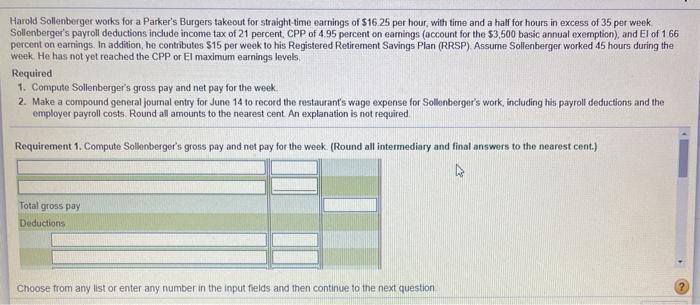

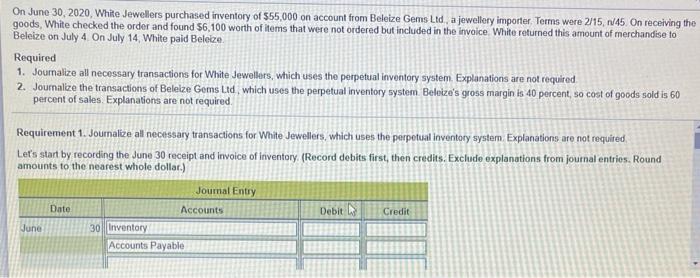

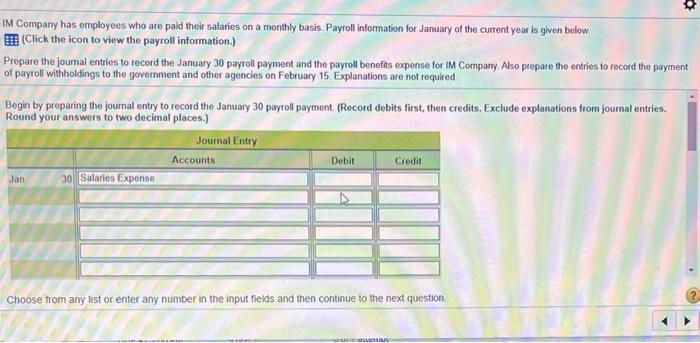

Harold Sollenberger works for a Parker's Burgers takeout for straight-time earnings of $16.25 per hour, with time and a half for hours in excess of 35 per week Solenberger's payroll deductions include income tax of 21 percent, CPP of 4.95 percent on earnings (account for the $3,500 basic annual exemption), and El of 166 percent on earnings. In addition, he contributes $15 per week to his Registered Retirement Savings Plan (RRSP). Assume Sollenberger worked 45 hours during the week. He has not yet reached the CPP or El maximum earnings levels. Required 1. Compute Sollenberger's gross pay and net pay for the week. 2. Make a compound general journal entry for June 14 to record the restaurant's wage expense for Sollenberger's work, including his payroll deductions and the employer payroll costs. Round all amounts to the nearest cent An explanation is not required Requirement 1. Compute Sollenberger's gross pay and net pay for the week. (Round all intermediary and final answers to the nearest cent.) Total gross pay Deductions Choose from any list or enter any number in the input fields and then continue to the next question On June 30, 2020, White Jewellers purchased inventory of $55,000 on account from Beleize Gems Ltd, a jewellery importer Terms were 2/15, 1/45. On receiving the goods, White checked the order and found $6,100 worth of items that were not ordered but included in the invoice White returned this amount of merchandise to Beleize on July 4 On July 14, White paid Beleze. Required 1. Journalize all necessary transactions for White Jewellers, which uses the perpetual inventory system. Explanations are not required 2. Journalize the transactions of Beleze Gems Ltd, which uses the perpetual inventory system Beloize's gross margin is 40 percent, so cost of goods sold is 60 percent of sales Explanations are not required Requirement 1. Journalize all necessary transactions for White Jewellers, which uses the perpetual inventory system. Explanations are not required Let's start by recording the June 30 receipt and invoice of riventory (Record debits first, then credits. Exclude explanations from journal entrios. Round amounts to the nearest whole dollar.) Joumal Entry Date Accounts Debit Credit June 30 Inventory Accounts Payable IM Company has employees who are paid their salaries on a monthly basis. Payroll information for January of the current year is given below Click the icon to view the payroll information.) Prepare the journal entries to record the January 30 payroll payment and the payroll benefits expense for IM Company. Also prepare the entries to record the payment of payroll withholdings to the government and other agencies on February 15. Explanations are not required Begin by preparing the journal entry to record the January 30 payroll payment. (Record debits first, then credits. Exclude explanations from journal entries. Round your answers to two decimal places.) Journal Entry Accounts Debit Credit Jan 30 Salaries Expense Choose from any list or enter any number in the input fields and then continue to the next question Harold Sollenberger works for a Parker's Burgers takeout for straight-time earnings of $16.25 per hour, with time and a half for hours in excess of 35 per week Solenberger's payroll deductions include income tax of 21 percent, CPP of 4.95 percent on earnings (account for the $3,500 basic annual exemption), and El of 166 percent on earnings. In addition, he contributes $15 per week to his Registered Retirement Savings Plan (RRSP). Assume Sollenberger worked 45 hours during the week. He has not yet reached the CPP or El maximum earnings levels. Required 1. Compute Sollenberger's gross pay and net pay for the week. 2. Make a compound general journal entry for June 14 to record the restaurant's wage expense for Sollenberger's work, including his payroll deductions and the employer payroll costs. Round all amounts to the nearest cent An explanation is not required Requirement 1. Compute Sollenberger's gross pay and net pay for the week. (Round all intermediary and final answers to the nearest cent.) Total gross pay Deductions Choose from any list or enter any number in the input fields and then continue to the next question On June 30, 2020, White Jewellers purchased inventory of $55,000 on account from Beleize Gems Ltd, a jewellery importer Terms were 2/15, 1/45. On receiving the goods, White checked the order and found $6,100 worth of items that were not ordered but included in the invoice White returned this amount of merchandise to Beleize on July 4 On July 14, White paid Beleze. Required 1. Journalize all necessary transactions for White Jewellers, which uses the perpetual inventory system. Explanations are not required 2. Journalize the transactions of Beleze Gems Ltd, which uses the perpetual inventory system Beloize's gross margin is 40 percent, so cost of goods sold is 60 percent of sales Explanations are not required Requirement 1. Journalize all necessary transactions for White Jewellers, which uses the perpetual inventory system. Explanations are not required Let's start by recording the June 30 receipt and invoice of riventory (Record debits first, then credits. Exclude explanations from journal entrios. Round amounts to the nearest whole dollar.) Joumal Entry Date Accounts Debit Credit June 30 Inventory Accounts Payable IM Company has employees who are paid their salaries on a monthly basis. Payroll information for January of the current year is given below Click the icon to view the payroll information.) Prepare the journal entries to record the January 30 payroll payment and the payroll benefits expense for IM Company. Also prepare the entries to record the payment of payroll withholdings to the government and other agencies on February 15. Explanations are not required Begin by preparing the journal entry to record the January 30 payroll payment. (Record debits first, then credits. Exclude explanations from journal entries. Round your answers to two decimal places.) Journal Entry Accounts Debit Credit Jan 30 Salaries Expense Choose from any list or enter any number in the input fields and then continue to the next