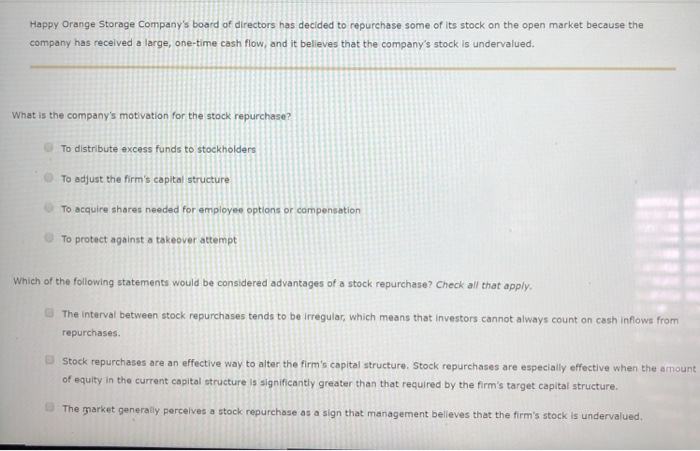

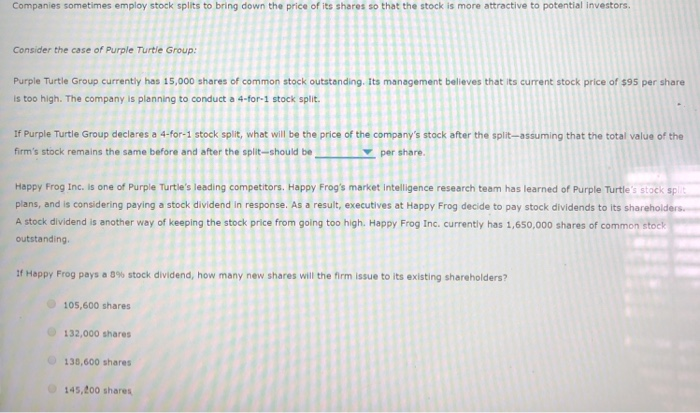

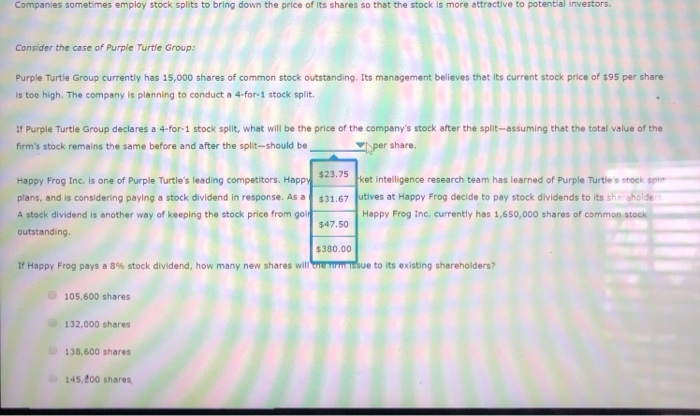

Happy Orange Storage Company's board of directors has decided to repurchase some of its stock on the open market because the company has received a large, one-time cash flow, and it beleves that the company's stock is undervalued. What is the company's motivation for the stock repurchase? To distribute excess funds to stockholders To adjust the firm's capital structure To acquire shares needed for employee options or compensation To protect against a takeover attempt Which of the following statements would be considered advantages of a stock repurchase? Check all that apply. The interval between stock repurchases tends to be irregular, which means that investors cannot always count on cash inflows from repurchases Stock repurchases are an effective way to alter the firm's capital structure. Stock repurchases are especially effective when the amount of equity in the current capital structure is significantly greater than that required by the firm's target capital structure The market generaly perceives a stock repurchase as a sign that management belileves that the firm's stock is undervalued. Companies sometimes employ stock splits to bring down the price of its shares so that the stock is more attractive to potential investors. Consider the case of Purple Turtie Group: Purple Turtle Group currently has 15,000 shares of common stock outstanding. Its management believes that its current stock price of $95 per share is too high. The company is planning to conduct a 4-for-1 stock split If Purple Turtle Group declares a 4-for-1 stock split, what will be the price of the company's stock after the split-assuming that the total value of the firm's stock remains the same before and after the split-should be per share Happy Frog Inc. is one of Purple Turtle's leading competitors. Happy Frog's market intelligence research team has learned of Purple Turtle's stocks plans, and is considering paying a stock dividend in response. As a result, executives at Happy Frog decide to pay stock dividends to its shareholders A stock dividend is another way of keeping the stock price from going too high. Happy Frog Inc. currently has 1,650,000 shares of common stock outstanding. If Happy Frog pays a 8% stock dividend, how many new shares will the firm issue to its existing shareholders? 105,600 shares 132,000 shares 138,600 shares 145,200 shares Companies sometimes employ stock splits to bring down the price of its shares so that the stock is more attractive to potential investors Consider the case of Purple Turtle Group: Purple Turtle Group currently has 15,000 shares of common stock outstanding. Its management believes that its current stock price of $95 per share is too high. The company is planning to conduct a 4-for-1 stock split. t Purple Turtle Group declares a 4 for-1 stock split, what will be the price of the company's stock after the split-assuming that the total value of the firm's stock remains the same before and after the split-should be r share Happy Frog inc. is one of Purple Turtle's leading competitors, Happy $23.75 k ket intelligence research team has learned of Purple Turtles stock sp plans, and is considering paying a stock dividend in response. Asa $31.67utives at Happy Frog decide to pay stock dividends to its shaiehalde A stock dividend is another way of keeping the stock price from goir outstanding. Happy Frog inc. currently has 1,650,000 shares of co 380.00 If Happy Frog pays a 8% stock dividend, how many new shares will to its existing shareholders? 105,600 shares 132,000 shares 138,600 shares 145,200 shares