Answered step by step

Verified Expert Solution

Question

1 Approved Answer

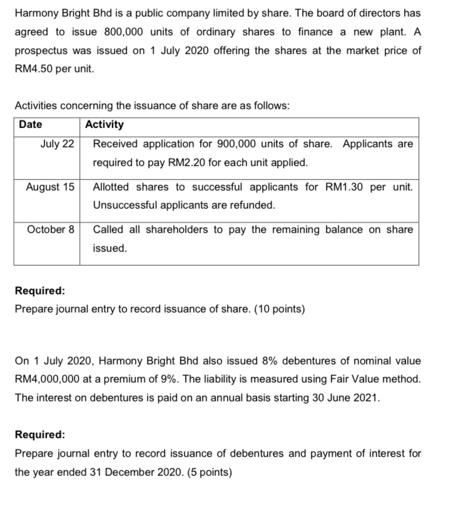

Harmony Bright Bhd is a public company limited by share. The board of directors has agreed to issue 800,000 units of ordinary shares to

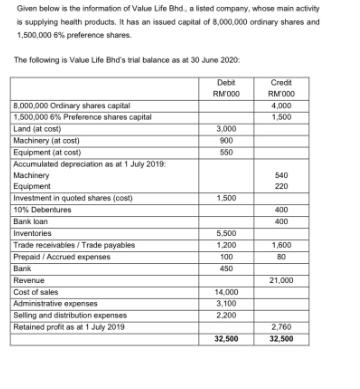

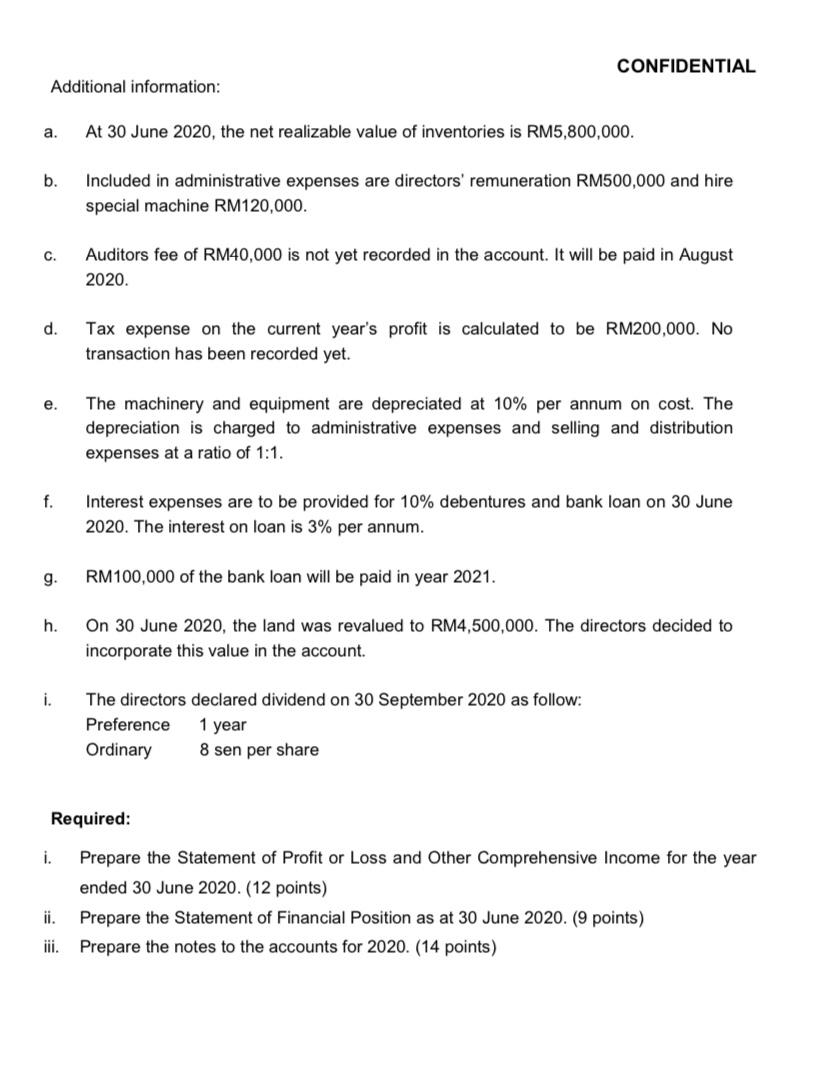

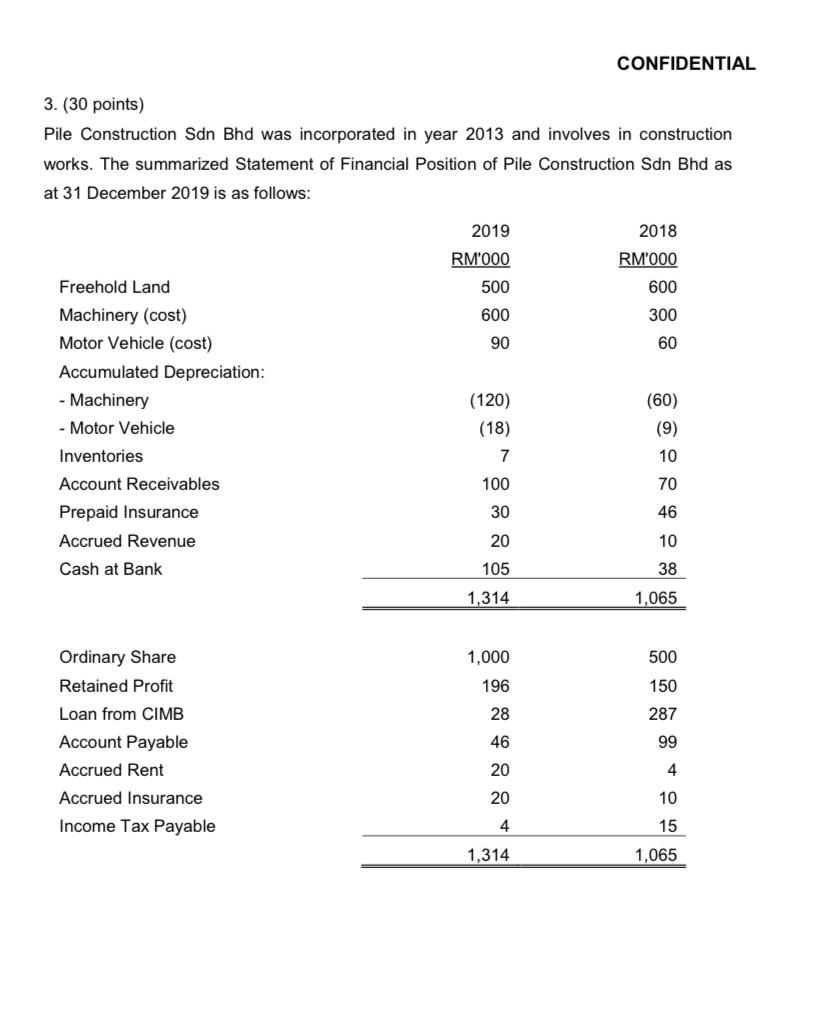

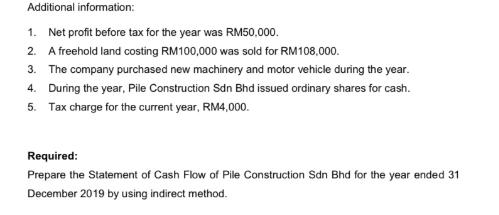

Harmony Bright Bhd is a public company limited by share. The board of directors has agreed to issue 800,000 units of ordinary shares to finance a new plant. A prospectus was issued on 1 July 2020 offering the shares at the market price of RM4.50 per unit. Activities concerning the issuance of share are as follows: Date Activity July 22 Received application for 900,000 units of share. Applicants are required to pay RM2.20 for each unit applied. August 15 October 8 Allotted shares to successful applicants for RM1.30 per unit. Unsuccessful applicants are refunded. Called all shareholders to pay the remaining balance on share issued. Required: Prepare journal entry to record issuance of share. (10 points) On 1 July 2020, Harmony Bright Bhd also issued 8% debentures of nominal value RM4,000,000 at a premium of 9%. The liability is measured using Fair Value method. The interest on debentures is paid on an annual basis starting 30 June 2021. Required: Prepare journal entry to record issuance of debentures and payment of interest for the year ended 31 December 2020. (5 points) Given below is the information of Value Life Bhd, a listed company, whose main activity is supplying health products. It has an issued capital of 8,000,000 ordinary shares and 1,500,000 6% preference shares. The following is Value Life Bhd's trial balance as at 30 June 2020: 8,000,000 Ordinary shares capital 1,500,000 6% Preference shares capital Land (at cost) Machinery (at cost) Equipment (at cost) Accumulated depreciation as at 1 July 2019 Machinery Equipment Investment in quoted shares (cost) 10% Debentures Bank loan Inventories Trade receivables / Trade payables Prepaid /Accrued expenses Bank Revenue Cost of sales Administrative expenses Selling and distribution expenses Retained profit as at 1 July 2019 Debit RM1000 3,000 900 550 1.500 5,500 1.200 100 450 14,000 3,100 2.200 32,500 Credit RM000 4,000 1,500 540 220 400 400 1,600 80 21,000 2,760 32,500 Additional information: a. C. b. Included in administrative expenses are directors' remuneration RM500,000 and hire special machine RM120,000. d. e. f. 9. h. i. i. At 30 June 2020, the net realizable value of inventories is RM5,800,000. ii. iii. CONFIDENTIAL Auditors fee of RM40,000 is not yet recorded in the account. It will be paid in August 2020. Tax expense on the current year's profit is calculated to be RM200,000. No transaction has been recorded yet. The machinery and equipment are depreciated at 10% per annum on cost. The depreciation is charged to administrative expenses and selling and distribution expenses at a ratio of 1:1. Interest expenses are to be provided for 10% debentures and bank loan on 30 June 2020. The interest on loan is 3% per annum. RM100,000 of the bank loan will be paid in year 2021. On 30 June 2020, the land was revalued to RM4,500,000. The directors decided to incorporate this value in the account. The directors declared dividend on 30 September 2020 as follow: 1 year 8 sen per share Preference Ordinary Required: Prepare the Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2020. (12 points) Prepare the Statement of Financial Position as at 30 June 2020. (9 points) Prepare the notes to the accounts for 2020. (14 points) 3. (30 points) Pile Construction Sdn Bhd was incorporated in year 2013 and involves in construction works. The summarized Statement of Financial Position of Pile Construction Sdn Bhd as at 31 December 2019 is as follows: Freehold Land Machinery (cost) Motor Vehicle (cost) Accumulated Depreciation: - Machinery - Motor Vehicle Inventories Account Receivables Prepaid Insurance Accrued Revenue Cash at Bank Ordinary Share Retained Profit Loan from CIMB Account Payable Accrued Rent Accrued Insurance Income Tax Payable 2019 RM'000 500 600 90 (120) (18) 7 100 30 20 105 1,314 1,000 196 28 46 20 CONFIDENTIAL 20 4 1,314 2018 RM'000 600 300 60 (60) (9) 10 70 46 10 38 1,065 500 150 287 99 4 10 15 1,065 Additional information: 1. Net profit before tax for the year was RM50,000. 2. A freehold land costing RM100,000 was sold for RM108,000. 3. The company purchased new machinery and motor vehicle during the year. 4. During the year, Pile Construction Sdn Bhd issued ordinary shares for cash. 5. Tax charge for the current year, RM4,000. Required: Prepare the Statement of Cash Flow of Pile Construction Sdn Bhd for the year ended 31 December 2019 by using indirect method.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 1 To record the issuance of shares for Harmony Bright Bhd well create journal entries for each activity July 22 Received application for 900000 units of shares at RM220 per unit August ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started