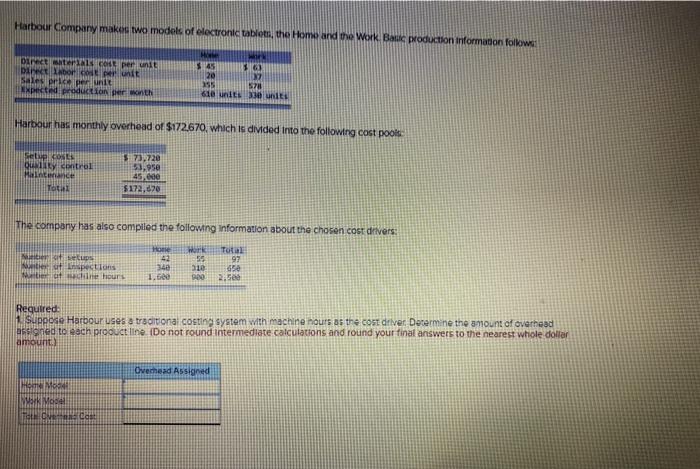

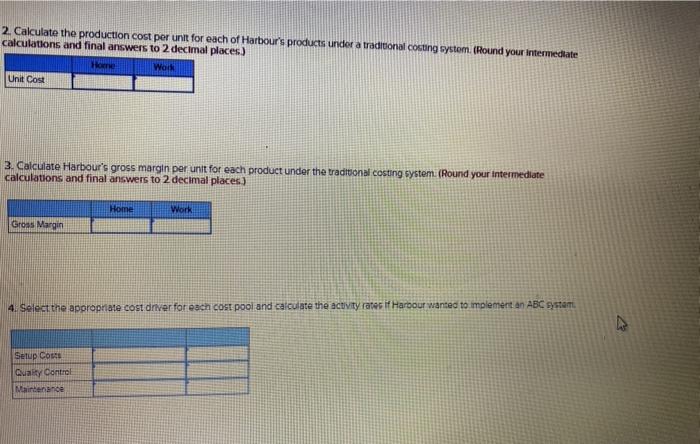

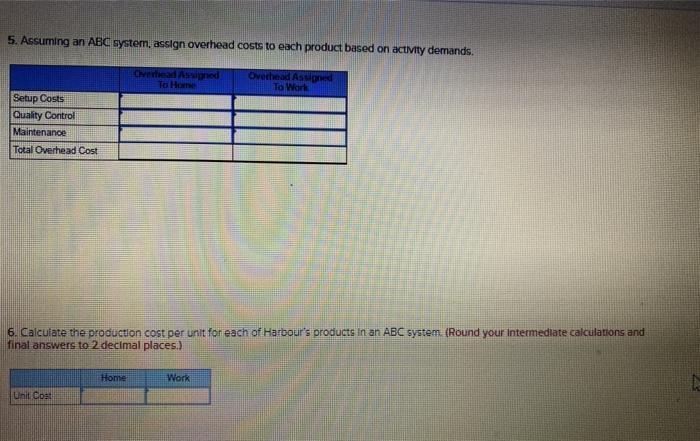

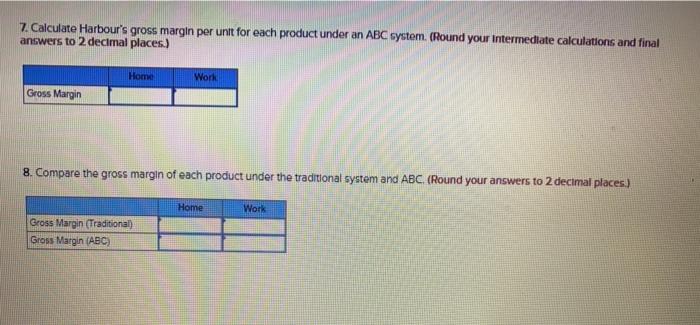

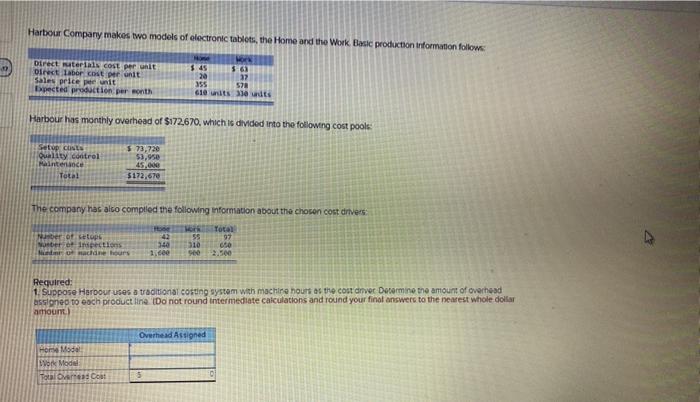

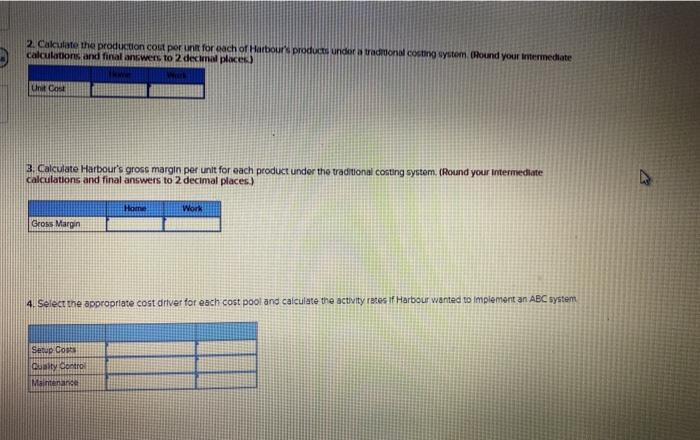

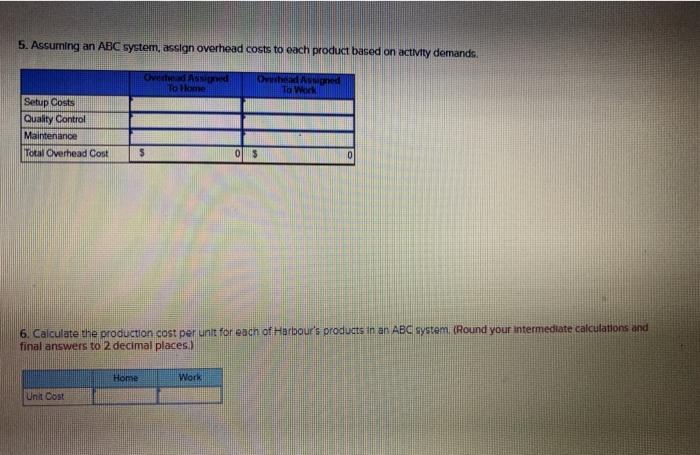

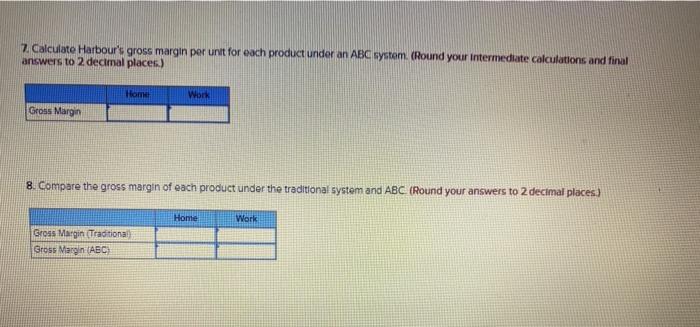

Harbour Company makes two models of electronic tablets, the Home and the Work Bac production Information follow Direct is cost per unit Directori per unit Sales prie per unit Ne production et 25 36 20 25 578 610 units 20 Harbour has monthly overhead of $172.670, which is divided into the following cost pools Setup QUICY control Hence Tot $ 73, 720 53,95 45.de $172,670 The company has also compiled the following Information about the chosen cost drivers: Hone 42 34 1.6 Tutil 97 NDS test aspections he hours WORK 55 310 DO 2,50 Required: 1. Suppose Harbour uses a traditiona costing system with machine hours as the cost deliver. Derermine the amount of overhead assigned to each prooutline (Do not round intermediate calculations and round your final answers to the nearest whole dollar amount) Ovemosd Assigned M MUSIK THON 2. Calculate the production cost per unkt for each of Harbour's products under a traditional costing system. (Round your intermediate calculations and final answers to 2 decimal places) Work Unit Cost Some 3. Calculate Harbour's gross margin per unit for each product under the traditional costing system (Round your intermediate calculations and final answers to 2 decimal places) Home Work Gross Margin 4. Select the appropriate cost driver for each cost pool and calculate the acuity rates if Harbour wanted to implement an ABC system Setup Costa Quality Control Maintenance 5. Assuming an ABC system, assign overhead costs to each product based on activity demands. chverhead Assigned To Home Overhead Assigned To Work Setup Costs Quality Control Maintenance Total Overhead Cost 6. Calculate the production cost per unit for each of Harbour's products in an ABC system (Round your Intermediate calculations and final answers to 2 decimal places.) Home Work tnt to 7. Calculate Harbour's gross margin per unit for each product under an ABC system. (Round your intermediate calculations and final answers to 2 decimal places.) Home Work Gross Margin 8. Compare the gross margin of each product under the traditional system and ABC. (Round your answers to 2 decimal places.) Home Work Gross Margin (Traditional) Gross Margin (ABC) 2. Calculate the production cost per unkt for each of Harbour's products under a traditional costing system. (Round your intermediate calculations and final answers to 2 decimal places) Work Unit Cost Some 3. Calculate Harbour's gross margin per unit for each product under the traditional costing system (Round your intermediate calculations and final answers to 2 decimal places) Home Work Gross Margin 4. Select the appropriate cost driver for each cost pool and calculate the acuity rates if Harbour wanted to implement an ABC system Setup Costa Quality Control Maintenance 2. Calculate the production cost per un foroach of Harbour products under traditional costing system (Bound your intermediate calculations and final answers to 2 decimal places) w Uni Cose 3. Calculate Harbour's gross margin per unit for each product under the traditional costing system. (Round your intermediate calculations and final answers to 2 decimal places) Home Work Gross Margin 4. Select the appropriate cost driver for each cost pool and calculate the activity rates if Harbour wanted to implement an ABC system Setup Costs Quality Control Maintenance 5. Assuring an ABC system, assign overhead costs to each product based on activity demands ded Tolome Orhead Aspred To W Setup Costs Quality Control Maintenance Total Overhead Cost 5 os 0 6. Calculate the production cost per unit for each of Harbour's products in an ABC system (Round your intermediate calculations and final answers to 2 decimal places) Home Work Unit Oost 7. Calculate Harbour's gross margin per unit for each product under an ABC system. (Round your intermediate calculations and final answers to 2 decimal places.) Home Work Gross Margin 8. Compare the gross margin of each product under the traditional system and ABC (Round your answers to 2 decimal places.) Home Work Gross Margin (Traditional Gross Margin (ABC