Happy Camper

Company wants to invest some of its excess cash in trading securities and is considering two investments, The Canoe

Company (CC)

and Very

Life Vests (VLV).

The income statement, balance sheet, and other data for both companies follow for 2019

and 2018,

as well as selected data for 2017:

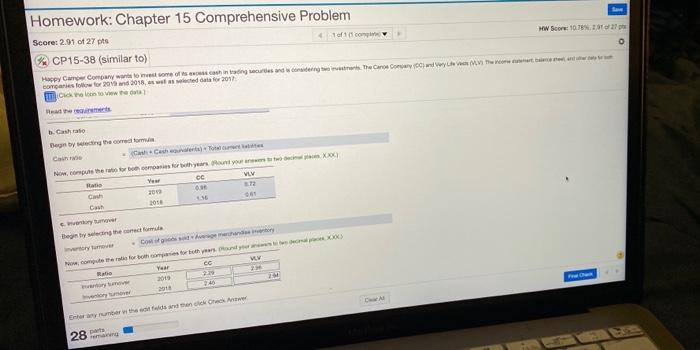

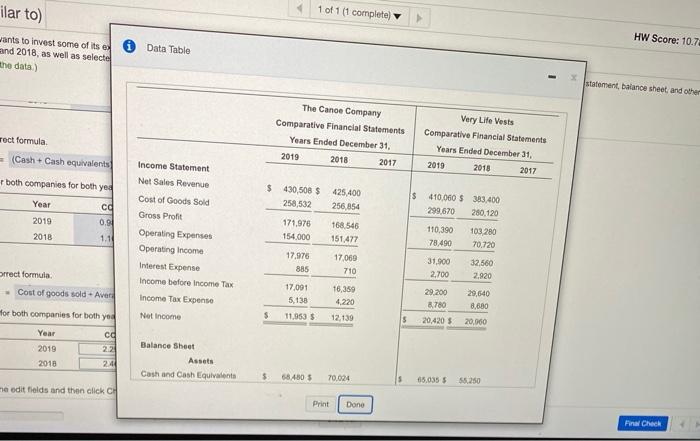

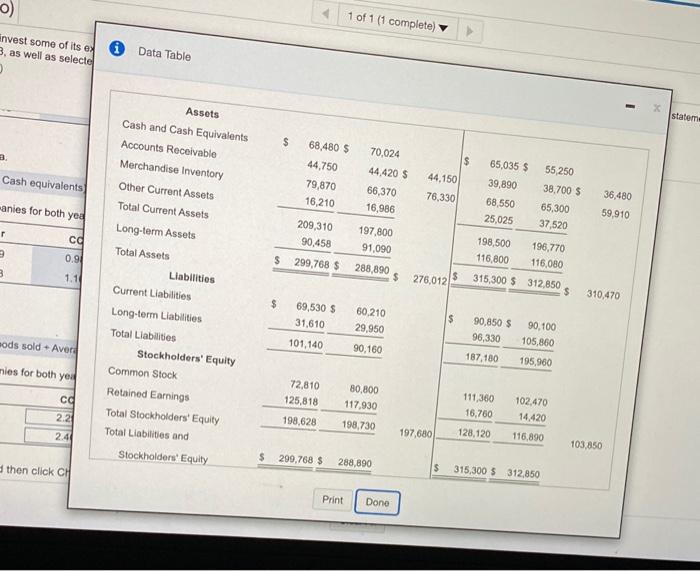

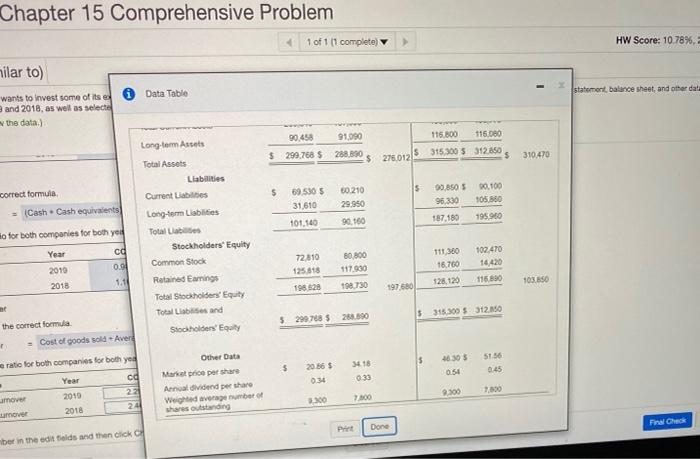

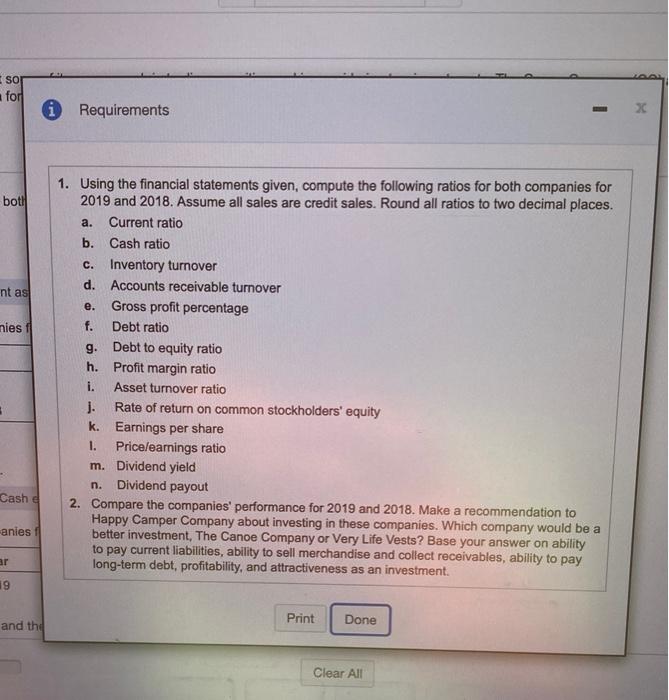

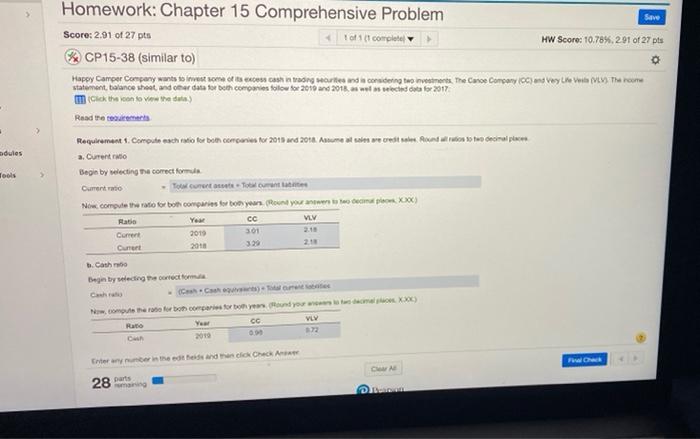

Homework: Chapter 15 Comprehensive Problem HW Score: 10.78% 0 Score: 2.91 of 27 pts 11.com CP15-38 (similar to) Mapy Crow Company want to meet some of things we wonderingen The Cane Corydych throw con follow for 2018 2018 sted data for 2017 ved res i Gashi Ben by the correctomia Cain CHI + CHI HI HA) TH TH Walia. Nother to be companies for years at your XXX Hats View 2000 C 2018 teg by selecting the contesto VY cc 2009 1 with her 28 ilar to) 1 of 1 (1 complete) HW Score: 10.72 wants to invest some of its ex and 2018, as well as selecte the data) 6 Data Table statement, balance sheet and other The Cance Company Comparative Financial Statements Years Ended December 31, 2019 2017 rect formula (Cash + Cash equivalent Very Life Vests Comparative Financial Statements Years Ended December 31, 2019 2018 2017 2018 $ 430,508 $ 258,532 + both companies for both yed Year ca 2019 0.9 2018 1.1 425.400 256 954 $ 410.060 $ 383.400 299.670 280,120 Income Statement Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Operating Income Interest Expense Income before Income Tax Income Tax Expense Net Income 171.976 154.000 168546 151.477 110.390 103.280 70.720 78.490 17,976 885 17.069 710 31.900 2.700 32 560 2.920 orrect formula Cost of goods sold + Aver 17.091 5,138 11,950 $ 16.359 4.220 12.130 29.200 29,640 8.780 8.680 20.420 $ 20,000 Hor both companies for both yod $ 5 Year 22 2019 2018 244 Balance Sheet Assets Cash and Cash Equivalent 5 684805 70.024 05.035 5 55.250 me edit fields and then click CH Print Dono Final Check 0) 1 of 1 (1 complete) invest some of its ex 3, as well as selecte Data Table statem $ 68,480 $ 3 Assets Cash and Cash Equivalents Accounts Receivable Merchandise Inventory Other Current Assets Total Current Assets Long-term Assets 44,750 $ 65,035 $ Cash equivalents 79,870 16,210 70,024 44,420 S 66,370 16,986 44.150 76,330 55,250 38,700 $ 65,300 37,520 39,890 68,550 25,025 anies for both yed 36,480 59,910 r co 209,310 90,458 299,768 $ 197.800 91,090 198,500 116,800 0.94 196,770 116,080 $ 3 288,890 $ 1.11 276,012 315,300 $ 312,850 310,470 $ 69,530 $ 31,610 60210 29,950 $ sods sold - Averd Total Assets Liabilities Current Liabilities Long-term Liabilities Total Liabilities Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and 101,140 90,850 $ 96,330 187.180 90,160 90,100 105,860 195,960 mies for both yeu 72,810 125,818 ca 80.800 117,930 198,730 102.470 14.420 2.2 111,360 16,760 128,120 198.628 2.4 197,680 116.890 103.850 Stockholders' Equity $ 299,768 $ 288,890 then click CH $ 315,300 $ 312.850 Print Done Chapter 15 Comprehensive Problem 1 of 1 (1 complete HW Score: 10.78%, statement balance sheet, and other data hilar to) wants to invest some of its d 0 Data Table and 2018, as well as selecte the data) 90.458 91,090 116.800 115080 $ 299,768 $288.890 $ 276.0121 $315,300 5 312.850 $ 310470 $ s correct formula =Cash Cash equivalents 69.530 5 31 610 80.210 29.950 90.8505 96,330 187.180 0.100 105.880 195.900 101.140 90.160 Long-term Assets Total Assets Liabilities Current Labbes Long-term Liabilities Total Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Labs and Ho for both companies for both you cd Year 2010 72.810 125.818 80.800 117030 111 30 16.760 102410 14,420 0.0 1.11 116.00 2018 126 120 198.730 10350 198.628 197680 $ 315300 $312.15 5290708 $288.800 Stockholders' Equity the correct formula - Cost of goods sold Aver 16.305 ratic for both companies for both yod $ $ 20.56 5156 0:45 18 039 054 cd - amover Other Data Market price per share Anno dividend per share Weighted average number of share outstanding Year 2019 2018 7,80 2.300 24 2.300 100 Print Done Final Chuck in the edities and then click SO for Requirements X bot! nt as nies i 1. Using the financial statements given, compute the following ratios for both companies for 2019 and 2018. Assume all sales are credit sales. Round all ratios to two decimal places. a. Current ratio b. Cash ratio c. Inventory turnover d. Accounts receivable turnover e. Gross profit percentage f. Debt ratio g. Debt to equity ratio h. Profit margin ratio i. Asset turnover ratio j. Rate of return on common stockholders' equity k. Earnings per share 1. Pricelearnings ratio m. Dividend yield n. Dividend payout 2. Compare the companies' performance for 2019 and 2018. Make a recommendation to Happy Camper Company about investing in these companies. Which company would be a better investment, The Canoe Company or Very Life Vests? Base your answer on ability to pay current liabilities, ability to sell merchandise and collect receivables, ability to pay long-term debt, profitability, and attractiveness as an investment. Cash anies i ar 19 Print Done and the Clear All - . > Homework: Chapter 15 Comprehensive Problem Save Score: 2.91 of 27 pts 1 ot complete HW Score: 10.78%,291 of 27 pts Se CP15-38 (similar to) Happy Camper Company want to let one da com can taong parte da considering the investments The Cance Company (CC) and very Lie Versio (V. The room statement balance sheet ander data for both companies follow for 2019 and 2018 as wel eeclados for 2017 Click then to view the do) Read the teamets Requirement 1. Compute schrift for bon companies for 2018 2018. Asume at se me credit was not croire place a. Currento Begin by selecting the correct formula Current vai Tour Tour Now compute the ratio for both companies from your own your own empow XXX) You VLV Current 2010 21 Current 2018 t. Casho Begin by select the correct form dules Tools > Ratio 301 329 com ho for both for boys and you do XX) Ratio VLY 2010 Cherryberiet and CA 28 P