Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Happy Ltd. has an executive stock option plan as follows: Each qualified manager will receive, on I January, an option for the computed number

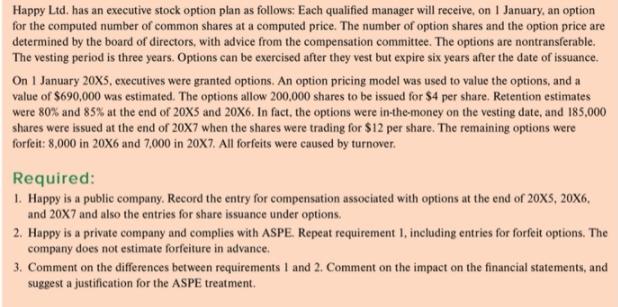

Happy Ltd. has an executive stock option plan as follows: Each qualified manager will receive, on I January, an option for the computed number of common shares at a computed price. The number of option shares and the option price are determined by the board of directors, with advice from the compensation committee. The options are nontransferable. The vesting period is three years. Options can be exercised after they vest but expire six years after the date of issuance. On I January 20X5, executives were granted options. An option pricing model was used to value the options, and a value of $690,000 was estimated. The options allow 200.000 shares to be issued for $4 per share. Retention estimates were 80% and 85% at the end of 20X5 and 20X6. In fact, the options were in-the-money on the vesting date, and 185,000 shares were issued at the end of 20X7 when the shares were trading for $12 per share. The remaining options were forfeit: 8,000 in 20X6 and 7,000 in 20X7. All forfeits were caused by turnover. Required: 1. Happy is a public company. Record the entry for compensation associated with options at the end of 20X5, 20X6. and 20X7 and also the entries for share issuance under options. 2. Happy is a private company and complies with ASPE. Repeat requirement 1, including entries for forfeit options. The company does not estimate forfeiture in advance. 3. Comment on the differences between requirements I and 2. Comment on the impact on the financial statements, and suggest a justification for the ASPE treatment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 20X5 Compensation expense 690000 Forfeited options 0 Issued options 0 20X6 Compensatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started