Question

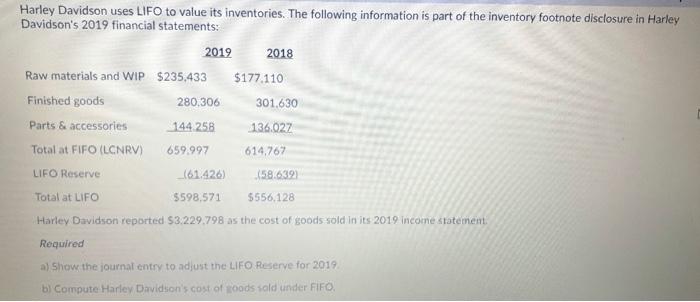

Harley Davidson uses LIFO to value its inventories. The following information is part of the inventory footnote disclosure in Harley Davidson's 2019 financial statements:

Harley Davidson uses LIFO to value its inventories. The following information is part of the inventory footnote disclosure in Harley Davidson's 2019 financial statements: 2019 2018 Raw materials and WIP $235,433 $177.110 Finished goods 280.306 301.630 Parts & accessories Total at FIFO (LCNRV) 144.258 136.027 659.997 614,767 LIFO Reserve (61.426) (58.632) Total at LIFO 5598,571 $556,128 Harley Davidson reported $3.229,798 as the cost of goods sold in its 2019 income statement. Required a) Show the journal entry to adjust the LIFO Reserve for 2019. bl Compute Harley Davidson's cost of goods sold under FIFO.

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Journal entry cost of goods sold 2787 To Lifo re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for business decision making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

6th Edition

978-1119191674, 047053477X, 111919167X, 978-0470534779

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App