Question

Harington Co. is an established construction company and has been in operation for 50 years. It specializes in building warehouses for companies and their supply

Harington Co. is an established construction company and has been in operation for 50 years. It specializes in building warehouses for companies and their supply chains. With the covid pandemic almost over, Harington Co. has received offers to build warehouses for businesses that intend to expand. Below are two offers they have received to build warehouses, However, since the pandemic has affected Harington's business over the past year, the company can undertake only one of the offers.

Warehouse for Amazon Sweden:

Initial outflow: 420,000 SEK

| Year | Cash inflow (in SEK) |

| 1 | 100,000 |

| 2 | 200,000 |

| 3 | 300,000 |

| 4 | 400,000 |

Warehouse for H&M:

Initial outflow: 760,000 SEK

| Year | Cash inflow (in SEK) |

| 1 | 400,000 |

| 2 | 300,000 |

| 3 | 200,000 |

| 4 | 100,000 |

Harington Co. has a cost of capital of 12%.

All cash flows occur at the end of each year.

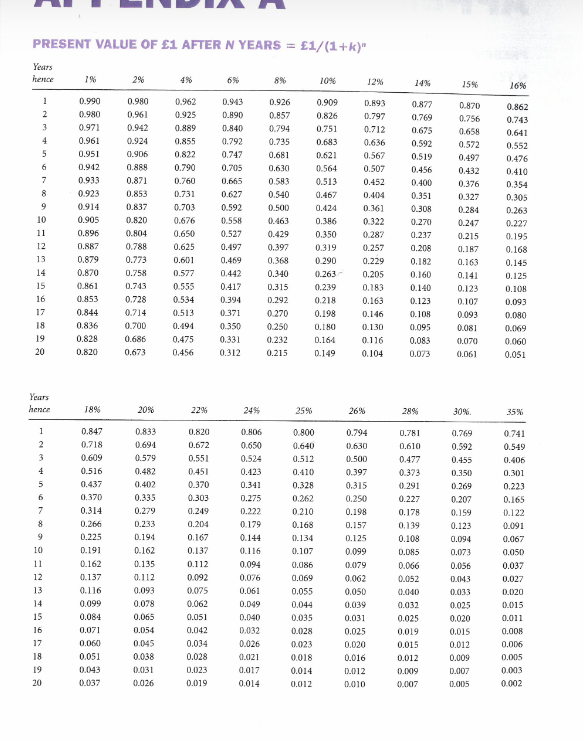

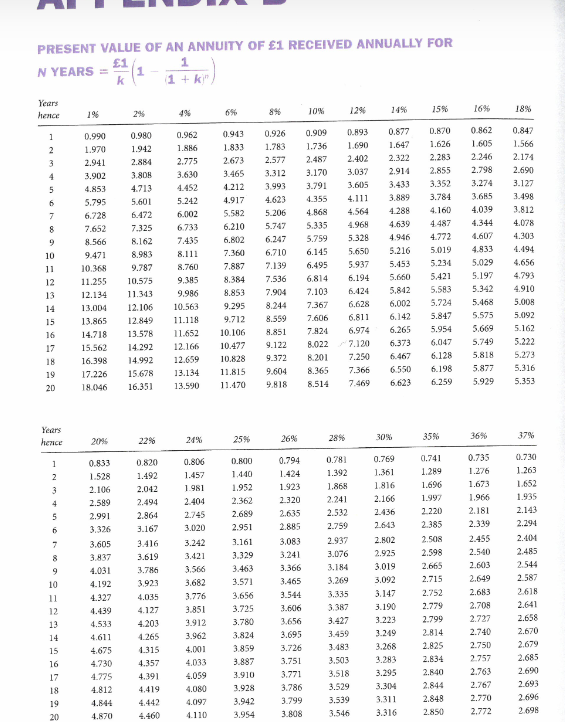

The present value tables are attached to this question as a PDF document.

Formulas for capital investment:

FVn = V0 (1 + K)n

PV0 = FV1/(1+K) + FV2/(1+K)2 + .......

Present value of 1 after N years = 1/(1+k)n

Present value of an Annuity of 1 received annually for N years = (1/k)( 1 (1/(1+k)n))

Required (show all your calculations below and write in your own words):

(a) Calculate the Net Present Value (NPV) for both warehouses.

(b) Calculate the payback period for both warehouses.

(c) Which warehouse should Harington Co. build?

(d) Explain in full two (2) non-financial factors Harington Co. should consider before making the above decision.

PRESENT VALUE OF 1 AFTER N YEARS = 1/(1+k)" Years hence % 8% 10% 12% 14% 15% 16% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 0.592 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.980 0.961 0.942 0.924 0.906 0.889 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 0.081 0.070 0.061 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.125 0.108 0.093 0.080 0.069 0.060 0.051 0.625 0.601 0.577 0.555 0.534 0.513 0.191 0.475 0.456 0.073 Years hence 18% 20% 22% 245 25% 26% 28% 30% 35% 1 2 3 0.741 0.549 0.406 0.301 0.223 0.165 0.122 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 0.847 0.718 0.609 0.516 0.437 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0.116 0.099 0.084 0.071 0.060 0.051 0.833 0.691 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.820 0.672 0.551 0.451 0.370 0.303 0.249 0.204 0.167 0.137 0.112 0.092 0.075 0.062 0.051 0.042 0.034 0.028 0.023 0.019 0.806 0.650 0.524 0.423 0.341 0.275 0.222 0.179 0.144 0.116 0.094 0.076 0.061 0.049 0.040 0.032 0.026 0.021 0.017 0.014 0.800 0.640 0.512 0.410 0.328 0.262 0.210 0.168 0.134 0.107 0.086 0.069 0.055 0.044 0.035 0.028 0.023 0.018 0.014 0.012 0.794 0.630 0.500 0.397 0.315 0.250 0.198 0.157 0.125 0.099 0.079 0.062 0.050 0.039 0.031 0.025 0.020 0.016 D.012 0.010 0.781 0.610 0.477 0.373 0.291 0.227 0.178 0.139 0.108 0.085 0.066 0.052 0.040 0.032 0.025 0.019 0.015 0.012 0.009 0.007 0.769 0.592 0.455 0.350 0.269 0.207 0.159 0.123 0.094 0.073 0.056 0.0143 0.033 0.025 0.020 0.015 0.012 0.009 0.007 0.005 0.091 0.067 0.050 0.037 0.027 0.020 0.015 0.011 0.008 0.006 0.005 0.003 0.002 0.043 0.038 0.031 0.026 0.037 PRESENT VALUE OF AN ANNUITY OF 1 RECEIVED ANNUALLY FOR 1 1 1+k" N YEARS 1 k Years hence 8% 10% 2% 12% 49 14% 16% 15% 18% 1% 0.870 1.626 2.283 1 2 3 4 5 2.855 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.0D4 13.865 14.718 15.562 16,398 17.226 18.046 0.980 1.942 2.884 3.80 4.713 5.601 6.172 7.325 8.162 8.983 9.787 10.575 11.343 12.106 12.849 13.578 14.292 14.992 15.678 16.351 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 0.913 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.815 11.170 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9,818 0.909 0.893 1.736 1.690 2.487 2.402 3.170 3,037 3.791 3.605 4.355 4.111 4.568 4.564 5.335 4.968 5.759 5.328 6.145 5.650 6.495 5.937 6,814 6.194 7.103 6.424 7.367 6.628 7.606 6.811 7.824 6.974 8.022 7.120 8.201 7.250 8.365 7.366 8.514 7.469 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 3.352 3.784 4.160 4487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.669 5.749 5.818 5.877 5.929 0.847 1.566 2.174 2.690 3.127 3.498 3.812 4.078 4.303 4.194 4.656 4.793 4.910 5.000 5.092 5.162 5.222 5.273 5.316 5.353 6.047 6.128 6.198 6.259 Years hence 25% 30% 20% 24% 26% 28% 35% 36% 22% 37% (1.741 1.289 1.696 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.844 4.870 0.820 1.492 2.042 2.494 2.864 3.167 3.416 3.619 3.786 3.923 4.035 4.127 4.203 4.265 1.315 4.357 4.391 4.419 4.442 4.460 0.806 1.457 1.981 2.404 2.745 3.020 3.242 3.421 3.566 3.682 3.776 3.851 3.912 3.962 4.001 4.033 4.059 4.080 D.NO 1.440 1.952 2.362 2.689 2.951 3.161 3.329 3.463 3.571 3.656 3.725 3.780 3.824 3.859 3.887 3.910 3.928 3.942 3.954 0.794 1.424 1.923 2.320 2.635 2.885 3.083 3.241 3.366 3.465 3.544 3.606 3.656 3.695 3.726 3.751 3.771 3.786 3.799 3.808 0.78 1.392 1.868 2.241 2.532 2.759 2.937 3.076 3.184 3.269 3.335 3.387 3.427 3.459 3.483 3.503 3.518 3.529 3.539 3.546 0.769 1.361 1.816 2.166 2.436 2.643 2.802 2.925 3.019 3.092 3. 147 3.190 3.223 3.249 3.268 3.283 3.295 3.314 3.311 3.316 1.997 2.220 2.385 2.508 2.598 2.665 2.715 2.752 2.779 2.799 2.814 2.825 2.834 2.840 2.844 2.848 2.850 0.735 1.276 1.673 1.966 2.181 2.339 2.455 2.540 2.603 2.649 2.683 2.708 2.727 2.740 2.750 2.757 2.763 2.767 2.770 2.772 0.730 1.263 1.652 1.935 2.143 2.294 2.401 2.485 2.544 2587 2.68 2.641 2.658 2.670 2.679 2.685 2.690 2.693 2.696 2.698 4.097 4.110Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started