Answered step by step

Verified Expert Solution

Question

1 Approved Answer

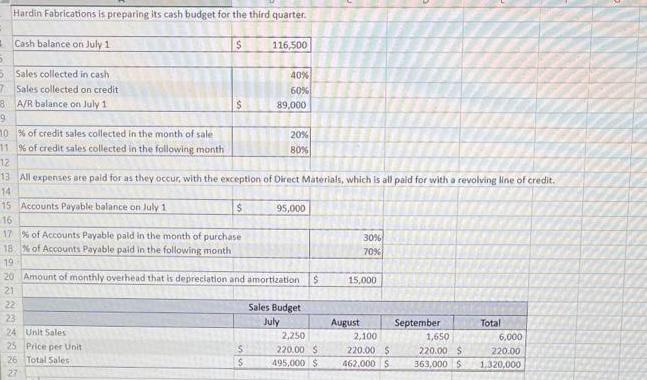

Hardin Fabrications is preparing its cash budget for the third quarter. Cash balance on July 1 $ 5 5 Sales collected in cash 7

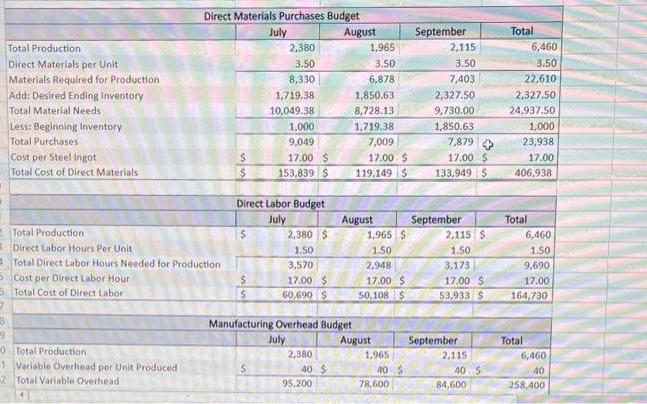

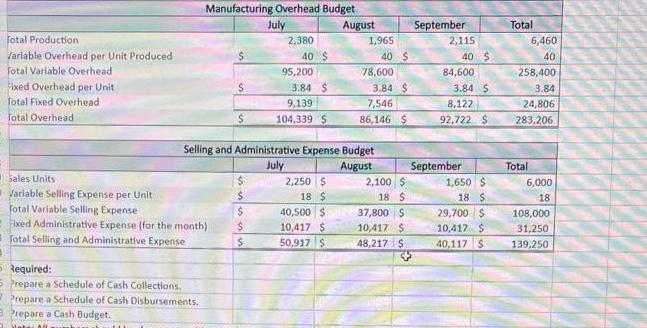

Hardin Fabrications is preparing its cash budget for the third quarter. Cash balance on July 1 $ 5 5 Sales collected in cash 7 Sales collected on credit 3 A/R balance on July 1 9 22 23 24 Unit Sales 25 Price per Unit 26 Total Sales 27 116,500 10 % of credit sales collected in the month of sale 11% of credit sales collected in the following month 12 13 All expenses are paid for as they occur, with the exception of Direct Materials, which is all paid for with a revolving line of credit. 14 $ 40% 60% S S 89,000 15 Accounts Payable balance on July 1 16 17 % of Accounts Payable paid in the month of purchase 18 % of Accounts Payable paid in the following month 19 20 Amount of monthly overhead that is depreciation and amortization $ 21 20% 80% 95,000 Sales Budget July 2,250 220.00 S 495,000 $ 30% 70% 15,000 August 2,100 220.00 $ 462,000 $ September 1,650 220.00 $ 363,000 $ Total 6,000 220.00 1,320,000 Total Production Direct Materials per Unit Materials Required for Production Add: Desired Ending Inventory Total Material Needs Less: Beginning Inventory Total Purchases Cost per Steel Ingot Total Cost of Direct Materials Total Production Direct Labor Hours Per Unit Total Direct Labor Hours Needed for Production 5 Cost per Direct Labor Hour 5 Total Cost of Direct Labor 7 3) 9 Direct Materials Purchases Budget 0 Total Production 1 Variable Overhead per Unit Produced -2 Total Variable Overhead $ $ $ $ July 2,380 3.50 8,330 1,719.38 10,049.38 $ 1,000 9,049 Direct Labor Budget July $ 17.00 $ 153,839 $ 2,380 $ 1.50 3,570 17.00 $ 60,690 $ Manufacturing Overhead Budget July 2,380 40 $ August 95,200 1,965 3.50 6,878 1,850.63. 8,728.131 1,719.38 7,009 17.00 $ 119,149 $ August 1,965 $ 1.50 2,948 17.00 $ 50,108 $ August 1,965 40 $ 78,600 September 2,115 3.50 7,403 2,327.50 9,730.00 1,850.63 7,879 + 17.00 $ 133,949 $ September 2,115 $ 1.50 3,173 17.00 $ 53,933 $1 September 2,115 40 S 84,600 Total 22,610 2,327.50 24,937.50 6,460 3.50 1,000 23,938 17.00 406,938 Total 6,460 1.50 9,690 17.00 164,730 Total 6,460 40 258,400 Total Production. Variable Overhead per Unit Produced Total Variable Overhead Fixed Overhead per Unit. Total Fixed Overhead Total Overhead Manufacturing Overhead Budget July Sales Units Variable Selling Expense per Unit Total Variable Selling Expense Fixed Administrative Expense (for the month) Total Selling and Administrative Expense B 5 Required: 5 Prepare a Schedule of Cash Collections. 2 Prepare a Schedule of Cash Disbursements. 3 Prepare a Cash Budget. $ S 2,380 $ $ $ $ $ 40 $ 95,200 3.84 S 9,139 104,339 $ August 2,250 $ 18 $ 40,500 $ 10,417 $ 50,917 $ 1,965 Selling and Administrative Expense Budget July August 40 $ 78,600 3.84 $ 7,546 86,146 $ 2,100 $ 18 S 37,800 $ 10,417 $ 48,217 $ September 2,115 40 $ 84,600 3.84 $ 8,122 92,722 $ September 1,650 $ 18 $ 29,700 $ 10,417 $ 40,117 $ Total 6,460 40 258,400 3.84 24,806 283,206 Total 6,000 18 108,000 31,250 139,250

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Schedule of cash collection July August September Total Budgeted Sales 495000 462000 363000 132000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started