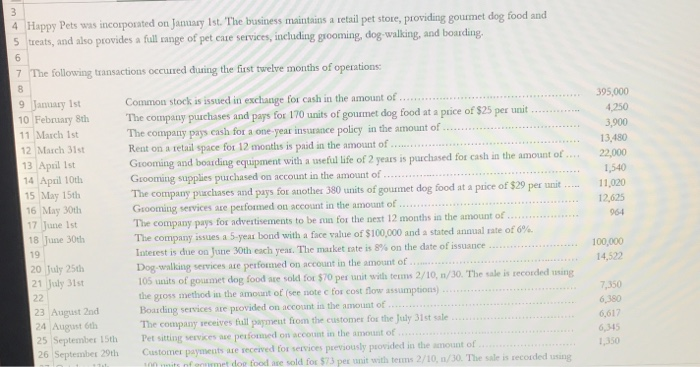

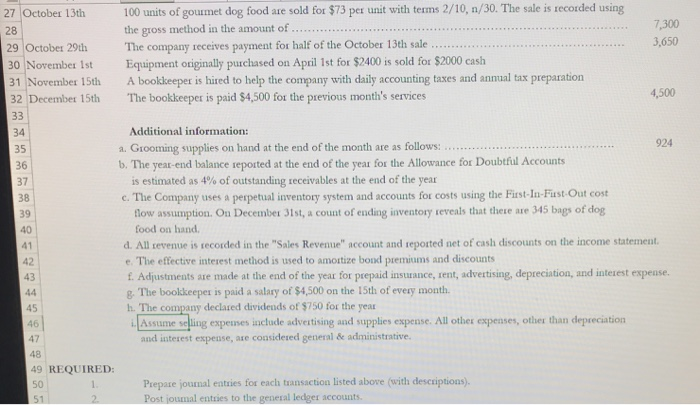

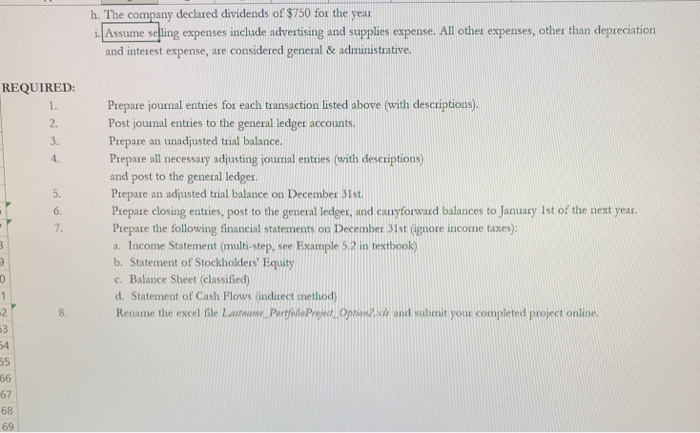

Happy Pets was incoxposated on janmary 1st. The business maintains a vetail pet store, providing gourmet dog food and 5 treats, and also provides a full ange of pet eaue services, ineluding grooming, dog walking,and boauding. 7 The following transactions occured duing the fist twelve months of Common stock is issued in exchange for cash in the amount of 9 January 1st 0 Febuary SthThe company purchases and pays fox 170 units of gourmet dog food at a price of $25 per unit 11 March 1st 12 March 31st 13 April 1st 14 April 10th 15 May 15th 16 May 30th 17 June Ist 395,000 250 3,900 13,480 February 8th The company pays eash for a one-year insuranice policy in the amount of Reat on a retail space for 12 months is paid in the amount of Giooming and boarding equipment with a efiulife of 2 years is parchased for cash in the amount of. Grooming supplies purchased on account in the amount of The company puxchases and pays fot auother 380 units of gourmet dog food at a price of $29 per nit Gsooming services axe perfomed on account in the amount of The company pays for advestisements to be rua for the nest 12 months in the amount of The company issues a 5-year bond with a face value of $100,000 and a stated anmual rate of 6% Interest is due on June 30th each year. The market rate is 8% on the date of issuance . Dog walking services ase performed on account in the amount of 105 units of goumet dog food aue sold for $70 pes unit with tens 2/10,n/30. The sale is recouded using the guoss method in the amount of (se sote c for cost flow assumptions) Boarding services are pxovided on account in the amouat of The company receives tull paymeut fiom the customer fot the July 31st sale 22,000 11,020 1,540 12,625 964 18 June 30th 19 20 July 25th 21 July 31st 100,000 .. 14,522 7,350 6,617 23 August 2nd 24 August 6th 25 Septembes 15th Pet sitting sesvices aue pexsomed on accorunt in the amount of 6,345 6 September 29th Customer paymeuts ase recerived tor services pueviously peovided in the amount of uimity of ommet don food ase sold fou S73 per unit with tesnms 2/10, n/ 30. The sale is secorded using h. The company declared dividends of $750 for the year i ssume se ling expenses inchide advertising and supplies expense. All other expenses, other than depreciation and interest expense, are considered general & administrative. REQUIRED: Prepare jounal entries for each transaction listed above (with descriptions). Post journal eantsies to the general ledeger accounts Prepare an unadjusted trial balance. Prepare all necessary adjusting jounal entries (with desexiptions) and post to the general ledger Prepare an adjusted trial balance on December 31st Prepare closing entries, post to the general ledger, and caryforward balances to January Ist of the next year 1. 2. 3. 4. 5. 6. 7. 6. Pepare closing entries, post to the general ledges, and cauryforward balances to Januasy Ist of the next year Prepare the following financial statements on December 31st (gnore income taxes) a. Income Statement (multi-step, see Example 5.2 in textbool) b. Statement of Stockholders Equity c. Balance Sheet (classified) d. Statement of Cash Flows (indirect method) 2Renamethe excel the Labunit your compiotr project onlins 8. 64 67 68