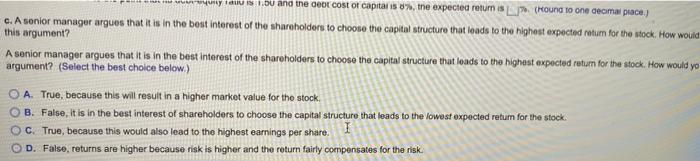

Hardmon Enterprises is currently an all-equity firm with an expected retum of 12%, it considering a leveraged recapitatization in which it would borrow and repurchase existing shares. Assume perfect capital markets 1. Suppose Hardmon borrows to the point that is debt equity ratio is 0.50. Win this amount of debt, the debt cost of capital is 0% What will the expected return of equity be after this 6. Suppose instead Hardmon borrows to the point that its debt equity ratios 1.50 win this amount of , Hardmon's debt wel be much rice. As a row the debt cost of capital wil be 8% What will the expected return of equity be in this case? c. A senior manager argues that it is in the best interest of the shareholders to choow the capital structure that leads to the highest expected return for the stock. How would you respond to this argument? transaction? 2. Suppote Hardmon borrows to the point that its debt-equity ratio is 0.50. With this amount of debt, the debt cost of capital is 0% What will the expected retum of equly be afer this transaction? Hardenon borrows to the point that its debt-equity ratio is 0.50 and the debt cost of capital is 6. the expected retum is % (Round to one decimal place.) b. Suppose instead Harmon borrows to the point that its debt equity ratio is 1.50. With this amount of debt, Hardmon's debt will be much risker. As a result, the debt cost of capital will be ALL What will the water of the in this casa a. Suppose Hardmon borrows to the point that its debt-equity ratio is 0.50. With this amount of debt, the debt cost of capital is 6% What will the expected return of equity be after this transaction? Harmon borrows to the point that its debt-equity radio is 0.50 and the debt cost of capital is 6%, the expected retum is % (Round to one decimal place) . Suppose instead Hardmon borrows to the point that to debe equity ratio is 1.50. With this amount of debt, Hurdmon's debt will be much niskier. As a result, the debt cost of capital will be 8%. What will the expected return of equity be in this case? it Hardmon borrows to the point that its debt-equity ratio is 1.50 and the debt cost of capital is 5%, the expected retums I (Round to one decimat place) A nenior manager argues that it is in the best interest of the shareholders to choose the capital structure that loads to the highest expected return for the stock. How would you respond to this ? A senior manager argues that it is in the best interest of the shareholders to choose the capital structure that leads to the highest expected return for the stock. How would you respond to this amoumet? Select the best choice below) was 1. bu and the cost cost of capital is 3%, the expected return is (Round to one decimal place) c. A senior manager argues that it is in the best interest of the shareholders to choose the capital structure that leads to the highest expected retum for the stock. How would this argument? A senior manager argues that it is in the best interest of the shareholders to choose the capital structure that leads to the highest expected return for the stock. How would yo argument? (Select the best choice below) O A. True, because this will result in a higher market value for the stock B. False, it is in the best interest of shareholders to choose the capital structure that leads to the lowest expected return for the stock. OC. True, because this would also lead to the highest earnings per share. D. False, returns are higher because risk is higher and the return fairly compensates for the risk