Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Happy Mart Sdn Bhd acquired an equipment in Year 2016 for RM100,000 and depreciates it on a straight-line basis over its expected useful life

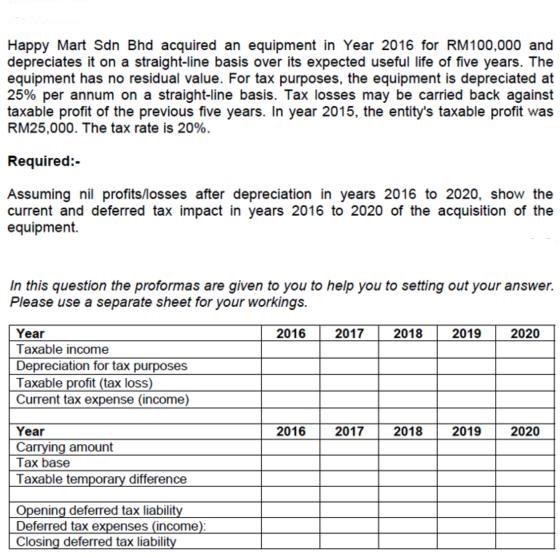

Happy Mart Sdn Bhd acquired an equipment in Year 2016 for RM100,000 and depreciates it on a straight-line basis over its expected useful life of five years. The equipment has no residual value. For tax purposes, the equipment is depreciated at 25% per annum on a straight-line basis. Tax losses may be carried back against taxable profit of the previous five years. In year 2015, the entity's taxable profit was RM25,000. The tax rate is 20%. Required:- Assuming nil profits/losses after depreciation in years 2016 to 2020, show the current and deferred tax impact in years 2016 to 2020 of the acquisition of the equipment. In this question the proformas are given to you to help you to setting out your answer. Please use a separate sheet for your workings. Year Taxable income Depreciation for tax purposes Taxable profit (tax loss) Current tax expense (income) 2016 2017 2018 2019 2020 Year Carrying amount Tax base Taxable temporary difference 2016 2017 2018 2019 2020 Opening deferred tax liability Deferred tax expenses (income): Closing deferred tax liability

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started