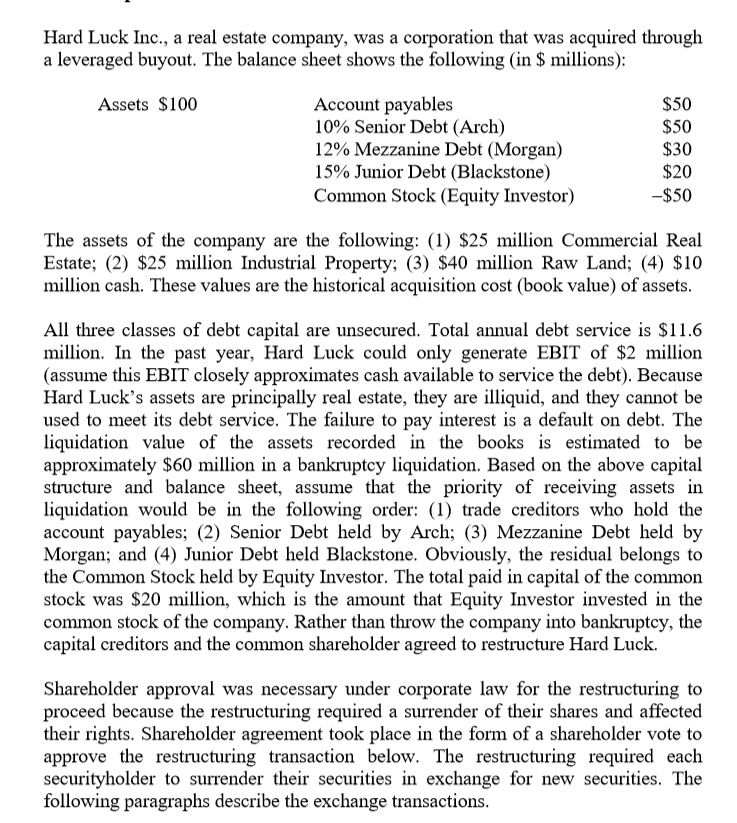

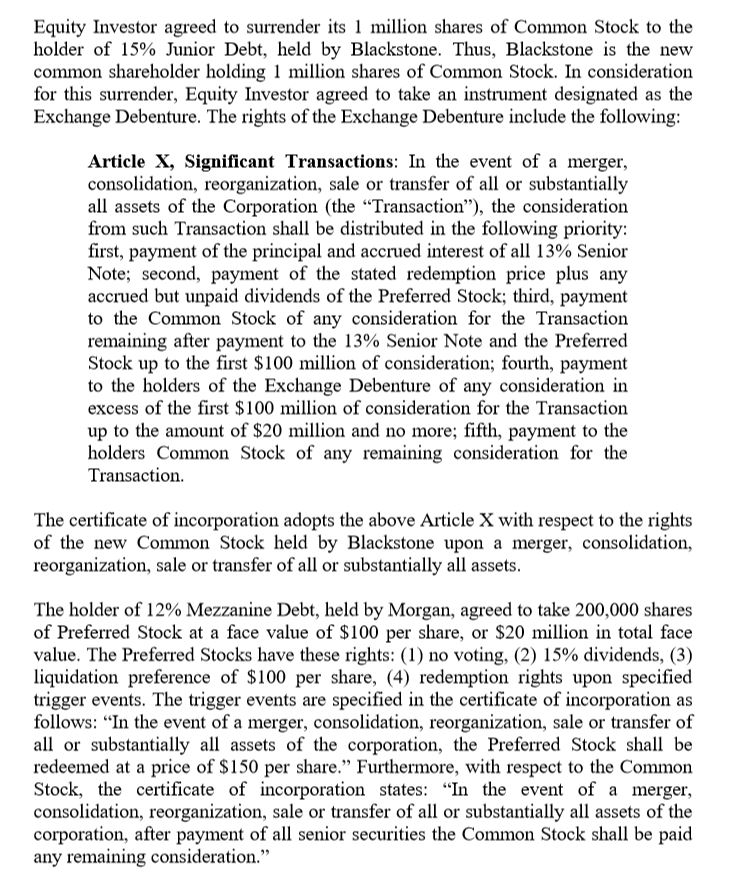

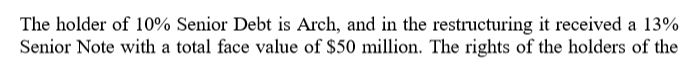

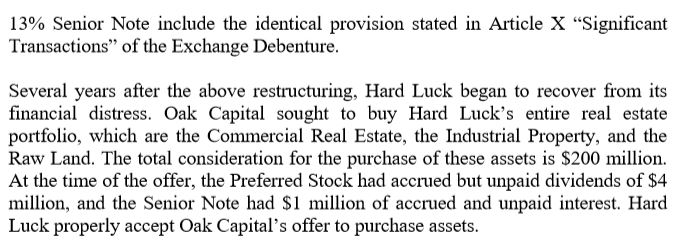

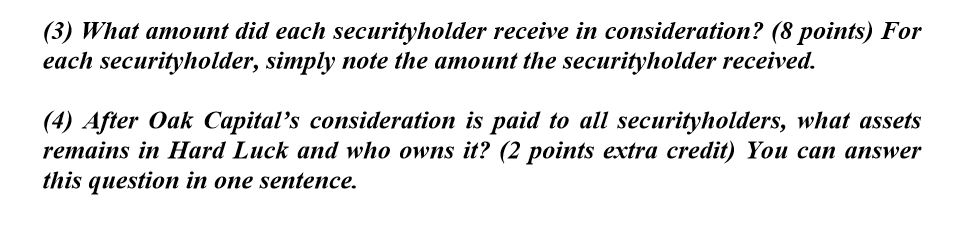

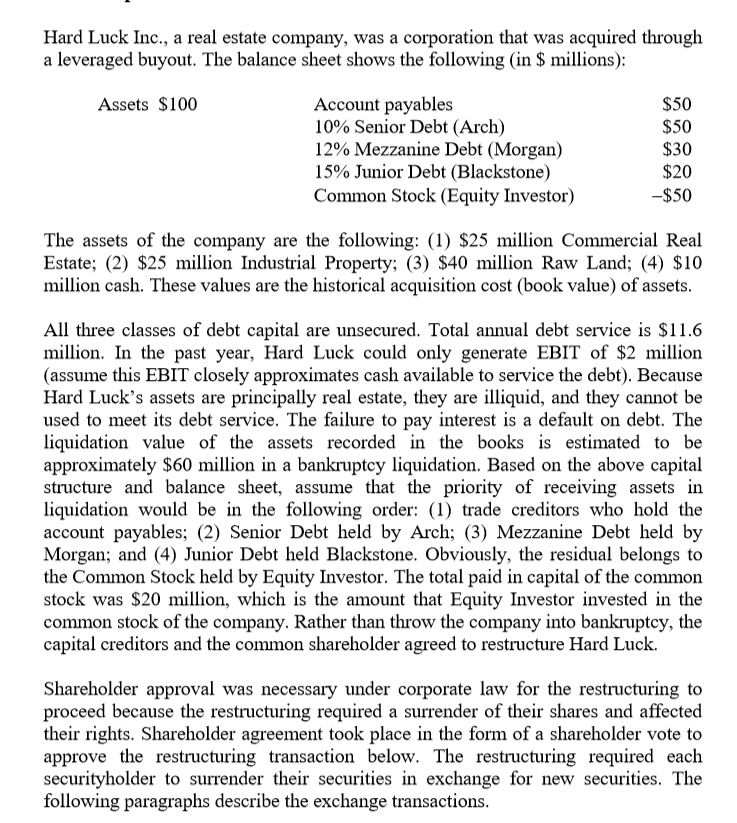

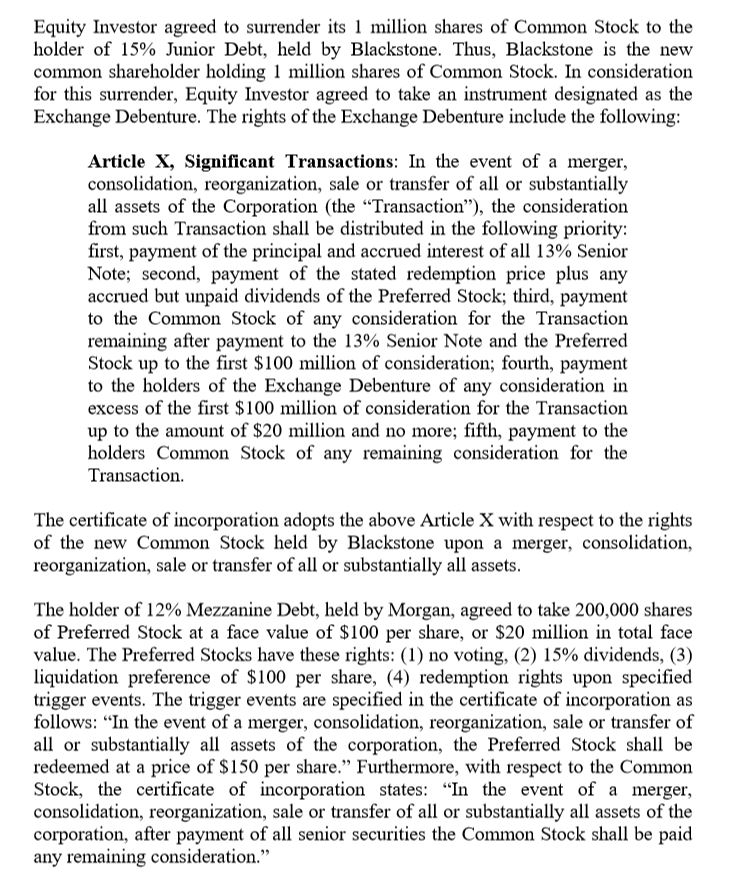

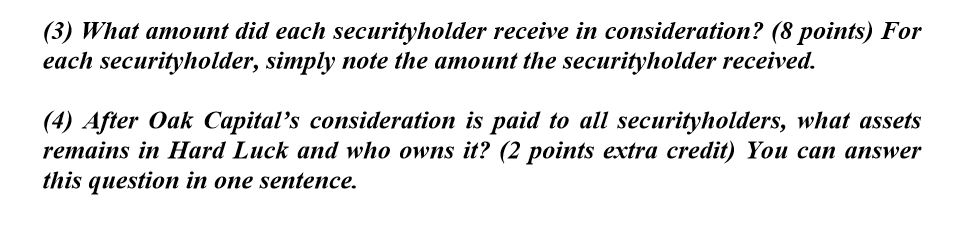

Hard Luck Inc., a real estate company, was a corporation that was acquired through a leveraged buyout. The balance sheet shows the following (in $ millions): Assets $100 Account payables 10% Senior Debt (Arch) 12% Mezzanine Debt (Morgan) 15% Junior Debt (Blackstone) Common Stock (Equity Investor) S50 S50 $20 $50 The assets of the company are the following: (1) $25 million Commercial Real Estate; (2) $25 million Industrial Property; (3) $40 million Raw Land; (4) $10 million cash. These values are the historical acquisition cost (book value) of assets All three classes of debt capital are unsecured. Total annual debt service is $11.6 million. In the past year, Hard Luck could only generate EBIT of $2 million (assume this EBIT closely approximates cash available to service the debt). Because Hard Luc's assets are principally real estate, they are illiquid, and they cannot be used to meet its debt service. The failure to pay interest is a default on debt. The liquidation value of the assets recorded in the books is estimated to be approximately $60 million in a bankruptcy liquidation. Based on the above capital structure and balance sheet, assume that the priority of receiving assets in liquidation would be in the following order: (1) trade creditors who hold the account payables; (2) Senior Debt held by Arch; (3) Mezzanine Debt held by Morgan; and (4) Junior Debt held Blackstone. Obviously, the residual belongs to the Common Stock held by Equity Investor. The total paid in capital of the commorn stock was $20 million, which is the amount that Equity Investor invested in the common stock of the company. Rather than throw the company into bankruptcy, the capital creditors and the common shareholder agreed to restructure Hard Luck. Shareholder approval was necessary under corporate law for the restructuring to proceed because the restructuring required a surrender of their shares and affected their rights. Shareholder agreement took place in the form of a shareholder vote to approve the restructuring transaction below. The restructuring required eaclh securityholder to surrender their securities in exchange for new securities. The following paragraphs describe the exchange transactions