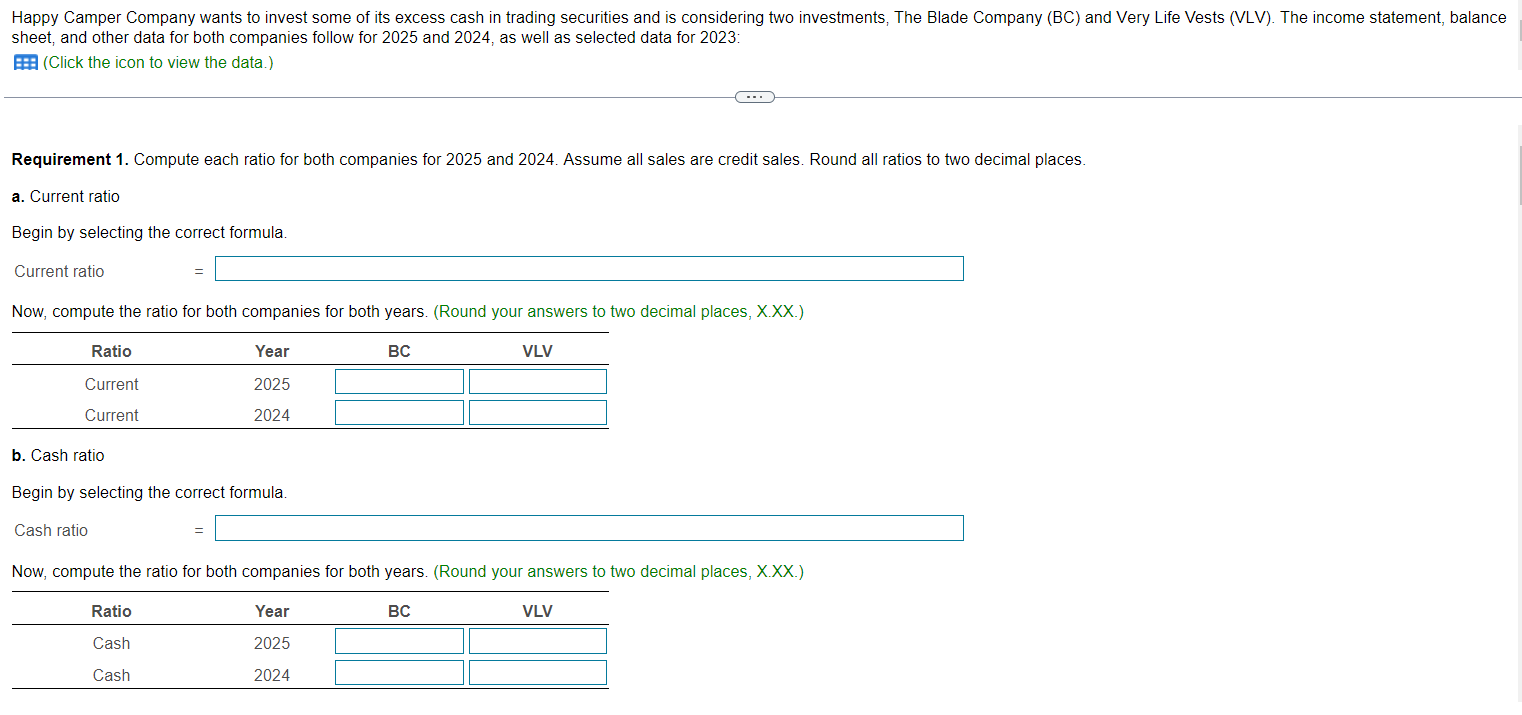

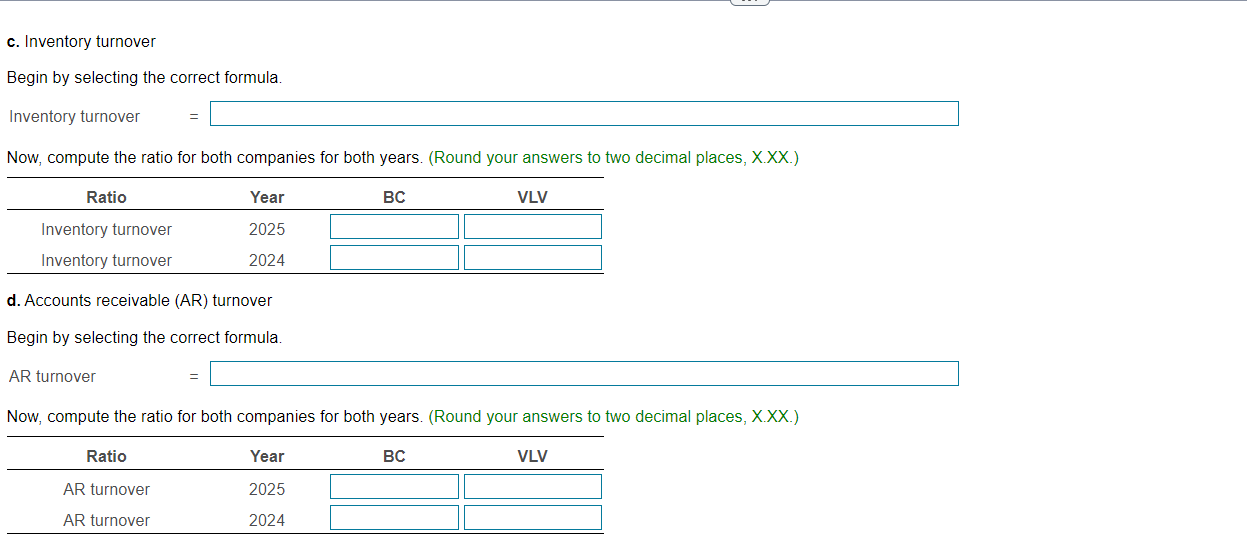

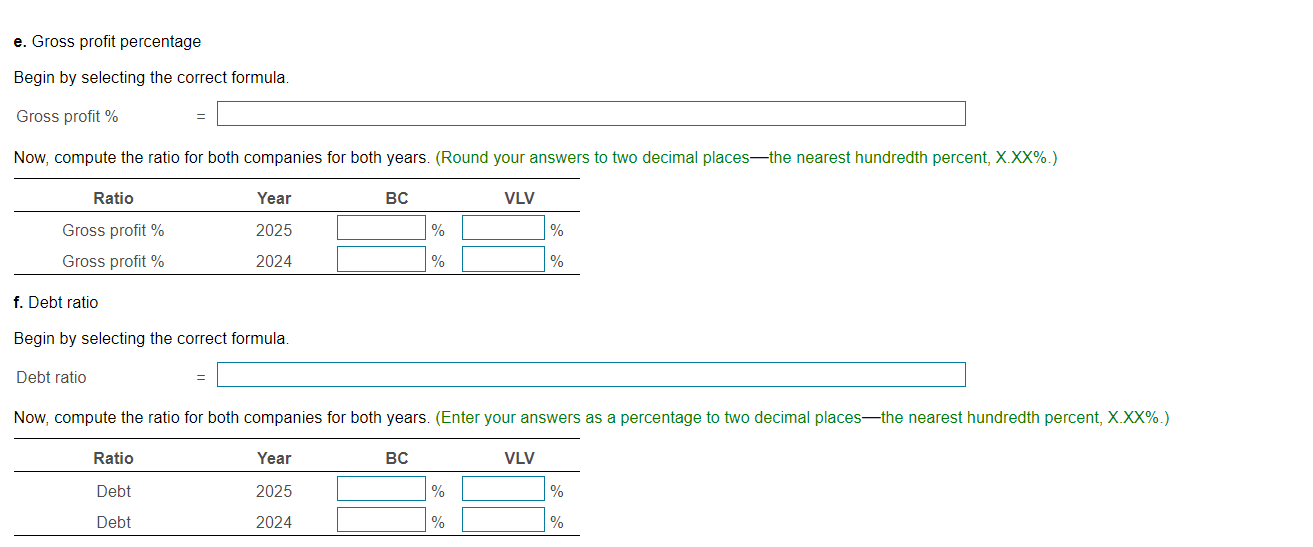

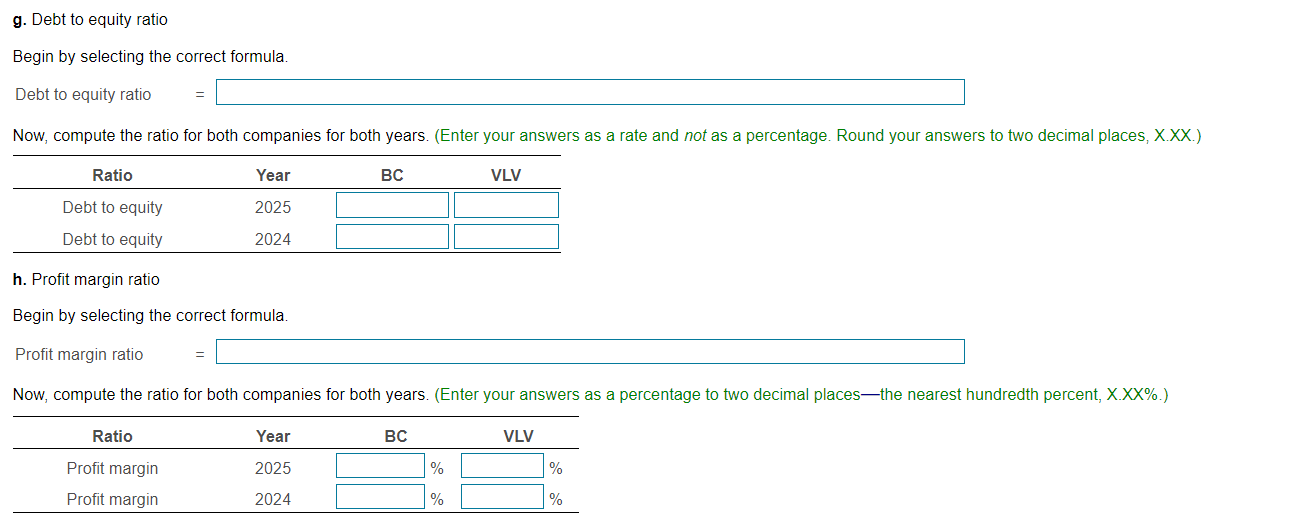

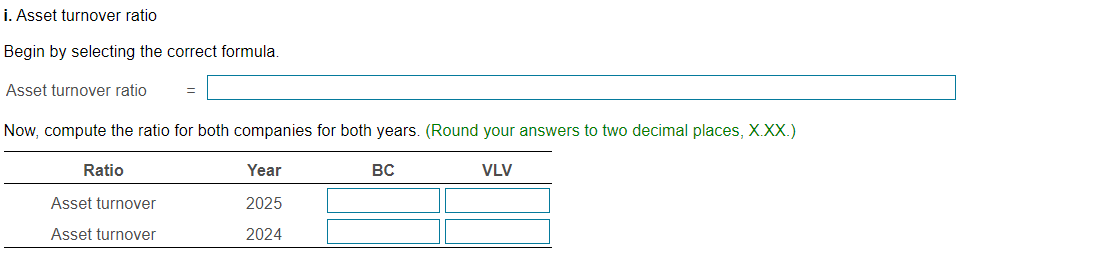

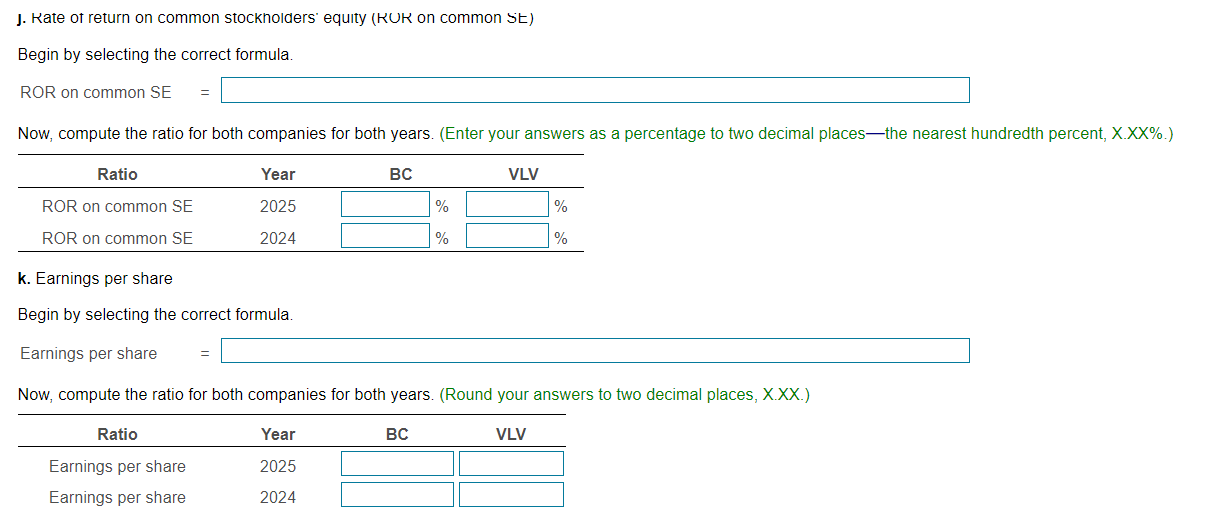

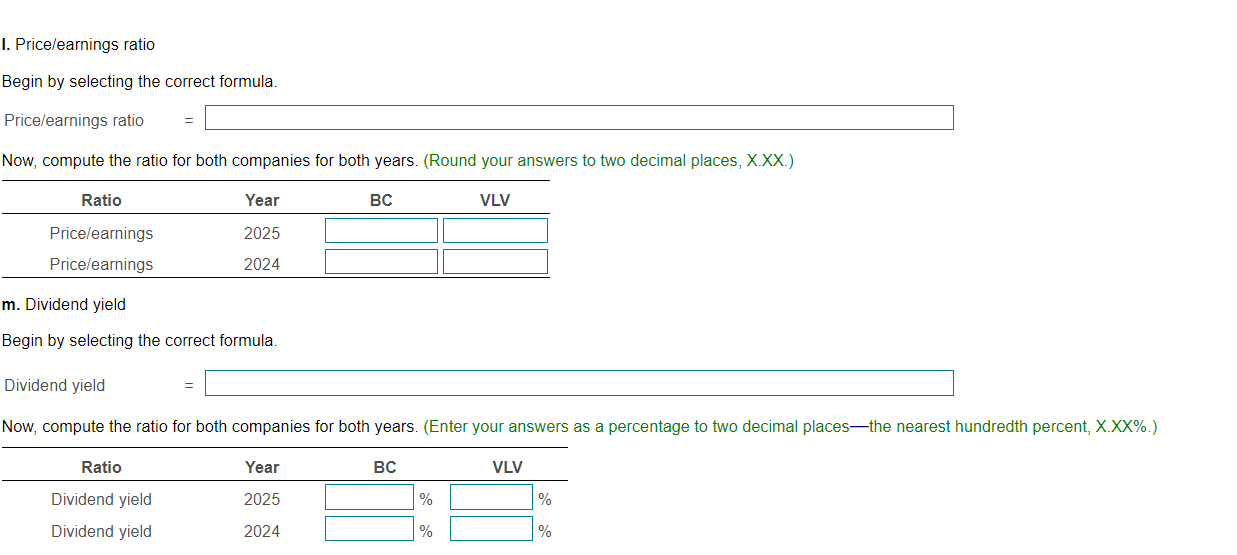

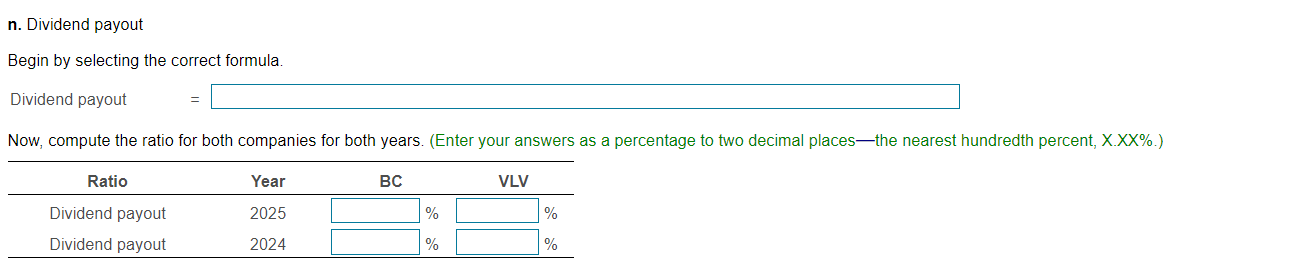

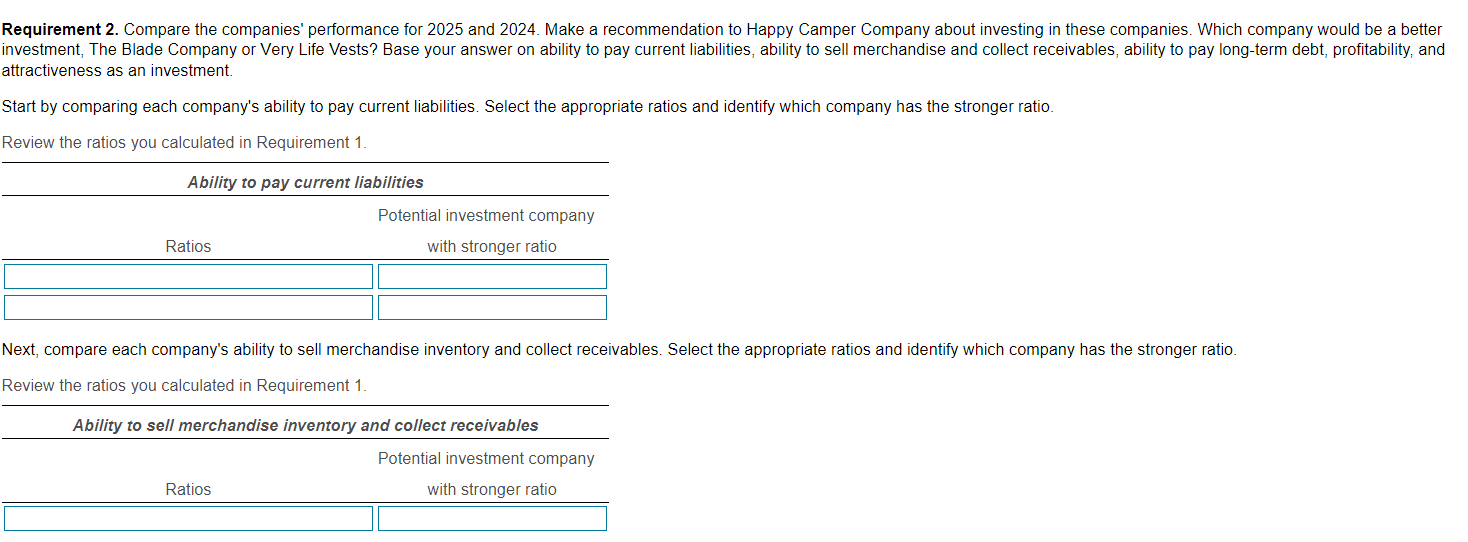

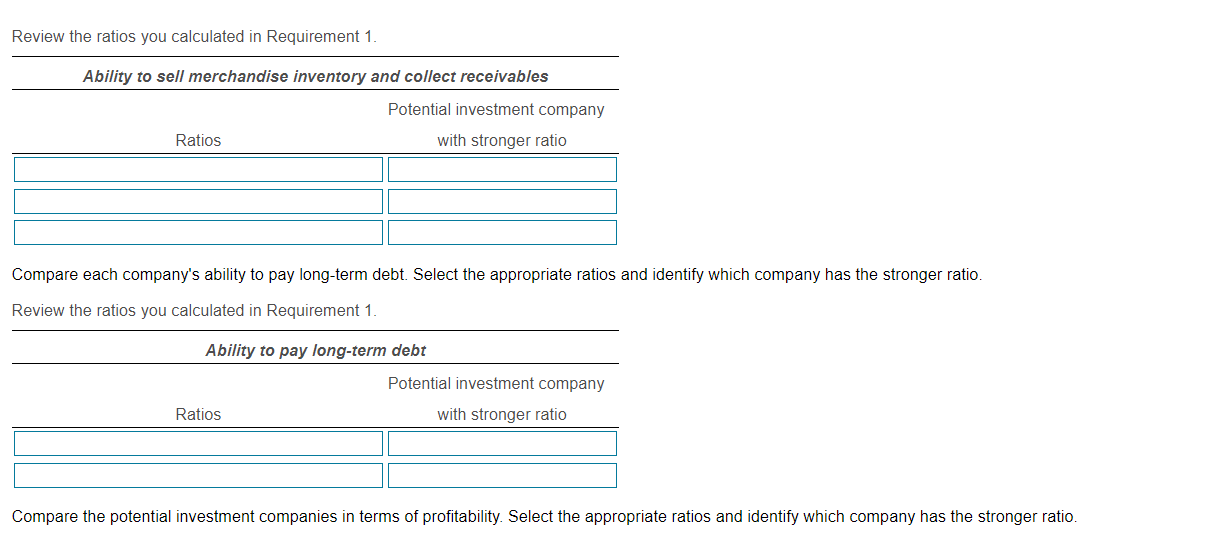

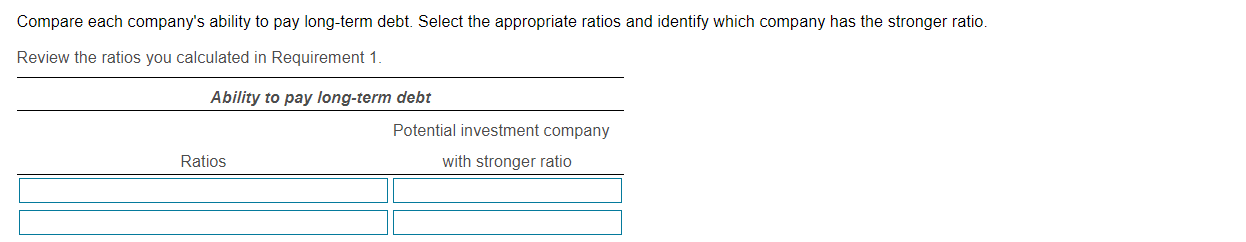

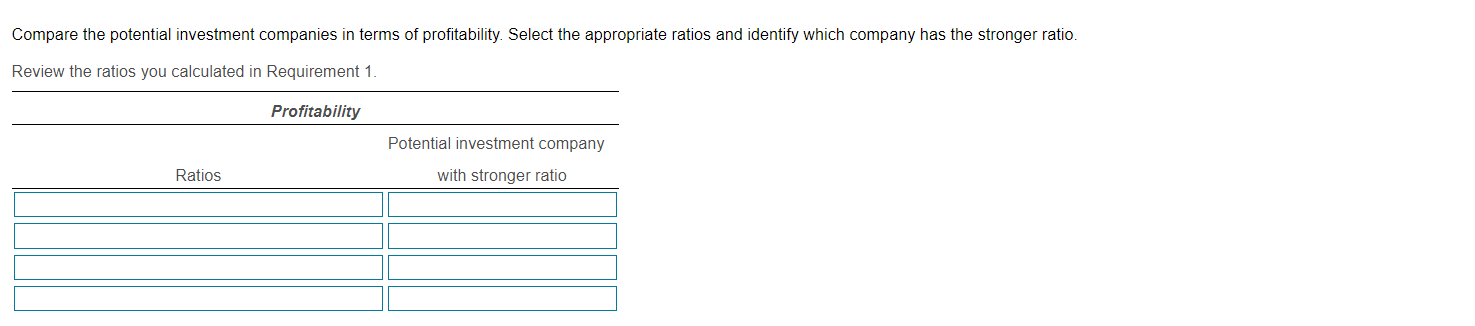

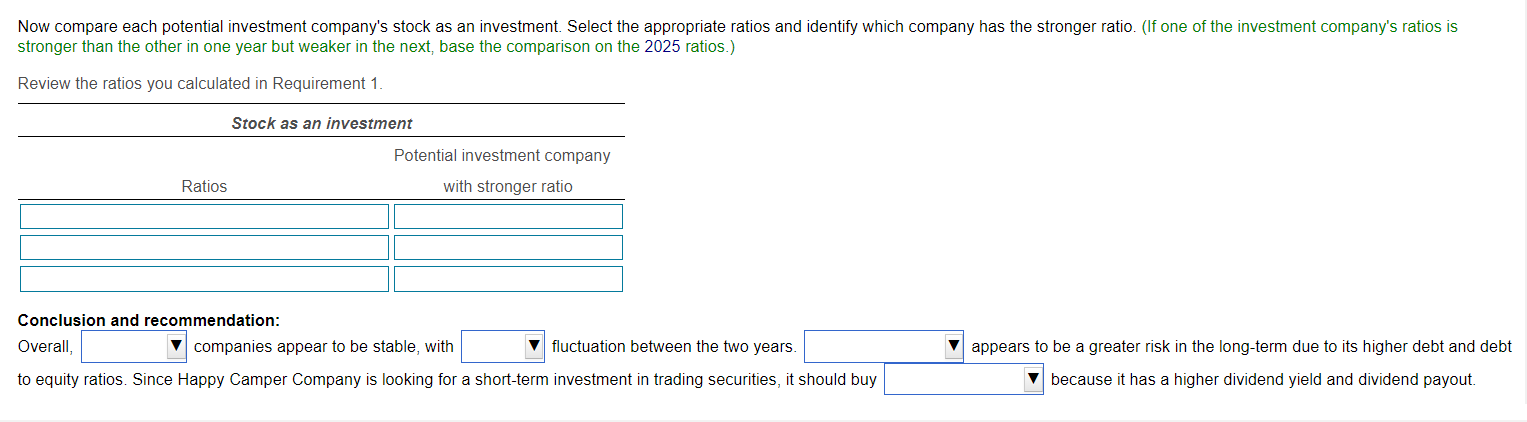

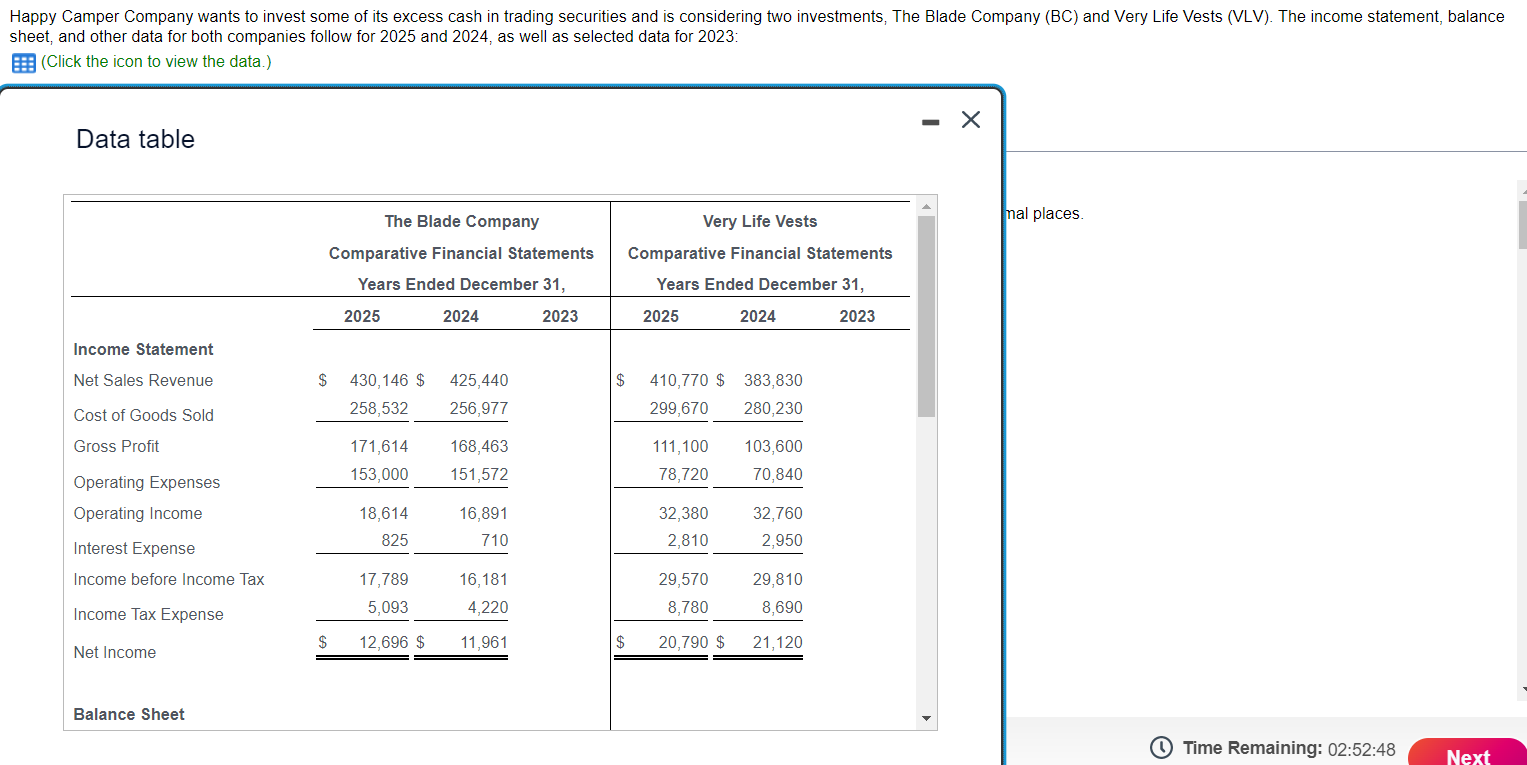

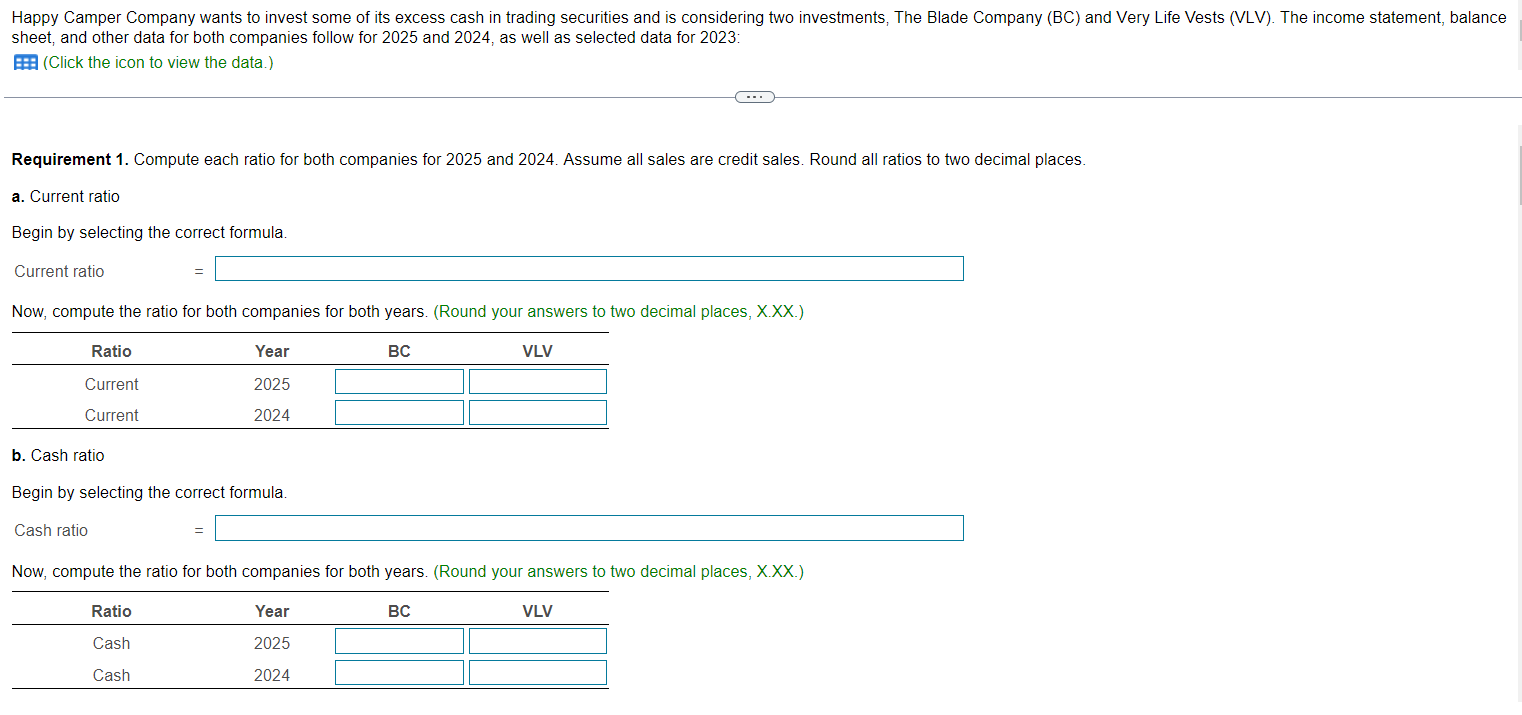

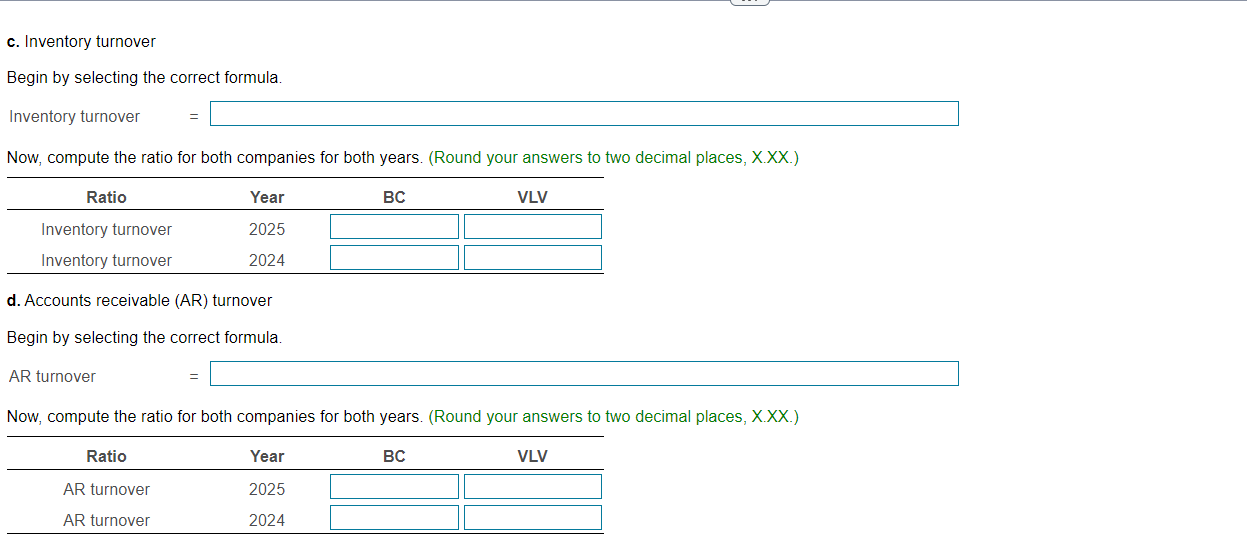

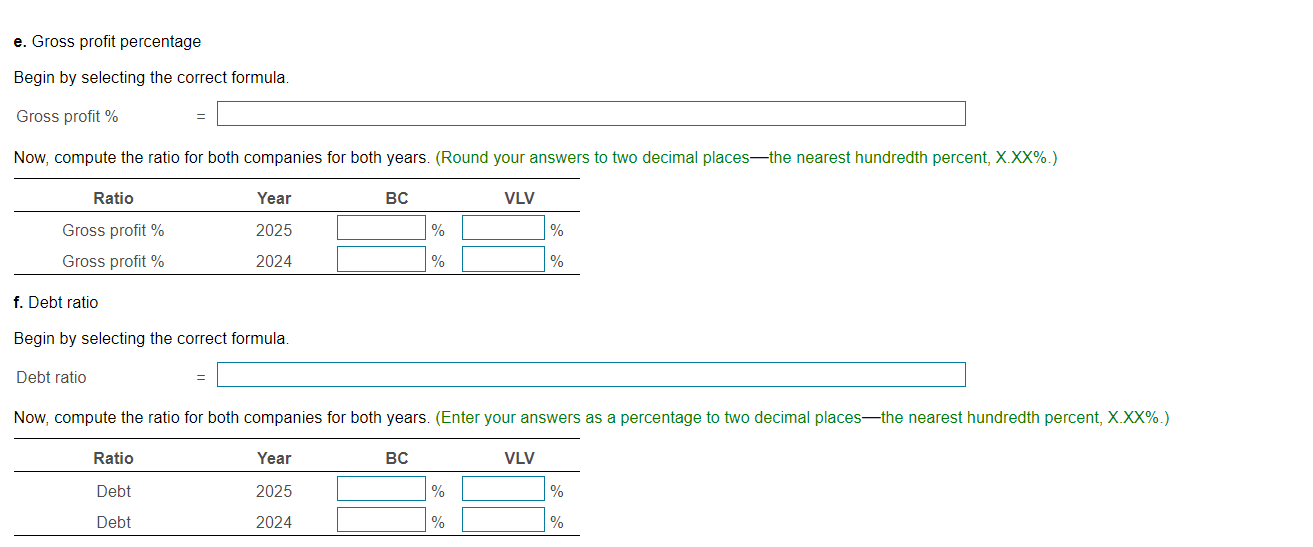

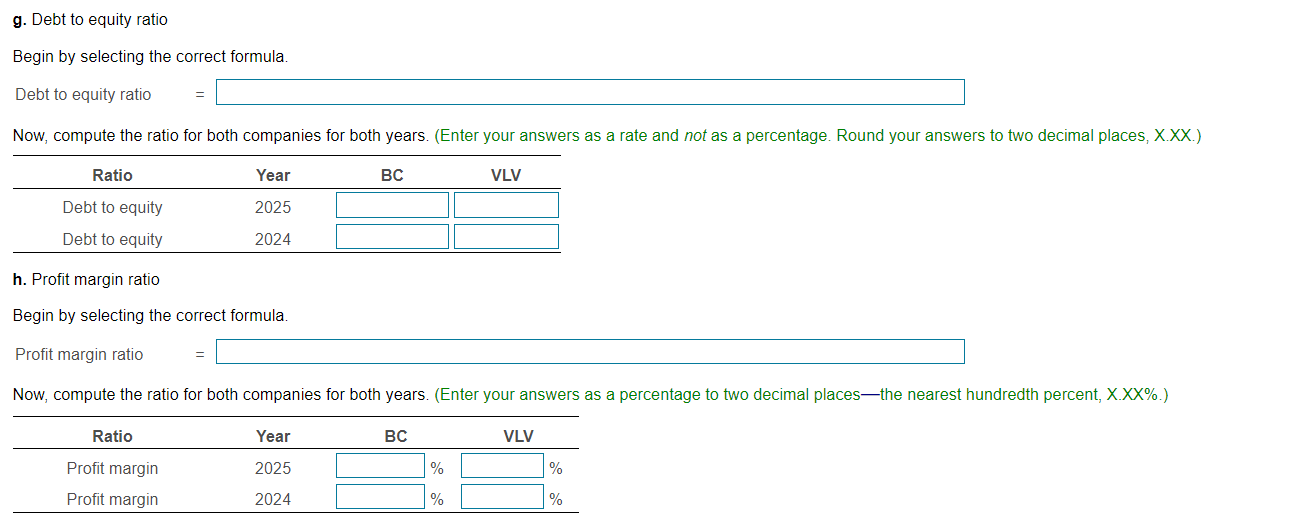

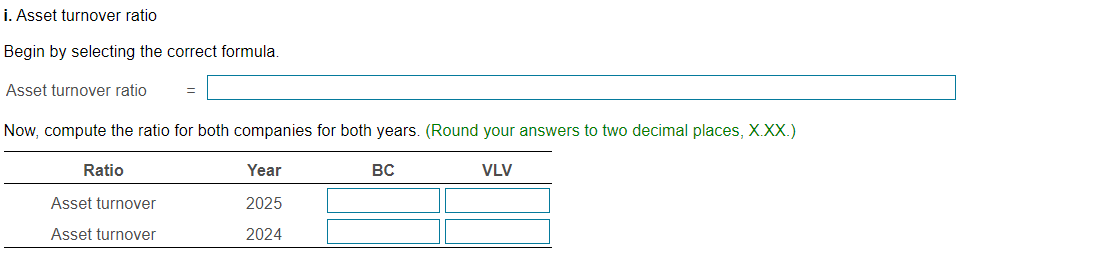

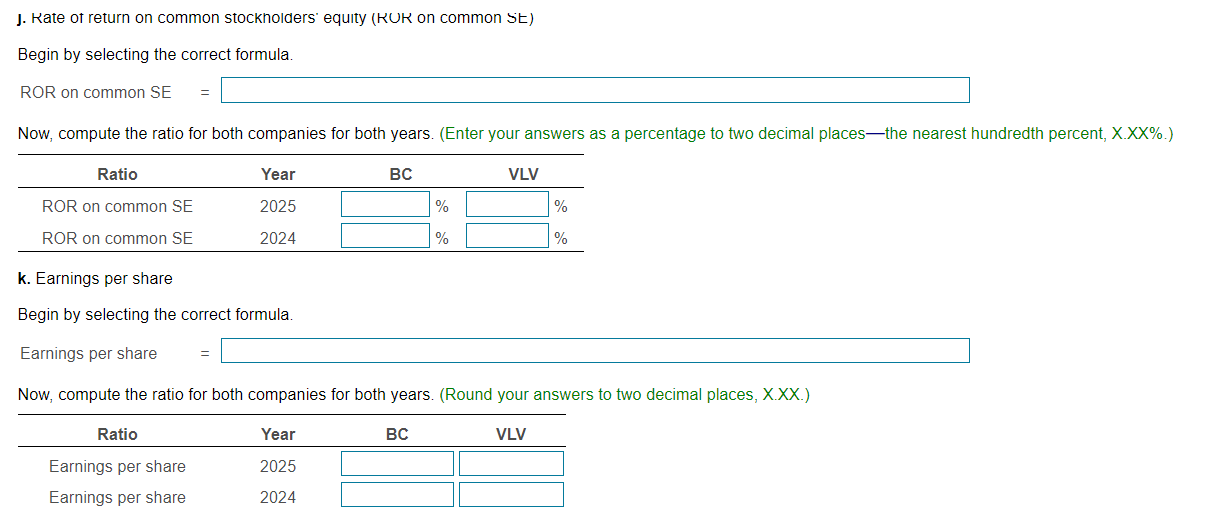

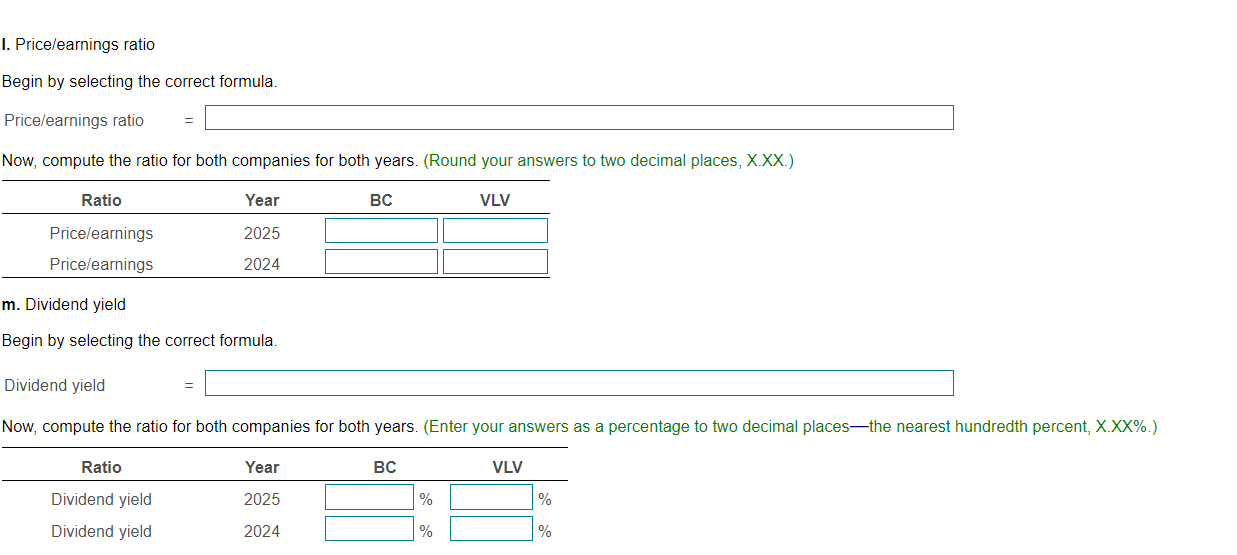

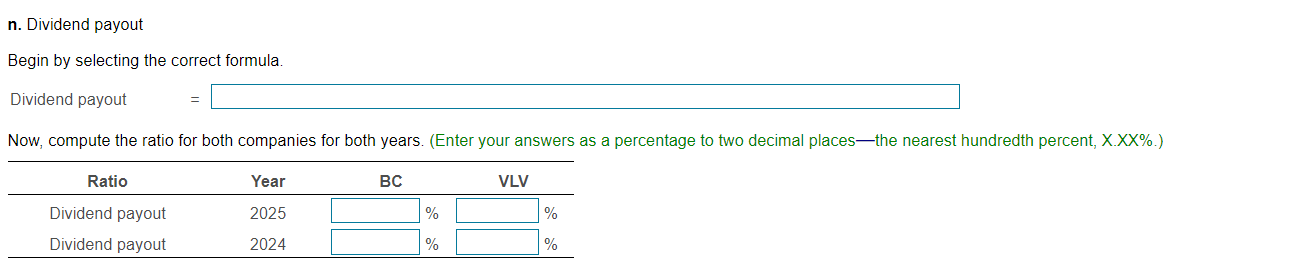

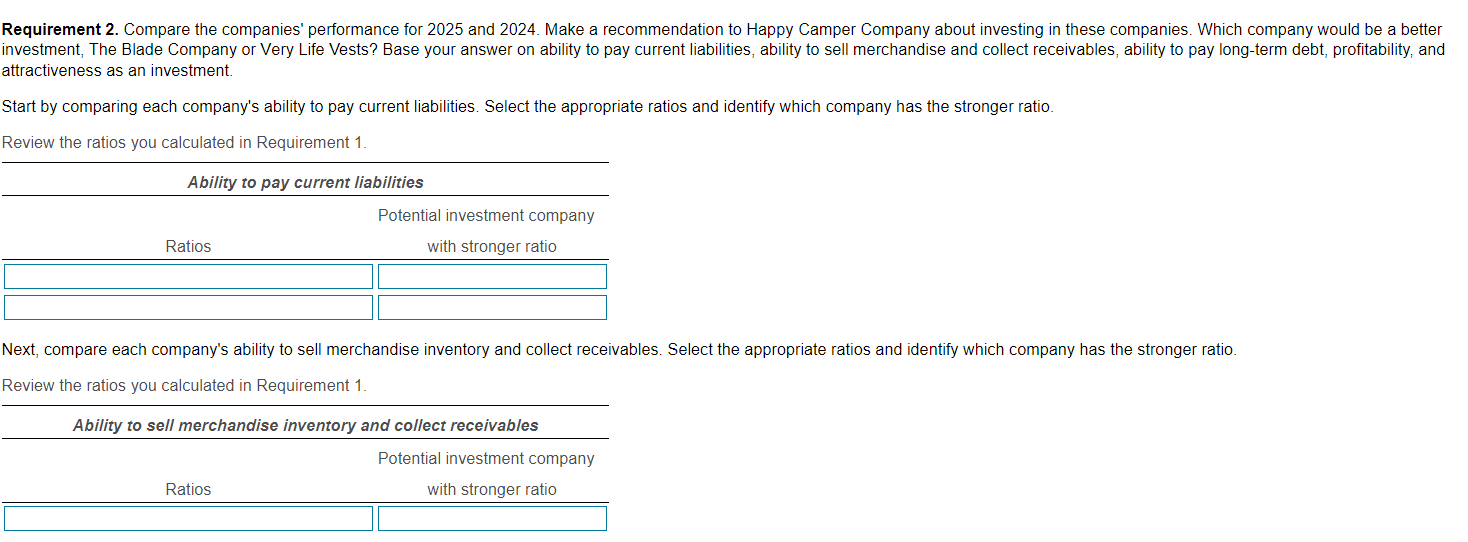

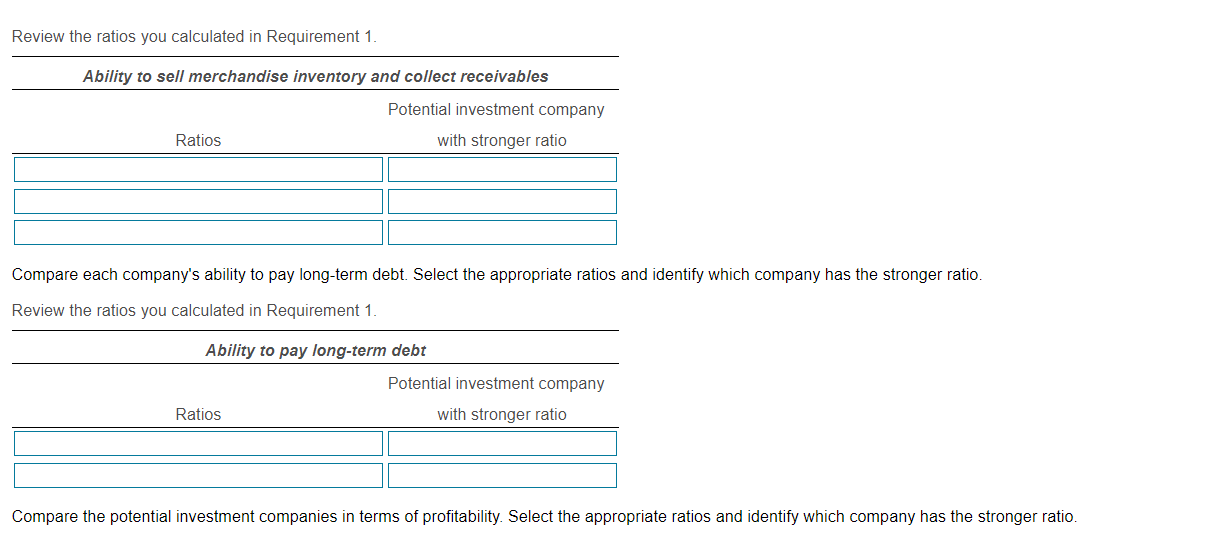

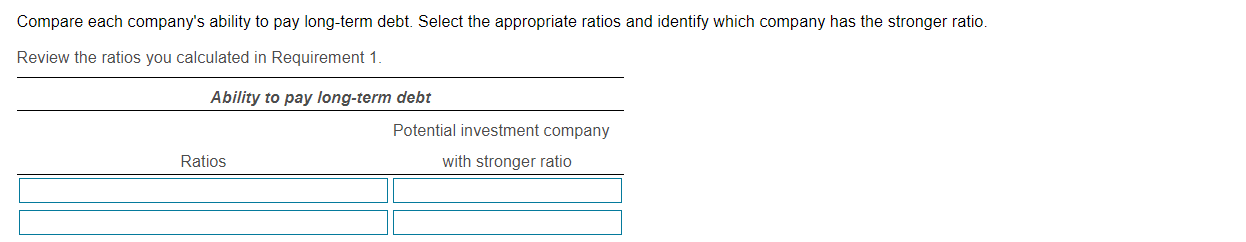

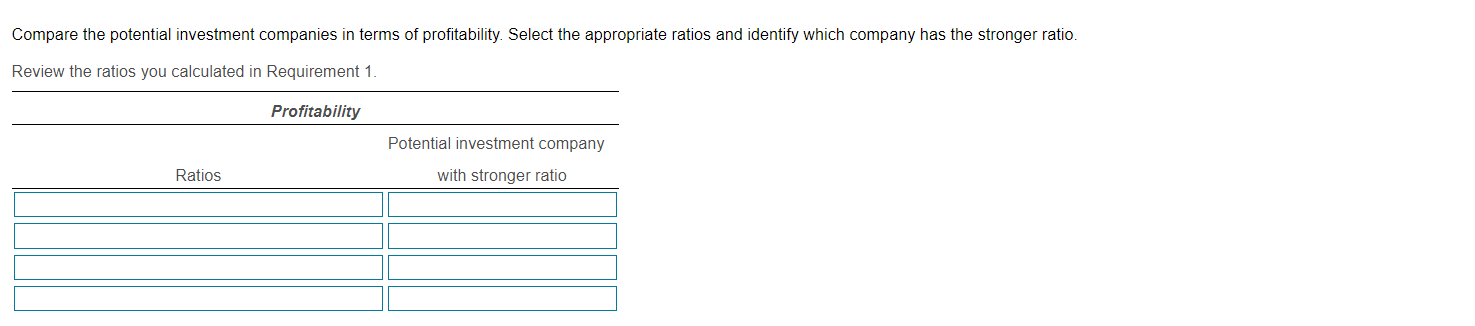

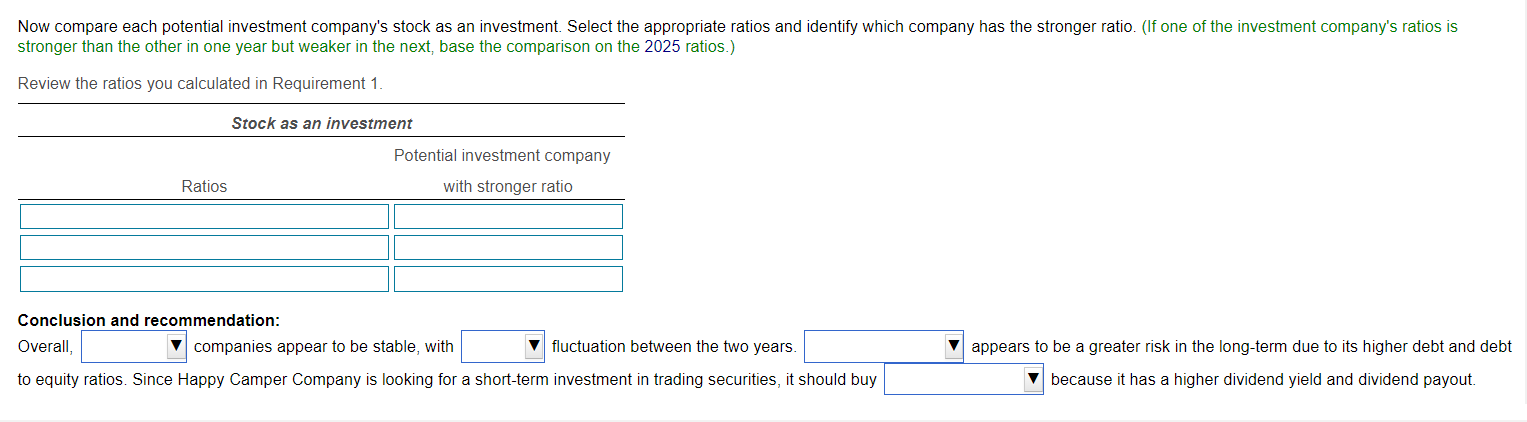

Happy Camper Company wants to invest some of its excess cash in trading securities and is considering two investments, The Blade Compar sheet, and other data for both companies follow for 2025 and 2024, as well as selected data for 2023: (Click the icon to view the data.) Data table sheet, and other data for both companies follow for 2025 and 2024, as well as selected data for 2023 : (Click the icon to view the data.) Requirement 1. Compute each ratio for both companies for 2025 and 2024. Assume all sales are credit sales. Round all ratios to two decimal places. a. Current ratio Begin by selecting the correct formula. Current ratio = c. Inventory turnover Begin by selecting the correct formula. Inventory turnover = Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) \begin{tabular}{cccc} \hline Ratio & Year & BC & VLV \\ \hline Inventory turnover & 2025 & & \\ Inventory turnover & 2024 & & \\ \hline \end{tabular} d. Accounts receivable (AR) turnover Begin by selecting the correct formula. AR turnover = Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) \begin{tabular}{cccc} \hline Ratio & Year & BC & VLV \\ \hline AR turnover & 2025 & & \\ AR turnover & 2024 & & \\ \hline \end{tabular} e. Gross profit percentage Begin by selecting the correct formula. Gross profit \% = Now, compute the ratio for both companie f. Debt ratio Begin by selecting the correct formula. g. Debt to equity ratio Begin by selecting the correct formula. Debt to equity ratio = Now, compute the ratio for both companies for both years. (Enter your answers as a rate and not as a percentage. Round your answers to two decimal places, X.XX.) \begin{tabular}{cccc} \hline Ratio & Year & BC & VLV \\ \hline Debt to equity & 2025 & & \\ Debt to equity & 2024 & \\ \hline \end{tabular} h. Profit margin ratio Begin by selecting the correct formula. Profit margin ratio = Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X. XX\%.) i. Asset turnover ratio Begin by selecting the correct formula. Asset turnover ratio = Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) \begin{tabular}{cccc} \hline Ratio & Year & BC & VLV \\ \hline Asset turnover & 2025 & & \\ Asset turnover & 2024 & & \\ \hline \end{tabular} k. Earnings per share Begin by selecting the correct formula. Begin by selecting the correct formula. n. Dividend payout Begin by selecting the correct formula. Dividend payout = Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX\%.) attractiveness as an investment. Start by comparing each company's ability to pay current liabilities. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. Review the ratios you calculated in Requirement 1. Compare each company's ability to pay long-term debt. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. Compare each company's ability to pay long-term debt. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. Compare the potential investment companies in terms of profitability. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. stronger than the other in one year but weaker in the next, base the comparison on the 2025 ratios.) Review the ratios you calculated in Requirement 1. Conclusion and recommendation: Overall, companies appear to be stable, with fluctuation between the two years. appears to be a greater risk in the long-term due to its higher debt and d to equity ratios. Since Happy Camper Company is looking for a short-term investment in trading securities, it should buy because it has a higher dividend yield and dividend payout. Happy Camper Company wants to invest some of its excess cash in trading securities and is considering two investments, The Blade Compar sheet, and other data for both companies follow for 2025 and 2024, as well as selected data for 2023: (Click the icon to view the data.) Data table sheet, and other data for both companies follow for 2025 and 2024, as well as selected data for 2023 : (Click the icon to view the data.) Requirement 1. Compute each ratio for both companies for 2025 and 2024. Assume all sales are credit sales. Round all ratios to two decimal places. a. Current ratio Begin by selecting the correct formula. Current ratio = c. Inventory turnover Begin by selecting the correct formula. Inventory turnover = Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) \begin{tabular}{cccc} \hline Ratio & Year & BC & VLV \\ \hline Inventory turnover & 2025 & & \\ Inventory turnover & 2024 & & \\ \hline \end{tabular} d. Accounts receivable (AR) turnover Begin by selecting the correct formula. AR turnover = Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) \begin{tabular}{cccc} \hline Ratio & Year & BC & VLV \\ \hline AR turnover & 2025 & & \\ AR turnover & 2024 & & \\ \hline \end{tabular} e. Gross profit percentage Begin by selecting the correct formula. Gross profit \% = Now, compute the ratio for both companie f. Debt ratio Begin by selecting the correct formula. g. Debt to equity ratio Begin by selecting the correct formula. Debt to equity ratio = Now, compute the ratio for both companies for both years. (Enter your answers as a rate and not as a percentage. Round your answers to two decimal places, X.XX.) \begin{tabular}{cccc} \hline Ratio & Year & BC & VLV \\ \hline Debt to equity & 2025 & & \\ Debt to equity & 2024 & \\ \hline \end{tabular} h. Profit margin ratio Begin by selecting the correct formula. Profit margin ratio = Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X. XX\%.) i. Asset turnover ratio Begin by selecting the correct formula. Asset turnover ratio = Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) \begin{tabular}{cccc} \hline Ratio & Year & BC & VLV \\ \hline Asset turnover & 2025 & & \\ Asset turnover & 2024 & & \\ \hline \end{tabular} k. Earnings per share Begin by selecting the correct formula. Begin by selecting the correct formula. n. Dividend payout Begin by selecting the correct formula. Dividend payout = Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the nearest hundredth percent, X.XX\%.) attractiveness as an investment. Start by comparing each company's ability to pay current liabilities. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. Review the ratios you calculated in Requirement 1. Compare each company's ability to pay long-term debt. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. Compare each company's ability to pay long-term debt. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. Compare the potential investment companies in terms of profitability. Select the appropriate ratios and identify which company has the stronger ratio. Review the ratios you calculated in Requirement 1. stronger than the other in one year but weaker in the next, base the comparison on the 2025 ratios.) Review the ratios you calculated in Requirement 1. Conclusion and recommendation: Overall, companies appear to be stable, with fluctuation between the two years. appears to be a greater risk in the long-term due to its higher debt and d to equity ratios. Since Happy Camper Company is looking for a short-term investment in trading securities, it should buy because it has a higher dividend yield and dividend payout