Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hardin Company received $60,000 in cash and a used computer with a fair value of $180,000 from Page Corporation for Hardin Company's existing computer

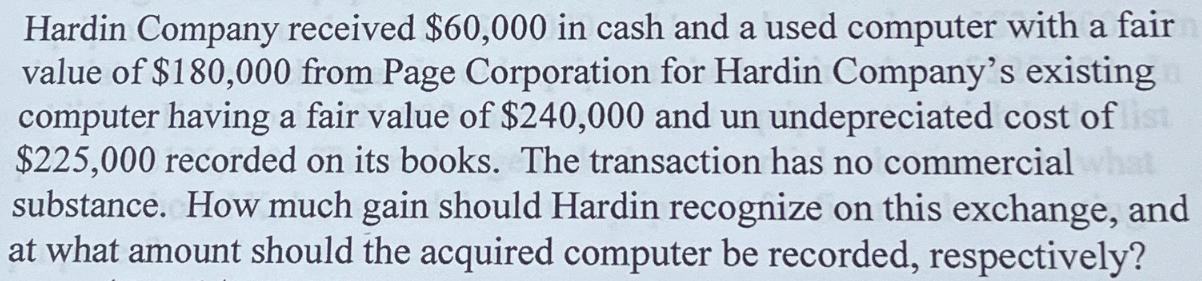

Hardin Company received $60,000 in cash and a used computer with a fair value of $180,000 from Page Corporation for Hardin Company's existing computer having a fair value of $240,000 and un undepreciated cost of list $225,000 recorded on its books. The transaction has no commercial hat substance. How much gain should Hardin recognize on this exchange, and at what amount should the acquired computer be recorded, respectively?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started