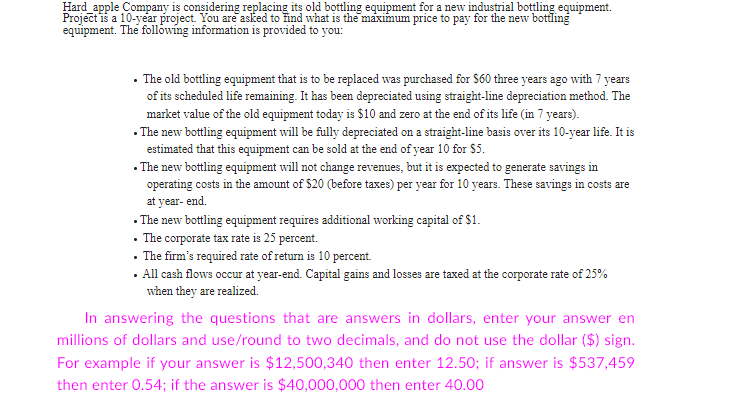

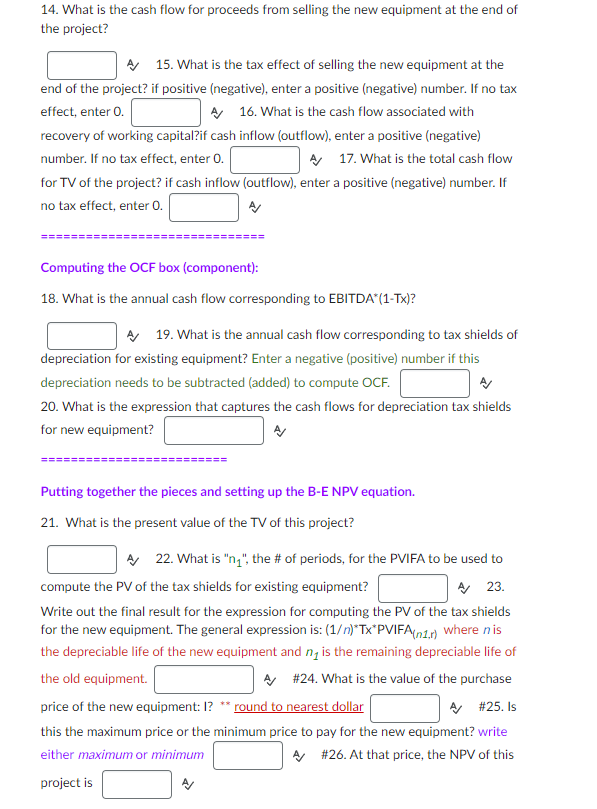

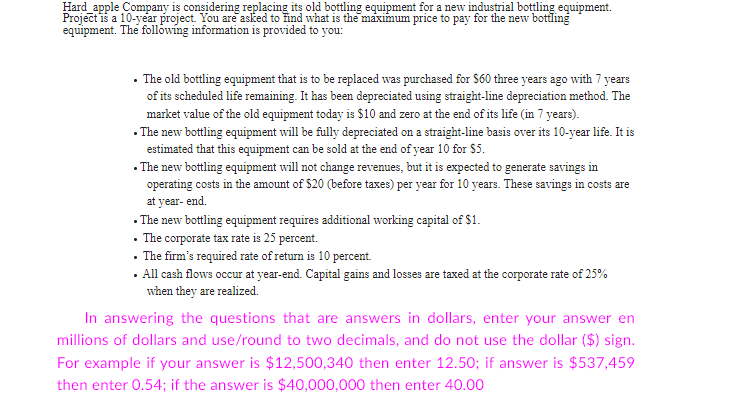

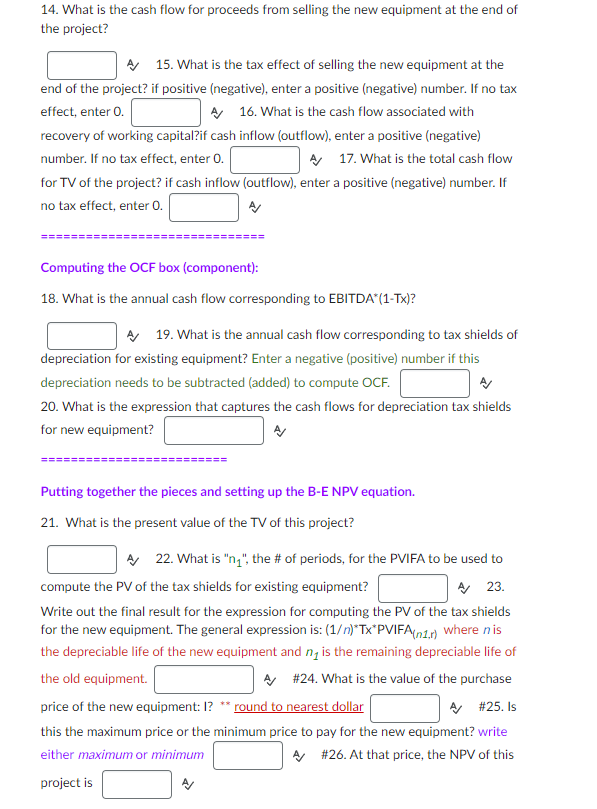

Hard_apple Company is considering replacing its old bottling equipment for a new industrial bottling equipment. Project is a 10-year project. You are asked to find what is the maximum price to pay for the new bottling equipment. The following information is provided to you: The old bottling equipment that is to be replaced was purchased for $60 three years ago with 7 years of its scheduled life remaining. It has been depreciated using straight-line depreciation method. The market value of the old equipment today is $10 and zero at the end of its life (in 7 years). The new bottling equipment will be fully depreciated on a straight-line basis over its 10-year life. It is estimated that this equipment can be sold at the end of year 10 for $5. The new bottling equipment will not change revenues, but it is expected to generate savings in operating costs in the amount of $20 (before taxes) per year for 10 years. These savings in costs are at year-end. . The new bottling equipment requires additional working capital of $1. The corporate tax rate is 25 percent. The firm's required rate of return is 10 percent. All cash flows occur at year-end. Capital gains and losses are taxed at the corporate rate of 25% when they are realized. In answering the questions that are answers in dollars, enter your answer en millions of dollars and use/round to two decimals, and do not use the dollar ($) sign. For example if your answer is $12,500,340 then enter 12.50; if answer is $537,459 then enter 0.54; if the answer is $40,000,000 then enter 40.00 14. What is the cash flow for proceeds from selling the new equipment at the end of the project? A 15. What is the tax effect of selling the new equipment at the end of the project? if positive (negative), enter a positive (negative) number. If no tax effect, enter 0. A 16. What is the cash flow associated with recovery of working capital?if cash inflow (outflow), enter a positive (negative) number. If no tax effect, enter 0. A 17. What is the total cash flow for TV of the project? if cash inflow (outflow), enter a positive (negative) number. If no tax effect, enter 0. Computing the OCF box (component): 18. What is the annual cash flow corresponding to EBITDA*(1-Tx)? A 19. What is the annual cash flow corresponding to tax shields of depreciation for existing equipment? Enter a negative (positive) number if this depreciation needs to be subtracted (added) to compute OCF. A/ 20. What is the expression that captures the cash flows for depreciation tax shields for new equipment? A/ Putting together the pieces and setting up the B-E NPV equation. 21. What is the present value of the TV of this project? A 22. What is "n", the # of periods, for the PVIFA to be used to compute the PV of the tax shields for existing equipment? A 23. Write out the final result for the expression for computing the PV of the tax shields for the new equipment. The general expression is: (1)*Tx*PVIFA(1.1) where nis the depreciable life of the new equipment and n, is the remaining depreciable life of the old equipment. A #24. What is the value of the purchase price of the new equipment: I? round to nearest dollar A/ #25. Is this the maximum price or the minimum price to pay for the new equipment? write either maximum or minimum A #26. At that price, the NPV of this project is Hard_apple Company is considering replacing its old bottling equipment for a new industrial bottling equipment. Project is a 10-year project. You are asked to find what is the maximum price to pay for the new bottling equipment. The following information is provided to you: The old bottling equipment that is to be replaced was purchased for $60 three years ago with 7 years of its scheduled life remaining. It has been depreciated using straight-line depreciation method. The market value of the old equipment today is $10 and zero at the end of its life (in 7 years). The new bottling equipment will be fully depreciated on a straight-line basis over its 10-year life. It is estimated that this equipment can be sold at the end of year 10 for $5. The new bottling equipment will not change revenues, but it is expected to generate savings in operating costs in the amount of $20 (before taxes) per year for 10 years. These savings in costs are at year-end. . The new bottling equipment requires additional working capital of $1. The corporate tax rate is 25 percent. The firm's required rate of return is 10 percent. All cash flows occur at year-end. Capital gains and losses are taxed at the corporate rate of 25% when they are realized. In answering the questions that are answers in dollars, enter your answer en millions of dollars and use/round to two decimals, and do not use the dollar ($) sign. For example if your answer is $12,500,340 then enter 12.50; if answer is $537,459 then enter 0.54; if the answer is $40,000,000 then enter 40.00 14. What is the cash flow for proceeds from selling the new equipment at the end of the project? A 15. What is the tax effect of selling the new equipment at the end of the project? if positive (negative), enter a positive (negative) number. If no tax effect, enter 0. A 16. What is the cash flow associated with recovery of working capital?if cash inflow (outflow), enter a positive (negative) number. If no tax effect, enter 0. A 17. What is the total cash flow for TV of the project? if cash inflow (outflow), enter a positive (negative) number. If no tax effect, enter 0. Computing the OCF box (component): 18. What is the annual cash flow corresponding to EBITDA*(1-Tx)? A 19. What is the annual cash flow corresponding to tax shields of depreciation for existing equipment? Enter a negative (positive) number if this depreciation needs to be subtracted (added) to compute OCF. A/ 20. What is the expression that captures the cash flows for depreciation tax shields for new equipment? A/ Putting together the pieces and setting up the B-E NPV equation. 21. What is the present value of the TV of this project? A 22. What is "n", the # of periods, for the PVIFA to be used to compute the PV of the tax shields for existing equipment? A 23. Write out the final result for the expression for computing the PV of the tax shields for the new equipment. The general expression is: (1)*Tx*PVIFA(1.1) where nis the depreciable life of the new equipment and n, is the remaining depreciable life of the old equipment. A #24. What is the value of the purchase price of the new equipment: I? round to nearest dollar A/ #25. Is this the maximum price or the minimum price to pay for the new equipment? write either maximum or minimum A #26. At that price, the NPV of this project is