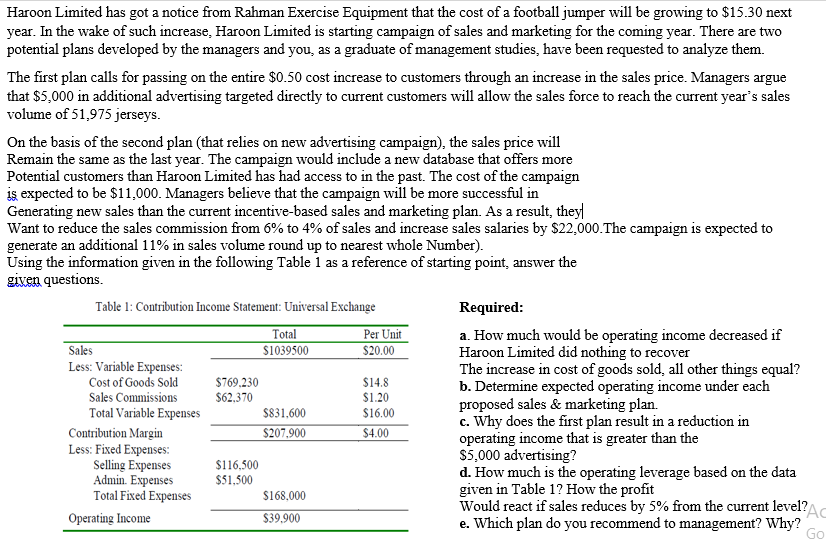

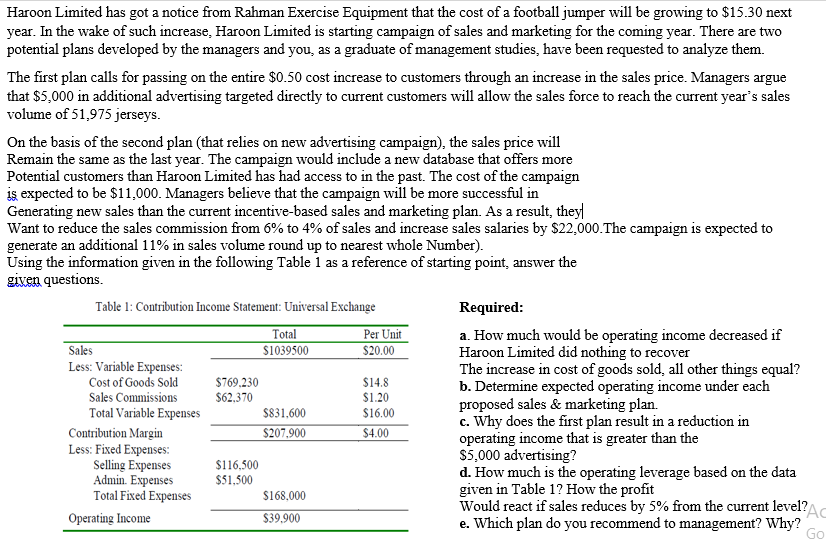

Haroon Limited has got a notice from Rahman Exercise Equipment that the cost of a football jumper will be growing to $15.30 next year. In the wake of such increase, Haroon Limited is starting campaign of sales and marketing for the coming year. There are two potential plans developed by the managers and you, as a graduate of management studies, have been requested to analyze them. The first plan calls for passing on the entire $0.50 cost increase to customers through an increase in the sales price. Managers argue that $5,000 in additional advertising targeted directly to current customers will allow the sales force to reach the current year's sales volume of 51,975 jerseys. On the basis of the second plan (that relies on new advertising campaign), the sales price will Remain the same as the last year. The campaign would include a new database that offers more Potential customers than Haroon Limited has had access to in the past. The cost of the campaign is expected to be $11,000. Managers believe that the campaign will be more successful in Generating new sales than the current incentive-based sales and marketing plan. As a result, they Want to reduce the sales commission from 6% to 4% of sales and increase sales salaries by $22,000. The campaign is expected to generate an additional 11% in sales volume round up to nearest whole Number). Using the information given in the following Table 1 as a reference of starting point, answer the given questions. Table 1: Contribution Income Statement: Universal Exchange Required: Total Per Unit a. How much would be operating income decreased if Sales $1039500 $20.00 Haroon Limited did nothing to recover Less: Variable Expenses The increase in cost of goods sold, all other things equal? Cost of Goods Sold $769.230 $14.8 b. Determine expected operating income under each Sales Commissions $62,370 $1.20 proposed sales & marketing plan. Total Variable Expenses $831,600 $16.00 c. Why does the first plan result in a reduction in Contribution Margin $207.900 $4.00 operating income that is greater than the Less: Fixed Expenses: $5,000 advertising? Selling Expenses $116,500 d. How much is the operating leverage based on the data Admin. Expenses $51,500 Total Fixed Expenses $168.000 given in Table 1? How the profit Would react if sales reduces by 5% from the current level? Operating Income $39.900 e. Which plan do you recommend to management? Why