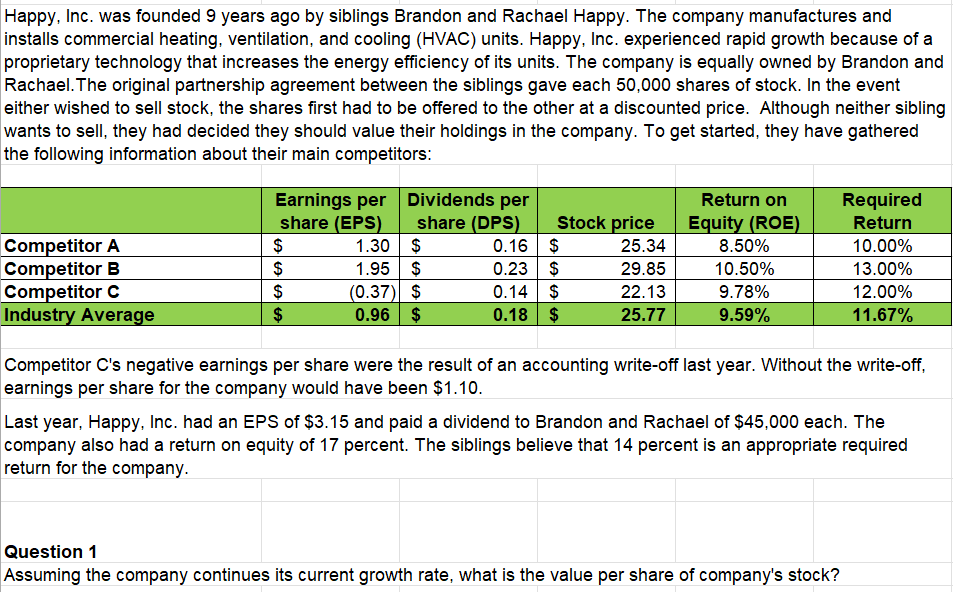

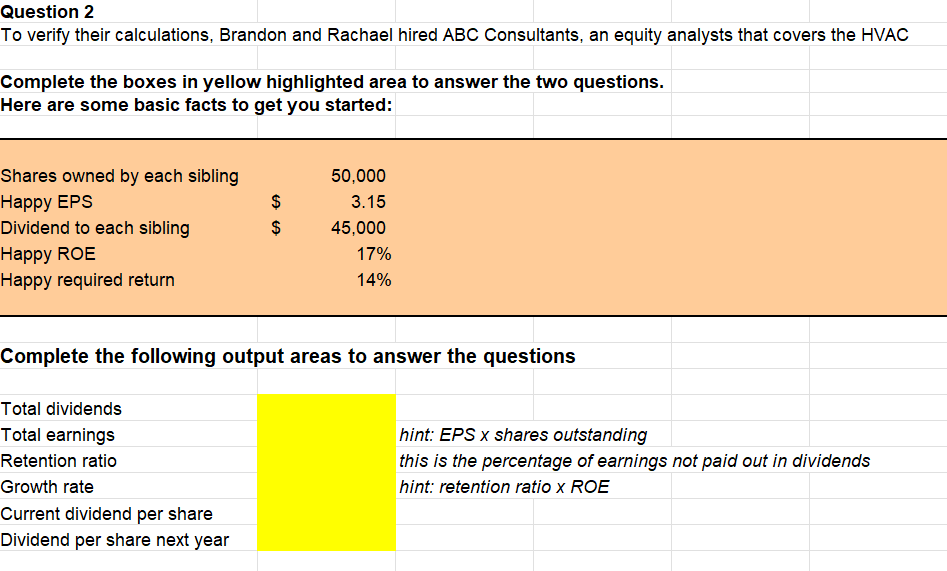

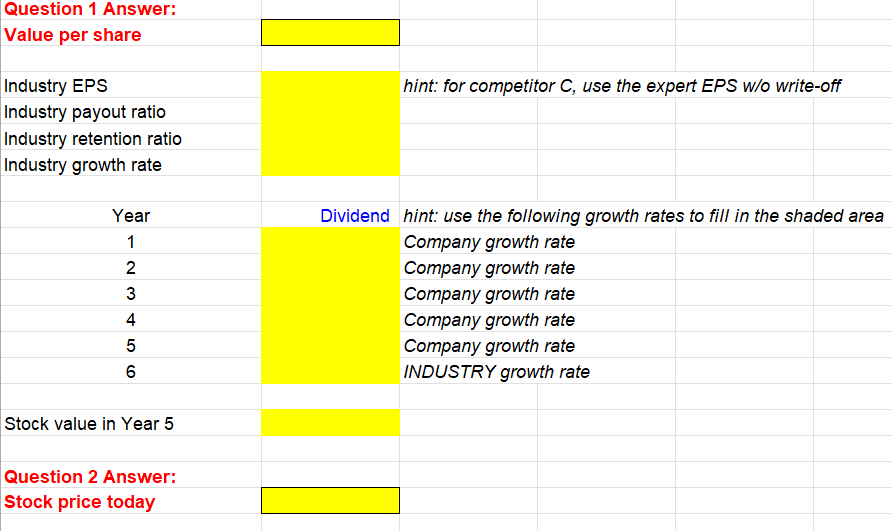

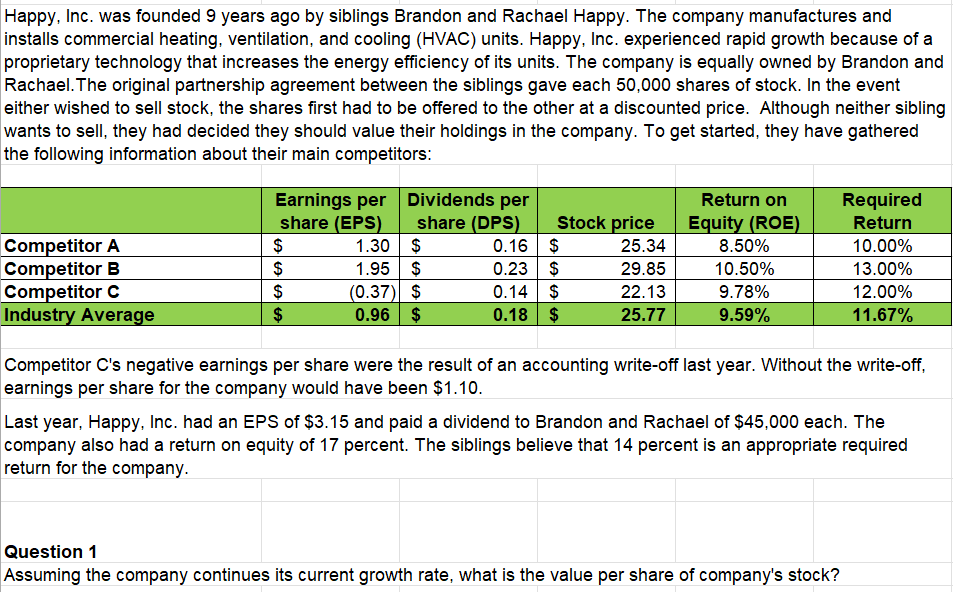

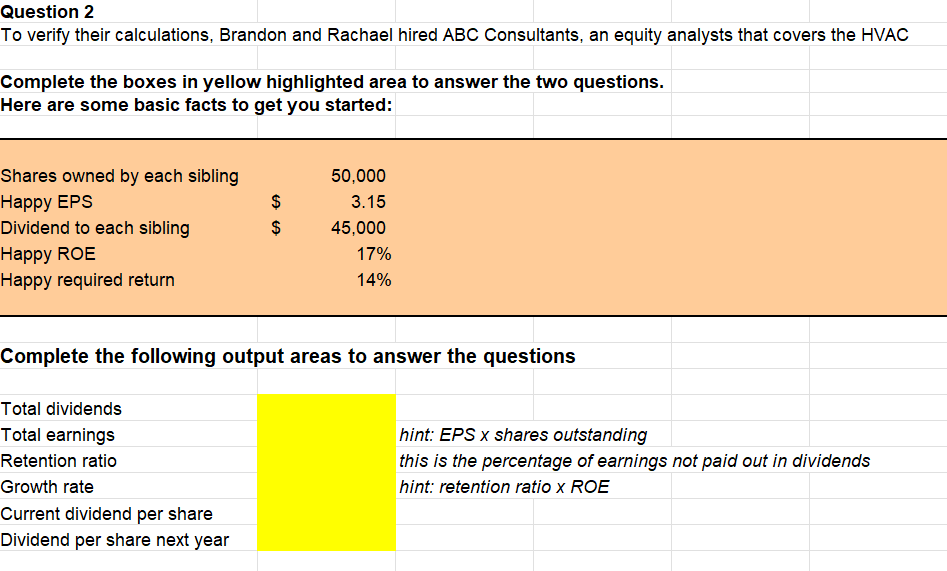

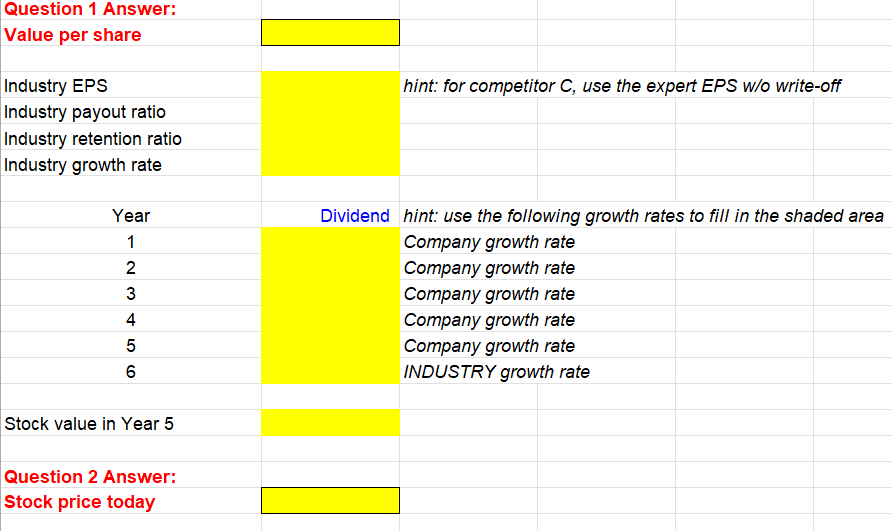

Happy, Inc. was founded 9 years ago by siblings Brandon and Rachael Happy. The company manufactures and installs commercial heating, ventilation, and cooling (HVAC) units. Happy, Inc. experienced rapid growth because of a proprietary technology that increases the energy efficiency of its units. The company is equally owned by Brandon and Rachael. The original partnership agreement between the siblings gave each 50,000 shares of stock. In the event either wished to sell stock, the shares first had to be offered to the other at a discounted price. Although neither sibling wants to sell, they had decided they should value their holdings in the company. To get started, they have gathered the following information about their main competitors: Competitor A Competitor B Competitor C Industry Average Earnings per Dividends per share (EPS) share (DPS) Stock price $ 1.30 $ 0.16 $ 25.34 $ 1.95 $ 0.23 $ 29.85 $ (0.37) $ 0.14 $ 22.13 $ 0.96 $ 0.18 $ 25.77 Return on Equity (ROE) 8.50% 10.50% 9.78% 9.59% Required Return 10.00% 13.00% 12.00% 11.67% Competitor C's negative earnings per share were the result of an accounting write-off last year. Without the write-off, earnings per share for the company would have been $1.10. Last year, Happy, Inc. had an EPS of $3.15 and paid a dividend to Brandon and Rachael of $45,000 each. The company also had a return on equity of 17 percent. The siblings believe that 14 percent is an appropriate required return for the company. Question 1 Assuming the company continues its current growth rate, what is the value per share of company's stock? Question 2 To verify their calculations, Brandon and Rachael hired ABC Consultants, an equity analysts that covers the HVAC Complete the boxes in yellow highlighted area to answer the two questions. Here are some basic facts to get you started: Shares owned by each sibling Happy EPS Dividend to each sibling Happy ROE Happy required return $ $ 50,000 3.15 45,000 17% 14% Complete the following output areas to answer the questions Total dividends Total earnings Retention ratio Growth rate Current dividend per share Dividend per share next year hint: EPS x shares outstanding this is the percentage of earnings not paid out in dividends hint: retention ratio x ROE Question 1 Answer: Value per share hint: for competitor C, use the expert EPS w/o write-off Industry EPS Industry payout ratio Industry retention ratio Industry growth rate Year 1 N 3 Dividend hint: use the following growth rates to fill in the shaded area Company growth rate Company growth rate Company growth rate Company growth rate Company growth rate INDUSTRY growth rate 4 5 0 0 6 Stock value in Year 5 Question 2 Answer: Stock price today Happy, Inc. was founded 9 years ago by siblings Brandon and Rachael Happy. The company manufactures and installs commercial heating, ventilation, and cooling (HVAC) units. Happy, Inc. experienced rapid growth because of a proprietary technology that increases the energy efficiency of its units. The company is equally owned by Brandon and Rachael. The original partnership agreement between the siblings gave each 50,000 shares of stock. In the event either wished to sell stock, the shares first had to be offered to the other at a discounted price. Although neither sibling wants to sell, they had decided they should value their holdings in the company. To get started, they have gathered the following information about their main competitors: Competitor A Competitor B Competitor C Industry Average Earnings per Dividends per share (EPS) share (DPS) Stock price $ 1.30 $ 0.16 $ 25.34 $ 1.95 $ 0.23 $ 29.85 $ (0.37) $ 0.14 $ 22.13 $ 0.96 $ 0.18 $ 25.77 Return on Equity (ROE) 8.50% 10.50% 9.78% 9.59% Required Return 10.00% 13.00% 12.00% 11.67% Competitor C's negative earnings per share were the result of an accounting write-off last year. Without the write-off, earnings per share for the company would have been $1.10. Last year, Happy, Inc. had an EPS of $3.15 and paid a dividend to Brandon and Rachael of $45,000 each. The company also had a return on equity of 17 percent. The siblings believe that 14 percent is an appropriate required return for the company. Question 1 Assuming the company continues its current growth rate, what is the value per share of company's stock? Question 2 To verify their calculations, Brandon and Rachael hired ABC Consultants, an equity analysts that covers the HVAC Complete the boxes in yellow highlighted area to answer the two questions. Here are some basic facts to get you started: Shares owned by each sibling Happy EPS Dividend to each sibling Happy ROE Happy required return $ $ 50,000 3.15 45,000 17% 14% Complete the following output areas to answer the questions Total dividends Total earnings Retention ratio Growth rate Current dividend per share Dividend per share next year hint: EPS x shares outstanding this is the percentage of earnings not paid out in dividends hint: retention ratio x ROE Question 1 Answer: Value per share hint: for competitor C, use the expert EPS w/o write-off Industry EPS Industry payout ratio Industry retention ratio Industry growth rate Year 1 N 3 Dividend hint: use the following growth rates to fill in the shaded area Company growth rate Company growth rate Company growth rate Company growth rate Company growth rate INDUSTRY growth rate 4 5 0 0 6 Stock value in Year 5 Question 2 Answer: Stock price today